- Elliott Wave

- May 5, 2025

- 2 min read

Yen Joins Gold at the Hip (USDJPY Elliott Wave)

Executive Summary

- USD/JPY is retesting 2024 lows

- JPY strength is correlated to Gold strength in 2025

- USDJPY downside targets include 132 and 128.

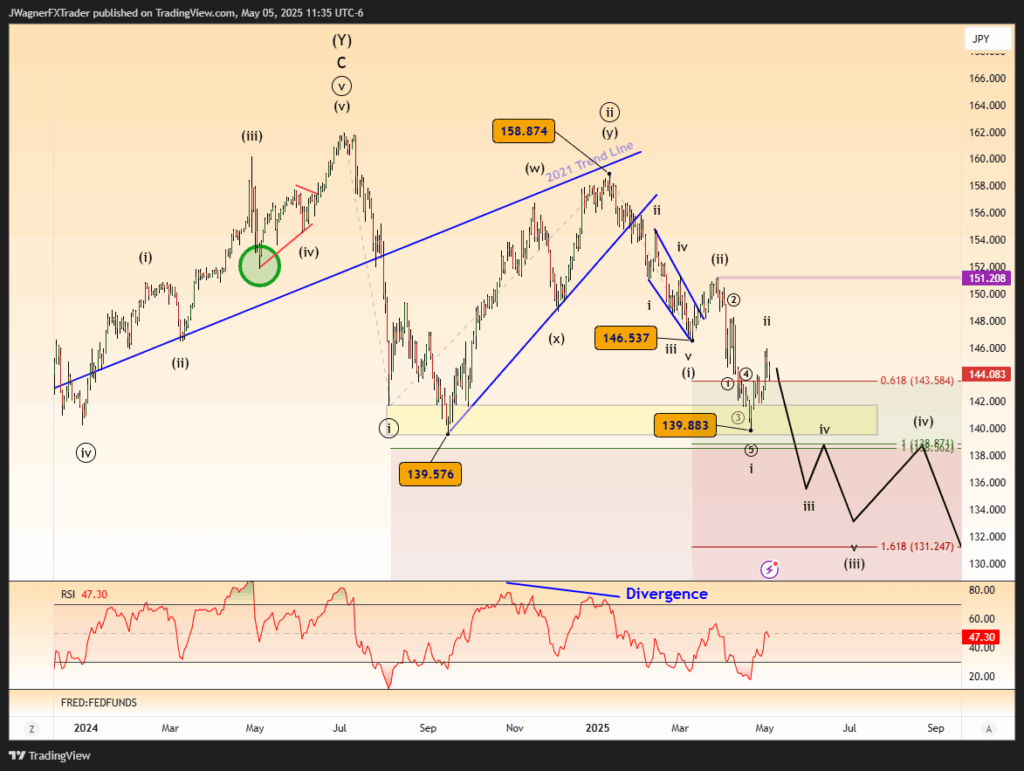

USD/JPY has been in a strong decline and is retesting a triple low going back to December 2023.

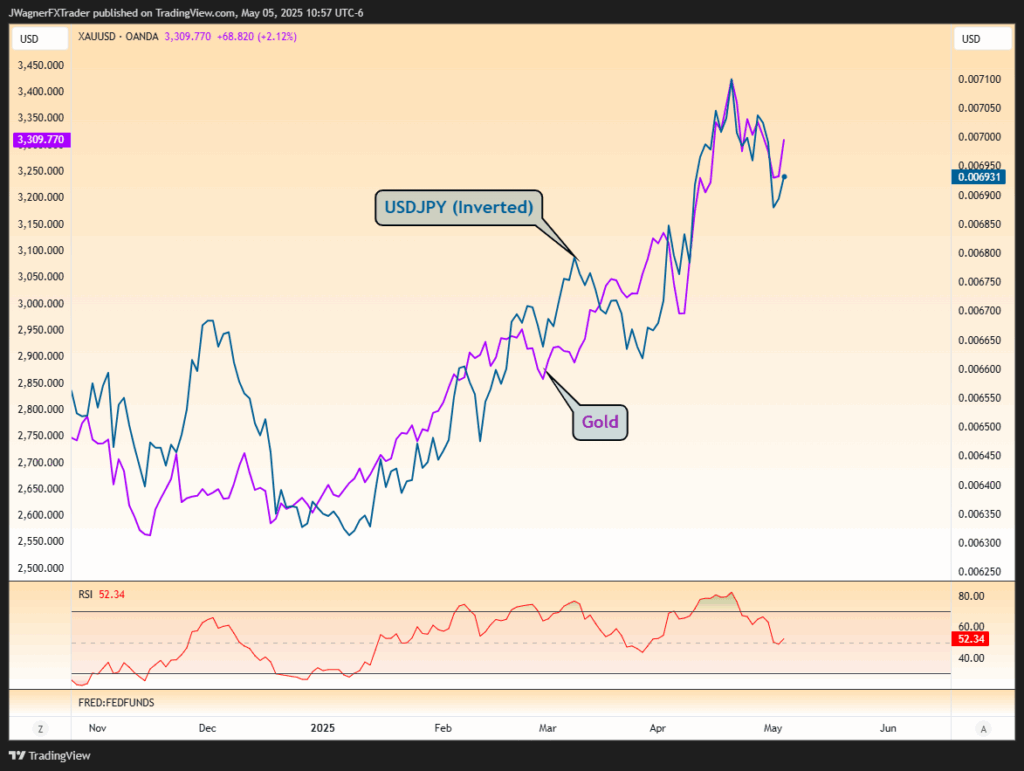

An interesting correlation has developed this calendar year. The strength in JPY (USDJPY trend

This relationship could be the result of stress developing in the markets. Both a strong JPY and gold tend to operate well in stressful risk off market conditions. Additionally, it could signal shunning away from the US dollar. A weakening dollar would naturally pull away from the USD to other assets and fiat currencies.

Current Elliott Wave Forecast

USDJPY does appear to be in a bearish wave (iii) that is incomplete to the downside. Currently, USD/JPY is processing through previous support between 139.57 and 141.68. These support levels were formed in August and September 2024. (see yellow horizontal box)

The preferred wave count suggests USDJPY likely breaks this support shelf to stretch down to lower levels.

If the pair is successful in breaking lower, a temporary low would be the finishing touches to wave ‘iii’ and lead to a bounce in wave ‘iv’ that may carry it back up to the level of broken support.

All of this would eventually lead to a wave v of (iii) lower that could target 128 and possibly lower levels.

Bottom Line

USDJPY is falling in wave (iii) of a five-wave impulse decline. Wave (iii) is forecasted to finish below 132 and possibly reach 128.

This forecast would remain valid so long as USDJPY holds below 151.21. In the unexpected event of a print above 151.21, then we’ll reconsider the wave count.

Short-Term Bias: Bearish

Long-Term Bias: Bearish

Key Level for Bearish Bias: 151.21

Initial Target: 132

Secondary Target: 128