- Elliott Wave

- January 23, 2026

- 2 min read

USD/CAD Elliott Wave: Loonie on the Loose

Executive Summary

- USD/CAD appears to be in the beginning stages of a third wave decline at multiple degrees of trend.

- Trend bias is bearish, with wave (iii) targets near 1.3438 and possibly 1.3143.

- A move above 1.3928 would invalidate count as listed below and require reassessment.

During the week of January 26-30, both the Bank of Canada and FOMC are scheduled to release their latest wisdom on their interest rate policy. The Elliott wave patterns we are following suggest that USD/CAD (nicknamed ‘Loonie’) continues its downtrend.

Current Elliott Wave Analysis

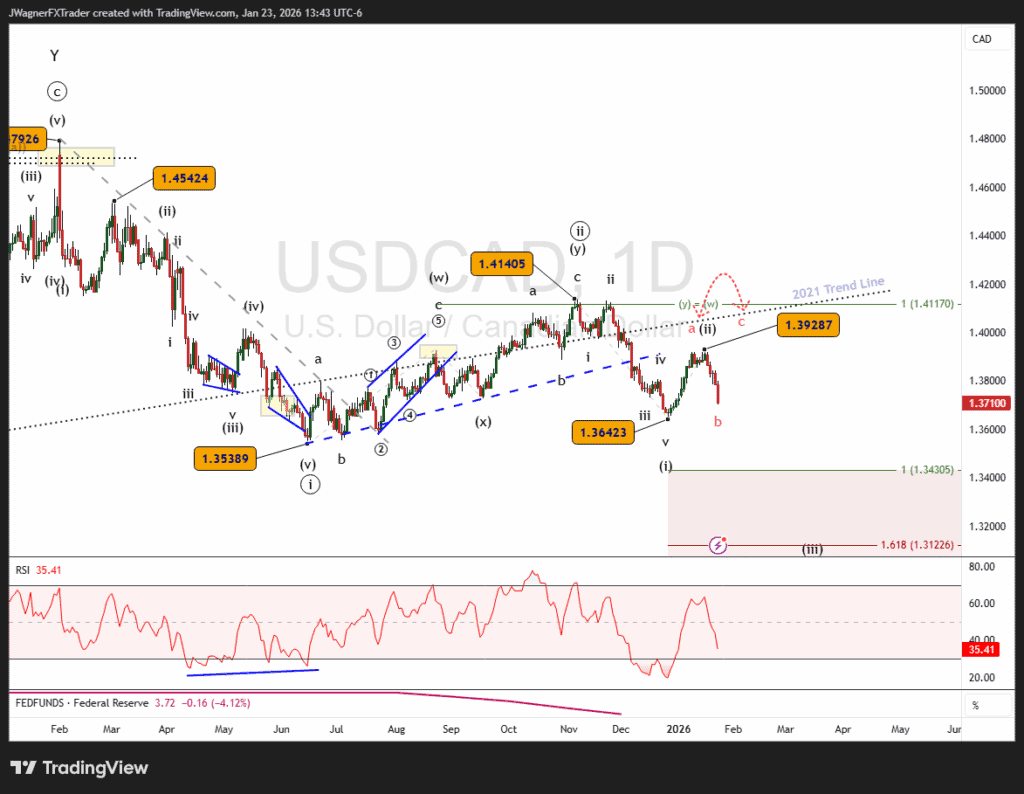

The daily price chart shows USDCAD forming an Elliott wave impulsive decline, beginning from the 1.4793 February 2025 swing high. That impulse pattern completed at the June 2025 low of 1.3538 making up a larger wave ((i)).

Wave ((ii)) rallied from June 2025 to November 2025, topping at 1.4140. The subdivisions since November suggest the pair has completed another bearish impulsive pattern, wave (i) of ((iii)).

The rally to 1.3928 is wave (ii) of ((iii)). The decline for the past week is the beginning stages of wave (iii) of ((iii)). Third waves tend to be the strongest wave of the Elliott wave sequence. This would be the third wave at multiple degrees of trend, and therefore, a potentially powerful downtrend.

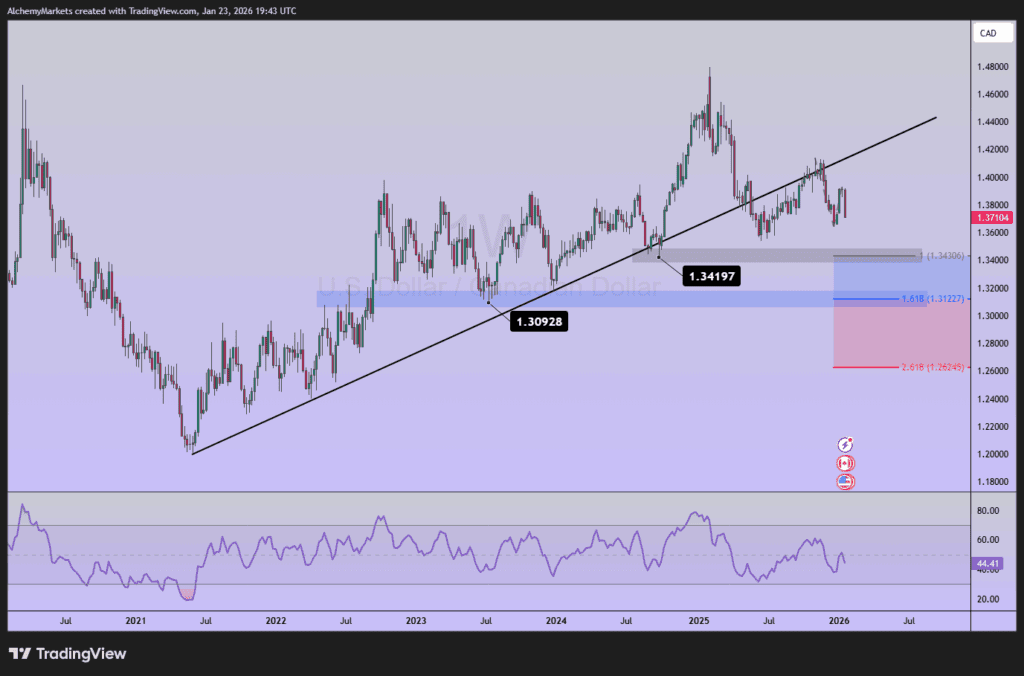

Using the Fibonacci extension tool, wave (iii) has near-term downside targets of 1.3438 and 1.3143.

These horizontal price levels also match up near previous swing low support of 1.3419 in September 2024 and 1.3092 formed in July 2023.

Once wave (iii) is in place, then a small rally for wave (iv) would help relieve the oversold conditions that wave (iii) would produce.

Bear in mind that once wave (iii) finalizes, the downtrend is not over. This week’s decline is the beginning stage of a larger degree wave ((iii)) that may push down to 1.20-1.24 over the coming months/years.

The key level for this bearish forecast is the January high of 1.3928.

Bottom Line

USDCAD remains positioned for continued downside as a five-wave decline unfolds from the 1.4140 high. Unless price breaks above 1.3928, rallies remain corrective, with 1.31 → 1.34 as the high-probability termination zone for wave (iii).