- June 5, 2025

- 20 min read

CFDs vs Options: What are the Differences?

CFDs and options are two of the most commonly used financial instruments for trading in global markets. Both allow traders to profit from price movements without owning the underlying asset, but they operate in fundamentally different ways. Choosing between the two depends on factors such as risk tolerance, market conditions, and trading objectives.

CFDs are derivative contracts where traders speculate on the price difference between an asset’s opening and closing values. They are widely used for short-term trading, offering flexibility, leverage, and direct exposure to market movements.

Options, on the other hand, provide the right—but not the obligation—to buy or sell an asset at a fixed price before a set expiration date. They are often used for hedging, strategic investing, and leveraging price volatility while limiting potential losses to the contract’s premium.

This article will explore the key differences between CFDs and options, their advantages and disadvantages, and how to determine which instrument aligns best with your trading style

What’s the Main Difference Between Trading CFDs and Options?

Both CFDs and options are popular derivatives that allow traders to speculate on market movements, but they operate in distinct ways. Understanding their key differences is crucial when deciding which instrument aligns with your trading strategy.

- CFDs are agreements between a trader and a broker to settle the difference between an asset’s opening and closing price. This allows traders to profit from price movements without owning the underlying asset.

- Options are financial contracts that give traders the right, but not the obligation, to buy or sell an asset at a predetermined price within a specified timeframe.

- CFDs are typically more straightforward, allowing traders to enter and exit positions with ease.

- Options require a more strategic approach, involving factors such as strike price, expiration date, and market volatility.

- CFDs are traded over-the-counter (OTC) with brokers, offering flexibility in market access.

- Options are exchange-traded, providing a structured environment with standardised contracts.

What are CFDs?

- A contract for difference (CFD) is a derivative agreement between a trader and a broker. The contract is based on the price movement of an asset rather than ownership of the asset itself.

- CFDs allow traders to speculate on rising or falling prices across various financial markets, including stocks, indices, commodities, and forex.

- Traders can use leverage to increase market exposure, although this also amplifies potential losses.

- Since CFDs do not involve asset ownership, there are no delivery requirements or expiry dates, making them ideal for short-term trading strategies.

What are Options?

- Options are contractual agreements between two parties that grant the holder the right, but not the obligation, to buy or sell an asset at a predetermined price (strike price) before a set expiration date.

- Options are commonly used for hedging, speculation, and income generation, allowing traders to manage risk effectively.

- Unlike CFDs, which have direct exposure to price changes, options provide a level of control over risk, as traders can only lose the premium paid for the contract.

- The pricing of options is influenced by time decay, volatility, and intrinsic value, making them more complex than CFDs.

| Feature | CFDs | Options |

| Definition | Derivative contract to speculate on price differences between opening and closing prices. | Financial contract granting the right (but not obligation) to buy/sell an asset at a predetermined price. |

| Market Type | Over-the-counter (OTC) with brokers. | Exchange-traded with standardized contracts. |

| Leverage | High leverage available, increasing both potential gains and losses. | Limited leverage, as contracts have predefined values. |

| Expiry Date | No expiry date, positions can be held indefinitely (subject to fees). | Has a fixed expiration date, requiring timely execution. |

| Risk Level | Higher risk due to leverage and market exposure. | Lower risk as maximum loss is limited to the premium paid. |

| Ownership of Asset | No ownership of the underlying asset. | No direct ownership, but offers potential for future ownership. |

| Trading Complexity | Simple to trade, direct relationship between price and value. | More complex due to strike prices, expiration dates, and premium calculations. |

| Trading Costs | Involves spread, commissions, and overnight fees. | Lower trading costs; mainly premium and brokerage fees. |

| Best For | Short-term traders looking for flexibility and quick market access. | Strategic traders looking for hedging, volatility trading, and long-term positioning. |

How CFDs Work

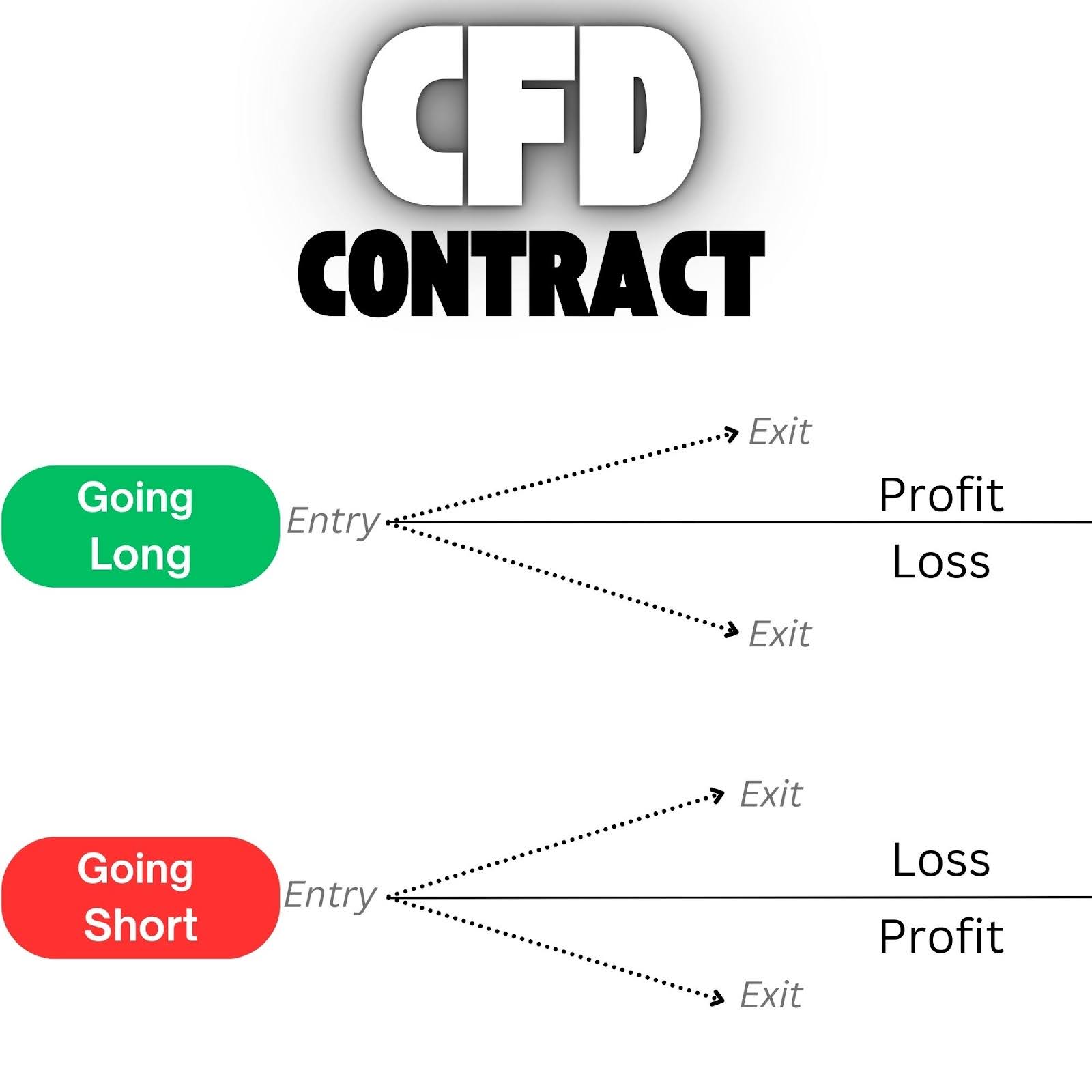

CFDs, or Contracts for Difference, allow traders to speculate on the price movements of various financial markets without owning the underlying asset. These instruments are designed to mirror the performance of the market they represent, providing opportunities to profit from both rising and falling prices.

Trading CFDs

- CFDs track the price movements of the underlying asset, ensuring traders gain exposure to market fluctuations without requiring asset ownership.

- Buying a CFD is similar to taking a long position in the market, where profits are made if the price increases.

- Selling a CFD works like taking a short position, meaning traders can profit from declining prices.

- CFDs offer leveraged trading, enabling traders to control a larger position with a smaller initial deposit (margin).

Advantages of Trading CFDs

Compared to options, CFDs provide a more straightforward way to speculate on market price movements. Some of the key advantages include:

- Higher potential profits per price movement – Unlike options, where profit potential is influenced by time decay and volatility, CFDs deliver direct exposure to price fluctuations.

- Easier to understand and trade – CFD pricing is directly linked to the underlying asset, making it simpler than options, which involve multiple factors such as strike price, expiry, and volatility.

- Transparency and market similarity – CFD prices closely reflect the actual market price of the asset, ensuring traders experience minimal discrepancies.

- No expiry dates – Unlike options contracts, CFDs do not have a set expiration date, allowing traders to hold positions as long as they want (subject to broker overnight fees).

- Leverage opportunities – Traders can amplify their market exposure through leverage, increasing the potential for higher returns while requiring a smaller capital investment.

- Diverse market access – CFDs provide exposure to a wide range of markets, including stocks, indices, commodities, forex, and cryptocurrencies.

Disadvantages of Trading CFDs

While CFDs offer flexibility and accessibility, they also carry certain risks:

- Higher risk due to leverage – Although leverage enhances profit potential, it also magnifies losses, making risk management essential.

- Overnight holding costs – Traders may incur financing fees when holding leveraged positions overnight.

- Counterparty risk – Since CFDs are traded through brokers rather than exchanges, traders depend on the broker’s financial stability.

- No ownership benefits – Unlike traditional stock investments, CFD traders do not receive dividends or voting rights associated with the asset.

How Options Work

| Position Type | Description | Market Outlook |

| Long Call | Gives the holder the right to buy an asset at the agreed strike price before expiry. | Bullish |

| Long Put | Gives the holder the right to sell an asset at the agreed strike price before expiry. | Bearish |

| Short Call | Requires the seller to provide the asset to the buyer if the option is exercised. | Bearish/Neutral |

| Short Put | Requires the seller to buy the asset from the holder if the option is exercised. | Bullish/Neutral |

Options are financial derivatives that provide traders with the right, but not the obligation, to buy or sell an underlying asset at a predetermined price within a specified period. Unlike CFDs, which involve direct exposure to price movements, options introduce strategic opportunities through time-based speculation, hedging, and risk management.

Call Options and Put Options Explained

Call Options

When a trader is long a call, they’ve purchased a call option, giving them the right (but not the obligation) to buy the underlying asset at a specific strike price before the contract expires. Traders go long calls when they expect the price of the asset to rise above the strike price, allowing them to profit from the upside beyond their premium cost.

Being short a call means the trader has sold a call option and is now obligated to sell the asset at the strike price if the buyer chooses to exercise. Traders might choose this approach when they expect the asset to stay below the strike price, aiming to collect the option premium as profit—but they take on unlimited risk if the price rises sharply.

Put Options

To be long a put is to buy a put option, granting the trader the right to sell the asset at a set strike price within a certain time. Traders take long puts when they anticipate the asset’s price will fall, enabling them to sell higher than market value and profit from the downside movement, minus the premium paid.

A short put involves selling a put option, which obligates the trader to buy the asset at the strike price if exercised. This strategy is typically used when a trader has a bullish or neutral view, expecting the asset’s price to remain above the strike level. The seller aims to earn the premium, but takes on risk if the price drops significantly, forcing them to buy the asset above market value.

Buying and Selling Options

- Call options give the holder the right to buy an asset at a fixed price (strike price) before or on the expiry date.

- Put options grant the right to sell an asset at a predetermined price before expiry.

- Traders can choose to exercise the option if the market moves in their favour or let it expire if it becomes unprofitable.

- Options can be used to enhance profitability, either through direct speculation or as a hedging tool against existing positions. (There is no guarantee an options trader will experience profits.)

Popular Option Trading Structures

Options offer various structured strategies that traders use to manage risk and maximise returns. Here are some of the most commonly used structures:

- Covered Call – A trader holds a long position in an asset and sells a call option to generate additional income while limiting upside potential.

- Protective Put – A trader buys a put option while holding the underlying asset to protect against potential losses.

- Straddle – Involves buying both a call and a put option with the same strike price and expiration, allowing traders to profit from significant price movements in either direction.

- Strangle – Similar to a straddle, but the call and put options have different strike prices, making it a lower-cost way to bet on volatility.

- Iron Condor – A combination of two credit spreads that allows traders to profit from low volatility by collecting premiums while limiting risk.

- Butterfly Spread – A strategy that involves multiple strike prices to create a limited-risk position, ideal for trading within a specific price range.

Advantages of Trading Options

Compared to CFDs, options provide structured risk management, lower costs, and strategic flexibility. The key benefits include:

- Potential for future ownership – Options allow traders to lock in an asset’s price today while delaying the purchase decision, offering flexibility in volatile markets.

- Lower trading costs – Unlike CFDs, which involve spreads and overnight financing fees, options trading typically requires only the payment of a premium.

- No financing costs – Since options are not leveraged instruments in the same way as CFDs, traders avoid paying interest on borrowed capital.

- Limited risk exposure – When purchasing options, the maximum potential loss is limited to the premium paid, making them a lower-risk alternative to leveraged CFD positions. Note, selling options can be riskier, so the limited risk only applies when buying an option.

- Advanced trading strategies – Options can be combined in various ways (such as spreads, straddles, and iron condors) to create sophisticated trading strategies suited to different market conditions.

- Effective hedging tool – Investors use options to hedge against portfolio risks, protecting against downside exposure in stocks, commodities, and other assets.

Disadvantages of Trading Options

Despite their strategic advantages, options trading also presents some challenges:

- Time decay (Theta risk) – The value of an option decreases as it approaches expiry, meaning traders must consider time-based factors when planning trades.

- Complex pricing models – Options pricing is influenced by multiple factors, including volatility, time to expiration, and market conditions, making them more intricate than CFDs.

- Limited liquidity in some markets – While major stock indices and commodities have active options markets, certain assets may experience lower liquidity, leading to wider bid-ask spreads.

- Requirement for greater market understanding – Compared to CFDs, options require knowledge of strike prices, expiry dates, and implied volatility, which can present a steeper learning curve.

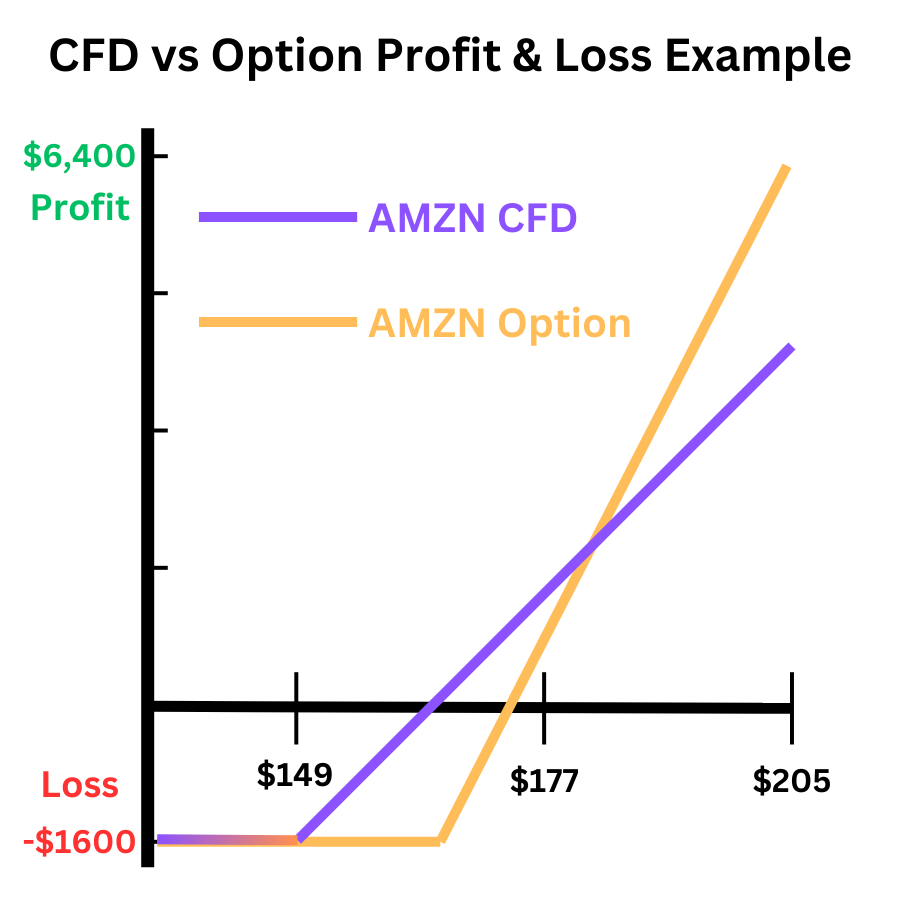

CFD vs Options Example

For this example, we assume a trader has a $100,000 account and follows these risk parameters:

- CFD Trade: Risks 1.6% of the account ($1,600).

- Options Trade: Invests $1,600 in call options.

| Trade Aspect | CFD Trade | Options Trade |

| Underlying Asset | Amazon (AMZN) | Amazon (AMZN) |

| Trade Duration | 50 Days | 50 Days |

| Entry Price | $165 | Call Option at $165 Strike Price |

| Exit Price | $205 | $205, option contracts valued at $40 per share |

| Position Type | Buy (Long Position) | Call Option Purchase |

| Leverage Used | 5:1 Leverage ($3,300 Margin) | Not applicable |

| Shares Purchased (CFD) | 100 shares | Not applicable |

| Stop-Loss Price (CFD) | $149.00 (calculated based on $1,600 risk) | Not applicable |

| Capital Allocation | $1,600 risk (1.6% of account) | $1,600 spent on contracts |

| Contracts Purchased (Options) | Not applicable | 2 contracts ($8 premium per share, $800 per contract) |

| Profit/Loss Potential | Potential profit amplified due to leverage, higher upside | Profit potential based on option price movement, capped at contract appreciation |

| Risk Exposure | Amplified due to leverage, potential for greater losses | Risk limited to the $2,000 premium paid |

| Additional Costs | Overnight financing fees for holding position | Commissions, but contract expires worthless if out of the money |

| Total Profit from Trade | $4,000.00 | $6,400.00 |

Profit and Loss Calculation Breakdown

Let’s walk through a couple of scenarios and see how the profit or loss would be impacted when trading CFDs versus Options.

Scenario 1 – Trader Closes When AMZN is $205

CFD Profit Calculation:

- The trader controlled 100 CFD units with $1,600 risk using 5:1 leverage.

- Calculated by taking the total margin used ($3,300 × 5 leverage = $16,500) and dividing it by the entry price of $165 per share, resulting in 100 shares controlled.

- Profit per unit = $205 – $165 = $40.

- Total CFD profit = 100 × $40 = $4,000 before financing fees.

Options Profit Calculation:

- 2 call option contracts were bought at $8 per share, totalling $1,600 (not including commissions).

- If the option value increased to $40 per share ($205 – $165), the total revenue = $8,000.

- Total options profit = $6,400 (after subtracting the initial $1,600 cost).

Scenario 2 – Trader Closes When AMZN is $149

CFD Loss Calculation:

- The trader controlled 100 CFD units with $1,600 stop loss risk.

- Loss per unit = $149 – $165 = -$16 per share.

- Total CFD loss = 100 × -$16 = -$1,600 before financing fees.

Options Loss Calculation:

- 2 call option contracts were bought at $8 per share, totalling $1,600.

- Since the option strike price was $165, and the price dropped to $148, the options would expire worthless.

- Total options loss = -$1,600 (plus commissions), as the entire premium is lost.

Scenario 3 – Trader Closes When AMZN is $164

CFD Loss Calculation:

- The trader controlled 100 CFD units with $1,600 stop loss risk.

- Loss per unit = $164 – $165 = -$1.

- Total CFD loss = 100 × -$1 = -$100 before financing fees.

Options Loss Calculation:

- 2 call option contracts were bought at $8 per share, totalling $1,600.

- Since the option strike price was $165, and the price closed at $164, the options would expire worthless.

- Total options loss = -$1,600 (plus commissions), as the entire premium is lost.

Key Takeaways:

- Options trading had a defined risk, where the maximum loss was capped at $1,600, demonstrating its value as a lower-risk strategy. This is evident as the maximum loss did not exceed $1,600 across all scenarios.

- CFDs derive their value directly from the underlying asset’s price movements, meaning traders experience gains or losses in proportion to the asset’s fluctuations. In Scenario 3, where AMZN fell just $1 below the entry price, the CFD loss was only -$100, showing that most of the capital remained intact and could be reinvested into another trade.

- Options pricing is influenced by multiple factors, including the underlying asset’s price, time to expiration, and market volatility. The options contracts expired worthless in Scenarios 2 and 3, highlighting how options can lose their entire value if the asset does not move favorably, resulting in a full loss of the premium paid.

- When the price remains flat or slightly declines (e.g., Scenario 3 at $164), the CFD retains most of its value, providing the opportunity to reallocate capital, whereas the options strategy leads to a total loss, emphasizing the benefit of flexibility with CFDs.

- Across the three scenarios, the risk-to-reward ratio for the CFD trade was $1,600 risk for a $4,000 reward, while the options trade offered a $1,600 risk for a $6,400 reward. This shows that options provided a better return relative to risk in this specific price movement. However, it’s worth noting that CFD profits scale linearly with price increases—so if AMZN had moved beyond $205, the CFD’s reward potential would surpass options. Ultimately, both instruments carry defined risks, but CFDs offer uncapped upside in trending markets.

Choosing the Right Trading Strategy

Selecting between CFDs and options depends on your trading style, market conditions, and risk tolerance. These trading vehicles offer unique advantages depending on how frequently you trade, how long you hold positions, and whether you seek flexibility or structured risk management.

Your Trading Style and Goals

Your trading approach will largely determine whether CFDs or options are more suitable.

- CFDs provide flexibility—ideal for short-term traders who react to market fluctuations in real time, with lower trading costs compared to options, which require commissions on each trade.

- Options require strategic planning—suited for traders who factor in time decay, volatility, and expiration dates, though they can also be used in short-term trading.

- Holding period matters—CFDs are better for frequent trades due to their cost efficiency, while options suit medium- to long-term strategies where timing and volatility play a crucial role.

If you prefer instant execution, high flexibility, and leverage, CFDs might be the right choice. If you want structured risk with defined maximum losses, then options would be a better approach.

Market Conditions and Trading Opportunities

The effectiveness of CFDs vs options depends on market conditions:

- CFDs are highly responsive to price action, making them effective in trending or volatile markets.

- Options contracts have an expiration timeframe, so you must monitor not just price movement, but also anticipate the time it would take for that trend to develop.

- CFDs suit unpredictable markets where quick decision-making is essential.

- Options work best in forecastable trends where time and volatility influence contract value.

Understanding market behavior helps determine which instrument provides the best risk-reward balance.

Day Trading

- CFDs are commonly used in day trading due to their instant execution and leverage.

- Options can be day traded, but time decay, bid-ask spreads, and commissions can limit profitability.

- Scalping and short-term strategies favor CFDs, as they track underlying market movements more directly.

Best for: High-frequency traders looking for rapid entries and exits.

Swing Trading

- Both CFDs and options can be used for swing trading, where positions are held for several days or weeks.

- CFDs benefit from trend-following, while options allow traders to speculate on future price moves with limited downside risk.

- Options provide the advantage of time to play out a market thesis, while CFDs require monitoring overnight fees.

Best for: Traders who want to capture medium-term price swings with controlled risk.

Position Trading

- Options are better suited for position trading, as they allow long-term speculation without the need for daily management.

- CFDs carry holding costs, making them less practical for long-term trades unless adjusted frequently.

- Options provide leverage without ongoing margin requirements, making them a strong alternative for investors seeking exposure to long-term market trends.

Best for: Investors looking to hold positions for weeks or months with predefined risk.

Market Conditions

- Trending Markets – CFDs perform well in strong directional trends, while options traders might use long calls or puts to capture movements.

- Volatile Markets – Options traders can take advantage of straddles and strangles, while CFD traders rely on stop-loss strategies to mitigate risk.

- Sideways Markets – Options strategies like iron condors and credit spreads work better than CFDs in range-bound markets.

Possibility of Ownership

- CFDs do not grant ownership—you’re simply speculating on price changes.

- Options provide an opportunity to own the asset if exercised, particularly with stock options.

- If ownership is a goal, options are the better choice, as they allow for eventual asset acquisition.

Product Pricing

- CFDs mirror underlying asset prices, with costs coming from spreads, commissions, and overnight financing.

- Options pricing is based on multiple factors, including intrinsic value, time decay, and implied volatility.

- CFDs are more straightforward, while options require a deeper understanding of pricing models.

If you prefer direct exposure to asset price movements, CFDs are a simpler approach. If you want strategic control over risk and premium costs, options offer more structure.

CFD vs Options: Key Similarities

While CFDs and options have distinct differences, they also share several core similarities that make them attractive trading instruments. Below are the key areas where they overlap.

1. Trading Characteristics

- Derivative Instruments – Both CFDs and options are derivatives, meaning their value is derived from an underlying asset rather than direct ownership.

- Speculation on Price Movements – Traders use both instruments to profit from rising (long) or falling (short) prices without purchasing the asset.

- Broad Market Access – CFDs and options allow trading across stocks, indices, commodities, forex, and cryptocurrencies.

- Leverage Opportunities – Both instruments provide leveraged trading, increasing market exposure with less capital, though risk management is crucial.

- No Physical Ownership – Neither CFDs nor options grant ownership of the underlying asset, which differs from traditional investing.

- Margin Trading – Depending on the broker, both CFDs and certain options strategies (such as selling options) may involve trading on margin.

2. Risk and Strategy Similarities

- Potential for High Returns and Losses – Both instruments offer significant return potential but also come with substantial risks if used improperly.

- Short-Term Trading Flexibility – CFDs and options are popular for short- to medium-term trading, with traders adjusting positions based on market conditions.

- Hedging Capabilities – Traders use both CFDs and options to hedge existing positions against market downturns or volatility.

- Market Volatility Sensitivity – Both CFDs and options are influenced by market fluctuations, requiring traders to manage risk accordingly.

- Cost Considerations – Each instrument involves transaction costs, including spreads, commissions, and potential holding fees (CFDs have financing fees, while options have premiums).

CFD vs Options Trading: Which is Better?

Choosing between CFDs and options depends on an investor’s trading goals, risk tolerance, and market preferences. CFDs provide wider market access and flexibility, making them ideal for short-term traders. Options, on the other hand, offer structured risk management and potentially higher returns, making them better suited for strategic investors and long-term positions.

The table below outlines the key differences between CFDs and options trading, helping you determine which instrument aligns best with your investment approach.

| Factor | CFD Trading | Options Trading |

| Market Variety | Broad access to stocks, indices, forex, commodities, and crypto. | Focuses on stocks, indices, and commodities with structured contract strategies. |

| Risk Management | Higher risk due to leverage but flexible risk controls with stop-losses. | Defined risk, limited to the premium paid, offering better hedging opportunities. |

| Leverage | High leverage available, increasing both potential profits and losses. | No direct leverage, but contracts provide exposure with a lower capital requirement. |

| Trading Complexity | Simple pricing model where profit/loss is based on price movement. | More complex due to strike prices, expiration dates, and volatility considerations. |

| Potential Returns | High potential returns due to full market exposure but with higher risk. | Potential for high returns from premium appreciation, but requires precise timing. |

| Holding Costs | Overnight financing fees apply for leveraged positions. | No financing costs, but contracts can expire worthless if out of the money. |

| Best Suited For | Short-term traders looking for flexibility and real-time market exposure. | Strategic traders seeking structured risk and long-term investment opportunities. |

Which One Should You Choose?

- CFDs are better for active traders who prefer direct exposure to price movements, with flexible leverage and real-time execution.

- Options are more suited for investors who want defined risk, strategic positioning, and hedging tools, with a longer-term perspective.

FAQ

CFD vs Options Trading- which should I choose?

If you want simplicity, direct exposure, and flexibility with lower upfront costs, CFDs are likely the better fit—especially for short-term trading. However, if you prefer defined risk, strategic setups, and longer-term opportunities, options may be more suitable.

Do professional traders prefer CFDs or options?

Professional traders use both, but options are preferred for strategic risk management, while CFDs are favored for quick market speculation.

Are CFDs options?

No, CFDs and options are different derivatives—CFDs track price movements directly, whereas options provide the right to buy or sell at a set price.

Are CFDs riskier than Options trading?

Yes, CFDs carry higher risk due to leverage, which can amplify losses, while options have limited risk capped at the premium paid.