- Weekly Outlook

- April 22, 2024

- 7min read

The Week Ahead: US Earnings and PCE Data Hold the Keys to a Busy Week

- US Earnings and PCE Data in Focus

- Meta, Google, Tesla, and Microsoft Among the Big Names Reporting on Q1

- Asia Pacific Focus Lies in Australian Inflation Data and the BoJ Rate Decision

- Are Commodities Eyeing Further Gains?

Week in Review

Following heightened Geopolitical tensions and the hawkish repricing of Fed rate cut expectations, the S&P 500 closed lower for a third straight week with the tech-dominated Nasaq100 closing lower for a fourth successive week and its worst week in over a year. A sign of the overall mood or driven largely by Geopolitical concerns?

Looking at the week holistically, the tone in markets appears to have shifted over the past few weeks. This has been down to robust US data and improving economic conditions globally. At the same time, the rising Geopolitical tensions have stoked fears around a higher oil price which could bleed into inflation moving forward. US earnings season has brought fresh challenges as market participants grapple with high valuations and a softer outlook than expected.

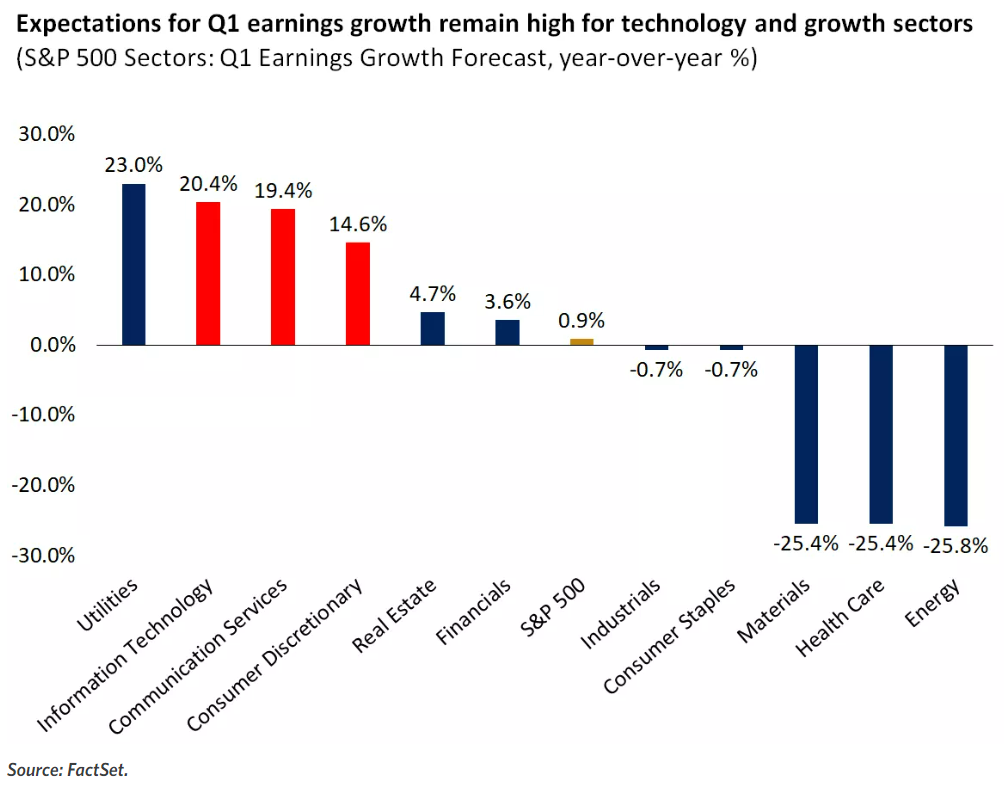

The markets have repriced expectations for Fed Rate Cuts which has led to losses for rate-sensitive technology stocks. Having said that, expectations for Q1 earnings growth remain high for technology and growth stocks as evidenced by the chart below.

**This chart shows the forecasted year-over-year earnings growth for the GICS sectors of the S&P 500 for the first quarter of 2024. Utilities, technology, communication services and consumer discretionary are expected to see the strongest year-over-year growth.

Given all the hype around AI this year, the poor results from semiconductor stocks also weighed on US equities and companies with AI-related earnings. Will this trend continue into the week ahead?

The Week Ahead: US Earnings, Core PCE Data, and FED Blackout Period

A massive week ahead for US equities in particular following the Nasdaq’s worst week in just over a year. As mentioned tech stocks which are more sensitive to a higher rate environment have struggled in recent weeks. The week ahead brings a raft of big tech names to the reporting floor with Tesla, Meta, Microsoft, and Google all releasing Q1 earnings and more importantly a trading update for the year ahead. The question will be whether the earnings releases will arrest the recent slump and serve as a potential catalyst for a bullish continuation.

The response so far from market participants to earnings has been poor, to say the least. US PCE data is another big data release that could have a material impact on US yields and thus equities as well. The PCE Data being the Fed’s preferred measure of inflation may also lead to repricing regarding rate cut expectations from the Federal Reserve which would add another layer of intrigue. The Fed has entered its two-week blackout period ahead of the next Central Bank meeting which means no commentary from Fed policymakers following this week’s data releases.

Looking at Europe, and Germany will be the key focus this week with flash PMI readings, business climate, and business confidence readings all being released. Europe’s most industrialized economy has shown promising signs of late with market participants no doubt eyeing a continuation of the recent trend.

Elsewhere we have Australian inflation data and more importantly the Bank of Japan interest rate decision. The BoJ faces a challenging task as the Yen has continued to slide the past few weeks, trading near the 155.00 handle. I do not expect an interest rate hike from the BoJ but will be paying close attention to the rhetoric from Governor Ueda and Co. regarding recent volatility in the FX space.

Economic Calendar for the Week Ahead (UK Time GMT+1)

Source: FXIFY

Technical Outlook

FX

Looking at the FX space, both EURUSD and GBPUSD have struggled of late trading at their lowest levels of 2024. Given the limited amount of data from the Euro Area and the UK both pairs will remain at the mercy of the US dollar this week.

The most intriguing currency pair to watch remains USDJPY as we trade at levels last seen around 1990. The apprehension of Japan’s top currency diplomat Masato Kanda on further FX intervention is telling but the possibility remains on the table and thus my intrigue around the pair.

USDJPY Daily Chart

Source: TradingView

As you can see from the USDJPY chart above, having broken the multi-month resistance at the 152.00 handle, USDJPY has made a run toward the 155.00 mark. Given the rise of intervention chatter once more, will it be able to inject some life into the Yen moving forward?

Immediate support for USDJPY rests around the 153.00 handle with a break of this level and the ascending trendline opening up a retest of support at the 152.00 and 150.80 levels. Alternatively, a break of the 155.00 handle could see a quick run up toward the key psychological 160.00 handle.

Commodities

Oil prices have retreated significantly this past week, down about 3.91% at the close of the trading week. It appears market participants had largely priced in a potential escalation of tensions in the Middle East. After the attack on Israel over the weekend of April 13, many analysts including myself expected a potential jump in price at the open. Having failed to materialize and with a retaliatory attack carried out against Iran there is still concern around further escalation. My main focus will be on any talk around the Hormuz Strait and how that may impact oil supply and thus affect prices.

WTI Oil Daily Chart

Source: TradingView

Key Levels to Keep an Eye on:

Support Levels

– 80.00 (psychological level)

– 78.68

– 77.10 (SMA-100)

Resistance Levels

– 84.00

– 85.00 (psychological level)

– 87.00

Gold has been a big beneficiary of the uncertainty plaguing markets thus far in 2024. The precious metal continues to roar higher with further upside still in play. The key risks affecting Gold this week could come from positive earnings releases as this could see funds being reallocated into equities. The tension in the Middle East also appears to have calmed somewhat over the weekend and thus any safe-haven demand may evaporate at the start of the week. For further appreciation in the precious metal, a break and daily candle close above $2400/oz is needed to provide bulls with more conviction.

Nasdaq 100: 100-Day SMA to Cap Any Potential Recovery?

The Nasdaq has been the one on everyone’s lips given the Indices’ stellar performance thus far in 2024. It is important to note that the optimism around AI has been a shot in the arm for the US technology sector. The earnings releases this week could well play a major role in determining the direction of the Nasdaq for the rest of the second quarter (Q2).

Nasdaq 100/US100 Daily Chart

Source: TradingView

As you can see from the chart above the Nasdaq 100 has put in a bearish couple of days to end the week on a sour note. It did however run into support around the 17000 handle, which was a key area of resistance in both December and January.

On the upside, the 100-day MA is now a key area of resistance and rests around the 17410 mark with a break higher opening up a retest of the breakout area around the 17800 handle.

Alternatively, a break below the 17000 handle may open up a retest of the 200-day MA resting at 16315 at the time of writing. Below this, the next key areas of support lie at the 16000 and 15300 handles respectively.