- Opening Bell

- May 27, 2025

- 2 min read

NZD/USD Eyes 0.610 as RBNZ Decision Looms – Fundamentals & Technicals Align

All eyes are on the Reserve Bank of New Zealand (RBNZ) ahead of its monetary policy decision tonight. The central bank is widely expected to reduce the Official Cash Rate (OCR) by 25 basis points to 3.25%, continuing its easing cycle.

While a rate cut seems imminent, markets are questioning how much further the RBNZ can go. This uncertainty stems from persistent inflation pressures:

- These developments suggest inflation is still a concern, limiting the central bank’s flexibility.

Recent domestic indicators show New Zealand’s economy holding up well:

- This resilience is prompting a repricing in financial markets:

The international landscape is also supportive of the NZD:

- These global tailwinds help balance any dovish tone the RBNZ might adopt.

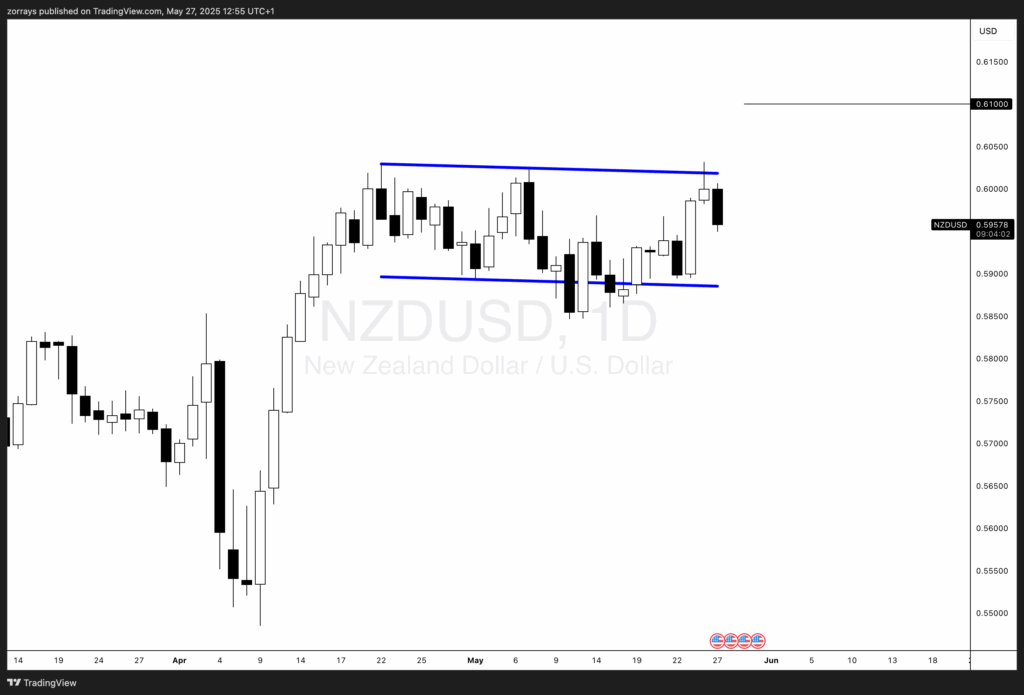

NZDUSD Daily Timeframe

From a technical perspective, NZD/USD is consolidating within a classic bullish flag pattern on the daily chart. The pair has been trading between approximately 0.5900 and 0.6050 following a strong rally in early April. Recent price action shows bullish candles pressing against the flag’s upper boundary, signaling growing breakout potential.

A decisive break above the 0.6050 level would validate the bullish flag formation and suggest an immediate target of 0.6100—a key psychological and technical resistance level. This price point also aligns with prior highs and represents the next logical area for bullish continuation.

The convergence of resilient economic data, sticky inflation, and global risk-on sentiment supports the technical view of further upside in NZD/USD. Even if the RBNZ proceeds with a rate cut, markets may interpret it as a measured move rather than the start of an aggressive easing cycle. This could keep NZD/USD supported and drive price action beyond the 0.6100 threshold in the near term.