- Chart of the Day

- November 5, 2024

- 2 min read

AUD/USD Outlook Following RBA Update

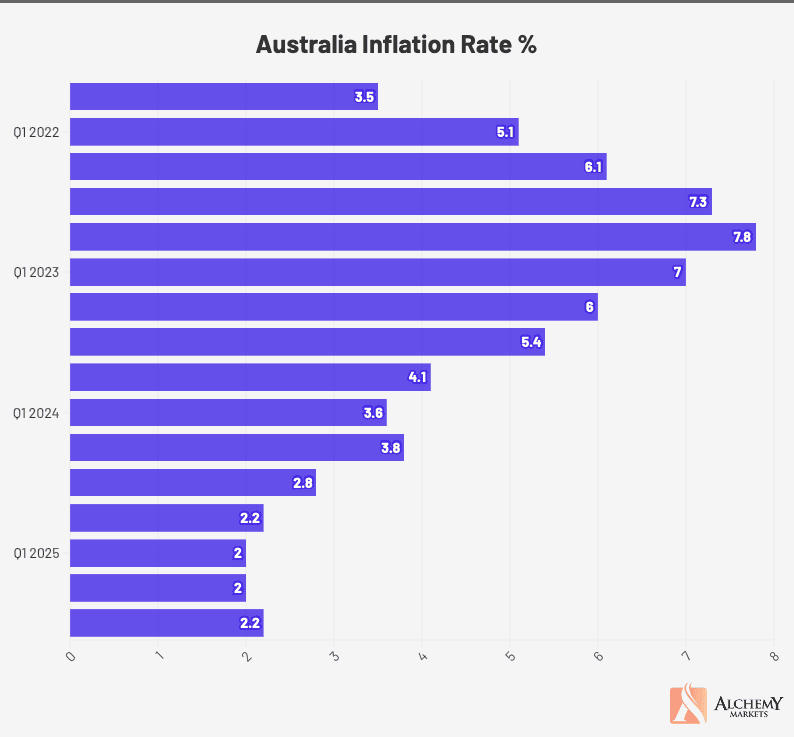

Data Source: Trading Economics

The Reserve Bank of Australia (RBA) held the cash rate steady at 4.35%, aligning with market expectations as they carefully assess inflationary pressures amid strong labor market conditions. Despite a dip in headline inflation to 2.8% in Q3, the RBA acknowledges that sustained inflation within the 2-3% target range may remain elusive until 2026. Meanwhile, the RBA cut its 2025 GDP growth forecast from 2.5% to 2.3%, signaling a more tempered outlook for the Australian economy. This reduced growth expectation may dampen Australia’s appeal for foreign investors, particularly as global economic uncertainties linger.

However, in the near term, AUD/USD may see temporary appreciation as investors seek yield stability in Australia, especially with other major economies maintaining or raising rates. Until the RBA shifts toward easing, the Australian dollar could remain relatively supported, though a weaker long-term economic outlook may weigh on sentiment.

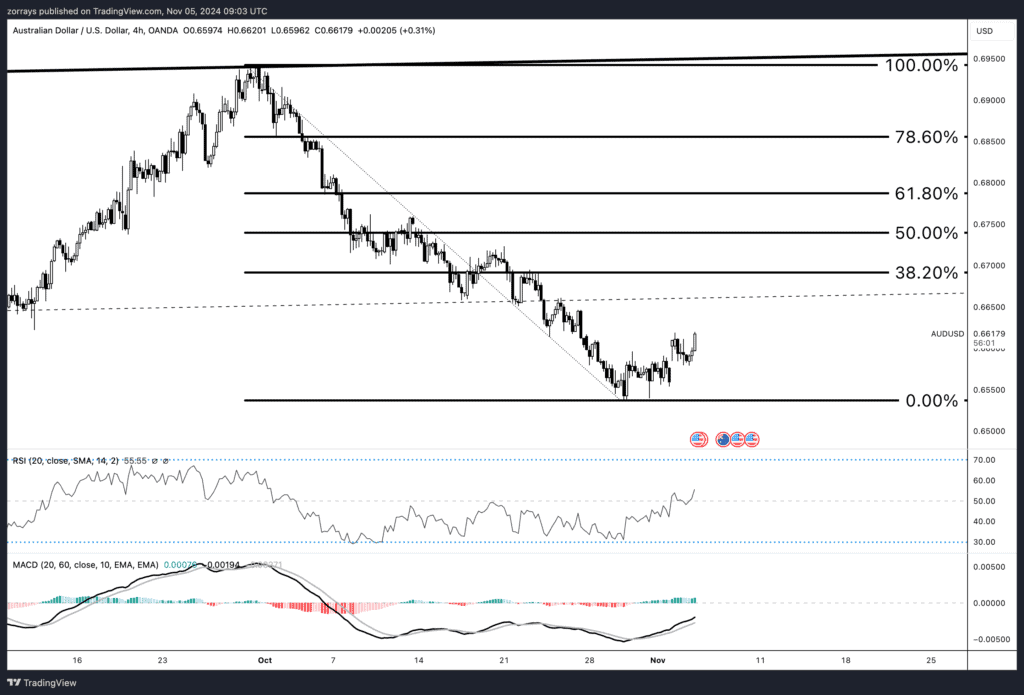

Technical Outlook

On the 4-hour chart, AUD/USD shows early signs of recovery. With RSI moving up and MACD signalling potential bullish momentum, we could see a corrective move towards the 38.2% Fibonacci retracement level around 0.67 as an initial target. This level aligns with a key technical resistance point, which may serve as a temporary cap for this rebound.

In summary, while short-term momentum could drive AUD/USD higher, a weaker economic outlook and slower growth forecast may limit gains in the medium term.