- Opening Bell

- February 10, 2025

- 3 min read

CPI Dominates a Light Trading Week Before Valentine’s

After last weeks’ earning reports and bombardment of economic news, a relatively ‘empty’ news week awaits us ahead of Valentine’s Day. We expect a relatively slow trading week except for Wednesday, when US inflation data (CPI) is released.

CPI Data — February 12th — Wednesday 1:30PM (GMT)

| Forecast | Previous | |

| Core CPI m/m | 0.3% | 0.2% |

| CPI m/m | 0.3% | 0.4% |

| CPI y/y | 2.9% | 2.9% |

In general, forecasts point towards weakening inflation, supporting the idea of rate cuts in 2025. This is bullish for the overall markets, but bearish for the US Dollar. However, deviations to the forecast will cause major volatility in the market.

- Higher CPI: Bearish for markets, Bullish for Dollar — Improved Rate Hold/Hike Chances

- Lower CPI: Bullish for markets, Bearish for Dollar — Improved Rate Cut Chances

CME Group Fedwatch Tool (Feb 10th, 2025)

If deviations occur, keep an eye on the CME Group FedWatch Tool, which tracks market expectations for upcoming Fed rate decisions. It projects the likelihood of a rate cut, hold, or hike in percentage terms.

- Higher Rate Cut Expectation: Weakens the dollar while boosting the S&P 500 and overall market sentiment.

- Higher Rate Hold Expectation: Maintains stability but keeps markets cautious.

- Higher Rate Hike Expectation: Strengthens the dollar, but pressures equities and risk assets.

Currently, the tool shows a 93.5% chance of a rate hold for the March 19, 2025 decision. However, unexpected deviations could shift these probabilities significantly, influencing market direction. Keep a look out!

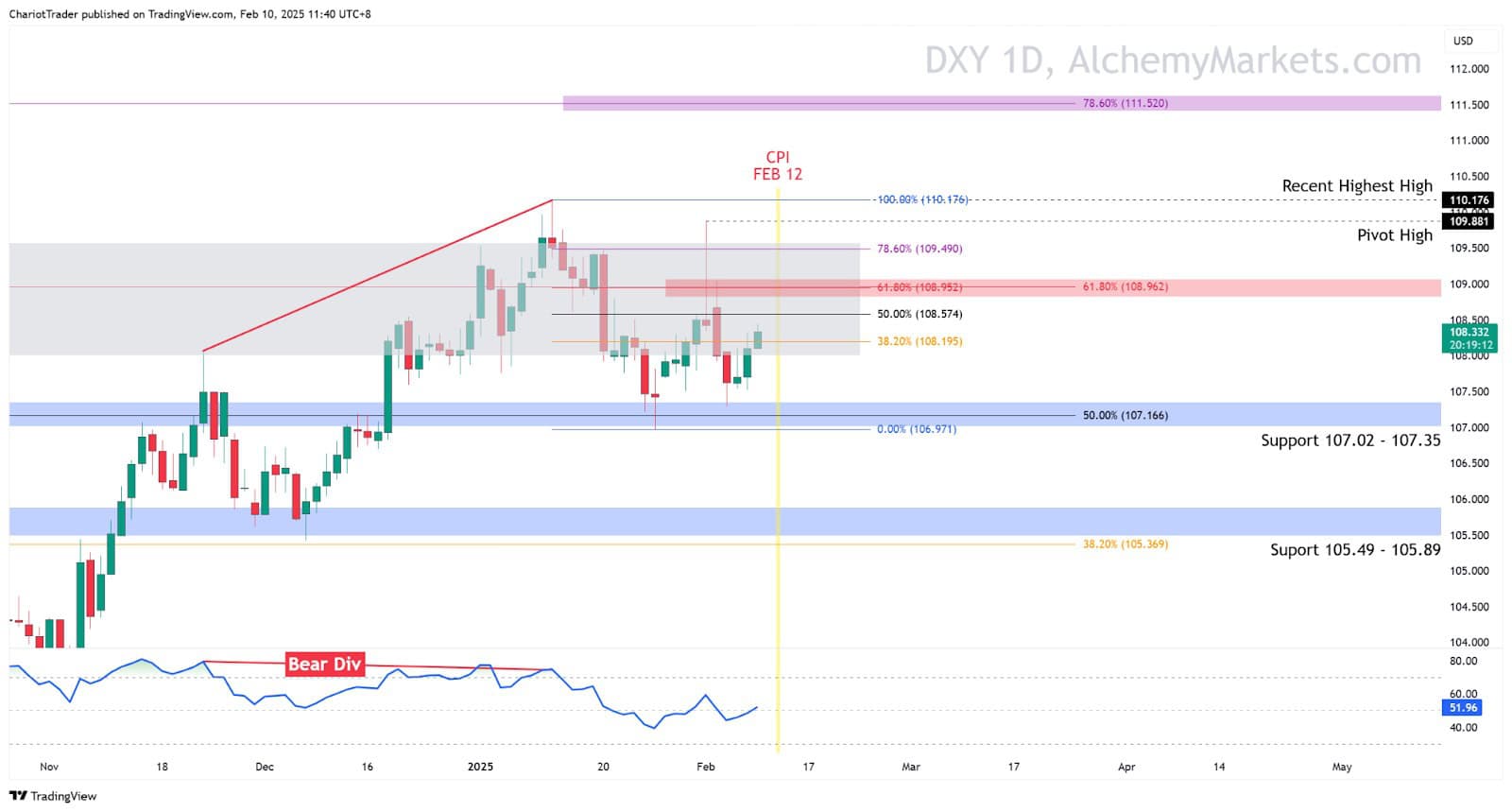

DXY Chart Analysis (Feb 10th, 2025)

In last week’s analysis, I noted how the DXY has rejected from a key resistance zone (Weekly FVG and 61.8% Fib Retracement). This highlights the possibility for a major top to be in for the DXY in the mid/long term.

However, don’t celebrate just yet — the DXY does have a fighting chance, which again is bearish for the overall markets.

The DXY bounced off the 107.02–107.35 support zone, keeping its uptrend intact.

Watch the key resistance at ~108.960, where two 61.80% Fib retracements align. A breakout above this level could push DXY toward its pivot high (109.881), recent high (110.176), or even the major 78.60% Fib retracement near 111.500, potentially marking a major top — if the recent high isn’t the major top.

We recommend staying cautious in your trading ahead of Wednesday (February 12) when the CPI data is released. After that, keep an eye on the FedWatch Tool and DXY chart for clues on the Dollar’s direction and broader market trends.

You may also be interested in: