- Elliott Wave

- November 20, 2025

- 2 min read

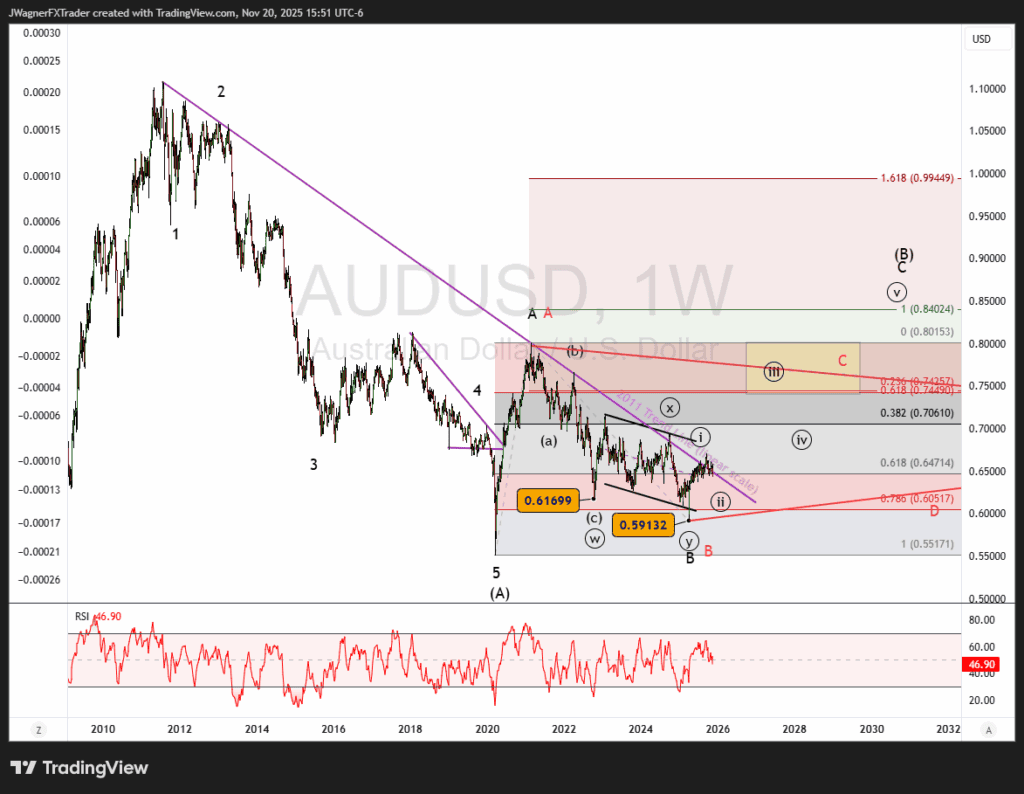

AUD/USD Elliott Wave: Fighting a 14-Year Trend Line

Executive Summary

- Trend Bias: The AUD/USD pair is rallying within a larger uptrend that began in 2020.

- Initial Rally Target: Near 0.80 where wave C of (B) would match the wave A of (B) high.

- Resistance to Watch: A trendline from 2011 is trying to hold Aussie down.

A resistance trend line in place since 2011 has been trying to hold AUDUSD down. We suspect it will break soon and Aussie may propel higher towards 80 cents.

Current Elliott Wave Analysis

It appears that AUD/USD is correcting lower in Elliott wave ((ii)) of C of (B). This 2nd wave decline is forecasted to end above .5913. Then, wave ((iii)) would propel the exchange rate higher, retesting .80 in the coming months.

Bigger picture, the low in 2025 appears to be the end of wave B of (B). The rally since April 2025 is the first portion of wave C of (B).

There are a couple of different structures we can anticipate for wave C of (B). If “C” is a motive wave, then prices likely carry above .80 over time.

If “C” is a zigzag (red labels), then that signals a larger symmetrical triangle may be unfolding. This would likely hold AUDUSD below .80, then lead to waves D and E of the bearish triangle. The triangle may take several years to unfold so it would call for a large sideways price range.

Bottom Line

If AUD/USD is successful in punching above the 14-year resistance trend line, then we anticipate an acceleration of the rally in a third wave at multiple degrees of trend.

The alternative count suggests AUDUSD may still rally, but fall shy of 80 cents.

We anticipate declines would be mild and rallies to grow stronger. If the Aussie prints below .59, then we’ll reconsider the wave count.