The Dollar Index (DXY) is showing signs of exhaustion after a sharp drop, with technical indicators suggesting a potential short-term bounce. Here’s what’s shaping the greenback’s outlook:

Key Drivers:

- Fed Rate Expectations:

- US short-dated rates have plummeted, with markets pricing the Fed terminal rate around 50 basis points lower in just over a month.

- Federal Reserve Chair Jerome Powell’s speech on Friday indicated no rush to cut rates, cooling expectations for a June rate cut.

- Upcoming US Data:

- Tuesday: JOLTS job openings data—any significant drop could shift market sentiment.

- Wednesday: February CPI data—core inflation expected to remain sticky at 0.3% month-on-month.

- Thursday: Weekly initial jobless claims—watch for any notable increase.

- Global Trade and Geopolitics:

- Focus remains on Ukraine peace talks in Saudi Arabia.

- The US-China trade dispute is intensifying with fresh retaliatory tariffs and potential ‘reciprocal’ measures.

- The market is watching USD/CNH closely as China deals with weak growth and deflation pressures.

Technical Analysis:

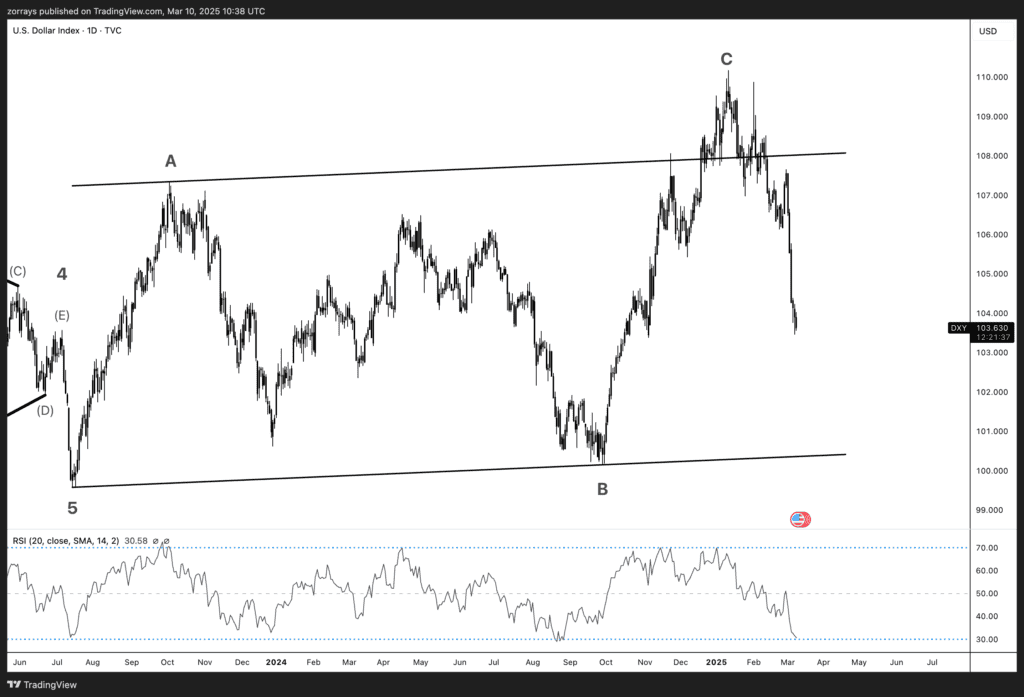

The attached chart highlights key technical insights:

- Price Action: After a steep decline from the 108 region, DXY is now hovering around 103.62. The recent sell-off could lead to a relief rally.

- RSI Insight: The Relative Strength Index (RSI) is nearing the oversold zone, signalling that the dollar might be approaching a short-term exhaustion point. This could trigger a retracement to a more balanced price level (equilibrium) before another potential push down.

- Key Resistance: Selling interest could resurface around 104.30/50, especially if sentiment towards Europe continues to improve.

Bottom Line:

While DXY hasn’t yet reached consolidation, the oversold RSI suggests a short-term rebound might be on the cards. However, further downside risk remains if US data disappoints or if trade tensions escalate. Watch closely for any retracement and key economic data this week!