- Chart of the Day

- November 12, 2025

- 2 min read

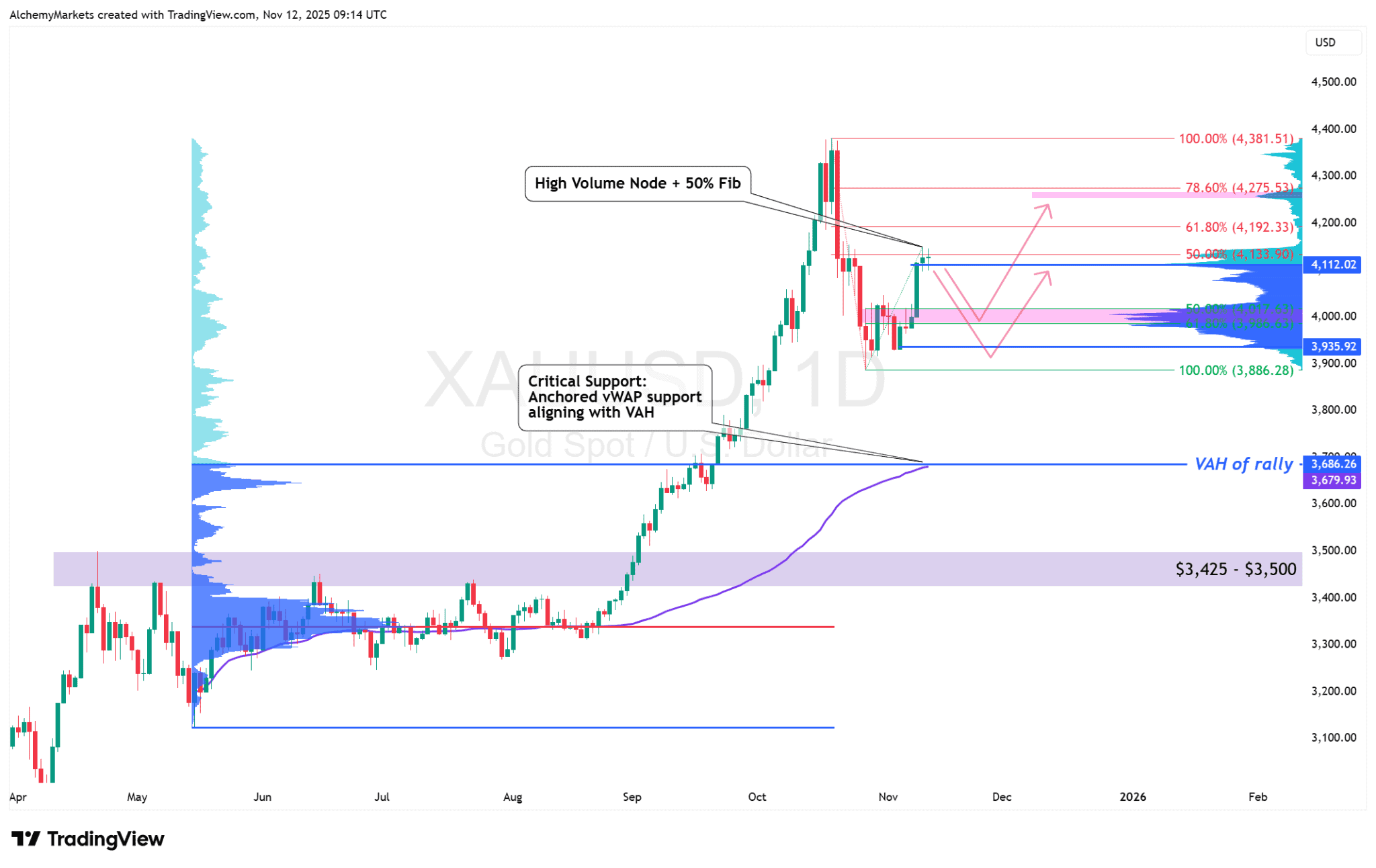

Gold’s Bounce Hits 50% Fib—Break or Fade?

Gold’s recovery off the lows has brought it right into a critical wall. After a sharp pullback, price has rebounded to the 50% Fibonacci retracement at 4,133.90, aligning with a High Volume Node. The daily candle is now printing a doji, suggesting indecision as momentum fades (if it closes this way). If this level holds as resistance, the move may unwind back toward the value zone at 4,000.

Technical Chart Analysis of Gold — November 12th, 2025

Resistance zone:

Price is pressing the 4,133.90 (50% Fib) — the midpoint of the red retracement range — while overhead resistance extends to 4,192.33 (61.8%) and 4,275.53 (78.6%). These levels overlap with prior distribution peaks, forming a tight supply pocket.

Base case (rejection):

A rejection here would target the green retracement zone around 4,000, which aligns perfectly with a high volume node from the volume profile anchored to the recent decline.

Harsh case:

If downside momentum accelerates, gold could retest 3,686.26, where the anchored VWAP from May 2025 and the Value Area High (VAH) of the larger rally align — a historically strong demand shelf.

Upside scenario:

A confirmed daily close above 4,134 would expose 4,192 and later 4,275, though fading candle strength suggests that’s less likely without a catalyst.

Fundamental Factors

Fundamentals aren’t giving a clean go-ahead either.

- U.S. inflation sits around 3%, while real yields near 1.8% remain elevated — limiting gold’s upside appeal.

- Growth is slowing, but not collapsing; this mild stagflation environment typically supports consolidation, not breakout trends.

- Macro sentiment is mixed: safe-haven flows are capped by firm yields, but inflation persistence prevents deep selling pressure.

Together, they paint a picture of equilibrium — gold’s fundamentals justify stability, not aggression. This means we could potentially range within the value area (with emphasis on the green retracement zone)

Closing Thoughts

Gold’s rebound is impressive but fragile. The 4,133.90 resistance is a key hinge point where both traders and fundamentals meet.

A rejection could pull price back toward 3,935–3,900, keeping gold range-bound between its VAL and VAH, while a clean daily close above 4,134 would open the path to 4,192–4,275.

Right now, gold is not breaking out. It is catching its breath at the halfway mark of its own rally.