- Chart of the Day

- August 28, 2024

- 2 min read

Gold Losing Its Shine? 4H, Daily Chart Hints at Exhaustion

After consistently forming all-time highs after all-time highs, Gold has begun to show signs of slowing momentum. This is partly because the markets are currently in indecision mode; as they are waiting for the Nvidia Earnings Report announcement today for further insights as to whether to take a Risk-On or Risk-Off approach to investing/trading.

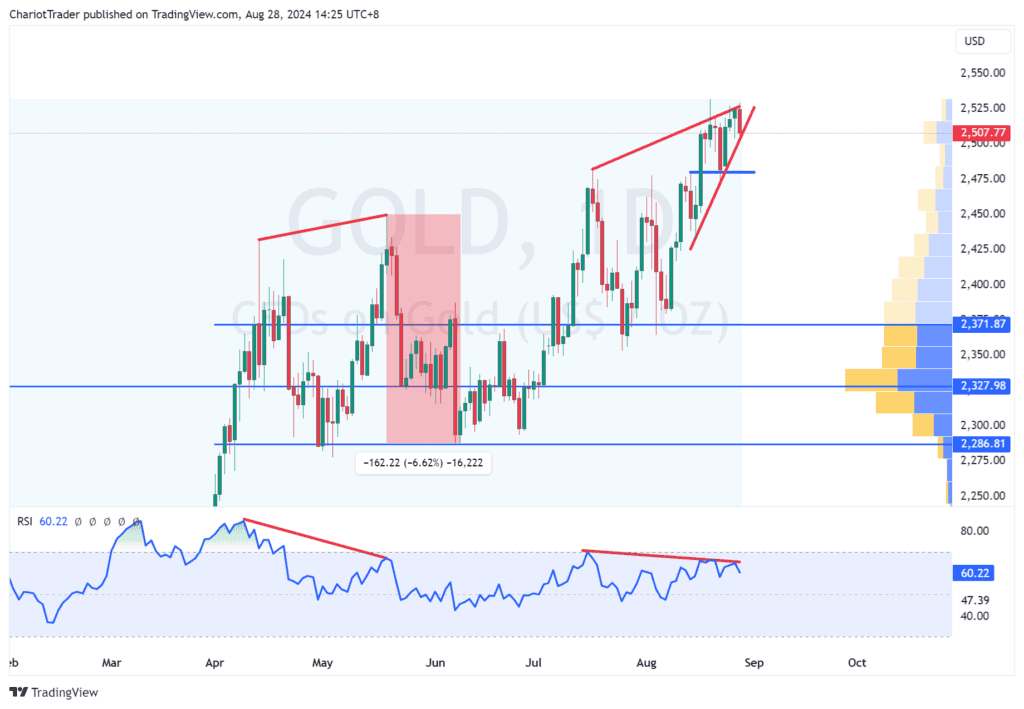

On the daily timeframe, Gold has created bearish RSI divergence with a tightening range – potentially signalling a rising wedge formation.

The last time a bearish divergence occurred on Gold, a downside move of -6.62%, or -1,622 pips, soon followed after. Will this time be different?

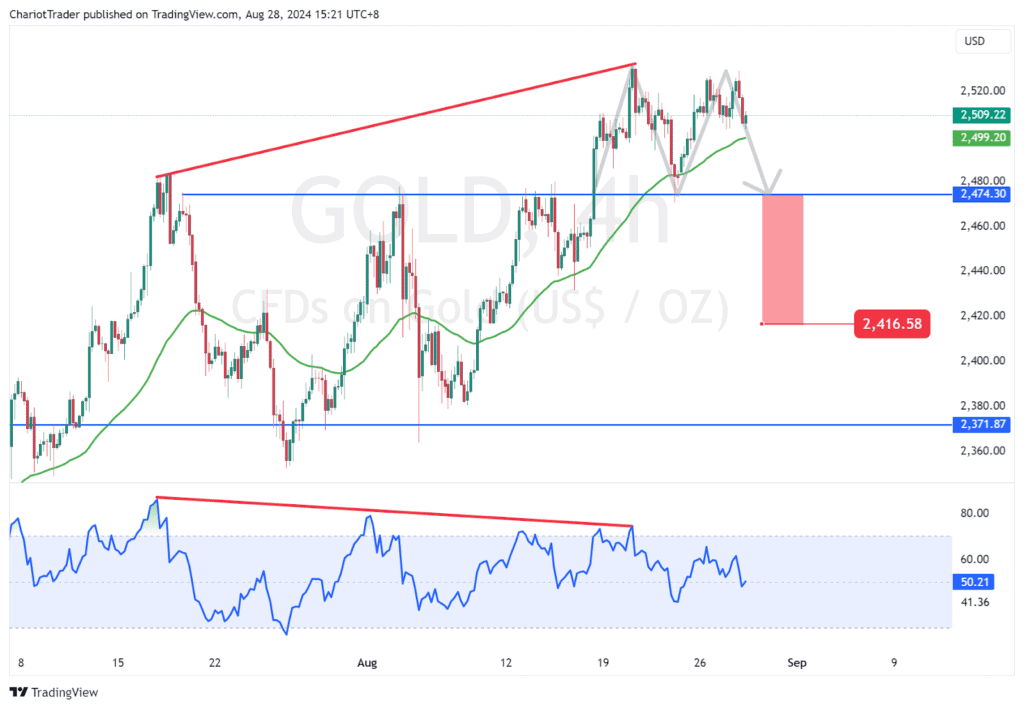

Potential Double Top on 4H Timeframe with Bearish RSI Divergence

Zooming into the 4H chart, we can see several factors that may bring a halt to Gold’s bullish luster.

A bearish RSI divergence has formed from between Mid-July to Mid-August, where the RSI formed a lower high as the price forms a higher high at approx. $2,531.

After forming the ATH (All-time High) at $2,531, Gold experienced a brief dip towards to the 4H 50-period exponential moving average (green line), where it found strong support. This drove prices back towards the ATH, where it faced two additional rejections before now consolidating at a rising trendline.

This price action hints at a possible formation of a double top, providing traders with a clear short trade opportunity if the price is able to break the neckline at $2,474.30.

The measured move target for this Double Top Pattern is $2,416.58, marking a 578 pips move. If the price moves beyond the measured move target, there are few extended support levels to watch.

| SUPPORT LEVELS TO WATCH ON GOLD |

| Double Top Neckline – Watch for a Short Opportunity: $2,474.30 • Measured Move Target: Approx. $2,416.58 • Value Area High: Approx. $2,371.87 • Point of Control: Approx. $2,327.98 • Significant Previous Low: Approx. $2,286.81 |

To see these extended levels clearly, refer to the daily timeframe chart posted above.

You may also be interested in:

GBP/USD Elliott Wave: Cable’s Climb is Pound-ing the Dollar