- Opening Bell

- February 20, 2026

- 2 min read

Is the Dollar About to Flip the Script? Watch DXY 4H

Careful trading the US Market Open today…because here comes the Dollar!

Although the US500 (S&P 500 index) is currently rising as we speak, it’s undeniable that it is happening at the same time that the Dollar is slowly making its way up…

But, this is happening on low liquidity outside of US market hours. We expect this correlation to break in a high liquidity environment, e.g. during the NY open today.

Let’s keep this analysis short, sweet and direct:

- Core Signal — Dollar could be reversing after tapping into a multiyear trendline.

- 4H timeframe — Dollar is building a double bottom or ascending triangle pattern.

- Fundamentally strong — High jobs growth, lower unemployment, and lower jobless claims, all support a stronger dollar in the short term.

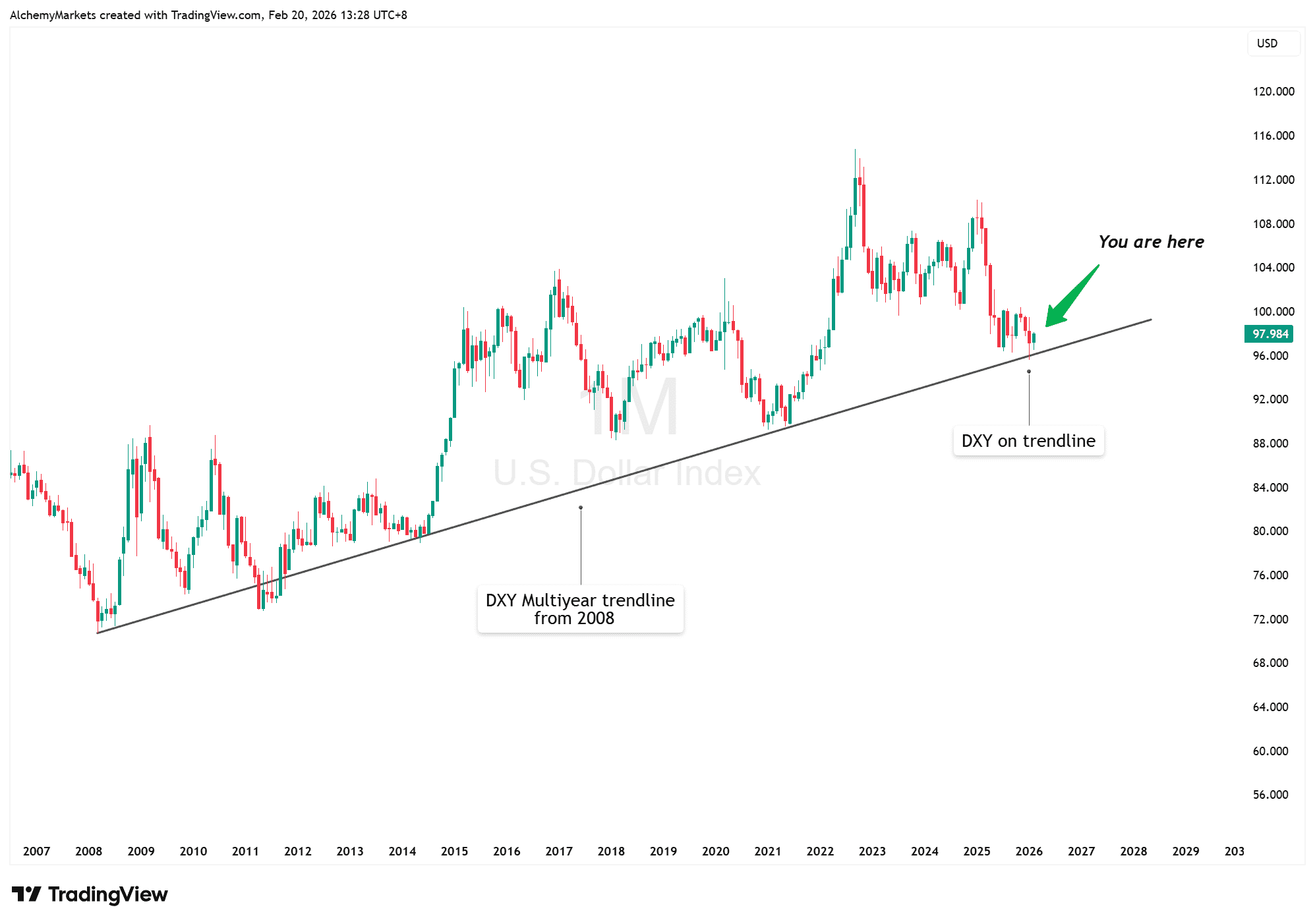

DXY Overview

Monthly Timeframe — Notice the 2008 Trendline Support

DXY has tapped a multi-year trendline stretching back to 2008. While slightly adjusted for alignment, the trendline still reflects the dollar’s long-term resilience through multiple downturns.

Now, we are once again back at extreme lows; a great environment for bullish reversals on the DXY.

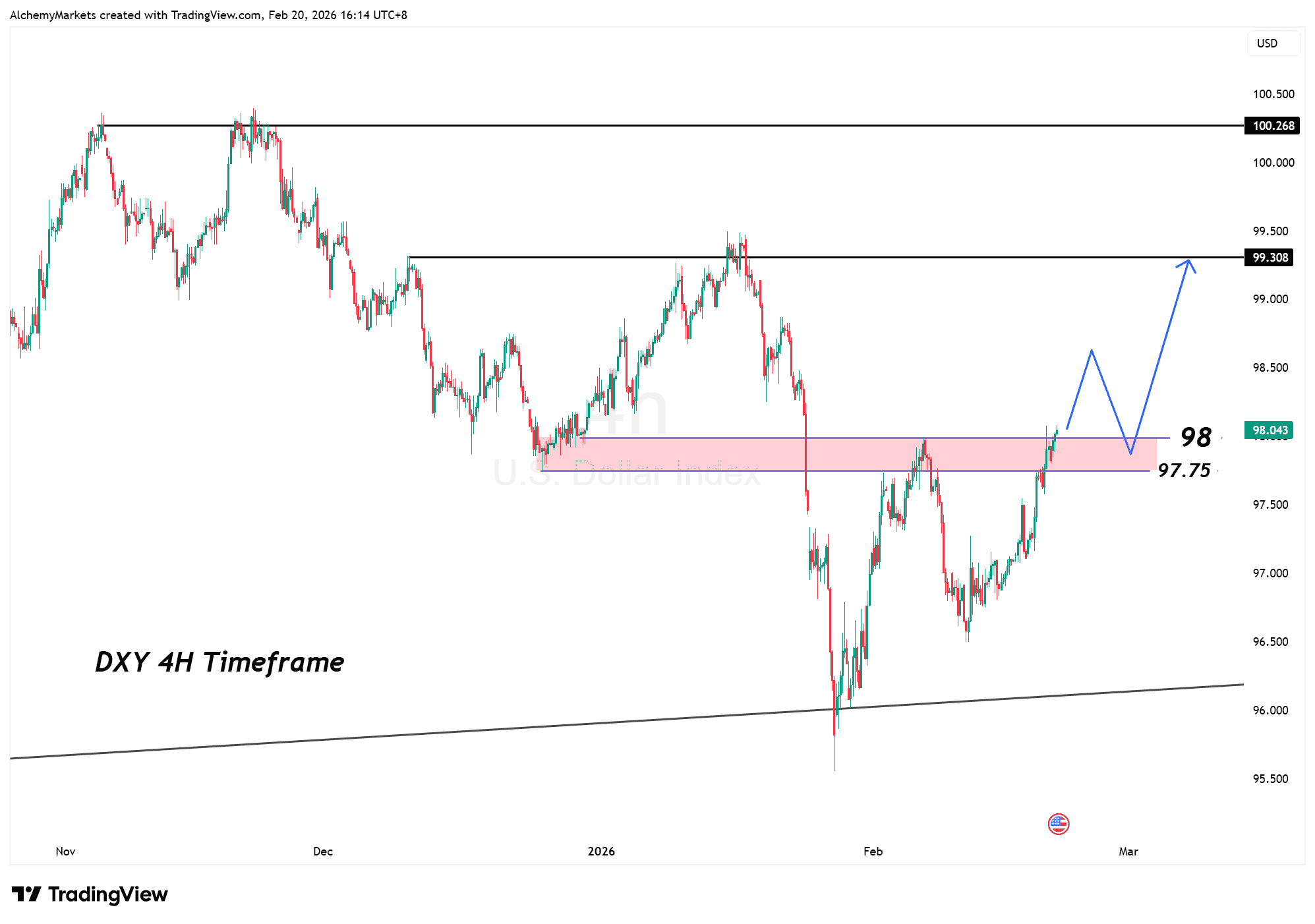

4H Timeframe — Potential Bullish Path for DXY

On the 4H timeframe, DXY is attempting to reclaim the 97.75–98.00 resistance zone, which previously acted as support before the breakdown. This area is now a key decision point.

A clean hold above 98 opens room toward 99.30, where prior structure capped price. Failure to hold above the zone, however, risks another rejection and a move back toward the recent higher lows.

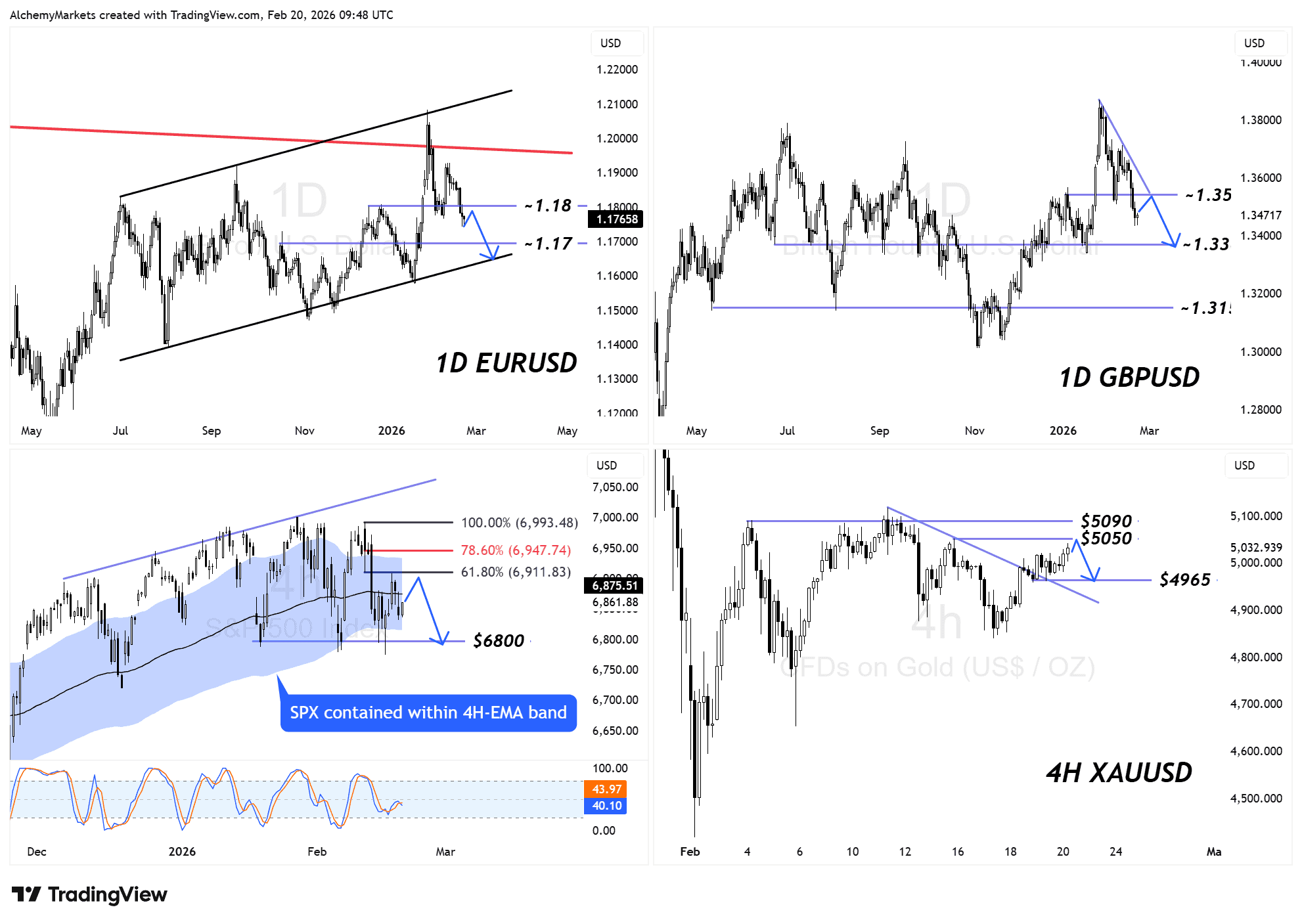

Intermarket Warning — Watch Equities & Gold

If the Dollar breaks and holds above 98 during NY liquidity, expect pressure on:

- US500 (SPX) — Stronger USD tightens financial conditions.

- Gold — Dollar strength often caps rallies, especially after strong jobs data.

- EUR/USD & GBP/USD — Most vulnerable to downside continuation.

This isn’t about panic. It’s about rotation. A Dollar bid changes flows and could create short setups. The above are possible scenarios, but not playbooks for how price will exactly play out.

Trade with caution and wait for the NY open before engaging the markets.