- Chart of the Day

- November 13, 2024

- 3 min read

DOGE Soars 24% After Trump Unveils Government Efficiency Department

DOGE makes it into the U.S. Government! Well… sort of.

Trump announced on Tuesday the formation of the Department of Government Efficiency (DOGE), which is to be led by Elon Musk and Vivek Ramaswamy.

Following an official statement from the President Elect’s Truth Social account, the price of DOGE soared 24% higher than its opening price – eventually closing at $0.3789.

Accounting for just the last two weeks, DOGE/USDT has made a ridiculous gain of more than 195%!

So with that being said, where will DOGE be going next?

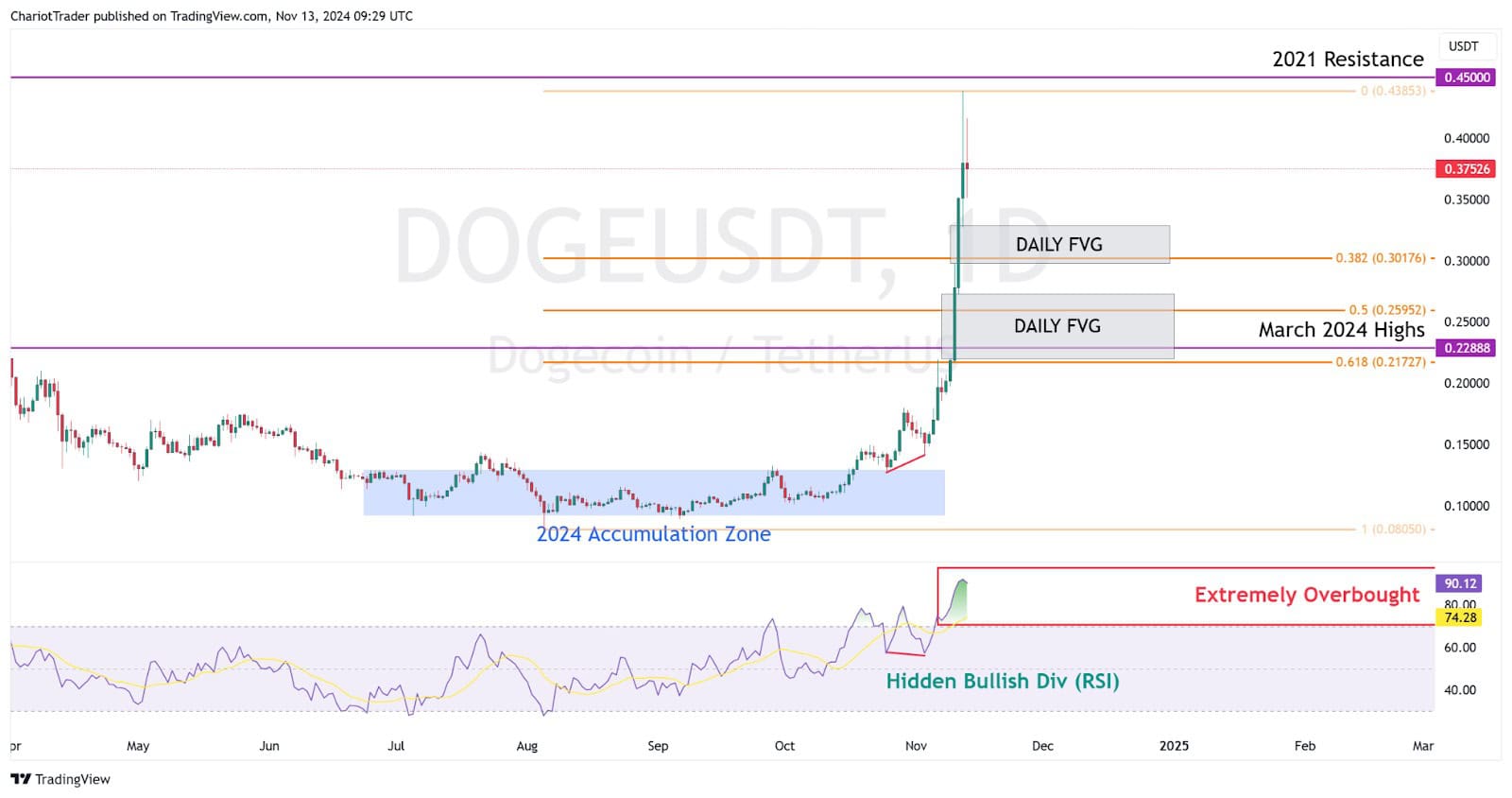

DOGE/USDT Narrowly Misses $0.45, Significant 2021 Level

With such a drastic price increase within the last two weeks, it is difficult to predict what will happen next to DOGE. On one hand, we have an obvious parabolic move to the upside, indicating that price exhaustion and a retracement is just around the corner.

On the other hand, parabolas can often go further than expected; especially when fueled by early shorters… A short gets liquidated, which turns into a buy (pushing prices higher), which then triggers more liquidations etc, etc.

With DOGE/USDT narrowly missing a critical resistance level dating back to 2021, traders must be thinking about whether or not DOGE is going to blitz up higher to take out some overhead liquidity.

DOGE/USDT is Extremely Overbought, But No Divergences Yet

Zooming into the chart, we see that DOGE is currently extremely overbought, according to the Relative Strength Index. Currently, it sits at a value of 90.12, which exceeds the overbought zone by 30 points. However, bullish assets can stay overbought for long periods of time, and so this is by no means and indication to sell/short DOGE.

Rather, it’d be more interesting to watch for the following scenarios:

- DOGE pushes higher towards the 2021 Resistance ($0.45), forming a Bearish Divergence.

- DOGE falls back towards 0.382 Fibonacci Retracement ($0.3017) with Fair Value Gap Support.

- DOGE falls towards the 0.50 and 0.618 Fibonacci Retracement ($0.2595 and $0.21727), which both share the same Fair Value Gap Support.

With such a parabolic move within the last two weeks, it would not be surprising to see DOGE retrace and cool off a bit. However, traders are advised to be cautious as no clear bearish indications are in play – at least on the Daily timeframe.

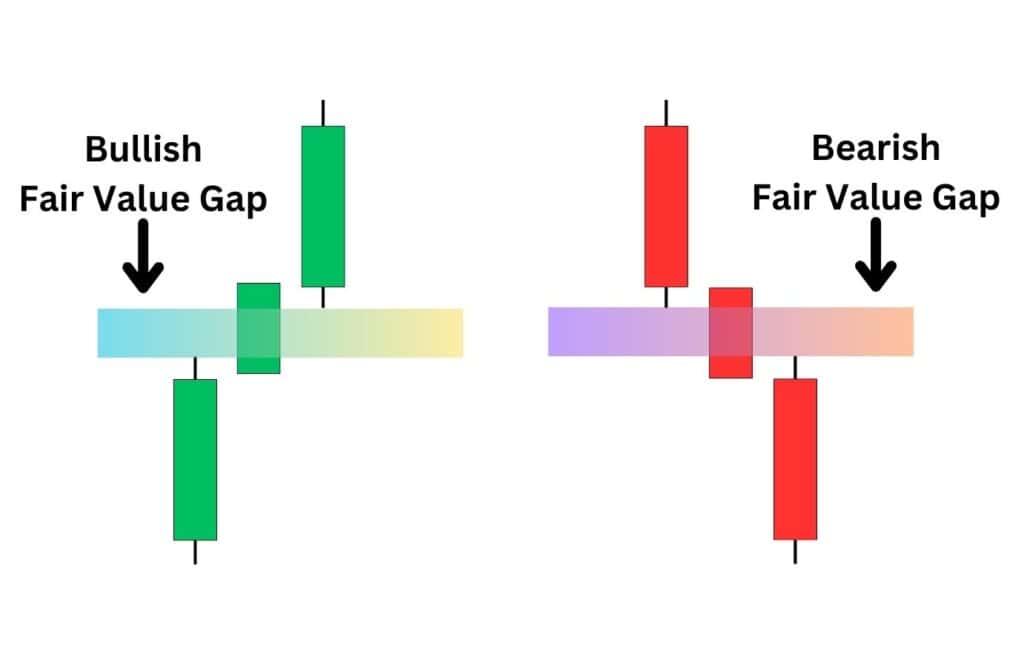

| What are Fair Value Gaps? A Fair Value Gap (FVG) is an “Air pocket” between three candles, where there have been no wicks present. It represents an area which the price has cut straight through – making it effectively an untested price zone. They work similarly to market gaps, in that price typically will return to the gap and test the market’s intentions. If the price rejects from a Fair Value Gap, it signifies that buyers or sellers are interested in defending the price from going any higher or lower. |

You may also be interested in: