- Opening Bell

- August 11, 2025

- 3 min read

McDonald’s Breakfast Sales Drop; A Sign of Weak Consumer Spending?

So, I spent my weekend rewatching The Big Short — partly for the finance nostalgia, partly because it’s one of the few movies that can make a mortgage-backed security sound more exciting than my Sunday laundry run.

There’s that one scene where Mark Baum learns a pole dancer owns five houses and a condo, and suddenly realises the housing market is toast. This got me thinking. What’s the modern-day equivalent?

What’s the small but telling signal that says “Hey, something might be off here?”

Well, it turns out, it might just be your Sausage McMuffin.

Breakfast Is Losing Its Sizzle

On McDonald’s August 4 earnings call, CEO Chris Kempczinski casually dropped a nugget that’s more telling than the share price: breakfast is the weakest part of the day for sales right now. Customers are either eating at home or skipping it entirely.

And it’s not just McD’s. Wendy’s says breakfast is underperforming across the industry, noting that when people tighten budgets, breakfast is the first meal to go.

If you connect the dots, it’s not just about Egg McMuffins — we’re witnessing a snapshot of consumer stress.

People aren’t trading down from a Big Mac to a McChicken… they’re trading out of the meal altogether.

Why This Matters (Without the Doom & Gloom)

- Consumer budgets are pinched. Even with value menus, McD’s US same-store sales slipped in Q1 2025.

- Alternatives are winning. Gas-station breakfast burritos and 7-Eleven coffee are quietly taking share.

- Macro echo. Credit-card balances have dipped for two months straight — a rare occurrence since 2021.

It’s not “crash incoming” territory, but it’s the kind of micro-signal traders and economists tuck away for later.

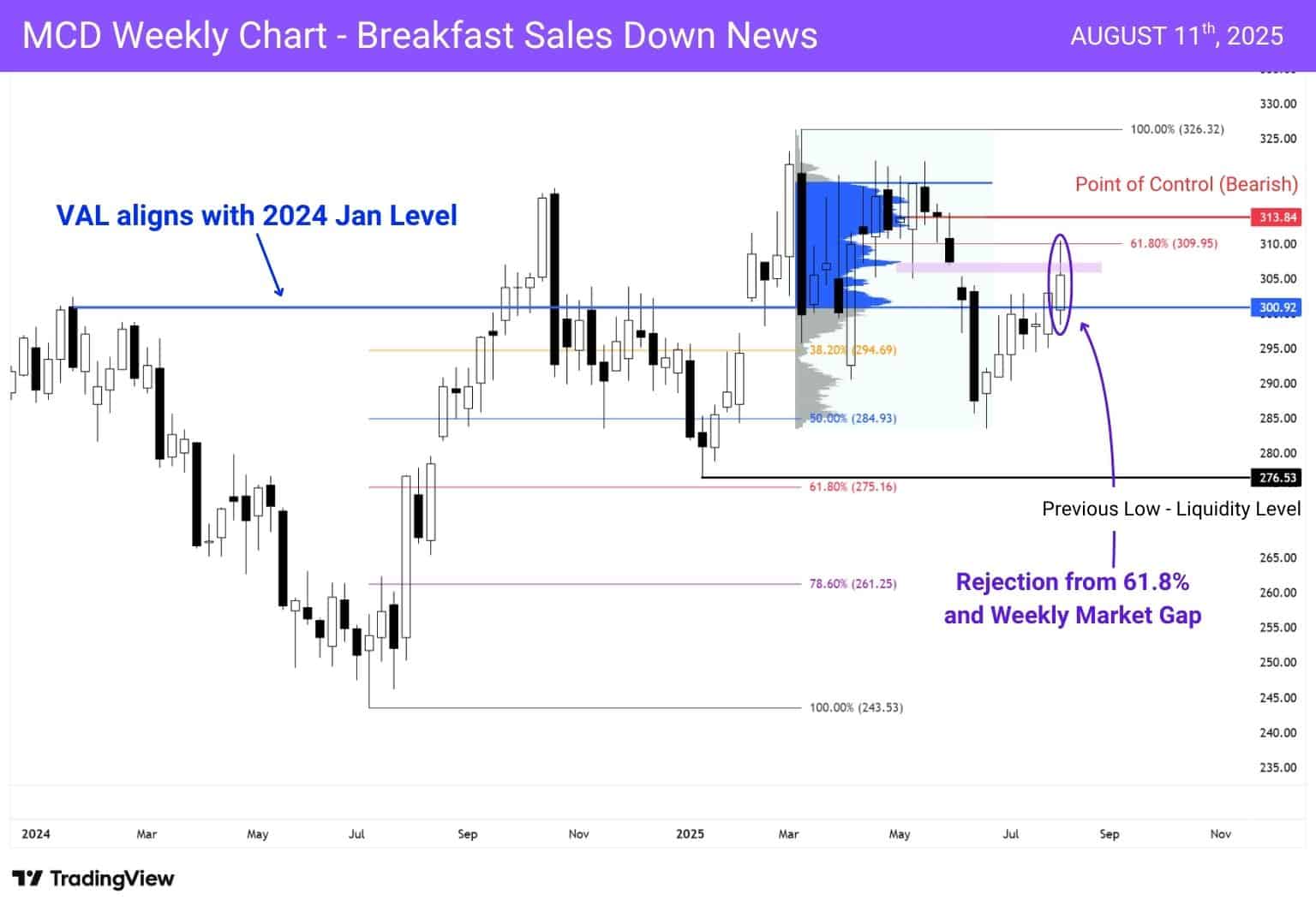

Chart Check: MCD’s Weekly Picture

McD’s tapped the 61.8% Fibonacci retracement at $309.95 last week, then backed off, leaving a wick on the weekly candle.

A few key levels to note:

- Support: $300.92 (Value Area Low). A clean break here could open a path toward $276.53.

- Resistance: $309.95 (Fib) and $313.84 (POC). Holding above either could suggest buyers are still hungry.

The context to note here is this: a drop below $300 in volume profile terms can be seen as a “failed auction” — essentially, the market saying no to higher prices for now.

However, none of this guarantees a direction — but it does frame where the next decisive move could form, at least for the stock itself.

Don’t Let This Distract You From the Bigger Picture

In The Big Short, you knew the housing bubble was in trouble when the condos started stacking up in the wrong hands. In 2025, maybe this breakfast kerfuffle is just one of many small tells in a much bigger story.

It’s not a crystal ball — tech and AI names are still driving the market narrative, and McDonald’s isn’t exactly trading on the same hype cycle. But shifts in everyday spending, even on something as small as a breakfast sandwich, can be early clues about broader consumer confidence.

And confidence, or the lack of it, eventually finds its way into earnings across sectors.