- Elliott Wave

- January 28, 2025

- 2 min read

Silver Linings Ahead: Elliott Wave Maps the Next Move

Executive Summary

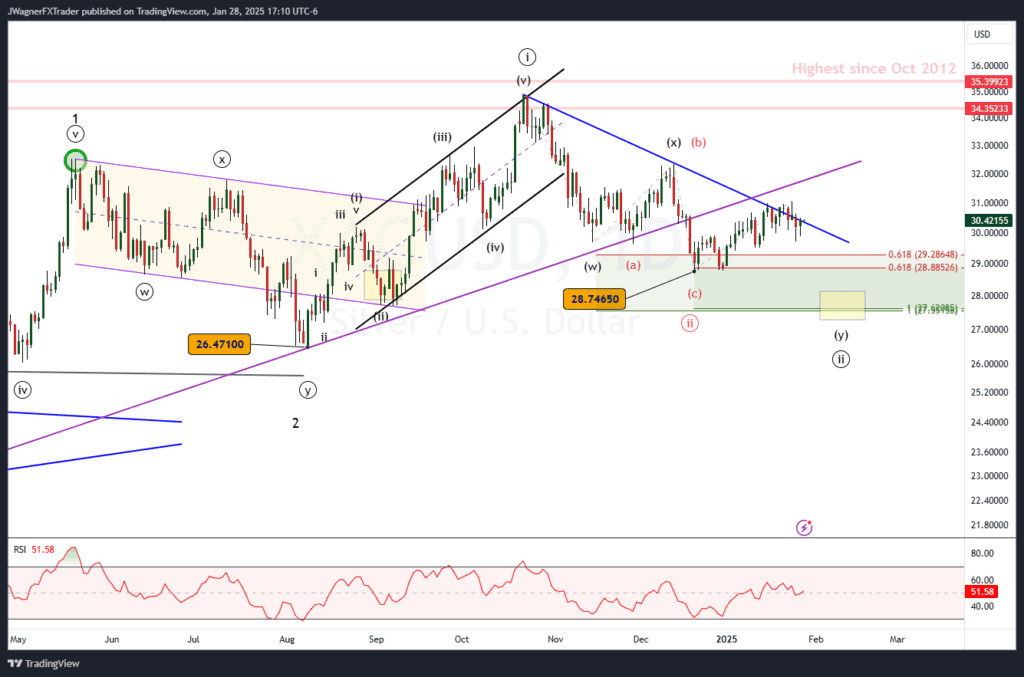

- Trend Bias: Silver is caught below a resistance trend line (blue) that keeps the immediate focus downward.

- Current Wave Structure: A double zigzag corrective pattern needs one more correction.

- Key Level: A small decline to $27.50-$28.10 may be supported. $26.47 is the bullish key level.

Current Elliott Wave Analysis

The Elliott wave analysis for Silver (XAG/USD) suggests it is currently in a corrective phase wave ((ii)) following an impulsive structure to the upside. Wave ((ii)) is unfolding as a double zigzag with wave b (not pictured) of (y) likely in place. This means a small decline in wave c of (y) would finish off wave ((ii)). Support is anticipated near $27.50-$28.10.

There is an alternative wave count (red labels) that we are considering to be lower probability in that wave ((ii)) is already complete at the December low of $28.74. If so, then silver would break above the blue resistance trend line over the next few days.

If you recall, back on November 29, we forecasted an additional decline was needed for silver to complete it’s corrective phase. That decline came in December, but the rally is not strong enough to act like the bottom is in. Additionally, if the US Dollar is going through a weak phase, that should help lift silver prices and it simply isn’t happening right now.

Therefore, it appears another decline is needed to set the table for a bullish rally.

Bottom Line

Silver’s Elliott Wave structure suggests we may see the conclusion of a corrective wave ((ii)) soon. A bullish reversal may appear near $27.50-$28.10. The key bullish level is $26.47. Below $26.47 and we’ll have to reassess our wave count.

Once wave ((iii)) begins, it would carry up to new highs above $35.

You May Also Be Interested In: