- Weekly Outlook

- July 12, 2024

- 7 min read

CPI Frenzy

This past week, the Reserve Bank of New Zealand (RBNZ) kept its interest rates unchanged, maintaining a hawkish stance to tackle inflation effectively. Meanwhile, the Federal Reserve exhibited a dovish tone during Chair Jerome Powell’s testimony, acknowledging that inflation is moderating. This dovishness, coupled with a softer-than-expected CPI release, led to a decline in the U.S. dollar and a subsequent rally in the stock markets. As we look ahead, the coming week is packed with significant CPI data releases from several countries, providing crucial insights into their inflation and economic health. Here’s a detailed look at the upcoming events and their potential market impacts.

Switzerland: Producer Price Index (PPI) (15th July)

Source: Trading Economics

Event: Producer Price Index (PPI) for June 2024

Insight: The PPI measures the average change over time in the selling prices received by domestic producers for their output, reflecting inflationary pressures at the wholesale level. Recent data indicated a 0.3% decline in May 2024, continuing a downward trend that could signal reduced cost pressures in the production process.

What’s Expected: For June, market participants will be looking to see if this deflationary trend continues. Analysts predict a modest decrease, influenced by global supply chain adjustments and lower raw material costs.

Market Impact: A lower-than-expected PPI could indicate reduced inflationary pressures, potentially leading to a softer Swiss franc (CHF) as the Swiss National Bank (SNB) may continue to loosen monetary policy.. Conversely, a higher PPI could strengthen the CHF as it may signal higher future inflation, prompting more hawkish monetary policy.

U.S.: Fed Chair Powell Speaks (15th July)

Event: Speech by Federal Reserve Chair Jerome Powell

Insight: Powell’s speech will be closely watched for any indications of future monetary policy, especially regarding interest rate adjustments and economic outlook. His recent testimony emphasized the Fed’s cautious stance on rate hikes, acknowledging the softer CPI data.

What’s Expected: Investors anticipate Powell to reiterate a cautious approach, balancing between controlling inflation and supporting economic growth. Any unexpected hawkish or dovish tones could sway market sentiment.

Source: TradingView

Market Impact: Hawkish comments indicating higher future interest rates could strengthen the USD, impacting equity markets negatively due to higher borrowing costs. Dovish comments might weaken the USD and provide a boost to stock markets due to expectations of continued lower rates. Given the recent dovish tone, markets may expect continuity, which could support a further stock market rally and maintain pressure on the USD.

U.S.: Core Retail Sales (MoM) (16th July)

Source: Census.gov

Event: Core Retail Sales for June 2024

Insight: This data measures the change in the total value of sales at the retail level, excluding automobiles, and is a key indicator of consumer spending. May 2024 saw a slight decline of 0.1%, suggesting a cautious consumer environment amid economic uncertainties.

What’s Expected: Analysts are forecasting a slight rebound in June, driven by seasonal factors and potential increases in consumer confidence and disposable income.

Market Impact: Better-than-expected retail sales data could boost confidence in the economic recovery, strengthening the USD and potentially leading to gains in stock markets. Weak data might have the opposite effect, weakening the USD and pressuring stock markets. Retail sales data is crucial for gauging consumer health, which is a significant driver of the U.S. economy.

Canada: Core CPI (MoM) (16th July)

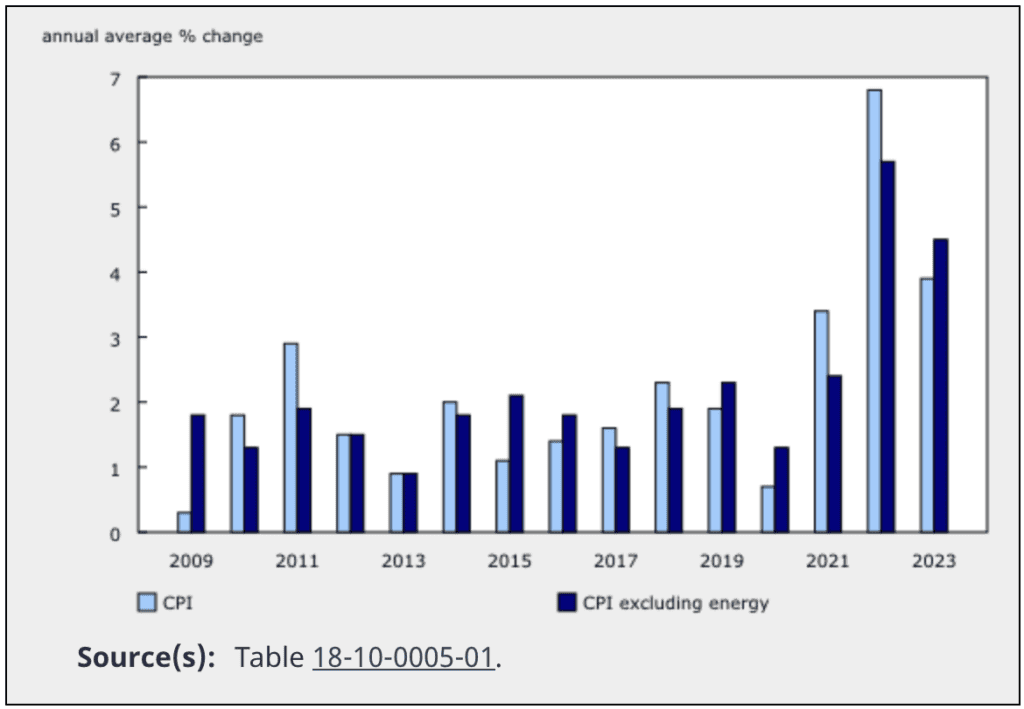

Source: Statcan

Event: Core Consumer Price Index for June 2024

Insight: The Core CPI excludes volatile items such as food and energy and is a key measure of underlying inflation trends. May 2024 saw a modest increase of 0.17%, reflecting persistent inflationary pressures in the Canadian economy.

What’s Expected: For June, markets expect a continuation of this moderate inflation trend, possibly influenced by wage growth and stable housing costs.

Market Impact: Higher-than-expected CPI could lead to a stronger CAD as it might prompt the Bank of Canada (BoC) to raise interest rates. Conversely, lower-than-expected inflation could weaken the CAD and reduce the likelihood of near-term rate hikes. Core inflation data is critical as it directly influences the BoC’s monetary policy decisions.

New Zealand: CPI (QoQ) (Q2) (16th July)

Event: Consumer Price Index for Q2 2024

Insight: This data measures the change in the price of goods and services from the perspective of the consumer. Q1 2024 saw a 0.6% increase, indicating ongoing inflationary pressures despite the RBNZ’s efforts to control them.

What’s Expected: Analysts forecast a similar increase for Q2, reflecting stable but persistent inflation pressures. Any deviations could signal changes in consumer demand or supply-side issues.

Market Impact: A higher-than-expected CPI could strengthen the NZD as it increases the likelihood of the Reserve Bank of New Zealand raising interest rates. A lower CPI could weaken the NZD, suggesting more accommodative monetary policy. The inflation data will be pivotal in shaping market expectations for future RBNZ actions.

Eurozone: CPI (YoY) (June) (17th July)

Source: Trading Economics

Event: Consumer Price Index for June 2024

Insight: The CPI measures the annual change in the price of goods and services, providing insights into inflation. May 2024 saw an inflation rate of 2.6%, driven by higher service costs and a rebound in energy prices.

What’s Expected: Markets anticipate a slight increase or stabilization in June, influenced by energy price trends and core inflation components.

Market Impact: Higher inflation could lead to a stronger EUR as the European Central Bank might be prompted to raise interest rates. Lower inflation could weaken the EUR, indicating more accommodative monetary policy. The data will be crucial for assessing the ECB’s future policy trajectory.

UK: CPI (YoY) (June) (17th July)

Source: ONS

Event: Consumer Price Index for June 2024

Insight: The CPI measures the annual change in the price of goods and services in the UK. For May 2024, the CPI rose by 2.0%, down from 2.3% in April, marking a significant reduction from the peak of 11.1% in October 2022.

What’s Expected: Analysts expect a similar rate for June, with potential slight fluctuations based on recent economic activities and consumer trends.

Market Impact: Higher-than-expected CPI could strengthen the GBP as it may prompt the Bank of England to consider tightening monetary policy. Lower CPI could weaken the GBP, suggesting a more dovish stance from the BoE. This data is critical for understanding the UK’s inflation trajectory and monetary policy outlook.

Conclusion

Next week’s economic events will provide critical insights into inflationary trends and consumer spending across major economies. These data points will significantly impact central bank policies and market expectations, influencing both the FX and stock markets. Investors should closely monitor these events to adjust their strategies accordingly.

Technical Analysis

Bitcoin (BTC/USD)

Source: TradingView

Bitcoin in a Descending Channel

Bitcoin (BTC) is currently exhibiting a zigzag pattern within a descending channel. As seen in the chart, BTC has recently bounced off the lower bound of this channel, marked as point C, indicating a potential support level around $56,000.

Market Sentiment and Potential Movements

The recent bounce suggests that Bitcoin is respecting the descending channel’s boundaries, providing a short-term bullish signal. Given the market’s recent shift towards a more risk-on sentiment, there is potential for BTC to climb towards the upper bound of the channel, near $71,000. This potential move would represent a significant upside from the current levels.

Risk Considerations

Despite the optimistic outlook, traders should remain cautious. Bitcoin’s proximity to the lower bound of the channel means that any breach below this support could quickly turn the sentiment bearish, signaling further declines. Monitoring key support and resistance levels will be crucial in the coming days to determine Bitcoin’s next direction.

Conclusion

Bitcoin’s current position within the descending channel provides a pivotal point for traders. The recent bounce off the lower bound is a positive sign, but vigilance is required to confirm if the trend will indeed turn bullish. Keep an eye on the broader market sentiment and key technical levels to navigate the upcoming movements in Bitcoin.

Disclaimer: For educational purposes only. Trading comes with substantial risk, leading to possible loss of your capital. Traders are advised to do their own due diligence before investing.