- Chart of the Day

- July 24, 2025

- 3 min read

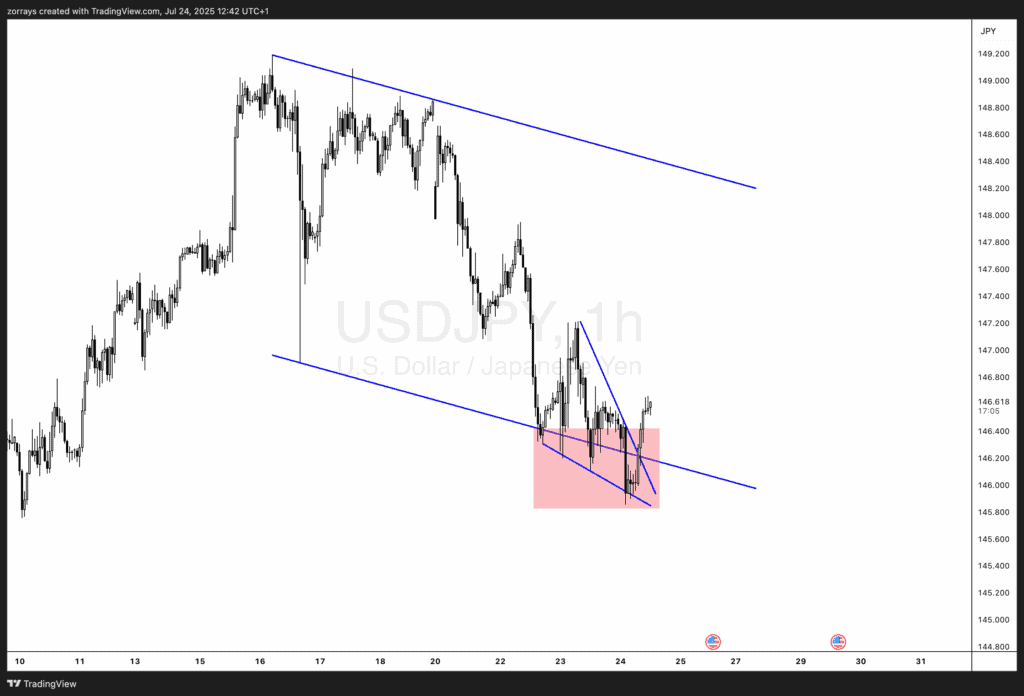

USD/JPY Breaks Out – Is a Move to 148 on the Way?

What’s Happening with USD/JPY?

USD/JPY has caught the attention of traders today after a clean bullish breakout from a tight wedge pattern. If you look at the chart, price had been stuck near the bottom of a bigger downtrend (descending channel). But now, it’s pushing higher — a sign that buyers might be stepping back in.

This breakout came after price hovered around the 145.80–146.00 support area, bounced several times, and finally broke out of the narrow wedge (marked in red).

Right now, USD/JPY is trading around 146.55, and we could be looking at a move toward 148.00 in the short term.

Why Did the Yen Strengthen Lately?

The Japanese yen has been strong this week — actually the best performer among the G10 currencies — gaining about 1.8% against the US dollar. Here’s why:

- US-Japan Trade Deal: Markets are reacting to a new trade agreement between the US and Japan. This is making traders think that the Bank of Japan (BoJ) might finally raise interest rates later this year.

- BoJ Rate Hike Bets Are Growing: Earlier this month, markets expected just a 0.10% hike by year-end. Now, they’re pricing in 0.20%, which is a big shift for Japan.

But here’s the twist:

Some analysts believe Japan’s political situation (like possibly getting a new prime minister) might slow down any aggressive moves from the BoJ. That means the yen’s strength might not last forever.

Why the Breakout Matters for Traders

From a technical view:

- Price bounced from major support (145.80)

- Formed a bullish wedge — a pattern that often signals a breakout

- Broke above the wedge trendline today

- Now trading above 146.50, showing strength

This setup could attract more buyers, especially if traders start betting on a bounce after the recent yen rally. With less aggressive rate hike bets on the horizon, some might start buying USD/JPY again.

Retail Trading Idea (Not Financial Advice)

| Entry Idea | Around 146.60 (after breakout confirmation) |

|---|---|

| Target (Take Profit) | 148.00 (mid-channel resistance) |

| Stop-Loss Zone | Below 145.80 (wedge base & channel support) |

| Risk-Reward Ratio | ~1:2 (depending on exact entry and exit) |

💡 Tip: Always manage your position size and risk before entering a trade.

What to Watch Next

| Level | Why It Matters |

|---|---|

| 145.80 | Key support, tested multiple times |

| 146.40 | Breakout zone – could act as new support |

| 147.20 | Minor resistance |

| 148.00 | Target zone if momentum continues |

If USD/JPY stays above 146.40, we could see momentum carry the pair higher in the next few days. But keep in mind, politics in Japan and global risk sentiment could shake things up quickly.

Quick Recap

- The yen has been strong, but that rally may be cooling off.

- USD/JPY broke out of a wedge this morning, bouncing from major support.

- There’s a possible move toward 148.00 if bullish momentum continues.