In a series of pivotal meetings today, major central banks—the Federal Reserve (Fed), Bank of England (BoE), Swiss National Bank (SNB), and Bank of Japan (BoJ)—announced their latest monetary policy decisions, reflecting a global economy grappling with slowing growth and persistent inflation.

Federal Reserve: Rates Unchanged Amid Revised Projections

The Federal Open Market Committee (FOMC) opted to maintain the benchmark interest rate within the 4.25% to 4.50% range. However, the Fed adjusted its economic outlook, anticipating slower growth and higher inflation, partly due to recent tariff implementations. Projections now suggest a 1.7% GDP growth for this year, down from the previous 2.1%, and an uptick in inflation to 2.8% from 2.5%.

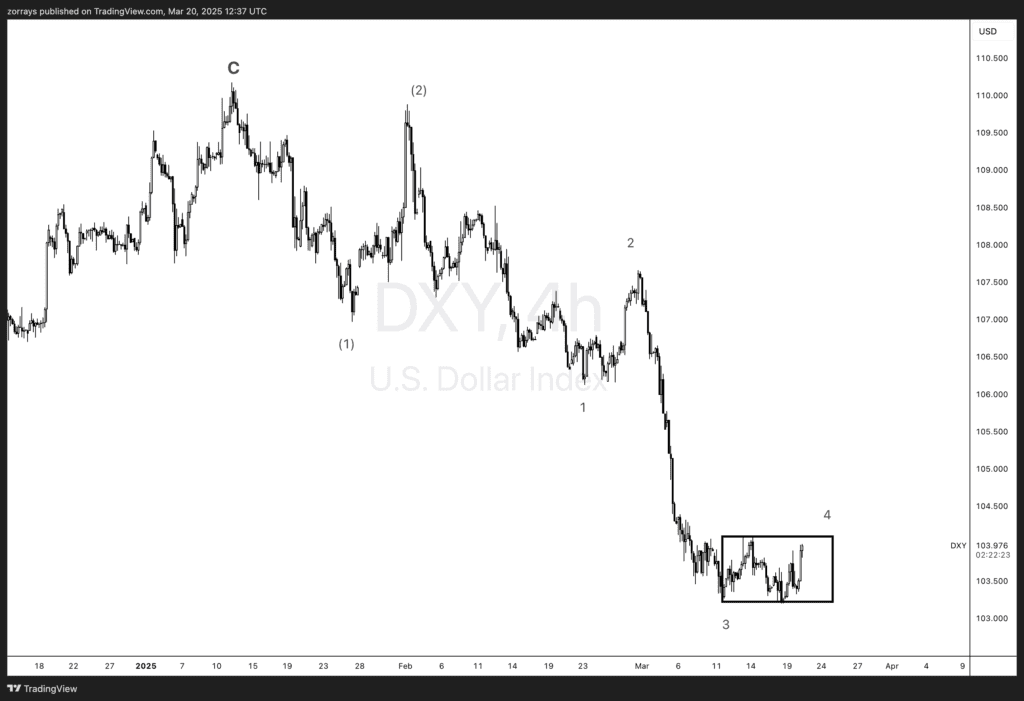

Technical Analysis: DXY (U.S. Dollar Index)

The DXY (U.S. Dollar Index) is currently stalling into an Elliott Wave Theory’s Wave 4 correction before a potential continuation to the downside. This aligns with the Fed’s cautious stance, as a weaker dollar could persist if expectations of future rate cuts grow stronger.

Bank of England: Steady Rates Amid Economic Uncertainty

The BoE’s Monetary Policy Committee voted 8-1 to keep the base interest rate at 4.5%. This decision reflects ongoing concerns about high inflation and sluggish economic growth. The UK economy is projected to grow by a modest 0.25% in the first quarter of 2025, a slight improvement from earlier estimates. Governor Andrew Bailey emphasised the heightened economic uncertainty, indicating that future rate decisions will be approached with caution.

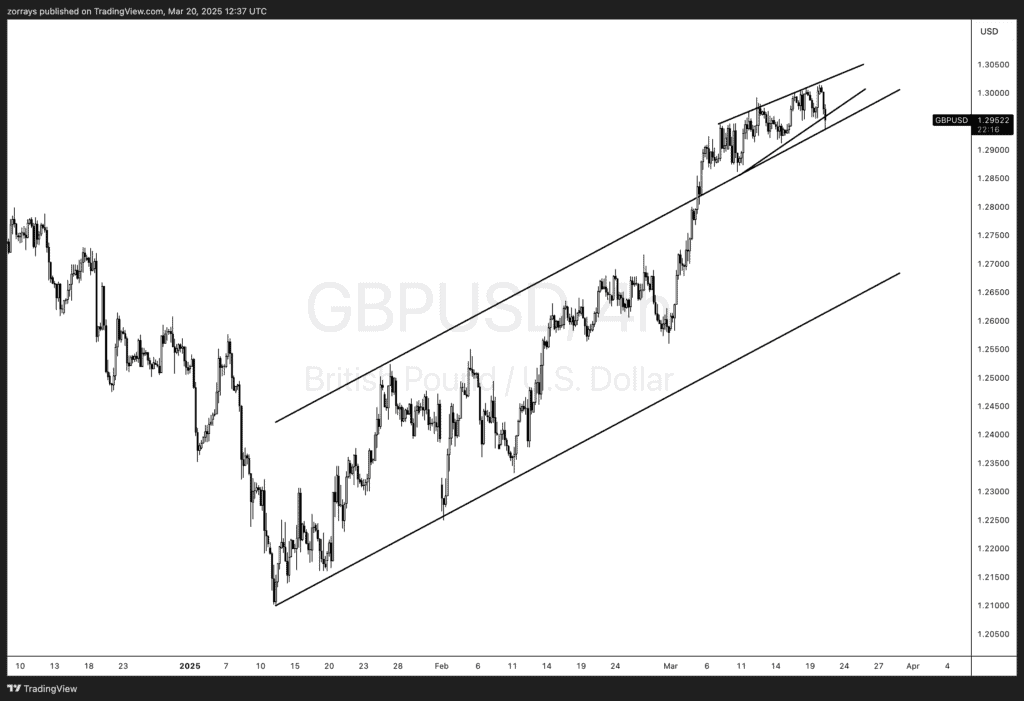

Technical Analysis: GBP/USD

GBP/USD has broken out of its ascending channel while maintaining its uptrend. If price continues to hold above this breakout zone, the bullish momentum could extend further, aligning with expectations that the BoE may remain hawkish for longer than the market initially anticipated.

Swiss National Bank: Unexpected Rate Cut

In a surprising move, the SNB reduced its key interest rate by 25 basis points to 0.25%, positioning Switzerland as the country with the world’s lowest policy rate. This decision aims to maintain appropriate monetary conditions amid low inflationary pressure and significant downside risks to inflation. The SNB expressed concerns about increasing trade barriers and geopolitical uncertainties potentially weakening the global economy.

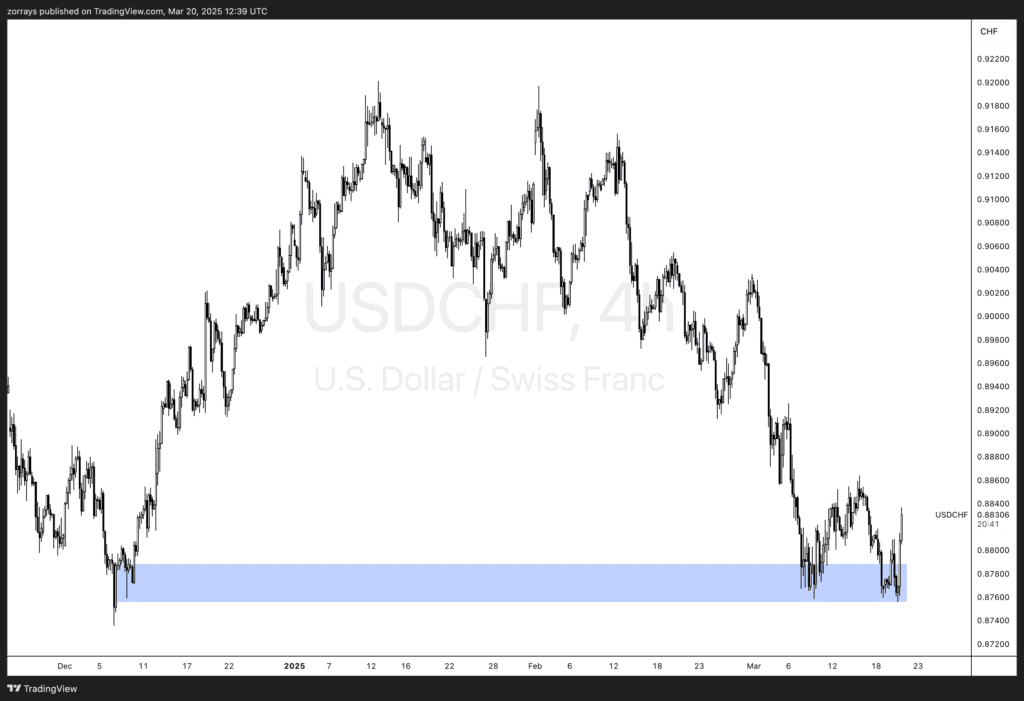

Technical Analysis: USD/CHF

USD/CHF is currently bouncing off a critical support area marked in blue. This could indicate a potential double-bottom formation, suggesting a possible bullish reversal if price continues to hold above this key support level.

Bank of Japan: Policy Rate Steady

The BoJ maintained its policy rate at 0.5%, continuing its accommodative monetary stance to support moderate economic recovery. The central bank acknowledged improvements in consumer spending and controlled inflation expectations but remains vigilant about potential global economic headwinds.

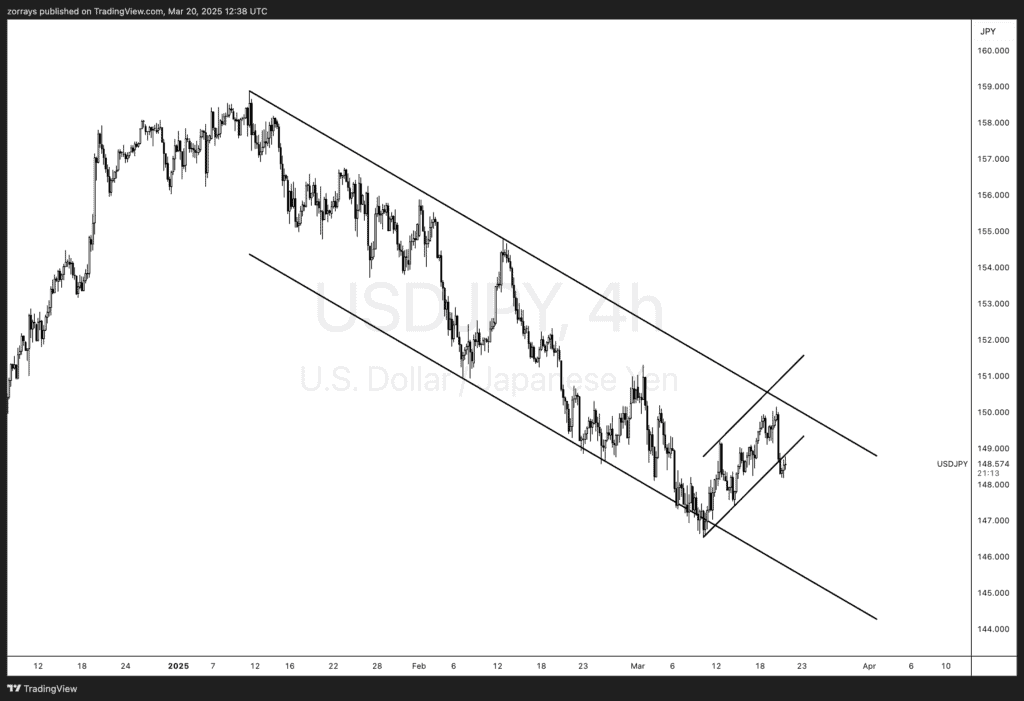

Technical Analysis: USD/JPY

USD/JPY remains within a descending channel, respecting the downtrend. As long as price continues to reject resistance at the upper boundary, another push to the downside could be in play, in line with the broader weakening trend in the U.S. dollar.

Conclusion

Today’s central bank decisions underscore a cautious approach to monetary policy amid a complex global economic landscape. While the Fed, BoE, and BoJ opted for stability, the SNB’s rate cut highlights the varied challenges policymakers face in balancing growth and inflation.

From a technical standpoint:

- The DXY is in a corrective wave, suggesting further downside for the U.S. dollar.

- GBP/USD is breaking out bullishly, hinting at further strength.

- USD/CHF is bouncing off support, possibly forming a double bottom.

- USD/JPY remains in a descending channel, pointing to potential downside continuation.