- Opening Bell

- March 19, 2025

- 2min read

FOMC Decision: Powell’s Tone Holds the Key

Markets expect the Fed to hold rates at 4.25–4.50% today, but the real focus is on what Powell signals next. With inflation easing and the job market softening, traders are looking for clues on when rate cuts might begin.

Rate Hold Priced In, But What’s Next?

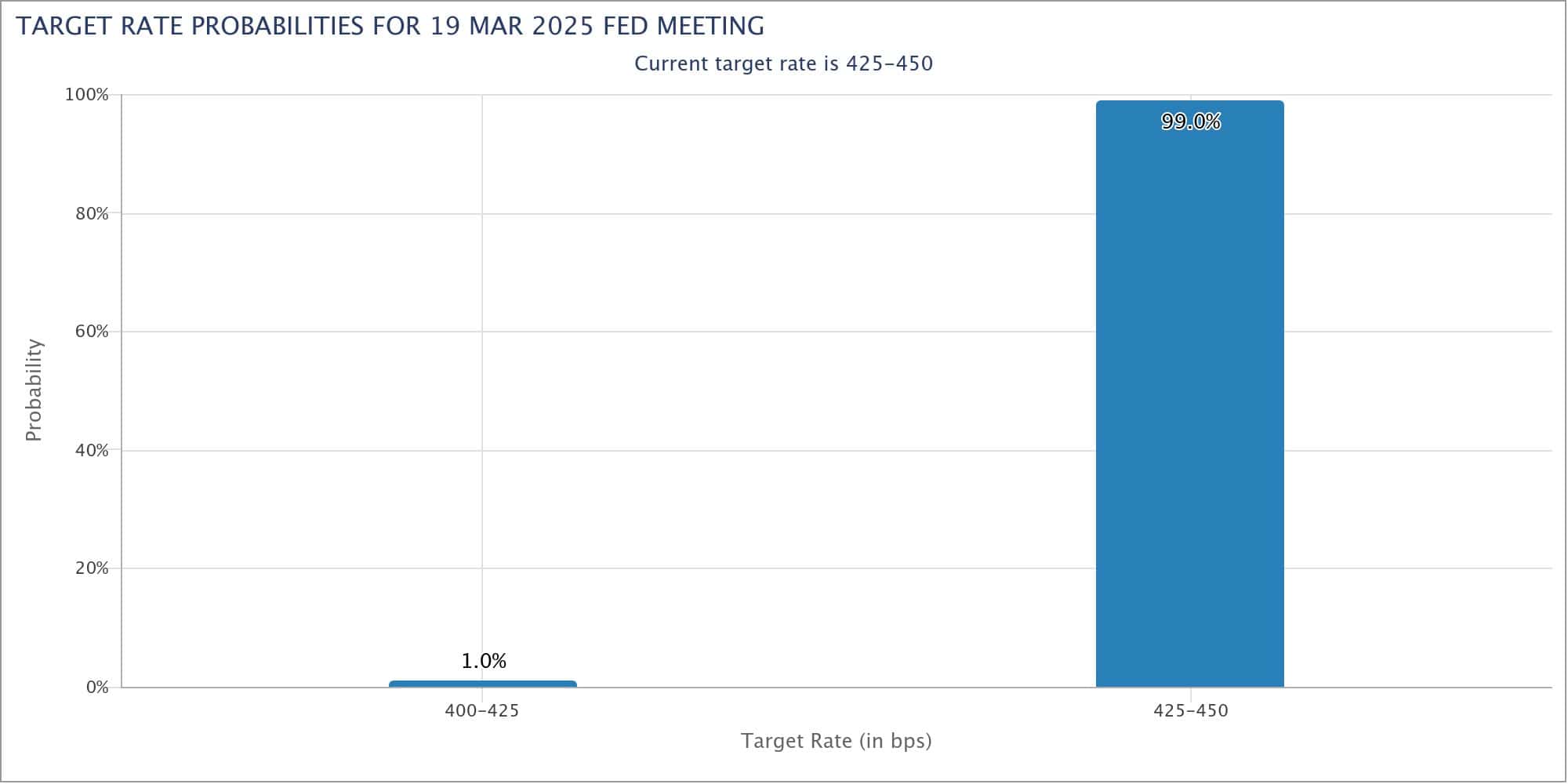

The CME Fedwatch Tool shows a 99% probability of a rate hold, reflecting broad agreement that the Fed will take a wait-and-see approach.

Inflation has cooled, with February CPI at 2.8% YoY and Core PCE at 2.6%, but still sits above the Fed’s 2% target. Meanwhile, unemployment has ticked up to 4.1%, the highest in over a year.

Slower economic growth also adds to the uncertainty—GDP expanded at 2.3% in Q4, down from 3.1% in Q3. The market wants answers: Will Powell acknowledge the slowdown and open the door to rate cuts, or will he push back against early easing expectations?

Market Positioning Ahead of the Meeting

Stocks have been under pressure as traders price in the reality that no immediate cut is coming. The U.S. dollar (DXY) remains firm, and bond yields have stabilised around 4.2% on the 10-year Treasury, signalling that investors are still cautious about when policy will ease.

Powell’s Words Will Move Markets

With a rate hold expected, the press conference is where the real action will be. Powell could go two ways:

- Dovish Tilt – If he highlights economic risks and suggests the Fed is preparing for cuts, expect stocks to rally, bonds to rise, and the dollar to weaken.

- Cautious Stance – If he stresses that inflation remains a concern and that rate cuts are still months away, equities could drop further, bond yields may rise, and the dollar could strengthen.

The Unlikely Scenario: A Surprise Cut

A rate cut today would shock the market, triggering an immediate rally in stocks and a sharp drop in the dollar. However, such a move could also raise concerns that the Fed sees deeper economic trouble ahead, leading to short-term volatility.

Bottom Line: Watch for the Pivot Signal

The Fed will likely hold rates steady, but Powell’s tone will decide whether markets get relief or more selling pressure:

- If he hints at cuts sooner than expected, risk assets could rebound.

- If he stays cautious, expect more downside for equities and a stronger dollar in the short term.

You may also be interested in: