- Opening Bell

- July 8, 2025

- 4min read

AUD/USD, EUR/CHF, DXY: Crosscurrents from RBA Surprise, SNB Dilemma & Tariff Apathy

RBA Holds Fire – AUD/USD Spikes, but Still a Short-Term Macro Game

The Reserve Bank of Australia surprised markets with a steady hand, holding rates at 3.85% in a split vote that leaned cautious. The official line: they want more confirmation that inflation is sustainably falling toward the 2.5% midpoint. The rate hold sparked a decent pop in AUD/USD, up 0.8%, but we’re skeptical about reading too much into it beyond the initial reaction.

The board is clearly still live for August. If Q2 CPI (out later this month) confirms trimmed inflation is easing further and the labor market softens, a rate cut is absolutely on the table. Our estimates keep the risk of a dovish August outcome alive.

What’s more interesting is how much of the AUD story gets hijacked by US data and tariff risk. If Trump moves forward with aggressive tariffs again, the USD might take more heat than AUD given Australia’s relatively light exposure and China’s buffering deal. But if tariff noise fades and hot US CPI triggers a hawkish Fed repricing, AUD/USD likely heads back south.

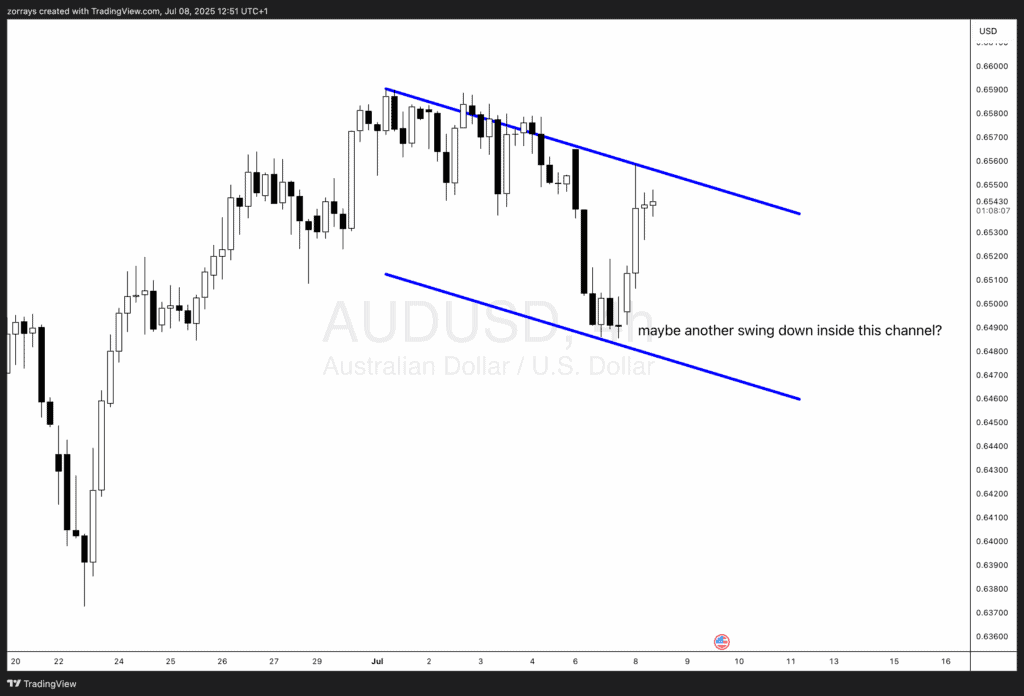

AUD/USD Technicals:

AUD/USD looks to be trading inside a clean descending channel. After the post-RBA spike, price is stalling near mid-channel. With lower highs holding, another leg lower into 0.6470-0.6450 support seems likely unless the USD softens materially.

Swiss Franc Strength – SNB’s Hands Tied in Front of USDCHF

The Swiss franc is back near the highs, especially versus the euro, and the SNB is notably quiet. With inflation near zero and the real trade-weighted franc at levels not seen since the 2022-23 FX fire-sale era, the central bank has little room to maneuver.

The political backdrop is likely contributing to the silence. Switzerland is deep in negotiation mode trying to sidestep a tariff blow from the US, particularly to its pharma sector. Going full FX intervention mode now would only complicate things.

That said, the SNB may not stay sidelined for long. If EUR/CHF drops toward 0.9200 again, a quiet round of euro buying looks increasingly probable—even if it skirts the edge of being labeled a manipulator again by the US Treasury.

If intervention is too sensitive, one alternative could be a tweak to CHF deposit charges—raising the 0.25% penalty above the threshold to 0.50%, especially if the SNB builds up sight deposits as it did in 2020.

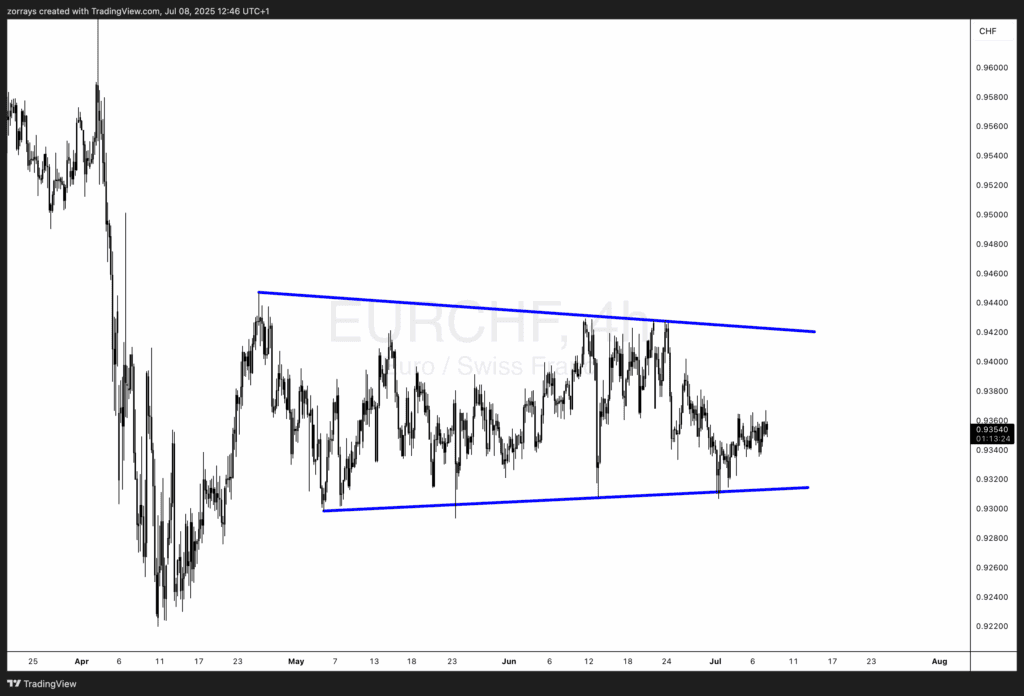

EUR/CHF Technicals:

Price continues to compress inside a symmetrical triangle. A breakout likely comes with fresh trade clarity or SNB action. Support sits around 0.9320, with upside capped near 0.9430 for now.

Markets Yawn at Tariff Letters – DXY Firming Inside Channel

The Trump administration’s latest salvo—letters warning partners of higher tariffs—was met with a shrug. US equity futures dipped then rebounded, and Asian markets (even Japan) are up. Seems like investors are reading this more as a negotiation tactic than a full-scale escalation.

The muted market reaction speaks volumes: until concrete tariff action hits balance sheets, traders are choosing to focus on macro fundamentals—particularly inflation and labor resilience in the US. That favors a stronger dollar setup near term, especially if June CPI shows signs of stickiness.

Fed policy isn’t off the table either. The 5y5y inflation swap is creeping higher again, sitting just below 2.60%. That could keep the Fed on alert and justify keeping September in play for a potential cut delay.

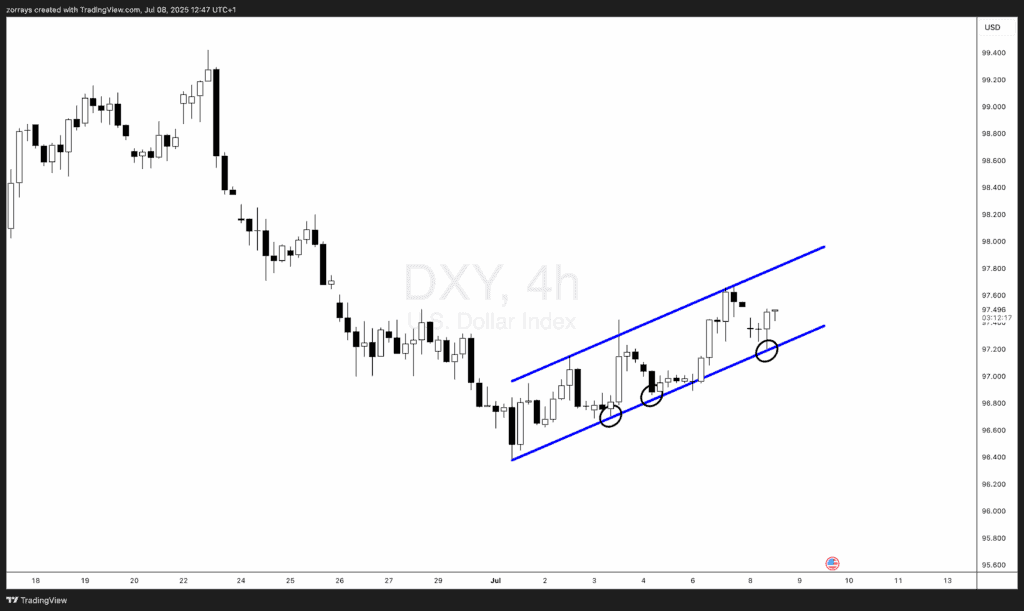

DXY Technicals:

The dollar index (DXY) is holding firm inside a rising parallel channel. It bounced cleanly off the lower boundary again on July 8, suggesting strong underlying demand. If CPI surprises to the upside, the 97.80-98.00 zone is well within reach this month.

Wrap-Up

We’re heading into a macro-heavy week where tariff chatter is the background music, but the real beat comes from inflation prints and central bank hesitations. RBA may have paused, but August’s in play. SNB is boxed in, and DXY continues to grind higher within range.