- Opening Bell

- December 12, 2024

- 5 min read

EURUSD and EURCHF: Global Markets in Focus

Yesterday’s Recap: CPI and Bank of Canada Take the Spotlight

Yesterday, the markets digested critical updates from both the U.S. and Canada, with inflation data from the U.S. and a significant rate cut from the Bank of Canada (BoC) setting the tone.

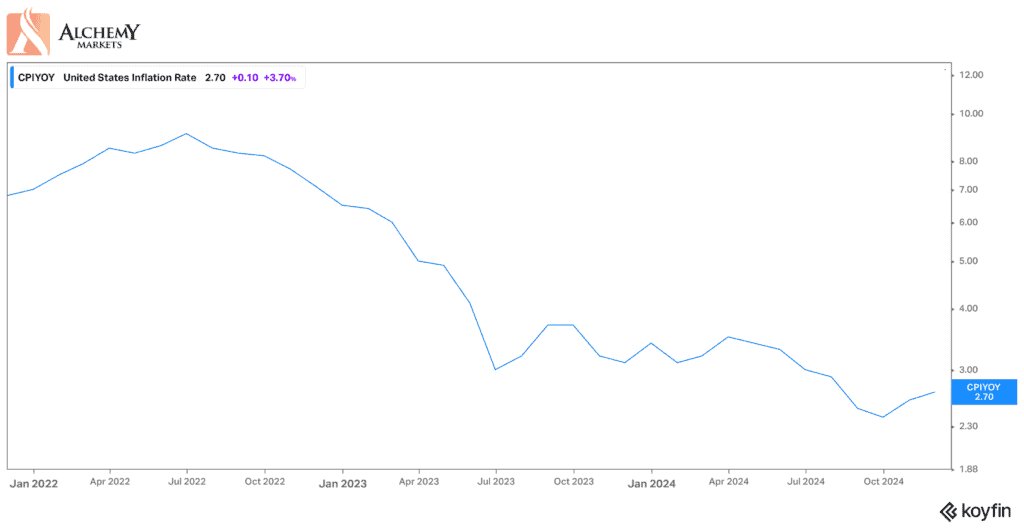

US CPI: Inflation Progress Stalls

Source: Koyfin

The U.S. Core Consumer Price Index (CPI) delivered its fourth consecutive 0.3% month-over-month increase, signaling that progress toward the Federal Reserve’s inflation target has plateaued. While the Fed’s preferred measure of inflation, the Core PCE deflator, has fared slightly better, the broader picture shows inflation remains too high for comfort.

Annual inflation rates have hovered just above 3% for the past six months, while the three-month annualised rate has risen notably since summer. To meet the Fed’s 2% target, monthly inflation would need to ease to around 0.17%. Unfortunately, current levels are simply too hot, even as tomorrow’s Producer Price Index (PPI) is expected to post a more moderate 0.2% increase, keeping hopes alive for a similar print in the Core PCE next week.

The labor market, however, continues to show signs of cooling, which could allow the Fed to proceed with another 25-basis-point rate cut next week. That said, given the lack of substantial progress on inflation, updated Fed projections may signal fewer rate cuts in 2025 compared to prior expectations. Markets now anticipate three rate reductions next year, a step down from the four cuts projected in September.

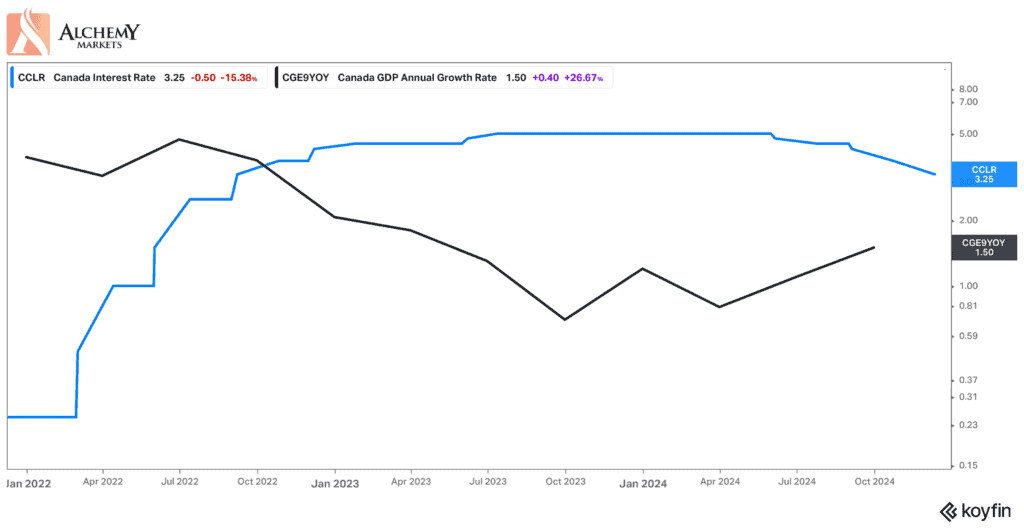

Bank of Canada: Aggressive Easing Continues

The Bank of Canada (BoC) surprised markets with another 50-basis-point rate cut, its second consecutive move of this magnitude. The central bank justified the decision by citing disappointing growth figures, excess supply in the economy, and inflation that is already at target levels. Immigration controls and other temporary factors, such as a sales tax holiday, are expected to influence GDP numbers in 2025 without significantly altering the inflation outlook.

The BoC has now cut its policy rate by 175 basis points since June and signaled that further cuts are likely. However, with the policy rate now at substantially lower levels, officials expect to shift to a more gradual pace of easing. This means smaller 25-basis-point cuts, likely one per quarter, as the rate approaches 2.75% by mid-2025. Despite the rapid easing this year, the BoC remains cautious about maintaining flexibility, especially given potential external shocks, such as tariff risks from the U.S.

Today’s Events: All Eyes on the Swiss National Bank and ECB

Markets are poised for another action-packed day with unexpected developments already emerging from Switzerland and major expectations from the European Central Bank (ECB).

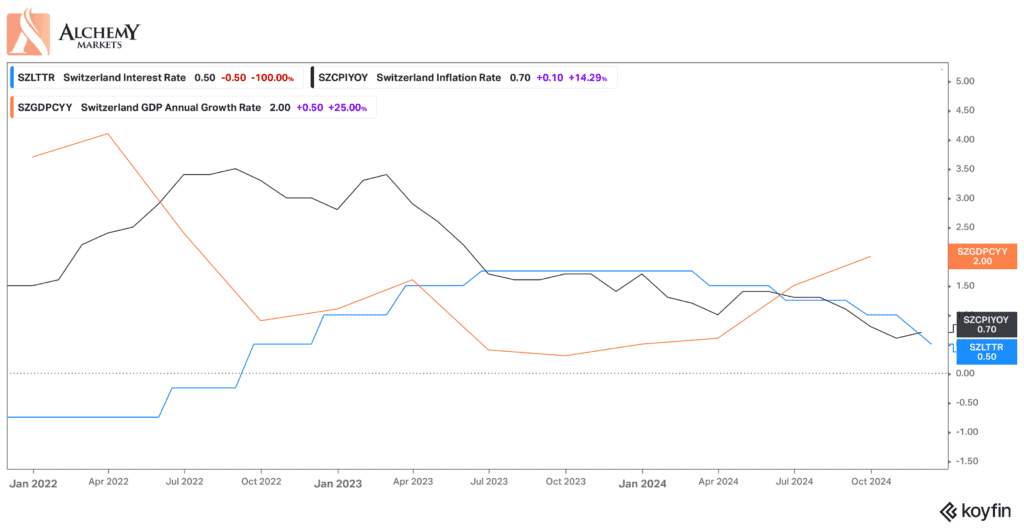

Swiss National Bank: A Surprise 50bp Cut

Source: Koyfin

The Swiss National Bank (SNB) shocked markets with a 50-basis-point rate cut, double the expected 25bp reduction. This brings the SNB’s key rate to 0.5%, down from 1.0%, increasing the likelihood of negative rates in 2025. However, the central bank appears cautious about delving into negative territory unless absolutely necessary.

The SNB is facing mounting challenges. A dovish European Central Bank, expected to slash rates by 125 basis points through 2025, could force the SNB to follow suit to prevent the Swiss franc from appreciating further against the euro. The SNB’s tools, however, are limited. Heavy foreign exchange intervention would risk Switzerland being labeled a currency manipulator by the U.S. Treasury, especially under the backdrop of a new Trump administration.

The decision to front-load rate cuts signals a proactive approach, but with inflation forecasted to remain stable and GDP growth projected at 1–1.5% in 2025, the SNB may refrain from returning to negative rates unless global economic conditions worsen. Markets are now watching closely for how the SNB navigates this delicate balance in the coming months.

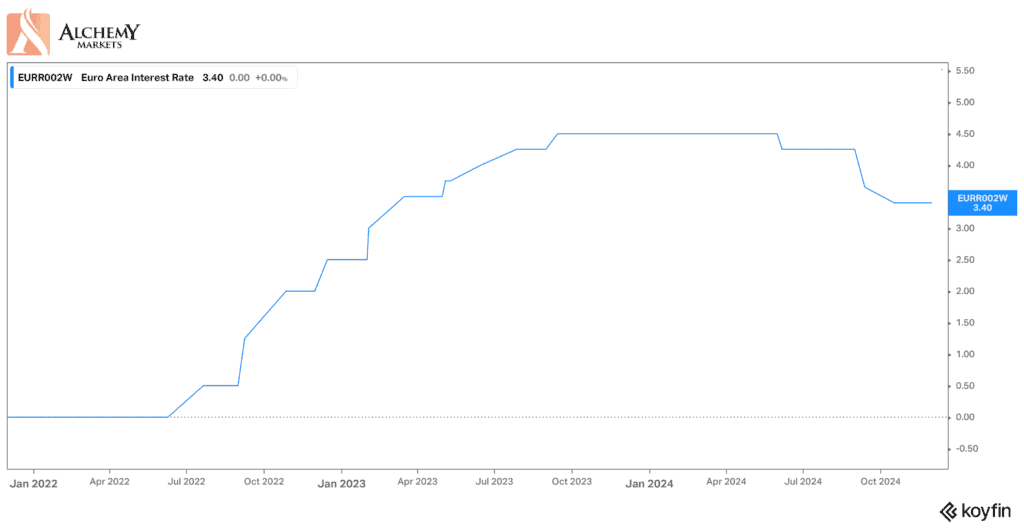

European Central Bank: More Easing Expected

Source: Koyfin

The ECB is widely expected to announce a 25-basis-point rate cut today, though whispers of a potential 50bp move persist. Markets will scrutinize any revisions to the ECB’s growth and inflation forecasts. Current projections place inflation at 2.5%, 2.2%, and 1.9% for 2024, 2025, and 2026, respectively. A downward adjustment to the 2025 figure, closer to the 2% target, could signal an accelerated easing cycle ahead.

Technical Analysis: Key Levels for EUR/CHF and EUR/USD

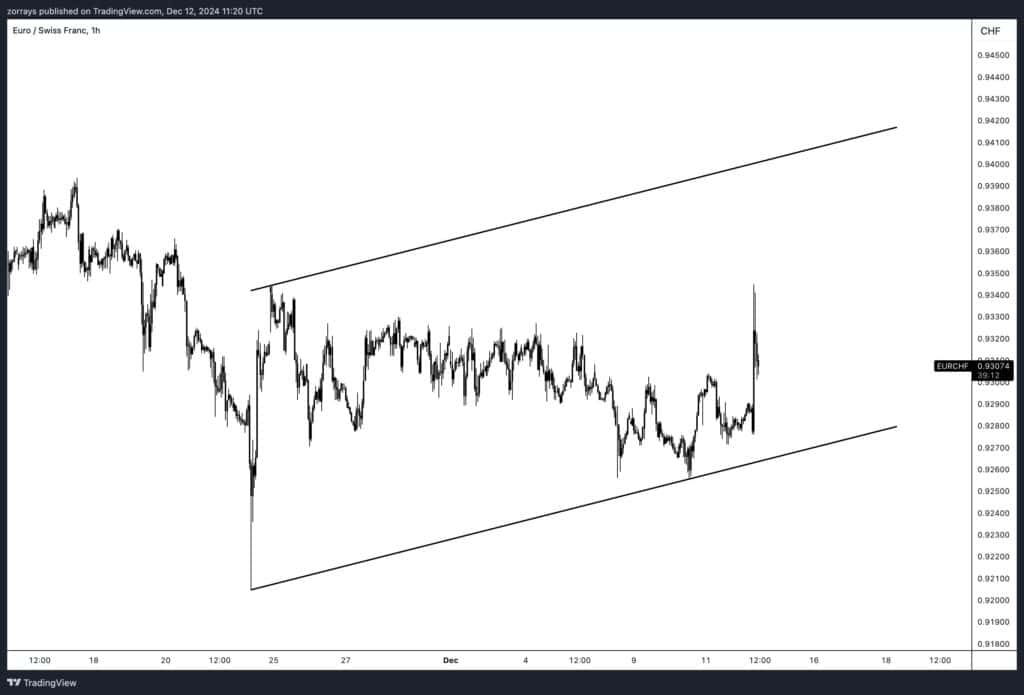

EUR/CHF: Temporary Relief Amid SNB Rate Cut

EUR/CHF bounced higher following the SNB’s surprising 50bp rate cut, but this relief may be short-lived. The ECB’s aggressive rate-cutting cycle expected through 2025 could continue to pressure the euro lower against the Swiss franc. Despite the SNB’s interventions to manage the franc, Switzerland’s trade surplus with the U.S. and geopolitical uncertainties could limit its policy flexibility.

Technically, the EUR/CHF pair remains within a rising channel, providing temporary support. However, the broader outlook suggests a grind toward 0.90 in 2025 as the low-yielding Swiss franc outperforms in an environment of falling global rates.

EUR/USD: Wave 5 to the Downside

The EUR/USD pair continues its bearish trajectory, with technical patterns pointing toward a fifth wave lower in Elliott Wave analysis. Markets are pricing in ECB rates falling into accommodative territory (below 2%) by next summer, leaving little room for the euro to rebound. With headwinds from soft growth forecasts and easing inflation projections, the pair could test the 1.025 level in the coming months.

USD/CHF – Flag Breakout Signals Upside Continuation

USD/CHF has broken above its descending flag pattern following the SNB’s unexpected 50bp rate cut, signalling potential for further upside. Key resistance levels to watch are 0.8920 and 0.9020, with support now around 0.8840 to maintain the bullish trend.