- February 20, 2025

- 28 min read

Bitcoin CFD Guide – Buy, Sell and Trade

What are Bitcoin CFDs?

A Bitcoin CFD (contract for difference) is a financial instrument that allows traders to speculate on the price of Bitcoin without actually owning bitcoin.

A CFD is a financial derivative that gives traders price exposure to an underlying asset, either in traditional finance or crypto. While cryptocurrency CFD trading mirrors the performance of the underlying asset, it doesn’t confer ownership rights. Instead, it represents a financial bet: traders open long positions when they expect a price increase and go short when they expect the price to decline.

Traders can speculate on the price movements of the largest cryptocurrency by market capitalisation, Bitcoin.

These CFD financial products are usually provided in a trading account by CFD brokers that focus on traditional underlying assets, including forex pairs, stocks, commodities, and funds. Now, traditional asset traders can access CFDs for Bitcoin too. As a result, traders of traditional markets trend to start trading bitcoin in a CFD trading account.

What Is Bitcoin?

The underlying asset of a Bitcoin CFD is Bitcoin (BTC), a decentralised cryptocurrency that is not governed by any central authority.

Bitcoin is the oldest cryptocurrency out there, being the first use case of blockchain technology, which offers a decentralised and trustless environment to conduct transactions.

Many investors are interested in Bitcoin because of its unique features, including:

- Decentralisation – Bitcoin represents a global network of servers that collectively approve transactions based on a consensus mechanism. Therefore, it doesn’t need any intermediaries like banks or governments to ensure trust.

- Security – Bitcoin is the most secure cryptocurrency due to its extensive network of nodes (servers) and robust consensus mechanism.

- Transparency and immutability – the history of all transactions is available at any time and transactions cannot be tampered with once approved.

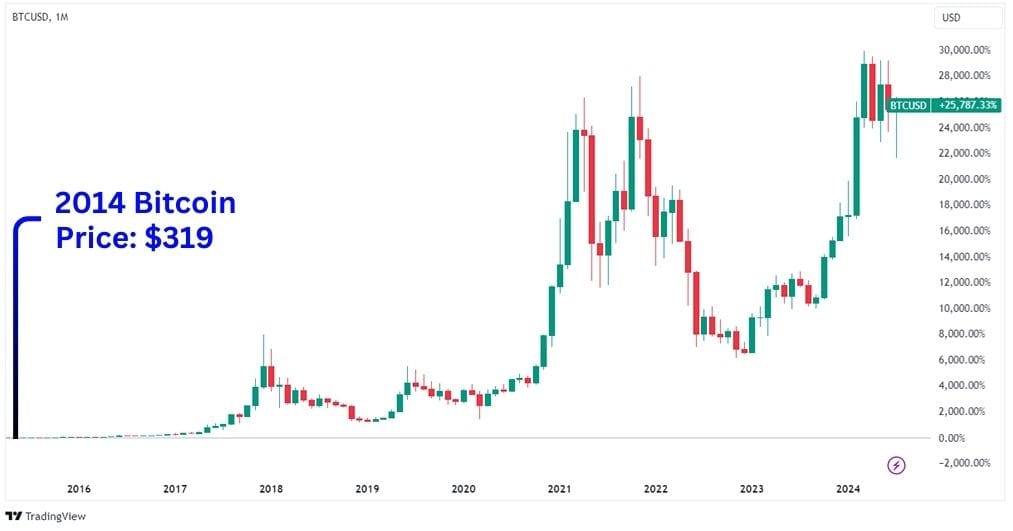

Aside from its technical features, Bitcoin attracts many investors due to its programmed scarcity, as it has its total supply capped at 21 million coins.

As a result, BTC has gained over 25,000% since 2014.

How Do Bitcoin CFDs Work?

A CFD Bitcoin is a contract between a trader and a broker that pays the difference in the prices between open and closed trades. Traders secure profits if they successfully predict the price movement. If the price moves against the trader’s prediction, he incurs losses paid from his deposits once the trade has been closed.

A Bitcoin CFD is a derivative of a trading pair involving Bitcoin and a fiat currency like USD, EUR, or GBP, which allows you to trade the price movements without owning Bitcoin.

If you expect Bitcoin to increase in value, you would BUY the Bitcoin CFD, or ‘go long.’ If you think the Bitcoin price is about to fall, you would sell the CFD, or ‘go short.’ Traders can take advantage of both rising and falling markets by going long or short on Bitcoin CFDs.

The entry price at which you open a position in either direction becomes the reference price against which the difference with the exit price is determined.

Example of a Bitcoin CFD Trade

Below is an example of a short position on Bitcoin. The trader goes short at about $65,000, making this the reference price for the CFD trade.

Observe the price dropping into the green zone – this is when the trader will be in unrealised profits. The larger the distance between the entry and exit prices, the larger the profit.

Conversely, whenever the price goes into the red zone, the trade will begin to go into unrealised losses. Once again, the larger the distance from the reference price, the bigger the loss.

The opposite of this situation occurs when the trader goes long or buys the CFD.

The essence of CFD trading boils down to timing, as each CFD trade can be held indefinitely. The trader can be in unrealised profits or losses at different points in the same trade. When the trader closes the trade, these profits/losses are then realised.

Key Aspects of a Bitcoin CFD

As with any CFD, a Bitcoin CFD has the following key elements:

- Ask price – The price at which you can buy the CFD (go long).

- Bid price – The price at which you can sell the CFD (go short).

- Spread – The difference between ask and bid prices.

- Margin – The collateral a trader provides to access leverage, amplifying the trade’s buying power and profit/loss per pip movement. When you open a Bitcoin CFD trade, a portion of your account balance is set aside as margin.

Leverage and CFDs

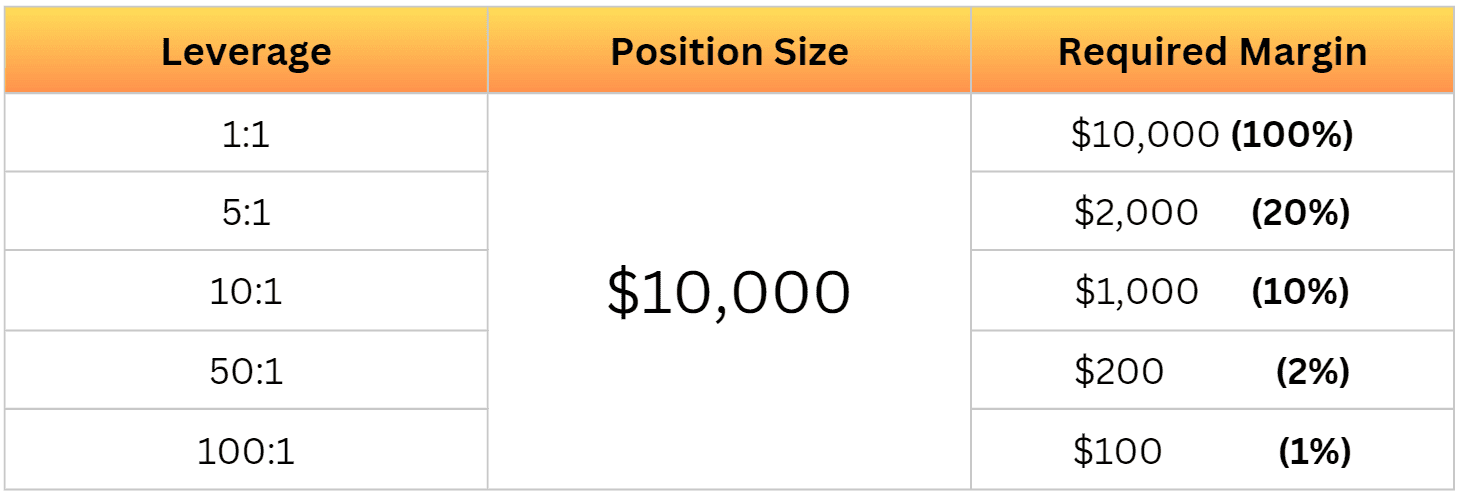

Bitcoin CFD traders can multiply their trade size with a smaller deposit by using leverage, although they get exposed to increased risk as well.

This means that for every pip movement, the amount of profit or loss is amplified. With leverage of 10:1, one dollar gain becomes ten dollars and a one dollar loss becomes a ten dollar loss.

When using leverage, traders borrow funds from the broker to initiate a larger position with only a partial contribution from their own funds. The trader commits to the process by providing a good faith deposit from their trading capital to hold the trade open. If the trade closes without a margin call, the good faith deposit is returned to the trader’s account. This good faith contribution is called margin.

Margin Requirements for Leverage

There is a margin requirement when using leverage, usually represented as a percentage and depends on the leverage size. For example, trading with 5:1 leverage would require the trader to keep 20% of their trade size locked up as collateral to open the trade.

This means a trader can open a trade position of $1,000 while only using $200 as deposit margin. The remainder of the trader’s account is unused margin that can absorb any floating losses from the leveraged position.

If Bitcoin moves significantly against the trader’s position, the broker may issue a margin call. This means the trader’s unrealised losses are nearing the critical level of a trade’s required margin – in the example above, this would be $200. If there is not enough unused available margin left to keep the trade open and the position will be automatically closed. If it was a fast moving market, it’s possible that some or all of the deposit margin could be lost too. It is very important to manage your account’s available margin.

Keep in mind that certain regulatory agencies may impose higher margin requirements on certain assets. Traders should consider trading with even lower amounts of leverage to leave enough unused margin to absorb any unrealised losses to due volatile market conditions.

On Alchemy Markets, cryptocurrency CFDs can be traded with up to 10:1 leverage, which means your margin requirement is set to 10% of the trade size or greater.

Is CFD Trading Legal?

Certain parts of the world have different regulatory bodies overseeing the brokers and clients. Some regulatory and governing bodies allow CFD trading in their jurisdiction while others do not. As a result, brokers’ ability to offer CFD trading will depend on licensing and capital requirements of the local regulatory body.

For traders, access to CFDs may differ based on their location and what authority they are governed by. Additionally, margin requirements may differ from one regulatory body to another.

There are some jurisdictions where CFD trading is not allowed like in the United States and Hong Kong.

If you are not sure whether your broker is allowed to offer CFDs to you, review their website and trading agreements or reach out to support.

What Affects the Price of Bitcoin CFDs?

Bitcoin has garnered the attention of many investors around the world as a deflationary, non-governmental asset. Since a CFD mirrors the price of the underlying asset, let’s look at the key factors which drive the price of Bitcoin.

Bitcoin Supply

Bitcoin has been a bullish asset, thanks to its deflationary model. Its creator, Satoshi Nakamoto, has created it with the idea of Bitcoin being like digital gold, where there is a limited supply, and a level of difficulty in mining it through software programs.

Bitcoin has a limited supply of 21 million coins, and as of mid-July 2024, 19.72 million coins are already in circulation, leaving little room for new coins to be created to dilute the value of the mined coins.

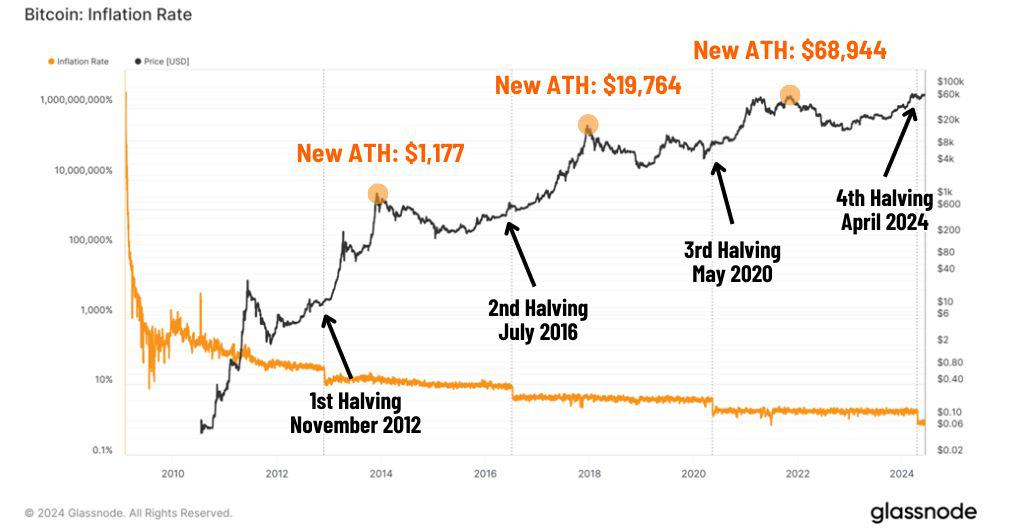

Bitcoin Halving

Approximately every four years, Bitcoin goes through an event called the halving. During a Bitcoin halving, the reward for mining new Bitcoin blocks is cut in half, reducing the rate at which new coins are introduced into circulation.

This scarcity mechanism is designed to effectively slash the inflation rate on Bitcoin, and will continue until the maximum supply is reached. This stabilises the supply of Bitcoin leaving its prices subject to the demand of investors and traders. This stable supply is a big reason why so many people tout Bitcoin as a store of value.

Check the chart below. Notice how each halving, aka inflation cut, typically led to a new record high a few months later.

Source: Glassnode, Alchemy Markets

Bitcoin Demand

To assess market sentiment and demand dynamics, you should keep an eye on several factors, including:

- Interest from institutions – Lately, Bitcoin’s rallies were driven by large institutional investors, financial institutions, and whales. Much of the interest has been catalysed by the SEC’s approval of Spot Bitcoin ETFs in January 2024, as the distributor of these ETFs must buy Bitcoin to back the ETF’s value.

This is significant as prior to the ETFs, Bitcoin was largely traded through Futures and Cryptocurrency Exchanges. The introduction of ETFs opens up interest from Wall Street, because they can now gain exposure to Bitcoin via Spot ETFs, available through stock market exchanges.

- Regulation – Many jurisdictions, such as the European Union, have adopted crypto regulations, but the global regulatory environment is still vague. For example, the US still hasn’t established a clear regulatory framework for crypto assets, with authorities being divided on potential risks. Any regulatory updates could have an impact on the demand for Bitcoin thereby affecting the price of Bitcoin.

- New products and services – New products related to Bitcoin may impact its adoption. For example, the introduction of Ordinals and Rune protocols has enabled the creation of non-fungible tokens (NFTs) on the Bitcoin blockchain. This creates an additional use case for Bitcoin, fueling additional demand.

- Other news and events – Other important events can also impact the demand, and price, of the cryptocurrency. For example, a series of bankruptcies in 2022 triggered by the collapse of the Luna ecosystem and culminating with the crash of FTX caused Bitcoin to lose over 60% of its value in a few months.

Why Trade Bitcoin CFD?

Trading Bitcoin CFDs is different from purchasing actual crypto. Here is why you should consider trading Bitcoin CFDs:

No Physical Ownership

Trading Bitcoin CFDs is more straightforward than interacting with actual Bitcoin. When you buy Bitcoin, you have to make sure to store it in a secure wallet, choosing between:

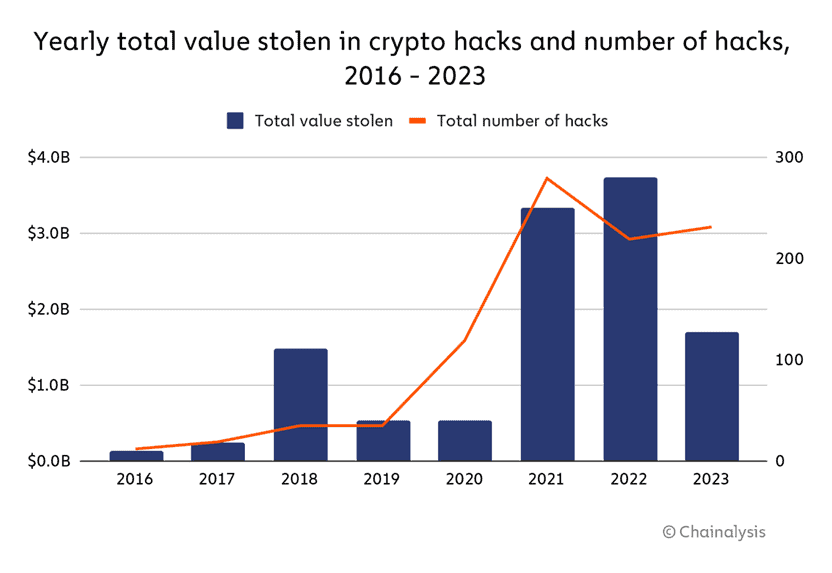

- Custodial wallets provided by crypto exchanges – here, the crypto exchange has access to your private keys, which leaves you exposed to the risk of hacking attacks or bankruptcy. During the last decade, hackers have targeted dozens of crypto exchanges, including major ones such as Mount Gox, leading to billions in USD Value being stolen.

Source: Chain Analysis

- Non-custodial wallets are more secure, but they require some experience with crypto. Hardware wallets are the most secure ones, but they cost between $60 and $250.

When trading cryptocurrencies with a CFD broker, you don’t have to worry about wallet hacks as you are simply trading the price movement.

Wealth of Trading Resources

Most brokerage firms offering Bitcoin CFDs provide a variety of tools and resources to enhance your trading experience. Traders can access advanced trading platforms with real-time charts, various order types, technical indicators, risk management tools, and trading bots. Additionally, many brokers offer educational materials, interactive courses, expert analysts, and demo accounts for beginners.

Diversification

Most brokers offering Bitcoin CFDs also provide CFDs for traditional assets like forex pairs, commodities, and equities. This allows traders to diversify and build portfolios that combine Bitcoin with traditional assets, an option not available on crypto exchanges, which usually only list digital assets.

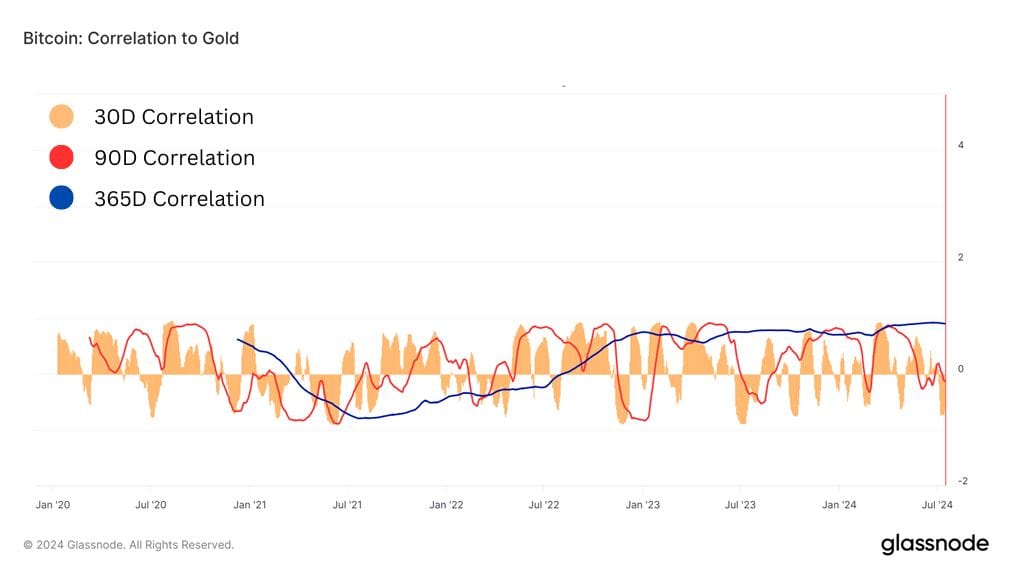

Adding Bitcoin CFDs to a traditional portfolio can be a game changer, as Bitcoin’s high volatility and low correlation with traditional assets offer unique diversification benefits. Bitcoin is often compared to gold due to its scarcity and has some degree of correlation with how gold moves (as gold climbs, so does Bitcoin). As of July 2024, the 1-year correlation between Bitcoin and gold sits at 1, illustrating a high positive correlation.

Source: Glassnode

Competitive Spreads

Many CFD brokers offer low spreads and commissions, enabling Bitcoin CFD traders to open multiple short-term positions simultaneously. This flexibility supports various trading strategies and easy hedging of positions. Typically, Bitcoin CFDs have a spread that is 0.1% the value of a coin plus a small commission, with potential discounts based on account size and trading volume.

The Alchemy crypto page illustrates what you may typically experience for Bitcoin CFD spreads and commissions.

Flexibility

Bitcoin CFD trading offers more flexibility than direct Bitcoin purchases, where you typically need to own the underlying crypto or USD-Tether. The process of buying USDT can be complex, and many countries regulate direct crypto trading. Bitcoin CFDs allow users to trade Bitcoin’s price without needing to navigate crypto purchases or exchange restrictions.

Additionally, earning in fiat enables direct withdrawals for daily use, eliminating the need to convert crypto to USD, GBP, or EUR.

Accessibility

Unlike traditional assets, crypto markets operate 24/7, allowing you to trade Bitcoin CFDs at any time, aside from brief server maintenance by the broker. All you need is a laptop or mobile device with an internet connection.

Liquidity

Bitcoin CFDs are highly liquid due to Bitcoin’s popularity as the most traded cryptocurrency, making it more preferred than other crypto CFDs. The high volume of trades reflected in our order book ensures you’ll get some of the fastest execution when trading Bitcoin CFDs.

The Ability to Go Long or Short

Bitcoin CFD traders can profit by betting on Bitcoin’s price moving up or down, offering more flexibility than holding Bitcoin, where profits are only made by selling at a higher price, not when the price declines.

Some instruments let crypto holders trade Bitcoin’s price like a CFD, earning in cryptocurrency instead of fiat. In contrast, Bitcoin CFD traders profit in fiat (government-issued currency), offering more convenience for trading in other market instruments or withdrawing to your bank account.

Stability

Trading Bitcoin CFDs offers more stability than purchasing Bitcoin on many crypto exchanges, as most CFD brokers provide risk management tools like stop-loss orders to help reduce potential risks. Additionally, major CFD brokers operate under regulatory frameworks that offer protection and oversight, unlike many unregulated crypto exchanges.

Margin and Leverage

Bitcoin CFDs allow traders to use leverage, enabling them to open larger positions with only a fraction of the total trade size. This can amplify potential gains but also increases the risk of losses. For example, with 10:1 leverage, a $1,000 margin deposit allows you to open a $10,000 Bitcoin position.

Volatility

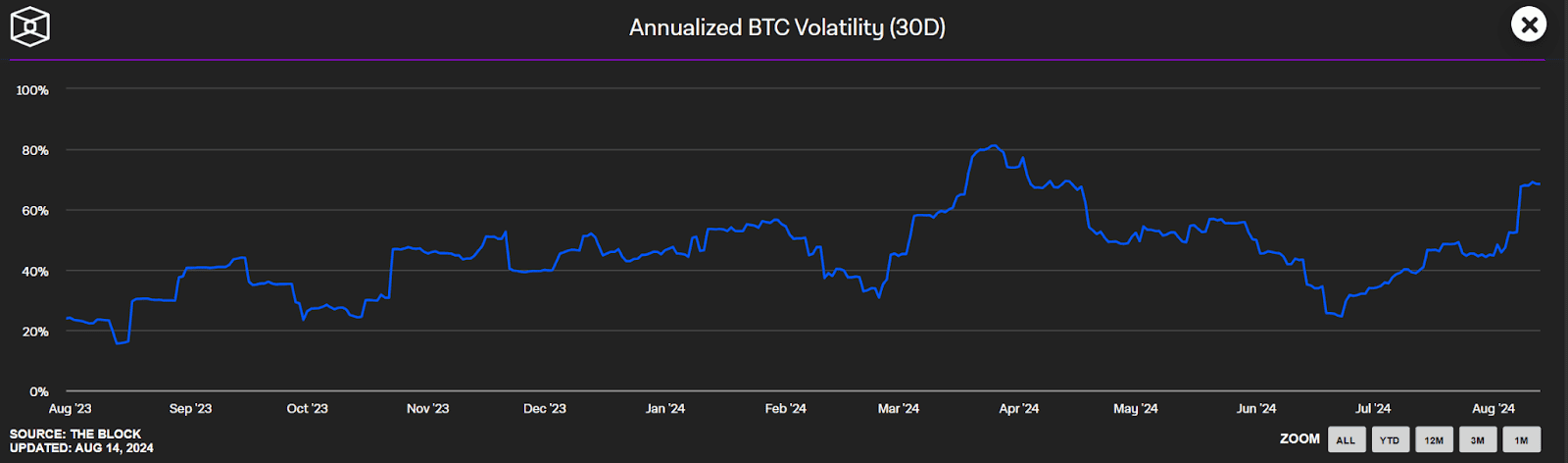

Bitcoin CFDs reflect the price of Bitcoin and offer the same volatility. Despite being the largest cryptocurrency by market cap, Bitcoin is still highly volatile, which can present both risks and opportunities for traders.

Source: TheBlock

Earlier in 2024, Bitcoin’s 30-day volatility rose to the highest level since the end of 2022. As of August 2024, we can see that Bitcoin’s 30D volatility sits above 60%.

When trading Bitcoin CFDs, traders can capitalise on these price swings without owning the crypto.

No Contract Expiration Date

Unlike traditional futures contracts or options, Bitcoin CFDs are derivatives without expiration dates. You can hold your positions for as long as you want. However, note that some CFD brokers may charge a small fee for holding positions overnight, this is also called a swap fee.

The ability to maintain a position indefinitely provides greater control and helps avoid the pressure of making hasty decisions as the expiration date approaches.

Bitcoin CFD Example

Here is an example of how you can trade CFDs on Bitcoin. The most popular Bitcoin CFD pair is BTC/USD, which we’ll use in our illustration.

In our case, the bid price for BTC is $60,000, and the ask price is $60,050. A CFD of Bitcoin represents the value of 1 BTC. If you think the price of Bitcoin will increase, you can open a long position with $1,000 of your own capital at $60,050.

With 5:1 leverage, you would increase your buying power by five times, opening a position of $5,000 with a 20% margin requirement.

If the price of BTC increases to $65,000 within a week, your position would gain 8.2% to reach approximately $5,412. Closing it would mean that you secure a net profit of $412. Thanks to the 5:1 leverage, this represents a 41% return on your initial margin of $1,000.

Bitcoin CFD Trading Strategies

Bitcoin CFD traders can implement a wide range of strategies based on their risk profiles and targets. Here are three popular trading styles:

- Day trading – Day traders open and close positions within the same day. They rely on technical indicators and chart patterns but keep an eye on major events that may affect the market sentiment. Day traders operate with 1m, 10m, and 15m timeframes, monitoring their positions on a regular basis.

- Swing trading – Swing traders hold their positions for a few days or even weeks. They look for price swings to enter long or short positions, depending on the general trend. While they use technical indicators like moving averages and RSI, swing traders also assess market sentiment through news, economic data, and fundamental analysis.

- Scalping – Scalping is a short-term strategy where traders aim to profit from very small price changes, opening and closing positions within minutes or even seconds. These traders often use high leverage and short time frames, targeting small gains that add up over the day.

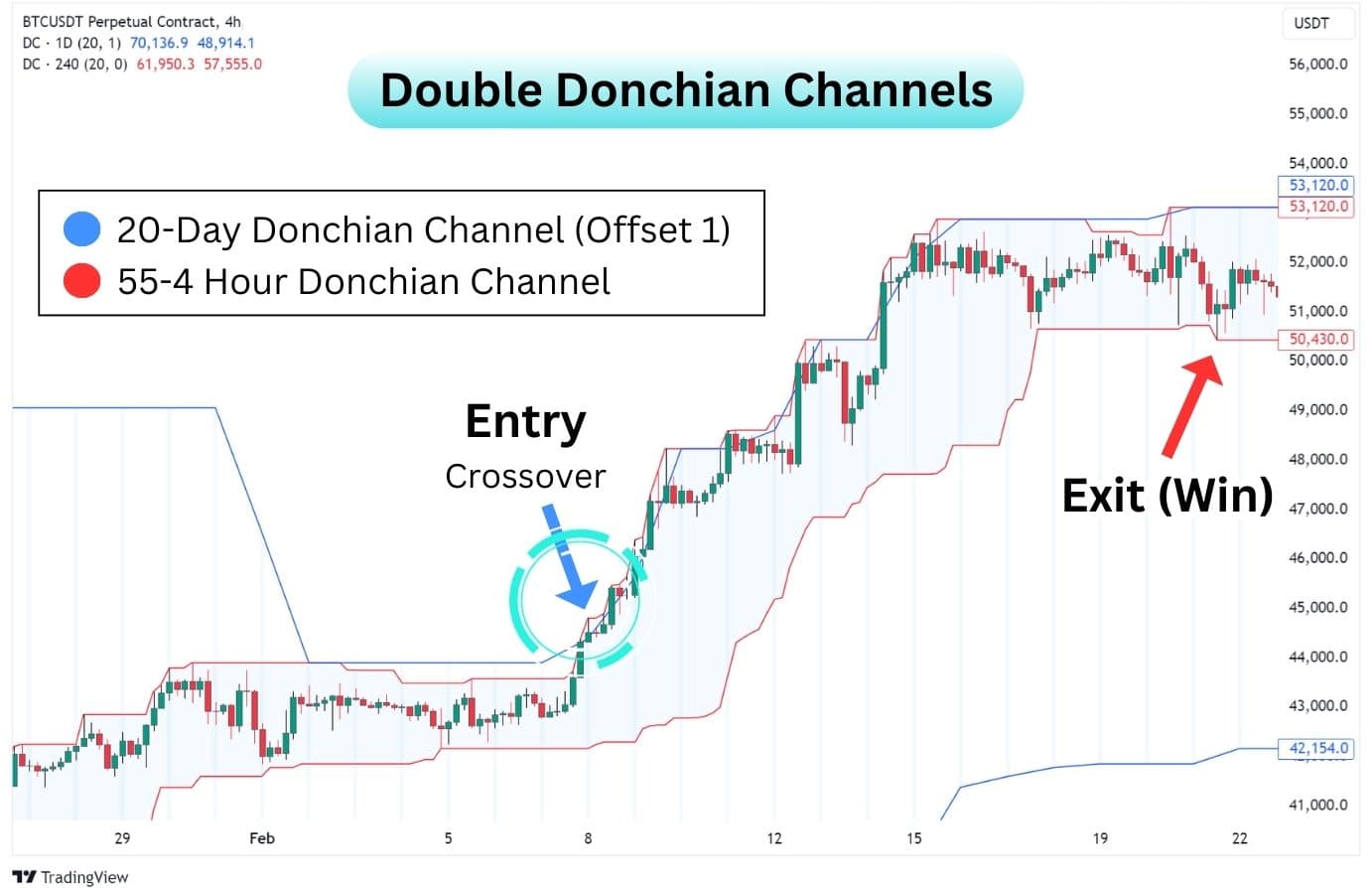

For Swing Trading: Double Donchian Channels

The Double Donchian Channels strategy is a trend-following strategy that aims to capture the big swings we typically experience in Bitcoin trading. Since Bitcoin has been an innately bullish asset since it began trading, we will only be looking for long positions (buys) with this strategy. This strategy has a built-in mechanism that indicates when the market is going through a drawdown and to stay on the sidelines until market conditions improve.

To apply this strategy, setup two Donchian Channel indicators on your chart, with one channel being on the daily timeframe, and the other being on the 4-hour time frame.

The idea here is when the 4H channel forms a new high, crossing over the Daily Channel (Offset 1), you are signalled to take a swing long position. Exit the trade only when the price comes down to tap the lower band of the 4H channel.

Here’s how it works:

| Indicator Settings 1. Fix a Donchian Channel to the Daily timeframe with 20-length and 1 offset. Colour it blue. 2. Disable the background, the basis line, and lower line. 3. Fix a second Donchian Channel to the 4-hour timeframe with 55-length and 0 offset. Colour it red. 4. Disable the background and basis line. Entry and Exit Conditions 1. When the 55-4 Hour Channel High crosses over the 20-Day Donchian Channel High. 2. Enter a long position on candle close. 3. Exit the trade when the price taps the 55-4H Channel Low. Hot Tip Whenever there’s an uptick on your Daily Donchian Channels (set to blue), switch to the 4H timeframe to see if a new 55-4H High (set to red) has been formed. |

Be warned: Double Donchian Channels can provide many false signals with significant drawdown in sideways markets. This is a low win-rate, high reward type of strategy that tends to perform better in strong uptrends. This is why Bitcoin and other crypto markets can be a good option to trade the strategy. Trade with low leverage/capital to ensure potential losses do not exceed 5% of your account.

For Day Trading and Scalping: Previous Day vWAP Strategy

This is a unique strategy that’s very powerful on Bitcoin, with a triggering rate of at least one to two day trades per week. This strategy only uses the Volume-Weighted Moving Average (vWAP), and in essence, is a simple support and resistance trading strategy.

The vWAP marks out the average price of an asset across a single trading day, a week, or for even longer. However, the key thing here to note is that it resets its calculations every 24 hours (or trading day), when set to calculate only the daily session. By capturing where the previous day vWAP closed, we can get the Previous Day vWAP (pdvWap) and use it as a hidden support/resistance level to enter a day trade.

How it works:

| Indicator Settings et the Volume-Weighted Moving Average (vWAP) to Daily Session. Entry Conditions 1. Draw a horizontal line at where the vWAP closed on the previous day, marking the pdvWAP. 2. If the price is above the pdvWAP, look for a long on a retest of pdvWAP. If it’s below, look for a short on a retest of pcvWAP. Exit ConditionsThere are several levels you can opt to take profit at with this strategy: 1. At current day vWAP: Partially take profit at this level to secure some profits. 2. At Upper or Lower Standard Deviation Bands: In a long, take profit at the upper band. In a short, take profit at the lower band. 3. At extended targets: These levels include previous high (close), previous low (close), or significant price levels such as historic support or resistances. Hot Tip In a trending environment, aiming for extended targets can improve your Risk-to-Reward ratio. Just keep in mind this increases the chance of missing profit targets if the price falls short, which is why taking partial profits at the current day vWAP, and at the standard deviation bands are so important. |

Advantages of Bitcoin CFDs

- Volatility – The high volatility of Bitcoin CFDs ensures many trading opportunities.

- Ability to go long and short – Unlike buying Bitcoin on crypto exchanges, trading CFDs offers the ability to capitalise on BTC price declines.

- Leverage – Bitcoin CFD traders can multiply potential profits with leverage.

- No need for digital wallets – Bitcoin CFD traders don’t have to bother with setting up digital wallets and transferring Bitcoin between multiple addresses.

- Regulated environment – Reputable CFD brokers are licensed and regulated in one or several jurisdictions.

- Advanced terminals – CFD brokers offer advanced trading terminals like MT5.

Disadvantages of The Bitcoin CFDs

- Margin Risk – CFDs are traded on margin, so if you don’t manage your unused margin well, your position may be automatically closed if your liquidation level is hit. This becomes more prominent if Bitcoin becomes even more volatile.

- Leverage – Bitcoin is a highly volatile market, and using leverage increases risks exponentially.

- Counterparty Risk – Although Bitcoin itself is decentralised, trading Bitcoin CFDs requires you to trust that the broker will honour its obligations. Check out who your broker is regulated with to ensure proper oversight.

- CFDs are illegal in some jurisdictions – A few countries, including the US, don’t allow CFD trading.

- Overnight fees – Some CFD brokers may charge fees for holding positions overnight because you are borrowing the funds to access leverage.

Bitcoin CFD vs. Bitcoin Futures

Bitcoin futures are another popular derivative type that enables traders to get exposure to the crypto coin without owning it. Popular futures exchanges like CME and CBOE have been offering Bitcoin futures since 2017.

Futures are contracts to buy or sell the asset at a predetermined price for delivery at a specified time. Most Bitcoin futures providers deliver the USD equivalent when the contract expires.

While both Bitcoin CFDs and futures make it easy to go short, the key difference between them is that the latter has an expiry date. This requires traders to settle their trades at a predetermined price. If the price at the expiry date is better, the trader secures a profit – but if not, they may break even or even incur a loss. CFDs don’t have any expiration time and can be held indefinitely, and closed at any moment.

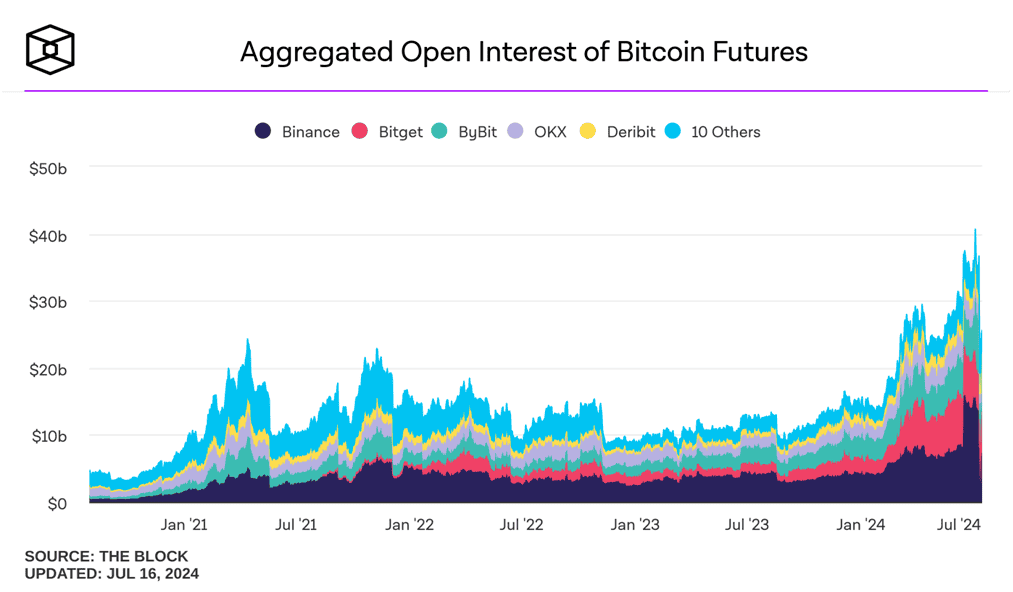

That being said, Bitcoin futures are still an extremely popular instrument, with aggregate open interest in Bitcoin futures reaching a record high of $40 Billion in July 2024.

Source: The Block

Bitcoin CFD vs. Bitcoin

Bitcoin CFD is a derivative that mimics the price of Bitcoin. It allows traders to long and short the price of Bitcoin without owning the asset. Other than that, it doesn’t share the benefits of the cryptocurrency in terms of technology, decentralisation, security, transparency, and immutability of transactions.

Aside from having access to leverage, another key benefit of trading Bitcoin CFDs over directly trading Bitcoin, or Bitcoin Futures is that profits are earned in US dollars (or other fiat currencies). This allows users to directly withdraw profits and use it for daily expenses, as opposed to withdrawing in USDT and needing to sell it for USD.

Bitcoin CFD vs. Bitcoin ETF

Bitcoin exchange-traded funds (ETFs) enable investors to gain exposure to Bitcoin via traditional stock exchanges. Unlike CFDs, Bitcoin ETF holders actually hold shares, allowing them to passively profit from the ETF’s price growth.

In January 2024, the US Securities and Exchange Commission (SEC) approved the first Bitcoin spot ETFs. These ETFs are listed on stock exchanges and backed by physical Bitcoin, which is held in the custody of ETF issuers. Unlike Bitcoin CFDs, Bitcoin ETF holders indirectly own a portion of that physical Bitcoin, via holding the ETF shares.

Therefore, while Bitcoin CFDs are treated as derivatives, Bitcoin ETFs are more like equities. This is why short-selling Bitcoin ETFs is more complicated because they behave like stocks.

Bitcoin CFD vs. Ethereum CFD

If Bitcoin is the king of crypto, then Ethereum is the queen—second in market capitalisation in the crypto market. As such, Ethereum CFDs have become a highly popular choice among CFD traders looking to explore the cryptocurrency markets and take advantage of the price action.

Due to Ethereum’s smaller market cap, Ethereum CFDs tend to move with greater volatility compared to Bitcoin CFDs – this means that when Bitcoin moves 3%, Ethereum may move 5-7% instead. A trader may prefer the Ethereum CFD for its volatility, or Bitcoin for its relative stability compared to altcoins.

For example, when Bitcoin had its infamous bull run in 2021, it moved up by over 400%. Ethereum on the other hand, moved by over 1200% in the same period of time!

Ethereum’s regular upgrades, driven by its active developer community, also add a dynamic, “stock-like” quality to the asset. Unlike Bitcoin, which lacks ongoing developer support, announcements of Ethereum upgrades can influence its price, much like product launches affect company stock prices.

Traders are also drawn to Ethereum for its technological innovation. As a layer-1 blockchain, Ethereum provides a foundation for others to build upon, enabling the creation of new cryptocurrencies and technologies. This flexibility not only fosters exciting opportunities within the Ethereum ecosystem but also contributes to the volatility that traders often seek.

Moreover, Ethereum’s transition from a Proof-of-Work consensus mechanism (like Bitcoin’s) to Proof-of-Stake has made it more environmentally friendly and scalable, positioning it as a forward-looking platform ready to adapt to future demands.

A neat trick to know when to focus on trading Ethereum over Bitcoin is by observing the ETH/BTC chart. This tells us when Ethereum is experiencing heightened volatility in comparison to Bitcoin, offering larger swings and potentially more lucrative trades.

As observed in the chart, Ethereum gained 1,337.99% against Bitcoin during February to June 2017, and then once again had a bigger run from December 2017 to January 2018. Both assets experience periods of heightened volatility, making them a great Crypto CFD couple to keep an eye on.

Bitcoin CFD vs. Litecoin CFD

Whereas Bitcoin is known as “Digital Gold”, Litecoin is often known as “Digital Silver” by the crypto community. Founded in 2011, Litecoin is designed to be a “lighter” version of Bitcoin, boasts faster block generation speeds, transaction speeds, and lower fees than Bitcoin.

As of recent, the interest for Litecoin has taken a backseat to other altcoins such as Ethereum, Solana, and even Doge. Even with Bitcoin’s recent rally of over 350% to $70,000, Litecoin has only made a move of 80%. Conversely, Litecoin has fallen by ~55% when Bitcoin fell by over 30% in 2024.

As of June 2023, Litecoin has shown that unlike other altcoins, it’s been unable to make significant upswings when Bitcoin does. This makes Litecoin a rather great short hedge to consider adding to your CFD watchlist, or employ trend-following strategies on.

Bitcoin CFD vs. Solana CFD

Compared to Bitcoin, Solana is a much faster blockchain and boasts 400 milliseconds as its transaction speeds. Bitcoin on the other hand, requires up to 10 minutes to generate a block, and can only handle up to 7 transactions per second.

Much like Ethereum, Solana is a layer 1 blockchain which allows users to build their own decentralised apps (dApps), NFTs, cryptos, and digital services on Solana’s blockchain. This utility makes Solana a major contender for mass crypto adoption. Many crypto enthusiasts and investors are keeping an eye on Solana for this speculative reason alone.

As of recent times, Solana has been the talk of the town, gaining over 1,600% in contrast to Bitcoin’s 350% between 2023 to 2024. There are even talks of Solana spot ETFs being approved. If the approval goes through, the demand for Solana may increase and impact the price of Solana and the Solana CFD.

Interestingly, Solana does not have a fixed supply cap. This makes it an inflationary token as opposed to Bitcoin, a deflationary crypto with a fixed supply of 21 million. Therefore, Solana is more akin to a tech stock rather than a store of value, like how Bitcoin is akin to gold.

Bitcoin CFD vs. XRP (Ripple) CFD

While Bitcoin is a store of value, and Ethereum is a platform for building dApps, XRP is built to fundamentally serve a different purpose. XRP, otherwise known as Ripple, is designed to be a bridge currency for financial institutions to make large cross border transactions cheaply, and swiftly.

As of August 2024, demand for XRP has been kept low due to an ongoing litigation claiming it’s a security in addition to being a cryptocurrency. Despite this, XRP still ranks at the 7th market cap among cryptocurrencies, making it an interesting crypto to watch.

XRP is highly impacted by the outcome of its legal proceedings, making it a prime instrument for news traders. Short-term volatility driven by these events can offer quick, yet explosive market movements for traders to capitalise on.

Additionally, the suppressed price from 2023 to 2024 has led to a tight, defined trading range for XRP. This stability is perfect for algorithmic traders to deploy range-bound strategies on XRP CFDs, allowing them to capitalise on predictable price movements without the need to hold the underlying asset.

How We Compare Against Other Crypto CFD Providers

The commissions for Bitcoin CFDs at Alchemy are as low as 0.25%, which is lower than those of crypto exchanges and other crypto CFD providers. Additionally, Alchemy offers 60+ cryptocurrency CFDs including favourites such as Ethereum, Solana, Binance Coin, Cardano, and Dogecoin. If a trend or range has developed in crypto, then you’ll be able to trade it with next to zero spreads via CFDs with Alchemy.

FAQ

What are the best timeframes to trade Bitcoin CFDs?

While Bitcoin can be traded around the clock, Bitcoin CFDs are more liquid during business week. The best time frames for trading Bitcoin CFDs depend on your preferred strategy. For instance, scalpers would use 1m and 5m charts, while swing traders would operate with 30m, 1H, and 1D charts.

How much capital do you need to trade Bitcoin CFDs?

Most CFD brokers offering Bitcoin CFDs have minimum deposit requirements. At Alchemy Markets, we have an account minimum of $100. It’s recommended to start with a deposit amount that aligns with your goals and risk tolerance. Note that each account type comes with their own trading conditions and commissions.

What are the fees in Bitcoin CFD trading?

CFD brokers incur commissions in the form of the spread. The size of the spread can be 0.1% and higher.

Is it safe to invest in Bitcoin CFD?

Investing in Bitcoin CFDs involves significant risk given that Bitcoin is highly volatile. On top of that, using leverage increases the risk exponentially. Bitcoin CFDs can be a source of significant profits, but they can also lead to losses that may exceed the initial investment.

Make sure that you deal with a reputable broker that is licensed in one or several jurisdictions.

Can I trade Bitcoin CFDs on the Metatrader 4 and Metatrader 5?

Yes – Bitcoin CFDs are no different than other CFDs offered by a broker. They can be traded on the terminals offered by a broker, including MT4 and MT5.