- Opening Bell

- January 27, 2026

- 2 min read

Gold Breaks $5,000 — Can the Rally Hold?

The Move

Gold has broken decisively above the $5,000/oz mark, setting a new all-time high and extending its powerful multi-week rally. The metal continues to attract strong buying interest, buoyed by macro tailwinds and investor demand for safety amid global uncertainty.

What’s Driving the Rally

- Rate-Cut Expectations

Markets are increasingly confident that the Federal Reserve will begin cutting rates later this year. Lower yields reduce the opportunity cost of holding non-yielding assets like gold, while a softer dollar amplifies its global appeal. - Safe-Haven Demand

Persistent geopolitical tensions and economic crosswinds have investors rotating into gold as a hedge against policy risks and potential market volatility. Institutional and central bank buying has further reinforced the uptrend.

Technical Outlook

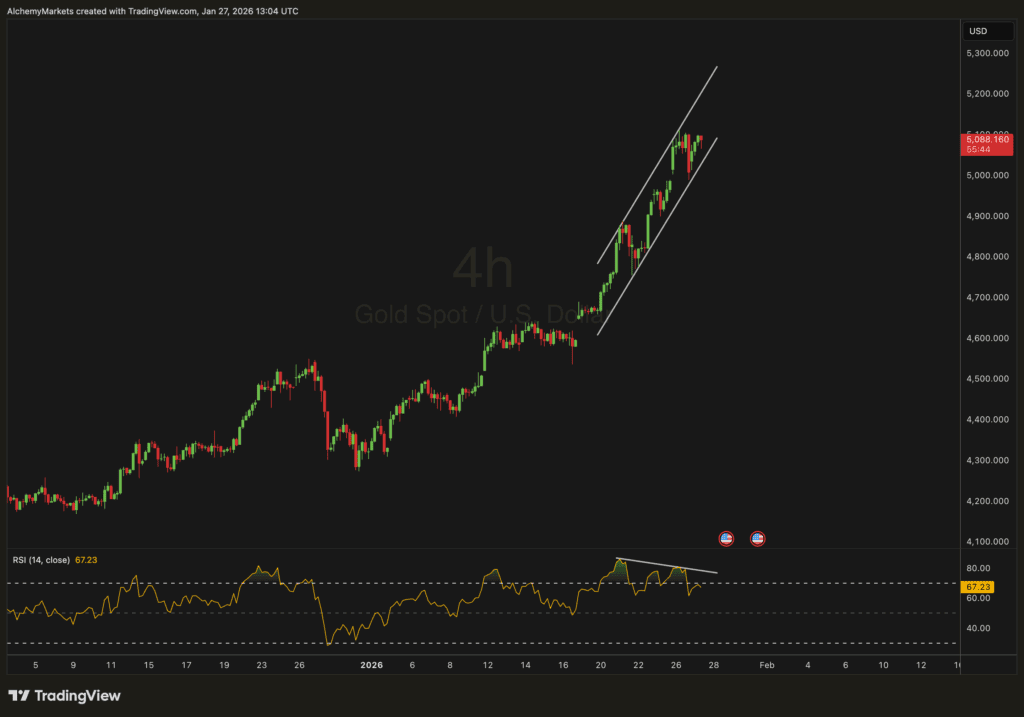

Gold is currently vacuuming higher within a steep ascending channel, reflecting strong momentum and bullish sentiment.

However, caution flags are emerging:

- RSI divergence is forming — momentum is flattening even as prices climb.

- This could signal that the rally is losing steam, increasing the risk of a near-term pullback if support breaks.

For now, price action remains constructive above trend support, but traders should monitor for a potential channel breakdown or momentum fade before adding fresh long exposure.

Takeaway

Gold’s surge past $5,000 is a milestone — but it comes at a time when momentum looks stretched.

Macro tailwinds remain supportive, yet near-term caution is warranted.

Expect volatility around this psychological level as markets test the conviction behind this historic breakout.