- Opening Bell

- January 2, 2025

- 2 min read

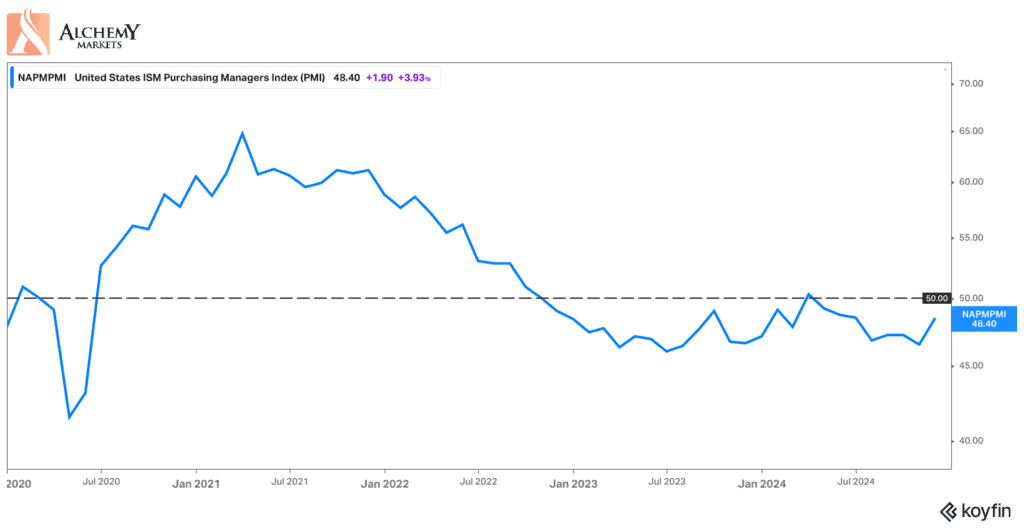

ISM PMI Expected to Hold at 48.3, Dollar Strengthens Amid Economic Uncertainty

As we head into the first trading week of 2025, all eyes are on tomorrow’s ISM PMI release, which is predicted to remain steady at 48.3, the same as last month. This level signals continued economic contraction in the U.S., reinforcing a deflationary bias and heightened investor caution. With the index below 50, the economy remains weak, but the dollar continues to benefit as a safe-haven asset in this uncertain environment.

The Fed’s recent confirmation that rate cuts will be slowed through 2025 further solidifies the dollar’s strength. The EUR/USD pair, which has been trending downward in a clear Elliott Wave structure, is expected to push lower into Wave 5. While the exact near-term target remains unclear, bearish momentum persists as the market awaits further clues on how the global economy will unfold this year.

If the ISM PMI eventually climbs above 50, signaling economic expansion, it would indicate an overheating U.S. economy with potential inflationary pressures. Such a shift could weaken the dollar as higher inflation erodes its purchasing power and dampens its appeal.

For now, however, the dollar remains dominant, with EUR/USD continuing its downward trajectory. Investors should brace for further volatility as economic data shapes the market’s direction in 2025.