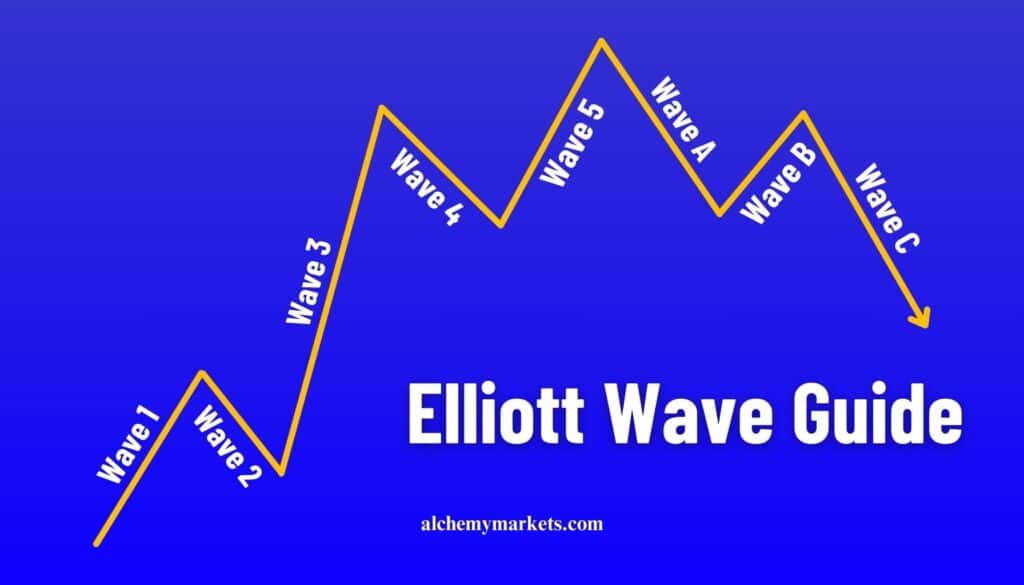

- Elliott Wave

- July 30, 2025

- 2 min read

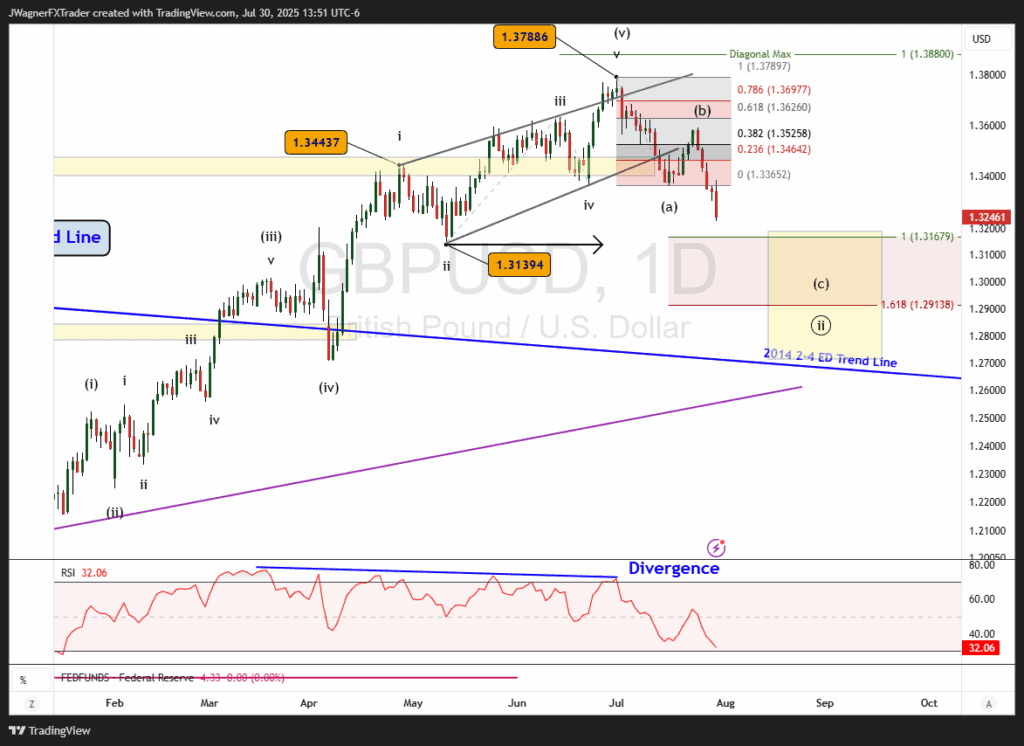

GBP/USD Elliott Wave: Declining in Wave 2

Executive Summary

- GBPUSD completed wave ((i)) of a larger bullish impulse sequence.

- Current decline is viewed as wave ((ii)) and may reach 1.31 and possibly 1.27.

- Current forecast for additional declines holds while prices remain below 1.3589.

GBPUSD Elliott Wave Count

The current Elliott wave count is that GBPUSD is declining in wave (c) of a larger (a)-(b)-(c) correction. This downtrend is anticipated to reach 1.3139 and possibly as low as 1.27.

This downward correction would consolidate the rally from January to July 2025. The rally needed 5 months to unfold, so this decline may need 2-8 months to consolidate.

Wave (v) of the H1 2025 impulse rally was an ending diagonal pattern, shaped like a rising wedge.

When an ending diagonal pattern appears, oftentimes there is a quick retracement back to the origination of the diagonal. In this case, the forecast is for a swift retracement back to 1.3139 and possibly lower levels.

If lower levels are sought after, there is a support trend line developed from 2014 that passes through near 1.27. Also, in the same area is the 61.8% Fibonacci retracement level.

Bottom Line

GBPUSD has progressed through the first wave of a larger degree wave 3. The decline from July 1 is viewed as wave ((ii)) of 3 and opens the door for the bearish count and lower levels down to 1.27-1.31.

Once lower price levels are established, then the prospects for a large and booming rally likely increase later on in 2025.