- Opening Bell

- February 7, 2025

- 3 min read

NFP Jobs Report Supports Weaker Dollar; FX Majors May Recover

The Non-Farm Payroll Jobs Report is releasing today at GMT 1:30PM, with the projection of 169K jobs being created – a significant contraction from the previous month’s value.

| NFP Jobs Report | Previous | Forecast |

| February | 256K | 169K |

This contraction supports the idea of a weakening dollar, and with the DXY rejecting off a major weekly resistance zone (and also backtesting the rejection with a 61.8% Fib Retracement), it’s likely that the Dollar will continue to weaken in the following days or weeks.

Aligning with this, regular bullish divergences have spotted on EUR/USD, AUD/USD, and NZD/USD on the daily timeframe

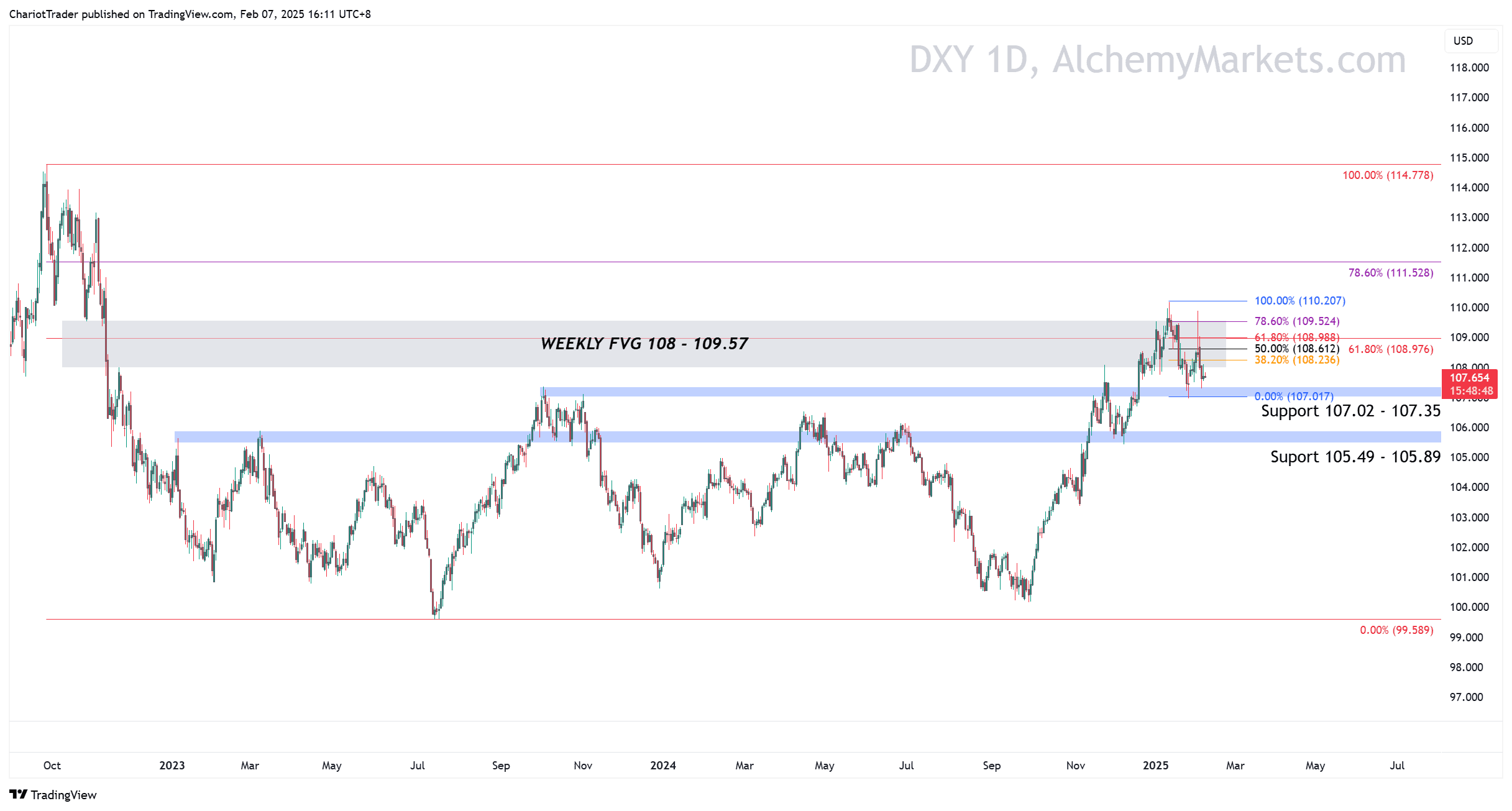

DXY Analysis

The Dollar Index recently just backtested the 61.8% Fib of its weekly rejection candle, resulting in a daily rejection candle — thus confirming bearish sentiment in the short term.

The closest support zone is 107.02-107.35, which has already experienced a test on January 27th, weakening the zone’s strength as a support. This increases the likelihood of a decline towards the 105.49-105.89 support.

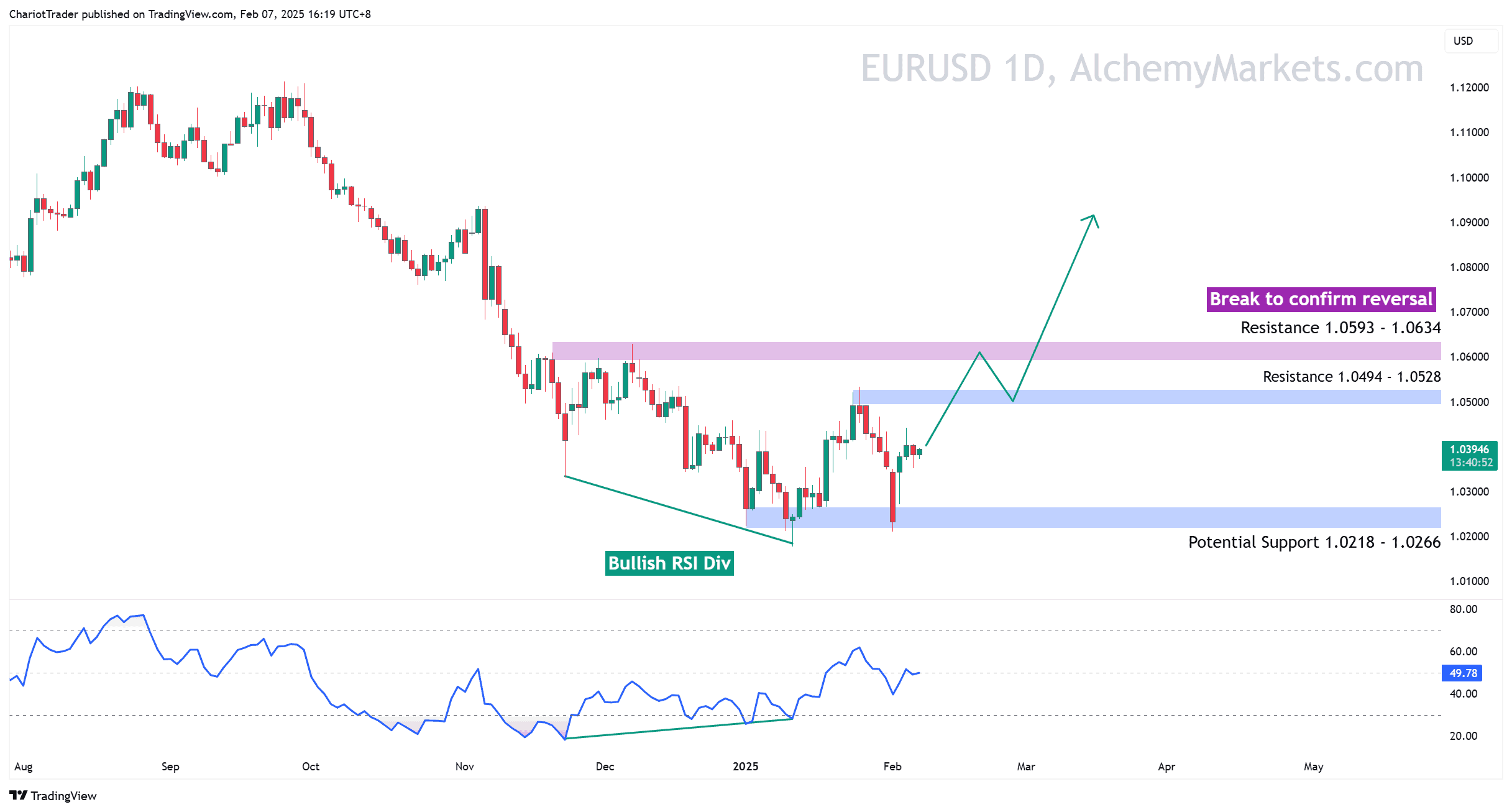

EUR/USD Analysis

Euro-Dollar has a bullish RSI divergence dating back to November 2024. A recent rally in January, followed by a successful retest of the pivot low zone on February 3rd, adds to the possibility of a bullish reversal.

For a broader reversal to be confirmed, a clear break of the pivot high at the 1.0593-1.0634 resistance needs to happen.

However, for more aggressive traders, there are two setups to look for:

- A break and retest of the 1.0494-1.0528 resistance, or;

- A retest of the pivot low zone at 1.0218-1.0266, which is now a potential bottom.

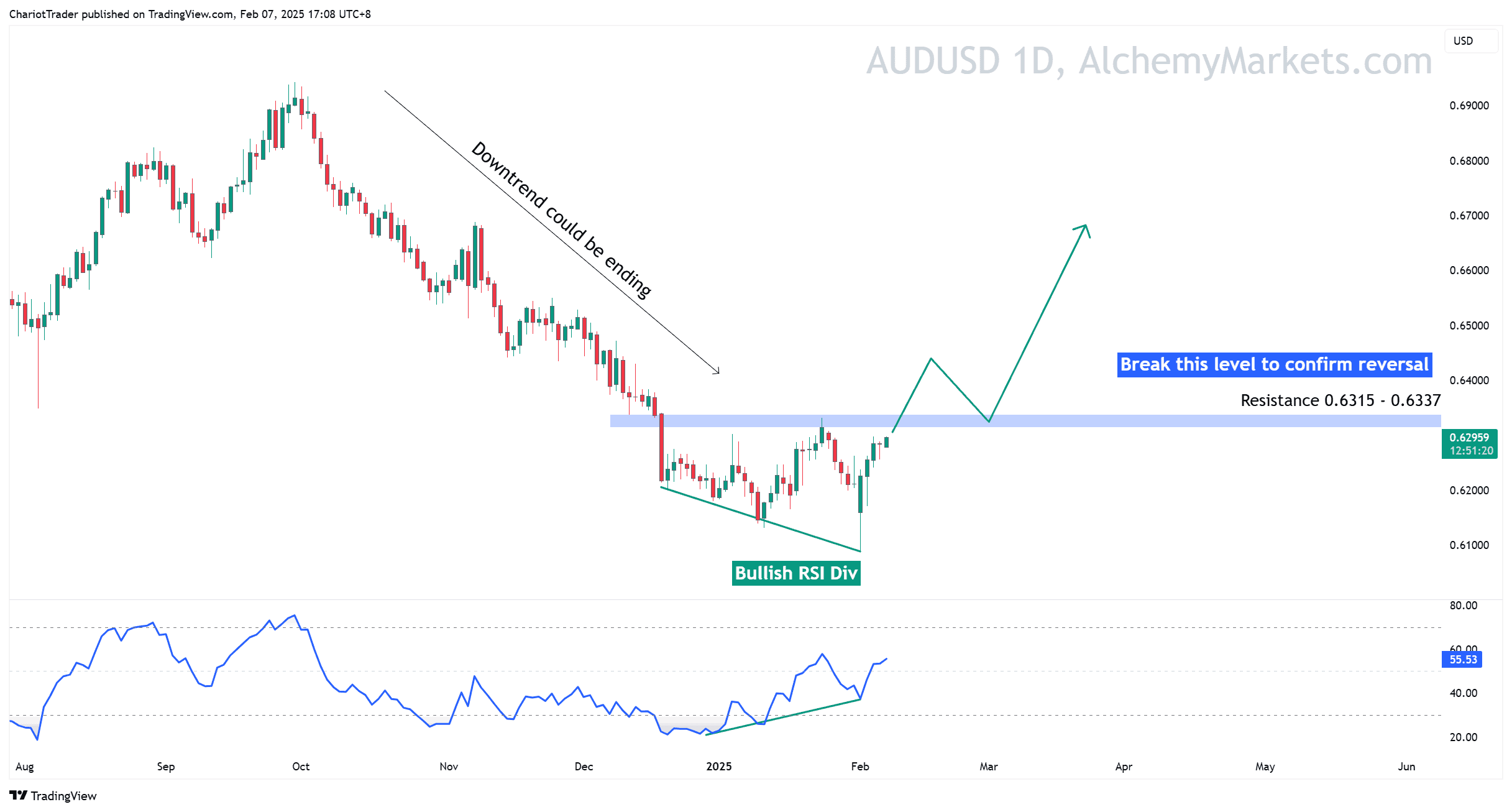

AUD/USD Analysis

Aussie-Dollar has a bullish divergence dating back to December 2024, with a clear resistance at 0.6135-0.6337. Breaking this level with high volume would confirm the bullish reversal, which could take the asset to sub $0.66 levels.

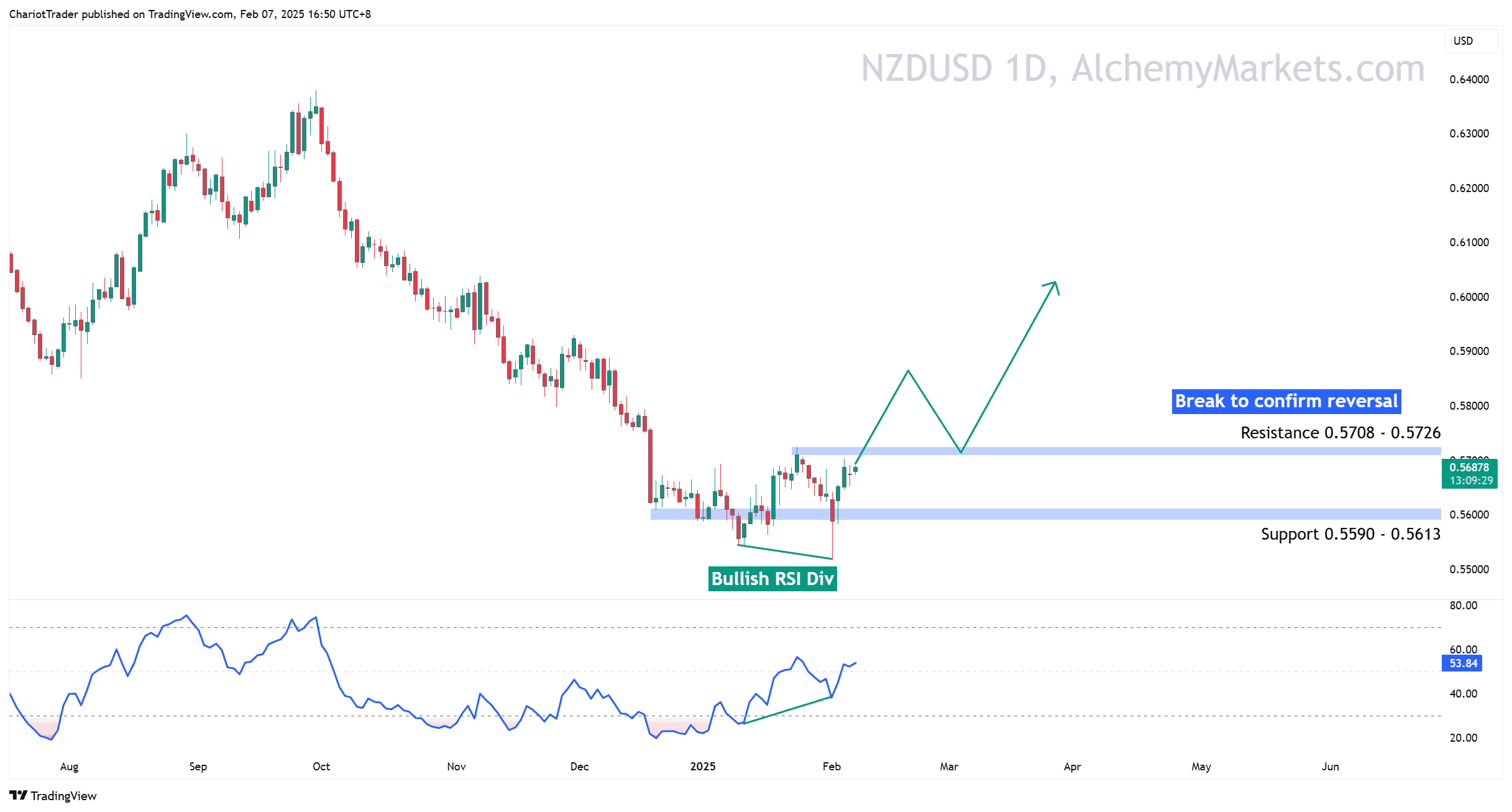

NZD/USD Analysis

Like AUDUSD, the Kiwi-Dollar pair is also seeing a bullish divergence on the daily timeframe. A break of the 0.5708-0.5726 resistance would confirm the reversal, supporting the idea of a weakening dollar in coming weeks.

If the price does reject at the resistance, an aggressive entry to consider is the support at 0.5590-0.5613, where multiple bullish wicks have occurred in the past.

Closing Thoughts: Cautiously Bullish

With the indications of bullish divergences and the double bearish confirmation on DXY, it can be easy to become overly confident in these bullish projections.

However, we advise cautious optimism, as sociopolitical conditions are uncertain. The recent tariff situation between the US, Canada, and Mexico attests to that.

It’s also important to consider that if NFP data goes significant off-course from projections, it would shock the markets. Here are two scenarios to consider:

- NFP Jobs Report comes out significantly higher: Bullish for USD – FX Majors likely to take a slump.

- NFP Jobs Report comes out significantly lower: Bearish for USD – FX Majors more likely to break bullishly.

You may also be interested in: