- Opening Bell

- July 19, 2024

- 3min read

Market Analysis: Crypto Retracement Likely as Bitcoin Gets Rejected

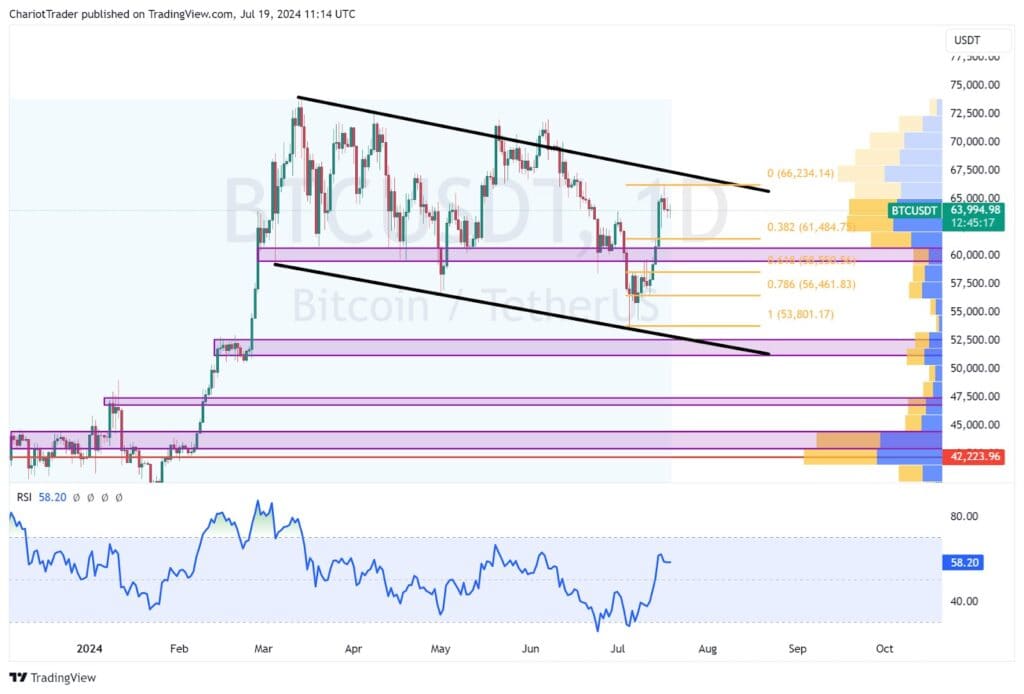

So in my previous analysis, I personally thought Bitcoin would fall towards $52,000 as there was a massive air pocket in volume from $56K to $52K.

However, that did not happen as Bitcoin was supported from a lower trendline of a descending parallel channel. As a result, the crypto market as a whole has been pumping for the past 2 weeks – with Bitcoin managing to climb back up to $66,000.

Bitcoin Weekly Chart

Unfortunately, as we head towards a weekly close, the Bitcoin price appears to be rejecting from a weekly 618 retracement level. This comes alongside a red weekly close on the Nasdaq and S&P 500.

As Bitcoin is heavily correlated with the performance of the Nasdaq and S&P 500, we should watch how the week closes across these three assets. The performance of Bitcoin will affect how the general crypto space performs as well, therefore investors and traders must keep an eye out for possible corrections coming in the next week.

The levels to watch in case of a major drop would be at $60,500 to $60,100, where Bitcoin has previously bounced in May of 2024. Alternatively, if Bitcoin manages to crash below $60,000, the 618 retracement level from the recent low to recent highs would sit at $58,550.

Bitcoin Daily Chart

Nasdaq Weekly Chart

The Nasdaq weekly chart is possibly closing an evening star pattern on the weekly timeframe, which is a sign for a bearish reversal. Fortunately there is a clear level to watch in case of a major drop, which would be at the 618 retracement level of $18,410.46.

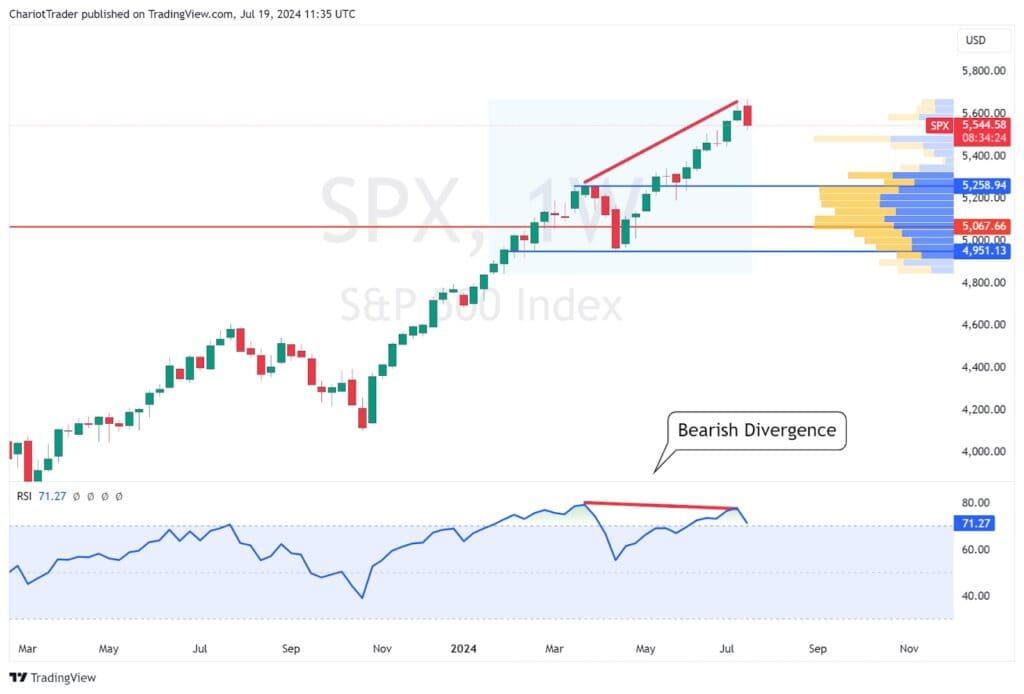

S&P 500 Weekly Chart

The S&P 500 has begun to show cracks in its weekly rise. The index has formed a bearish divergence last week, and is threatening to close a bearish engulfing candlestick this week.

Depending on how this week closes, the markets will either continue to move up in the next week, or begin a correction. In case of a drop, the major level to watch would be around $5,300 – where there is massive volume support underneath. The point of control sits at $5,067, and the pivot low would come in at $4,951.13. All these levels are critical in indicating the market’s health, and should serve as powerful support levels for the stock market.

Again, if the S&P 500 performs well, the Bitcoin price and crypto market by extension should as well.

Overview for the Crypto Market

As correlated markets with Bitcoin appear to be stifling, the crypto market space may be in for some correction, or sideways consolidation in the next week. Although on July 23 next week, eight ETH ETFs may hit the shelves and begin trading, we have to consider the bearish technical signs and proceed cautiously.

You may also be interested in: