- Chart of the Day

- January 26, 2026

- 2 min read

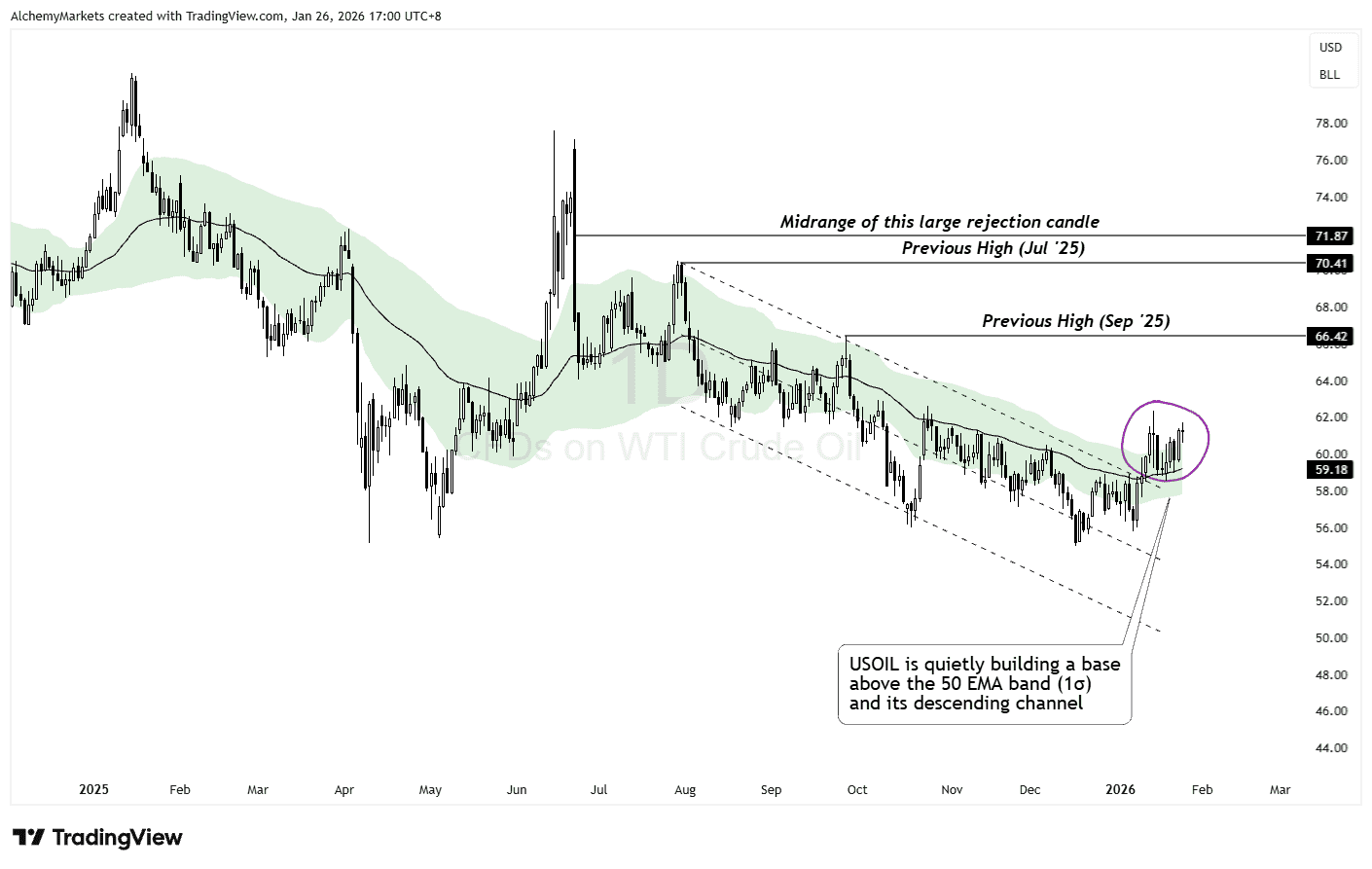

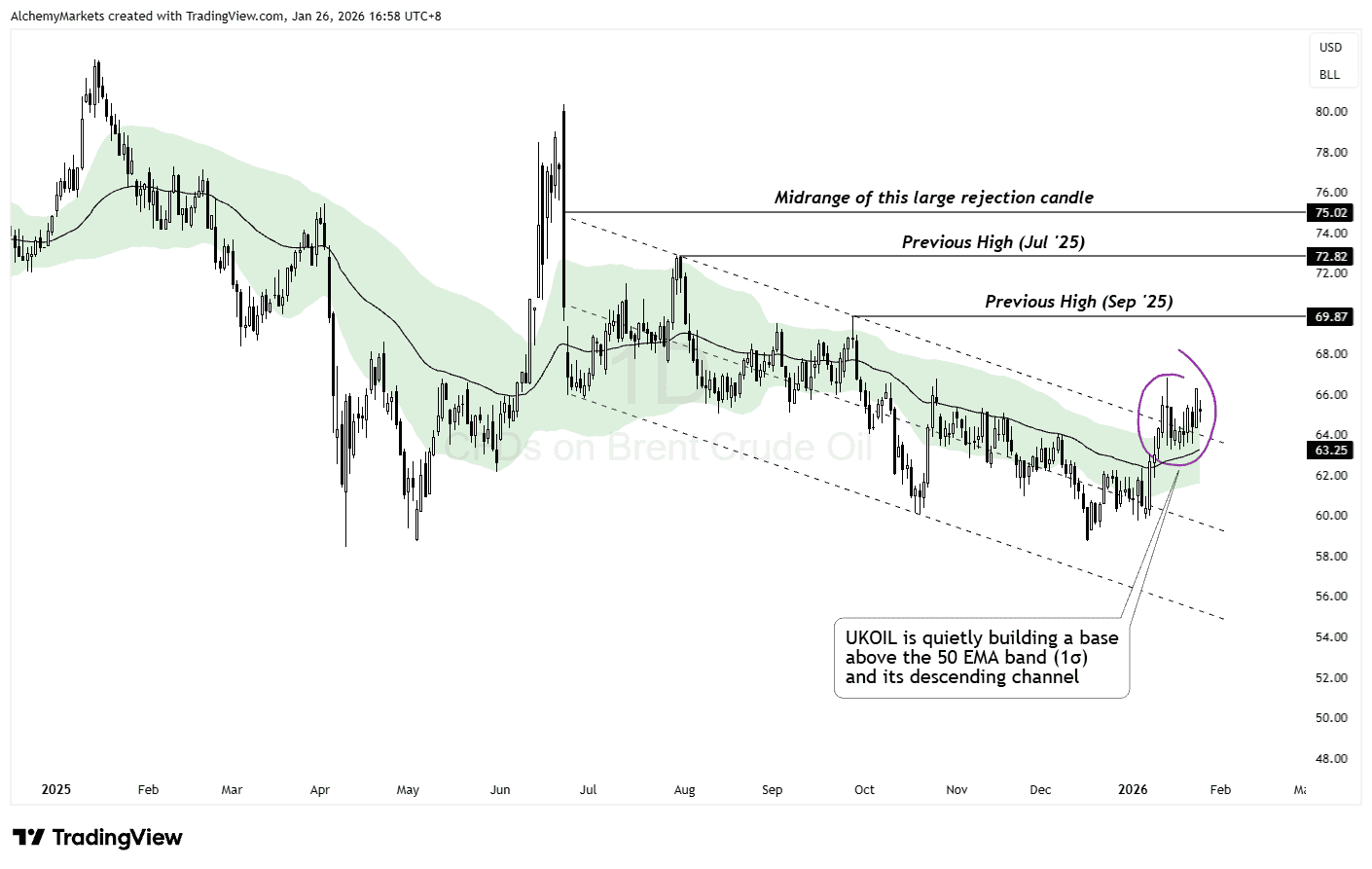

Oil Quietly Builds Base After Breaking Above Descending Channel

Oil is starting to do something it has not done for months. It is holding above the descending channel and 50-EMA band, it is doing so without any drama.

Both UKOIL (Brent) and USOIL (WTI) have pushed above their long running downward channels, and are now holding above the 50 EMA band on the daily. That shift signals that downside control is weakening, quietly building a base.

What has changed

For most of the second half of 2025, rallies in oil were sold aggressively at the channel top, daily 50-EMA, and at the top of the EMA band (set to 1 standard deviation). That pattern is now broken.

Price is no longer being capped by a descending structure, and pullbacks are being supported above the 50 EMA band instead of accelerating lower. That tells us selling pressure is easing, even if upside momentum is still limited.

USOIL 1D Chart

UKOIL 1D Chart

Why UKOIL and USOIL together matter

Brent and WTI tend to correlate with each other, but they don’t always share clean patterns.

This time, both broke above their respective descending channels and started stabilising at the same time, suggesting this move is not contract specific noise.

Levels that still matter

Above current prices, the midrange of the large rejection candle and the previous highs from July and September remain key resistance zones. These are the areas that will decide whether this move matures into a trend reversal or stalls into consolidation.

As long as price holds above the former channel and the 50 EMA band, the base building narrative stays intact. A failure back below those levels would delay the idea, not invalidate it.

Bottom line

Oil is not in a confirmed uptrend. But for now, it has stopped trending down. Breaking above the descending channel shifts the market from distribution to early base building. This makes oil an interesting market to watch in February.