- Elliott Wave

- January 24, 2025

- 2 min read

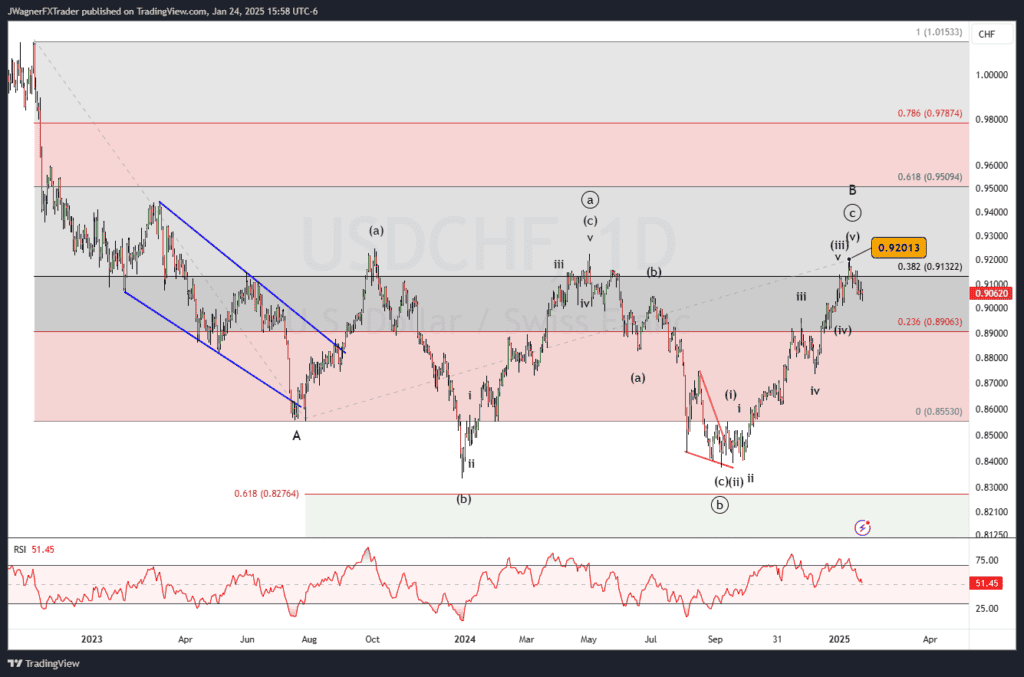

USD/CHF Elliott Wave Forecast: Is Wave C About to Unfold?

Executive Summary

- Trend Bias: USD/CHF appears to have topped at .9201 and beginning a bearish trend in Wave C.

- Key Levels: Bearish below .9201.

- Target Zone: Downside target lies near the 0.83 region and possibly .77 completing the larger A-B-C corrective structure.

Current Elliott Wave Analysis

The Elliott wave analysis for the USD/CHF daily chart illustrates a completed A-B structure, suggesting the pair is in Wave C of a larger corrective zigzag pattern. Here’s the breakdown:

Minor Degree Count:

- Wave A formed a clean 5-wave downward diagonal.

- Wave B retraced upward in a three-wave corrective pattern, reaching the 38.2% Fibonacci retracement of wave A topping at .9201.

Wave C often has a Fibonacci or equal wave (100%) relationship with the length of wave A. This places targets near .83 and possibly .77.

Currently, shorting USDCHF would incur negative swap rates. Therefore, be mindful if you plan to hold a long Swissie position (short xxxCHF) that the swap will eat away at your capital. As a result, look for strategic places after a bounce to consider short positions.

Bottom Line

USD/CHF’s decline in Wave C is likely underway, targeting the 0.83 and possibly the .77 zone. USDCHF prices should hold below .9201 under the wave count presented.

You Might Also Be Interested In: