- June 9, 2025

- 26 min read

CFD Trading for Beginners | How to Trade CFDs Explained

CFD trading, or Contracts for Difference, is a way for beginners to profit from price changes in various financial markets without actually owning the assets. In fact, CFD trading for beginners allows you to trade stocks, currencies, and commodities, benefiting from both rising and falling prices. In this guide, we’ll cover the basics of CFD trading, key terms, risk management, and how to start effectively.

What is CFD Trading?

CFD trading, short for Contracts for Difference, allows traders to speculate on the price movements of various financial instruments without owning the underlying assets. Essentially, a CFD is a contract between a trader and a broker to exchange the difference in the value of an asset between the opening and closing of the trade. This means you can profit from both rising and falling markets, providing a level of flexibility not found in traditional trading methods. If you want to maximize your opportunities, consider how to trade cfds effectively.

One of the key benefits of CFD trading is that it eliminates the need for physical ownership of the asset, which can often be cumbersome and costly. Instead, traders can focus solely on the price movements and employ various strategies to maximize their returns.

This flexibility makes CFD trading particularly appealing for those looking to diversify their investment portfolio and take advantage of market opportunities quickly and efficiently.

Is CFD Trading Safe for Beginners?

CFD trading can be both rewarding and risky, especially for beginners. While it offers the potential for significant returns, it also comes with high risks due to the leverage involved.

Leverage allows traders to control larger positions with a smaller amount of capital, amplifying both potential gains and losses. This means that while you can make substantial profits, you can also incur significant losses if the market moves against your position.

However, with the right approach and proper risk management strategies, beginners can navigate these risks effectively. It’s crucial to have a solid understanding of the markets and to develop a robust trading strategy before diving in.

Utilizing tools such as stop-loss orders can help manage potential losses. Additionally, starting with a free demo account can provide a risk-free environment to practice and refine your strategies before committing real capital.

CFD Trading Terms Beginners Need to Know

Understanding the key terms in CFD trading is important for navigating the market effectively. From leverage and margin to spreads and lot sizes, these terms form the foundation of your trading knowledge and help you make informed decisions.

Leverage and Margin

Leverage in CFD trading allows traders to control larger positions with a smaller amount of capital. This means that with a leverage ratio of, say, 10:1, you can open a position worth $10,000 with just $1,000 of your own money. While this can amplify your profits on successful trades, it also increases the risk of significant losses, as profits and losses are calculated based on the full value of the leveraged position, not just the margin.

Margin, on the other hand, refers to the deposit required to open a position. Typically, this is a fraction of the total value of the trade, often ranging from 5% to 10%. To open a $1,500 position with a 1:30 leverage, a margin of $50 is required. This means you can control a larger position with a smaller amount of capital.

Spread

The spread in CFD trading represents the difference between the buy and sell prices of an asset. This spread is essentially the cost of entering and exiting a trade and can vary based on market conditions. In many CFDs, the spread includes all trading costs, meaning traders do not need to pay a separate commission fee.

Understanding the spread is important because it directly impacts your profitability. A tighter spread means lower costs and can enhance your trading returns. Conversely, a wider spread increases the cost of trading, making it more challenging to achieve profitable trades. Spreads by brokers can be fixed or variable and fluctuate depending upon market volatility.

Commission Fees

While many CFD brokers incorporate trading costs into the spread, some markets, particularly stock CFD trades, often require traders to pay a commission fee. These fees can vary widely depending on the broker and the specific market being traded.

It’s essential to understand the commission structure of your chosen broker to accurately calculate your trading costs and potential profitability.

Shorting

Shorting in CFD trading allows traders to profit from declining markets by selling CFDs without owning the underlying asset. The trader generates a sell position to open the trade. If the asset’s price decreases, you can close your position and realize a profit from the price difference.

This ability to profit from falling prices is one of the key advantages of CFD trading, providing additional opportunities to benefit from market movements.

Lot Size

In CFD trading, the lot size can vary and often equates to single shares, where each CFD mirrors the movement of one share in the underlying asset. For other markets like forex, gold, or crypto CFDs, lot sizes may vary. The lot size you choose impacts the overall risk and potential return of your trade, making it an important consideration when planning your trading strategy.

How CFD Trading Works – Beginner’s Guide

Executing a CFD trade involves several steps. First, you need to start CFD trading by selecting a market and deciding whether you believe the price will rise or fall. If you anticipate an increase, you open a buy position (or long trade); if you expect a decrease, you open a sell position (or short trade). The difference between the opening and closing prices of your position, minus any associated fees, determines your net profit or loss.

CFD trading platforms provided by brokers facilitate these trades, allowing you to enter and exit positions with ease. Choosing a reputable CFD broker and becoming familiar with their trading platform ensures a smooth trading experience while trading CFDs online.

Understanding the mechanics of CFD trading helps in better navigating the market and making informed decisions.

How to Start Trading CFDs

To start trading CFDs, the first step is to select a reputable broker and open a real trading account. This typically involves filling out an online form and verifying your identity with legal documents. Once your account is set up, you can fund it with your initial investment, which can range from as little as $50 to $500, depending on the broker’s requirements.

Here are the steps to start trading CFDs:

- Select a reputable broker.

- Open a trading account by filling out an online form.

- Verify your identity with legal documents.

- Fund your account with capital, which can range from as little as $50 to $500, depending on the broker’s requirements.

Before diving into live trading, it’s wise to practice with a demo account. This allows you to familiarize yourself with the trading platform and test your strategies without risking real money. Once you’re confident, you can transition to a live account and start trading CFDs in your chosen markets.

What Affects the Price of CFD Trading that Beginners Should Know

The price of CFD trading is influenced by various factors, including supply and demand dynamics, market sentiment, economic indicators, geopolitical events, currency fluctuations, inflation rates, interest rates, and natural disasters.

Understanding these factors can help you anticipate volatile price movements while making more informed trading decisions.

Supply and Demand

The balance between supply and demand plays a crucial role in determining CFD prices. When demand exceeds supply, prices tend to rise, and vice versa. For example, when the demand for physical gold is strong, prices will generally rise as the supply of new gold remains relatively stable.

Monitoring these dynamics can provide valuable insights into potential price movements.

Market Sentiment

Market sentiment, the overall attitude of investors towards a particular market or asset, can drive price movements in CFDs. Positive sentiment can lead to rising prices, while negative sentiment can cause prices to fall.

Economic Conditions

Economic conditions, such as employment rates, GDP growth, and inflation, significantly affect market stability and can lead to shifts in CFD prices. For instance, strong economic growth can boost investor confidence, leading to higher asset prices. Conversely, economic downturns often result in increased volatility and bearish sentiments.

Changes in monetary policy, including interest rate adjustments by central banks, can also impact CFD trading outcomes. For example, higher interest rates may attract foreign investment, strengthening the currency and affecting CFDs linked to that currency.

Geopolitical Situation

Geopolitical events, including political unrest and international conflicts, can create volatility in CFD markets. Such events can impact investor confidence and currency values, leading to sudden price fluctuations.

For instance, trade tensions between major economies like the U.S. and China have historically caused significant market movements.

Currency Movements

Fluctuations in currency values can significantly impact the pricing of CFDs, especially in forex trading. For example, a decline in a country’s currency can make its exports cheaper in foreign markets, potentially boosting the stock prices of export-oriented companies. Conversely, such fluctuations can increase the cost of imports, affecting domestic markets.

Inflation and Deflation

Inflation and deflation impact purchasing power and can lead traders to adjust their positions in CFDs based on anticipated changes in economic conditions. For instance, rising inflation often results in higher costs for goods and services, influencing CFD prices as traders anticipate future economic shifts.

Interest Rates

Interest rate changes set by central banks influence CFD prices. Higher interest rates can attract foreign investment, strengthening the currency and impacting associated CFDs. Additionally, interest rates affect overnight charges for CFD positions, influencing the cost of holding trades. In stable and growing economic conditions, many will trade forex and buy the higher yielding (interest rate) currency.

Natural Disasters

Natural disasters can disrupt markets and supply chains, leading to significant price volatility in CFDs related to affected regions or sectors. Events like earthquakes or hurricanes can cause sudden price changes in commodities, equities, and currencies, impacting CFD trading.

CFD Pricing: Per Share, Asset Price, and Spreads

When trading Contracts for Difference (CFDs), understanding how pricing works is essential for managing risk and making informed trading decisions. One key aspect of CFD pricing is the ability to trade “per share,” meaning traders can control their position size based on the number of shares they wish to buy or sell without owning the underlying asset. This structure allows traders to take advantage of price movements with greater flexibility, as they can scale their position according to their capital base and risk tolerance. The price of the CFD typically mirrors the underlying asset, meaning if you are trading a stock CFD, its price will closely track the stock’s live market value.

Another important factor in CFD pricing is the spread—the difference between the bid (sell) and ask (buy) price. Brokers usually incorporate their fees into the spread rather than charging commissions separately. This means traders need the asset price to move beyond the spread to reach a breakeven point before making a profit. Since CFDs also allow leverage, traders can amplify their exposure while only committing a fraction of the trade’s full value as margin. However, this can magnify both gains and losses, making it crucial to factor in spreads, asset price movements, and per-share pricing when structuring trades.

Why CFD Trading for Beginners?

CFD trading offers several advantages for beginners, making it an attractive option for those new to the financial markets. From the wealth of trading resources available to the flexibility and potential for diversification, CFDs provide numerous opportunities for novice traders.

Wealth of Trading Resources

CFD brokers offer a wealth of trading resources, including market analysis, commentary, and educational materials to help traders understand the market. These resources can be invaluable for beginners looking to build their trading knowledge and skills.

Margin and Leverage

Leverage in CFD trading enables traders to control larger positions with a smaller initial capital outlay. For example, with a leverage ratio of 10:1, a trader can engage in trades worth significantly more than their initial deposit. This allows for potentially higher returns on investment compared to trading without leverage.

However, it’s important to remember that while leverage can amplify profits, it also increases the risk of significant losses. Proper risk management is crucial to avoid over-leveraging and to protect your capital.

Understanding how to use leverage effectively can help beginners maximize their trading potential while managing risks.

Diversification

CFDs provide access to a wide variety of financial instruments, including indices, stocks, commodities, currencies, and cryptocurrencies. This allows traders to diversify their portfolios across different asset classes and geographic regions, helping to mitigate overall investment risk.

Lower Costs

Trading CFDs typically involves lower costs compared to purchasing the underlying assets directly. This budget-friendly option allows investors to access market positions at a fraction of the price, making it more accessible for beginners.

No Physical Ownership

When trading CFDs, investors do not possess the actual underlying asset, which allows for speculation on price movements without the associated costs of ownership. This eliminates the need for physical delivery, making transactions simpler and more efficient.

Flexibility

CFD trading allows traders to profit from both rising and falling prices. Additionally, traders can hold positions for as short or long as they want, providing flexibility in trading strategies.

This flexibility enables traders to take advantage of various market conditions.

Competitive Spreads

Competitive spreads in CFD trading allow traders to execute trades at lower costs, which is particularly advantageous for active traders. Tighter spreads can enhance a trader’s potential for profit as less price movement is needed to break even on a trade.

Accessibility

CFD trading provides access to various asset classes through a single platform, facilitating trading across multiple financial instruments without the need for multiple accounts, including a cfd trading account. This ease of access makes it convenient for traders to engage with global markets.

Liquidity

CFD trading typically benefits from high liquidity, allowing traders to easily enter and exit positions with minimal price impact. High liquidity can lead to tighter spreads, which is advantageous for cost-effective trading.

The ability to go long or short

CFD trading allows investors to profit from both rising and falling markets by enabling short positions. This flexibility provides traders with the ability to take advantage of various market conditions, enhancing their trading opportunities.

Stability

CFDs provide a stable trading environment by allowing for immediate cash settlement, which helps traders quickly access their funds after closing positions. Risk management tools such as stop-loss orders can further enhance stability by mitigating potential losses.

Volatility

Volatility measures the price fluctuations of an asset over time, indicating potential profit opportunities while also posing risks of significant losses. Traders can exploit volatility by developing strategies that focus on assets with large daily price movements.

No Contract Expiration Date

CFDs do not have expiration dates, allowing traders to hold positions as long as they desire without the pressure of an impending deadline. This feature provides greater flexibility to react to market conditions and manage positions strategically.

Customer Support

Customer support is an important aspect of CFD trading, providing traders with the assistance they need to manage their positions effectively. Good customer support includes comprehensive FAQs, information on managing positions, and details on overnight finance charges for holding CFDs.

A reliable support system can significantly enhance the trading experience, especially for beginners.

CFD Trading Example for Beginners

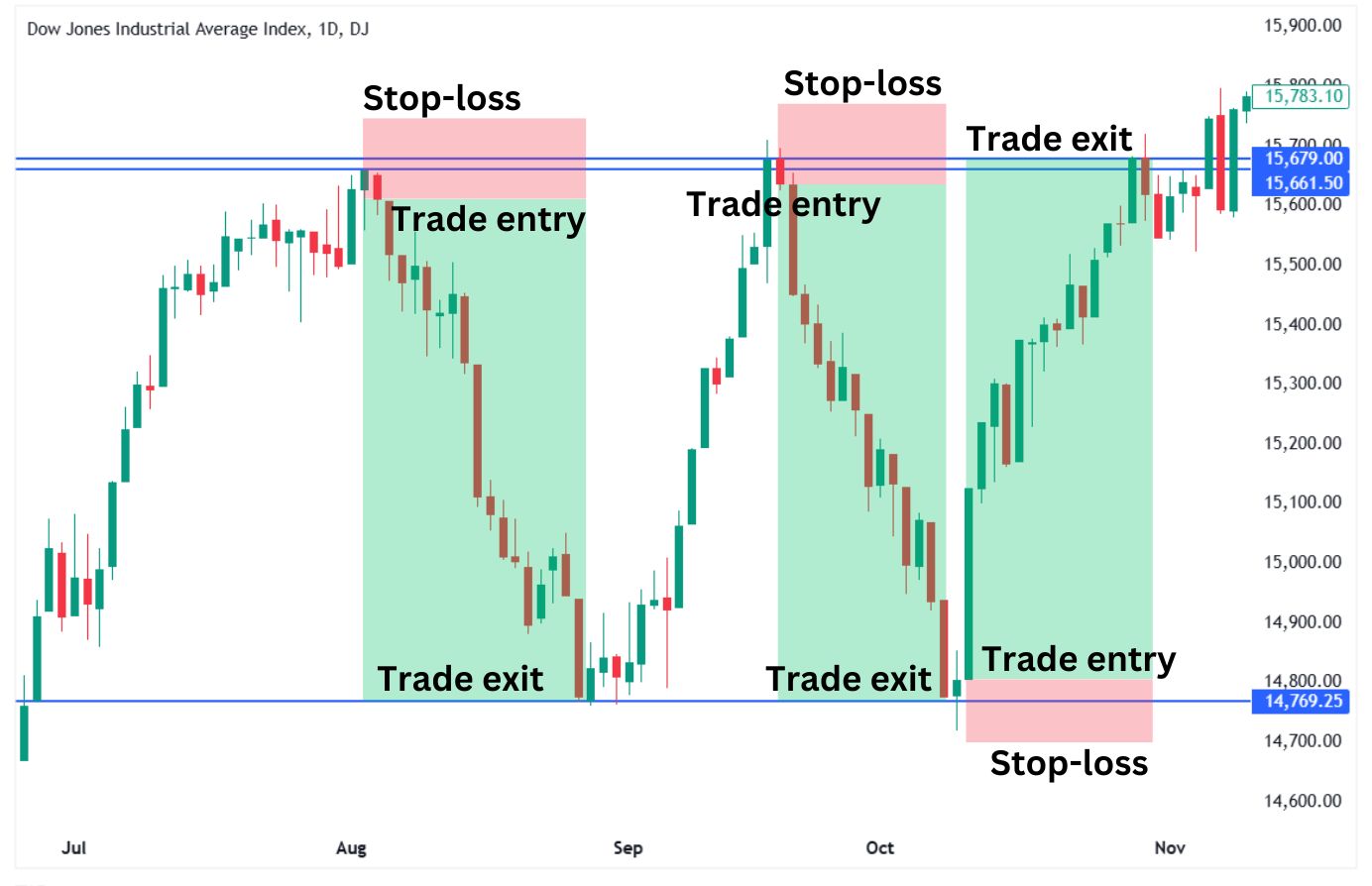

Let’s illustrate CFD trading with a practical example. Suppose you expect the Dow Jones index to rally higher from a crucial support level, you could enter a buy order at the selected price point. You expect the index CFD to rise to its previous highs at which point you will close the trade and secure your profits.

The above trade was chosen because the Dow Jones index CFD had pulled back to a crucial horizontal support level from where it had bounced to rally higher. Your risk on the trade is the distance between the trade entry and the stop-loss order. The distance between the trade entry and trade exit points represents your potential gains from the trade.

To purchase five CFDs of the Dow Jones index, you can buy five lots of the CFD at a broker of your choice. If the trade moves in your favour, you stand to book a significant gain, while your losses are limited by the stop-loss order attached to the trade if it moves against you.

CFD Trading For Beginners Trading Strategies

Successful CFD trading relies on a well-structured trading strategy that incorporates market understanding and analysis. Various CFD trading strategies can help beginners navigate the complexities of CFD trading and make informed decisions.

Day Trading

Day trading involves opening and closing positions within the same trading day, taking advantage of short-term price movements. In order to make the trades worthwhile, traders will add leverage which allows them to control larger positions, amplifying both potential profits and losses.

Day trading is riskier for beginners because you are making more frequent decisions with leverage included.

The above Ethereum CFD chart shows a trader making bearish day trades on the 15-minute chart based on the bearish pin bar candlestick. Each time the candlestick appears, it has led to sustained moves lower in the past. The trader enters a short position on the close of the bearish pin bar candlestick. The stop-loss orders are placed above the pin bar candle’s high, and the take-profit orders are placed at crucial support levels.

This strategy requires quick decision-making and constant market monitoring.

Swing Trading

Swing trading aims to profit from short to medium-term price fluctuations. Traders typically hold positions for several days to weeks. They use technical analysis to identify potential opportunities and capture price movements within defined highs and lows.

The above Gold CFD chart shows a swing trade taken by a trader based on the 50-period Exponential Moving Average (EMA) applied to the Gold 4-hour chart. The trader kept the trade open so long as it was above the 50-EMA, which was dynamic support for Gold and the trade. One reason traders love swing trading is because it requires less time commitment when compared to day trading.

Scalping

Scalping involves making multiple rapid trades to profit from small price fluctuations within a short time frame. Successful scalpers require quick decision-making and the ability to execute trades efficiently, often within minutes or seconds. As a result of the quick in and out nature of the trades, algorithmic strategies are common to manage the trades.

The chart above shows some scalp trades made by a trader on the West Texas Intermediate (WTI) crude oil CFD 5-minute chart that lasted for a short duration. You can see that the scalp trades are executed at crucial resistance levels where the price was most likely to reverse lower. This strategy emphasises capitalising on minor price changes.

Trading the Range

Range trading involves identifying a price range for a CFD and making trades within that range, utilizing support and resistance levels. This strategy is beneficial in non-trending markets, allowing traders to capitalise on predictable price fluctuations.

The chart above shows examples of bearish and bullish trades when the Dow Jones Index CFD traded sideways. The trades capitalised on the price rising to a specific high, falling to a unique low, and repeating the movement severally to form a trading range. Such ranges allow traders to sell at the top and buy at the bottom until when the price breaks out

Hedging

Hedging involves opening a short CFD position to offset potential losses from an existing investment. This strategy allows traders to protect their portfolios against adverse market movements.

The chart above shows a trader’s short position on Intel Corporation stock CFD. Since the trader owns Intel shares, the trader opened this position as a hedge against the decline in Intel’s share price. The trader stands to gain from the CFD trade that capitalises on Intel’s share price decline, which should compensate for the losses incurred from holding Intel shares. Most traders open hedging trades that match their exposure to the particular asset.

Advantages of the CFD Trading For Beginners

CFD trading offers several advantages for beginners. It provides a cost-effective way to access various global markets, requires less capital upfront compared to purchasing underlying assets directly, and allows for diversification across different financial instruments.

Additionally, the leverage offered in CFD trading can amplify both gains and losses, making it an attractive option for those looking to maximize their returns.

Disadvantages of the CFD Trading for Beginners

Despite its advantages, CFD trading also has potential drawbacks for beginners. The high leverage involved can lead to significant losses if not managed properly. Additionally, the complexity of the financial markets and the need for continuous monitoring can be challenging for novice traders.

Proper risk management and a solid understanding of the market are essential to mitigate these risks.

CFD Trading Tips for Beginners Traders

To succeed in CFD trading, beginners should start by practicing with a demo account to gain experience without risking real money. Understanding the costs associated with trading CFDs, such as spreads and overnight financing, is crucial for calculating potential profitability. Diversifying across various asset classes can help reduce reliance on a single asset and improve risk management.

Opening A CFD Position

For this illustration, we’ll assume the trader wants to take a position in a gold CFD. A similar process is followed for trading other CFDs. Let’s also assume the trader has $5,000 of capital in their account.

- Analyze Market Conditions

Check gold’s price trends using technical indicators like moving averages, support and resistance levels, and momentum oscillators. In this example, we used a crucial support/resistance zone as the main entry criteria. You could also consider fundamental indicators. - Set Entry Price

Enter at the current market price (market order) or specify a future level (pending order). If you expect gold to rise, go long (buy); if you anticipate a decline, go short (sell). In this case, we set a pending sell order, anticipating the price to retrace to the resistance level outlined on the chart. The trader would enter a bearish trade at 2941, which is the red resistance line plotted on the above chart. - Apply a Stop-Loss Order

To cap potential losses, place a stop-loss at a strategic level. A common approach is to set it below a recent swing low for long trades or above a swing high for short trades. We set the stop-loss order above the swing high in our example before our bearish trade entry. The trader would enter a stop-loss order at 2953 as outlined on the trade setup chart below. - Decide on Position Size

Calculate the appropriate lot size based on your risk tolerance and available margin. Many brokers offer micro-lots, allowing you to trade in small increments. Alchemy Markets is one such broker that allows its clients to trade fractions of a lot.

Step 1: Determine Risk Per Trade- Account Balance: $5,000

- Risk per trade (5%): $250

- Step 2: Calculate Stop Loss in Points

- Entry Price: 2941

- Stop Loss Price: 2953

- Stop Loss Distance: 2953 − 2941 = 12 points

- Step 3: Determine Lot Size

Gold (XAU/USD) is typically traded in lots, where:- 1 standard lot = 100 ounces (units)

- 1 mini lot = 10 ounces

- 1 micro lot = 1 ounce

- Each 1-ounce unit moves $1 per point, meaning a 1-lot trade (100 ounces) moves $100 per point.

The total risk per lot is:

12 points × 100 (USD per lot per point) = 1200 USD per standard lot

To keep risk within $250, the trader should calculate:

250/ 1200 = 0.2083 standard lots

Final Answer- Lot size to trade: 0.21 standard lots (rounded up slightly for practical execution).

- Confirm and Execute the Trade

Once everything is set up, double-check all inputs—trade size, stop loss, and order type—before clicking the execution button. If you use a market order, the broker will process your request instantly.

Closing a CFD Position

Keep an eye on the gold chart and key technical levels. If the price reaches your target or conditions change, be ready to close the position manually.

- Decide on a Closing Strategy

- Manual Exit

- Take Profit Order

- Stop Loss Order

Manual Exit is when the trade is closed at that moment with manual entry into the platform. As the you follow the charts, you can close the trade at a profit or cut losses if market sentiment shifts. In example, we decided on a manual exit after the price retraced the entire length of the previous bearish candlestick. The trade manually exit the trade at 2906 as shown on the above chart.

There are other ways a CFD trader can close out the position using different order types.

Take-Profit Order is when you alert the broker a certain price you’d like to close the position for a profit. Once this price is hit, then the order will go to the broker to close out the position assuming there is enough liquidity at that price to close it.

Stop Loss Order is when you alert the broker to a certain price worse than the current price to close out at the next best available price. When that price is hit, the order converts to a market order that closes out your trade at the next best available price. During illiquid market conditions, the next best available price could be several points away.

- Execute the Close Order

- On the trading platform, navigate to your open positions.

- Select the gold CFD trade and choose the “Close” option.

- If closing manually, confirm the current price before finalizing the action.

- Once you confirm, a market order is sent to the broker and you’ll exit at the next best available price

- Review Trade Outcome

Check your account balance and trade history. Analyze what worked and what could be improved for future trades.

This structured approach ensures disciplined execution and effective risk management when trading gold CFDs.

Stop Loss Orders

It’s advisable to risk only a small percentage of your total capital on each trade, no more than 5% and oftentimes less than 2%. Utilizing stop-loss orders can help manage risk by automatically closing positions at predetermined loss levels.

Focusing on a limited number of familiar markets initially can build confidence before diversifying. Continuous education and staying informed about market conditions are essential for long-term success.

CFDs vs Options

CFDs and options are both financial derivatives, but they operate under different specifications and structures. While CFDs allow traders to speculate on price movements without owning the underlying asset, options provide the right, but not the obligation, to buy or sell an asset at a predetermined price. This distinction makes each instrument suitable for different trading strategies and risk profiles.

CFDs vs Futures

CFDs and futures are distinct types of financial derivatives, each with unique characteristics. While futures contracts involve an obligation to buy or sell an asset at a set price on a specific date, CFDs offer more flexibility as they do not have expiration dates.

This allows CFD traders to hold positions as long as they want, providing greater flexibility in trading strategies.

FAQ

How much capital do you need for CFD trading for beginners?

To start trading CFDs, a beginner may need as little as $50. However, a more effective strategy would require more substantial capital depending upon your goals, trading strategy, and risk management. A larger capital base allows for larger gains or larger losses, even without using leverage. Therefore, deposit an amount of capital that you can afford to lose so that it does not impact your lifestyle.

What are the main factors determining a successful CFD trader?

Most successful CFD traders employ risk management strategies to protect their capital from significant losses. A solid understanding of market trends and the ability to understand both technical and fundamental analysis is important for trading success.

Discipline in sticking to a well-defined trading plan and adaptability to changing market conditions are also essential traits.

What are the best times to trade CFD trading for beginners?

The periods of highest trading volume and volatility in CFD trading typically occur during major market hub overlaps. The biggest overlap in the world is when London and New York are open simultaneously. Trading during these overlaps provides more trading opportunities and higher liquidity.

Be mindful during these active sessions, you’ll need to monitor economic news releases as they can add to price volatility.

Is CFD trading risky for beginners?

CFD trading poses significant risks as it involves market speculation, and the potential for loss is always present. Leverage can amplify both profits and losses, increasing the overall risk for traders, especially beginners.

Implementing risk management measures, such adding a stop loss order on every trade, will help you manage the risk and losses in a fast moving market.

Is CFD trading good for beginners?

While CFD trading may appeal to novices due to its low initial capital requirements and potential for high returns, it comes with considerable risks that must be acknowledged. Beginners need to have a clear understanding of essential CFD concepts such as leverage, margin, and stop-loss mechanisms.

Selecting a trustworthy and regulated broker is vital for ensuring a safe trading environment.

Which markets can I trade with CFDs?

CFDs can be traded on a variety of financial instruments, including forex, stocks, indices, commodities, cryptocurrencies, and exchange-traded funds (ETFs). This wide range of available financial instrument allows traders to access global markets and diversify their portfolios.

How can I improve my CFD trading skills?

Improving your CFD trading skills involves continuous learning and practice. Utilizing the wealth of trading resources available on our website, including educational materials, market analysis, and commentary, can significantly enhance your understanding of the markets.

Practicing with a demo account can also help build your confidence and refine your strategies before committing real capital.

Is CFD trading just gambling?

CFD trading is fundamentally different from gambling, despite some similarities in speculation. The distinction lies in the reliance on research and analysis in CFD trading, which is not present in gambling.

Implementing risk management techniques to mitigate potential losses further differentiates CFD trading from gambling.

Why is CFD trading so hard?

CFD trading can be challenging due to its significant volatility, which can result in large financial losses without proper management. The high degree of leverage allows traders to borrow funds to open larger positions, increasing both potential profits and risks.

Successful CFD trading demands continuous market monitoring, detailed analysis, and quick decision-making, adding to its complexity.

Can you make a living from CFD trading?

While it is possible to make a living from CFD trading, it involves a high level of risk and requires a disciplined approach. A significant majority of retail investor accounts incur losses while engaging in CFD trading.

Proper risk management and continuous learning are essential for achieving long-term success in CFD trading.