- Weekly Outlook

- January 10, 2025

- 5min read

GBP/USD Outlook: CPI Data and Bearish Momentum Drive Cable into Critical Levels

As we approach the week of January 13–19, 2025, financial markets and policymakers are poised to analyse critical Consumer Price Index (CPI) data releases from the Eurozone, the United States, and the United Kingdom. These inflation indicators will provide valuable insights into the economic health and monetary policy trajectories of these major economies.

Eurozone CPI Release

The Eurozone’s CPI data for December 2024 is scheduled for release on January 17, 2025. Analysts anticipate a year-over-year inflation rate of 2.4%, a slight increase from November’s 2.2%. Core inflation, which excludes volatile energy and food prices, is expected to remain steady at 2.7%.

This uptick in headline inflation is primarily attributed to rising services costs and persistent wage pressures within the bloc. The European Central Bank (ECB) has been closely monitoring these developments, especially as they influence decisions on interest rate adjustments. Despite the recent inflationary trends, the ECB is projected to continue its accommodative monetary stance, with potential rate cuts aimed at supporting economic growth amid ongoing challenges in key member economies.

United States CPI Release

The United States will publish its December 2024 CPI data on January 15, 2025. Market consensus suggests a modest increase in both monthly and annual inflation figures. The Federal Reserve, having implemented a series of rate cuts throughout 2024, is expected to maintain a cautious approach in 2025, balancing the objectives of sustaining economic growth and achieving its inflation target.

Analysts forecast that the December data will reflect the impact of robust consumer spending during the holiday season, alongside ongoing supply chain adjustments. These factors are likely to contribute to upward price pressures in certain sectors, necessitating vigilant monitoring by the Federal Reserve to ensure inflation remains within acceptable bounds.

United Kingdom CPI Release

The UK’s Office for National Statistics (ONS) is set to release the December 2024 CPI figures on January 15, 2025, at 07:00 GMT. The previous month’s data indicated an annual inflation rate of 2.6%, aligning with market expectations.

For December, economists predict a slight uptick in inflation, driven by increased consumer spending during the festive period and rising energy costs. The Bank of England, which has been gradually reducing interest rates to stimulate economic activity, will closely assess this data to inform its monetary policy decisions moving forward.

Implications for Monetary Policy

The forthcoming CPI releases are pivotal for central banks in these regions as they calibrate their monetary policies to navigate the complex interplay between fostering economic growth and controlling inflation. In the Eurozone, persistent inflation may prompt the ECB to reconsider the pace of its rate cuts, especially in light of economic stagnation in major economies like France and Germany.

In the United States, the Federal Reserve’s policy decisions will be influenced by the inflation trajectory, particularly considering potential fiscal policies under the new administration that could exert additional inflationary pressures. Similarly, the Bank of England faces the challenge of managing inflation amid policy shifts affecting labor costs and national insurance contributions, which could lead to stagflation—a scenario of stagnant growth coupled with persistent inflation.

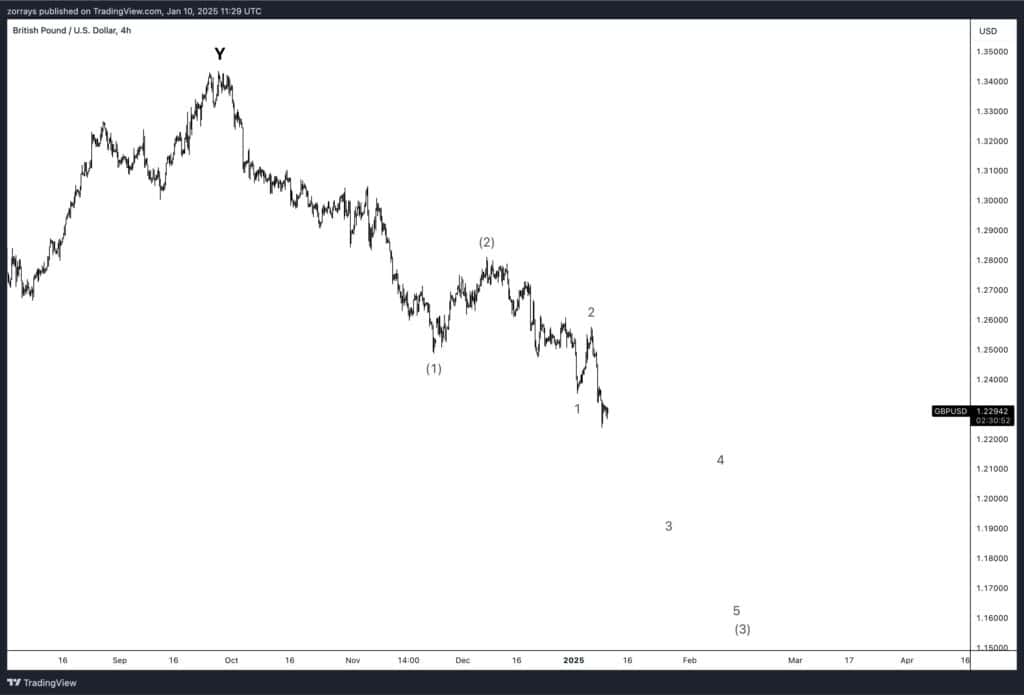

Technical Analysis of GBP/USD (Cable): Bearish Momentum Continues

GBP/USD has been in a clear bearish trend since the October 2024 highs near 1.3500. The pair has steadily declined over the past few months, marked by impulsive price action that aligns with Elliott Wave theory. Currently, the chart suggests that Cable is in Wave 3 of (3) to the downside—a phase characterised by strong momentum and steep declines.

The structure implies further bearish pressure, with the potential for even lower levels in the coming weeks, particularly as macroeconomic factors like CPI data add fuel to the volatility.

Key Observations in the Current Setup

- Wave Analysis:

- Following the October 2024 high, Cable formed a clear Wave (1) to the downside, retraced partially in Wave (2), and has now embarked on the impulsive Wave (3).

- Within Wave (3), we seem to be in the third wave (Wave 3), which is typically the strongest and most volatile part of the Elliott Wave cycle.

- Further declines toward 1.2000, 1.1900, and eventually 1.1700 are plausible, provided this bearish momentum persists.

- Support and Resistance:

- Immediate support lies at 1.2200, which is a psychological level and where minor buying activity could occur.

- On the upside, resistance near 1.2500–1.2600 marks a significant barrier that aligns with previous Wave (2) highs. Bulls would need to reclaim this level to invalidate the bearish wave count.

Impact of Upcoming CPI Data on GBP/USD

The upcoming CPI releases from the UK (January 15) and the US (January 15) will likely heighten volatility, adding to the bearish scenario in GBP/USD.

- UK CPI Influence:

- If the UK CPI comes in stronger than expected, we might see a temporary bounce in GBP/USD as markets anticipate hawkish adjustments from the Bank of England. However, this could be short-lived, given the broader bearish technical structure.

- US CPI Influence:

- A stronger US CPI print would bolster the dollar, reinforcing Cable’s downside as the Federal Reserve remains cautious about inflation pressures.

- If both the UK and US CPI come in hotter than anticipated, the scale of the surprises will determine the pair’s movement. Given the current technical momentum, any rebound in Cable is likely to face significant selling pressure.

Conclusion

The combination of bearish technicals and upcoming fundamental catalysts creates a high-risk environment for GBP/USD in the near term. The current wave structure suggests further downside, particularly if the CPI data supports continued USD strength or reveals unexpected weakness in the UK economy. Traders should monitor the reaction to key levels like 1.2200 and 1.2000 while remaining cautious about the heightened volatility surrounding the CPI releases.