- Chart of the Day

- October 13, 2025

- 2 min read

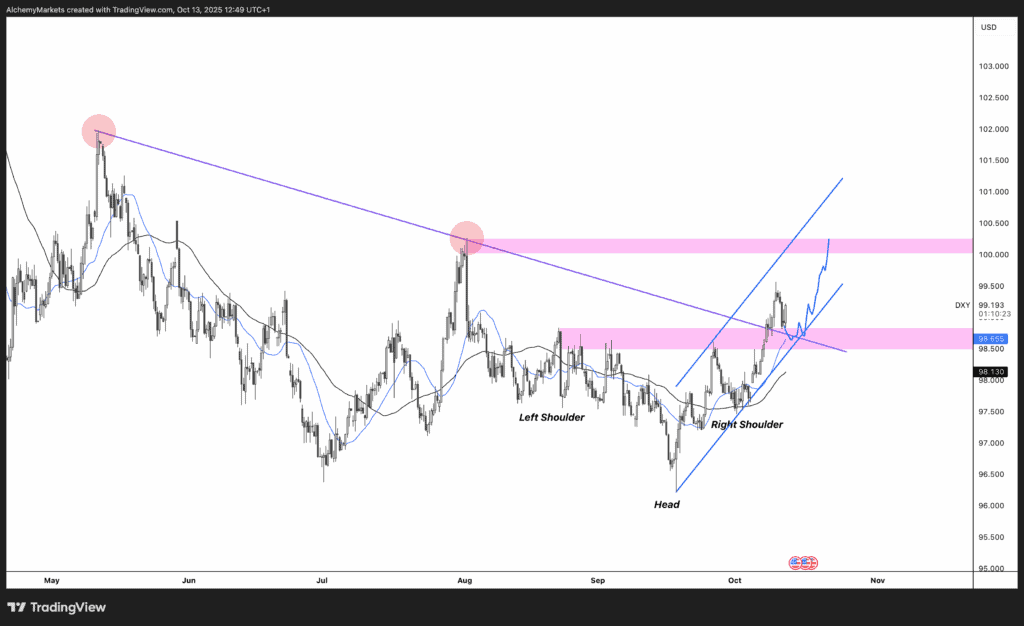

DXY Eyes 100 as Safe-Haven Demand Returns Amid U.S.–China Tensions

The U.S. Dollar Index (DXY) is showing renewed bullish momentum as geopolitical and macroeconomic headlines fuel a flight to safety. With escalating U.S.–China trade tensions, including Trump’s threat of 100% tariffs on Chinese imports and Beijing’s vow to retaliate, investors have sought refuge in the dollar — pushing DXY back toward the 99.00 zone.

Technical Picture: Inverse Head-and-Shoulders Signals Breakout Potential

The chart paints a clear inverse head-and-shoulders pattern, signalling a potential reversal from the summer’s downtrend. The neckline breakout above 98.50–98.70 support confirms renewed buying strength, reinforced by the 20- and 50-day moving averages now trending higher.

The price action is consolidating within a well-defined ascending channel, and as long as DXY holds above the 98.50 support zone, the bias remains to the upside. This zone also coincides with the retest of the neckline and the confluence of moving averages — providing a strong technical base for continuation.

Fundamental Backdrop: Trade War Fears and Safe-Haven Flows

Recent headlines have amplified dollar demand. The renewed tariff threats between the U.S. and China have heightened global risk aversion, leading investors to favor the dollar as a safe-haven asset. Additionally, uncertainty in European politics and weaker performance across key global currencies — particularly the euro and yen — have helped sustain the dollar’s edge.

Trump’s recent tweets have added volatility but not derailed sentiment, as markets interpret his softer tone as reassurance that escalation may remain contained. Still, the underlying narrative supports dollar resilience amid global uncertainty.

Upside Targets: 100 on the Horizon

With bullish structure intact and fundamentals aligned, DXY’s next key resistance lies in the 99.80–100.50 zone — a region marked by previous supply and technical confluence. A decisive daily close above 99.50 could open the door to a test of the 100 handle, a psychologically significant milestone.

Unless risk sentiment sharply improves or U.S. yields soften dramatically, the technical and macro landscapes suggest further upside potential for the dollar in the near term.

In summary: As long as DXY remains above 98.50 and continues to find support along the 20/50-day MAs, the momentum favors a bullish continuation toward 100.00. Watch for volatility spikes driven by U.S.–China headlines — but the bias stays upward for now.