- Chart of the Day

- December 22, 2025

- 3 min read

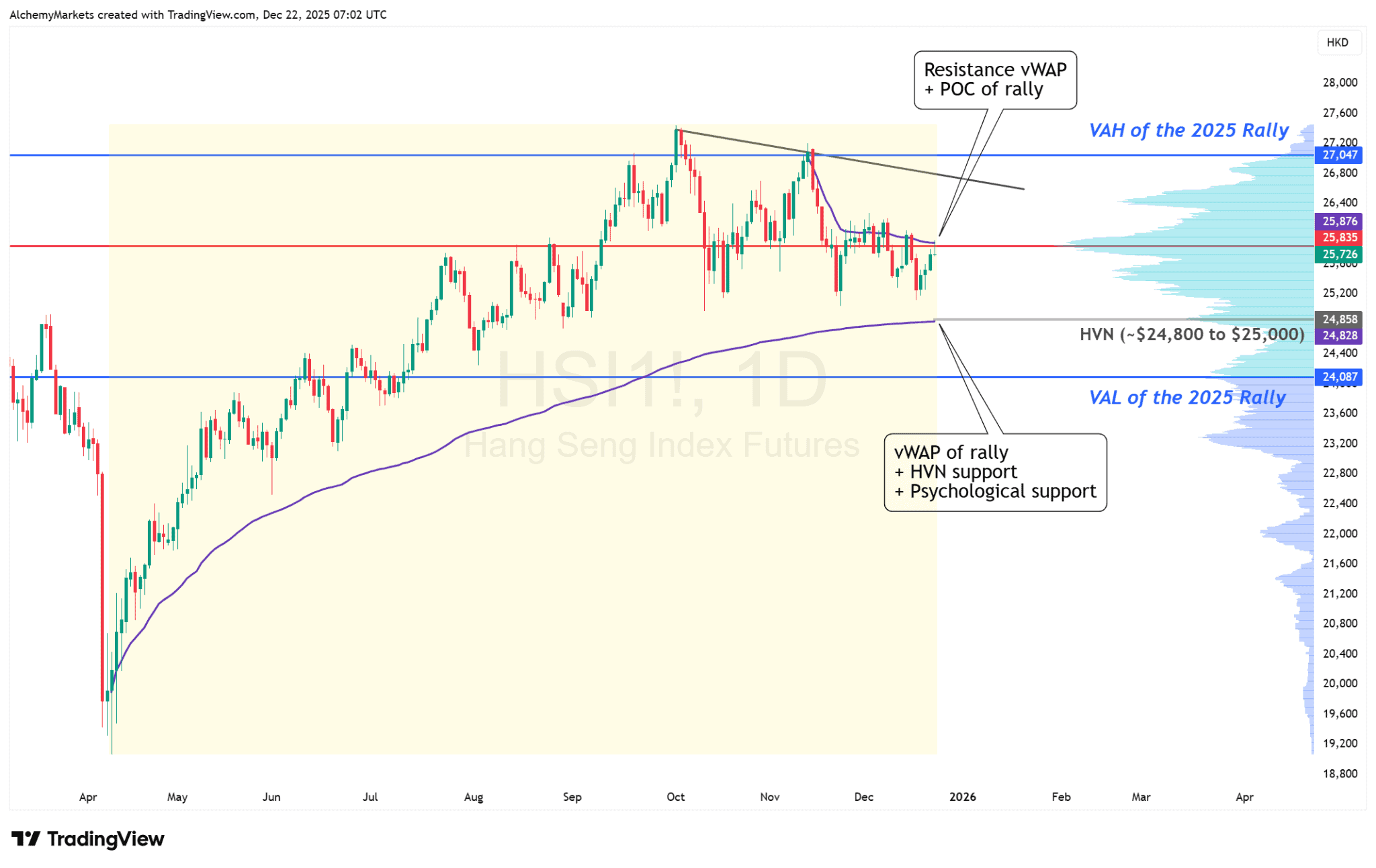

Clear Resistance and Support to Watch on Hang Seng Index

The Hang Seng Index is coiling. With price trapped between 25,800 resistance and 25,000 support, a massive move is brewing for the HSI.

Key Levels to Watch:

- Bullish: A daily close above 25,800 opens a fast rally to 27,047.

- Bearish: Losing the 24,800 floor signals a slide toward 24,087.

As global liquidity shifts, will the Hang Seng see a year-end “Santa Rally” or a January dip? Watch the 25,000 level; this structural pivot will determine the trend for early 2026.

Key Resistance Zones (Where rallies are capped)

Note: We used Volume Profile and anchored vWAPs to highlight price zones where the most trading has occurred since April 2025. These high-volume areas often act as key support or resistance levels.

25,800 – 25,900

- vWAP + POC of the decline since November

- Every push into this zone has stalled

- Sellers are clearly active here

If price accepts above this zone (daily close), upside opens quickly toward value expansion.

27,047 – VAH of the 2025 Rally

- Value Area High of the entire 2025 advance

- This is the real upside target, Hang Seng needs to break this level to keep expanding

Key Support Zones (Where buyers must defend)

24,800 – 25,000

- High Volume Node

- VWAP of the rally

- Psychological round number

- This is the structural bull support

As long as price holds here, this remains a bullish consolidation phase.

24,087 – VAL of the 2025 Rally

- If HVN fails, this becomes the next downside magnet

- Acceptance below here signals severe weakness in the rally

What the Structure Is Saying

- Lower highs have been pressing into vWAP resistance

- Higher lows still hold value support

- That equals coiling energy, not weakness

However, this resolves one of two ways:

Bullish Resolution

- Break and acceptance above 25,800

- Fast rotation toward 27,000 VAH

- Typical year-end liquidity behaviour supports this path

Bearish Resolution

- Failure + acceptance below 24,800

- Rotation toward VAL ~24,100

- This would likely happen early January, not late December

The Major Caveat

The vWAP of the entire rally remains untested. Large psychological levels like 25,000 HKD have a strong tendency to be revisited.

If price dips into this zone but quickly reclaims it, a fast recovery and squeeze higher would be structurally consistent with this chart.

China-Specific Fundamental Backdrop

China policy remains supportive but measured. Property stress has eased without turning into a growth engine, while global liquidity conditions quietly favour Asian equities. With sentiment still cautious, fundamentals are neutral-to-supportive and leave room for upside if price confirms.

Bottom line:

Fundamentals won’t push HSI higher on their own, but they won’t block a breakout either. Price confirmation is still the trigger.