- Chart of the Day

- November 5, 2025

- 2 min read

SPX: Support Under Threat Ahead of November Options Expiry

The S&P 500 is sitting at a key technical level near 6,735. While the broader trend remains upward, short-term price structure and derivatives positioning suggest caution may be warranted. This risk is exacerbated with a major options expiry looming on November 21.

Let’s delve in with a technical snapshot, and options data analysis.

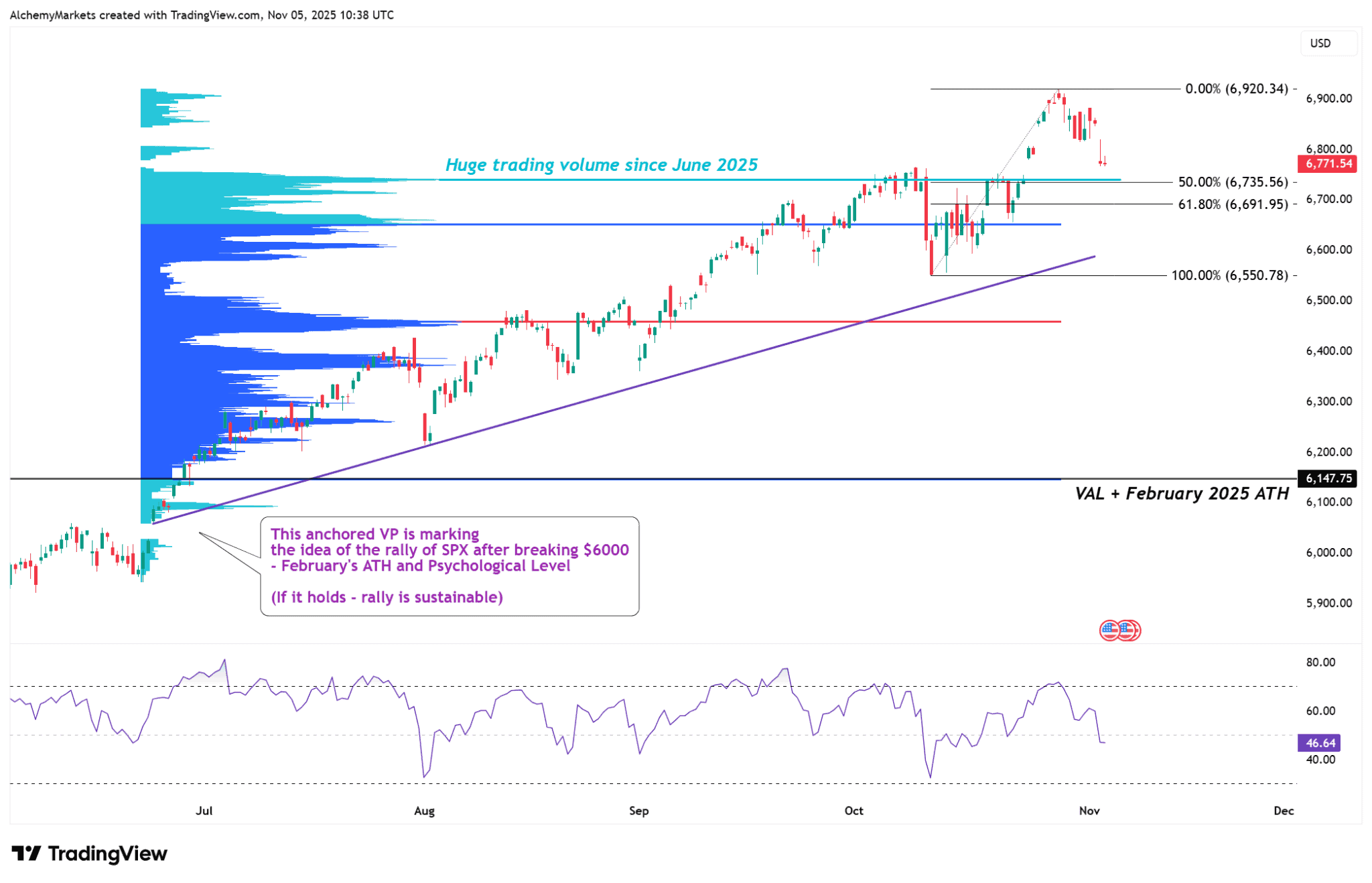

SPX Early November Technical Snapshot

The SPX recently pulled back from a local high near 6,920. It is now testing a well-defined support zone anchored by:

- The 50% Fibonacci retracement from the June 2025 low

- A high-volume node visible on the anchored volume profile

- A rising trendline support running into the VAH in weeks

Momentum is also fading. The daily Relative Strength Index (RSI) has broken below 50, suggesting buyers are no longer in control on this timeframe.

📌 If this support fails to hold, it may open a path toward deeper downside levels — not solely due to price action, but because of positioning dynamics in the options market.

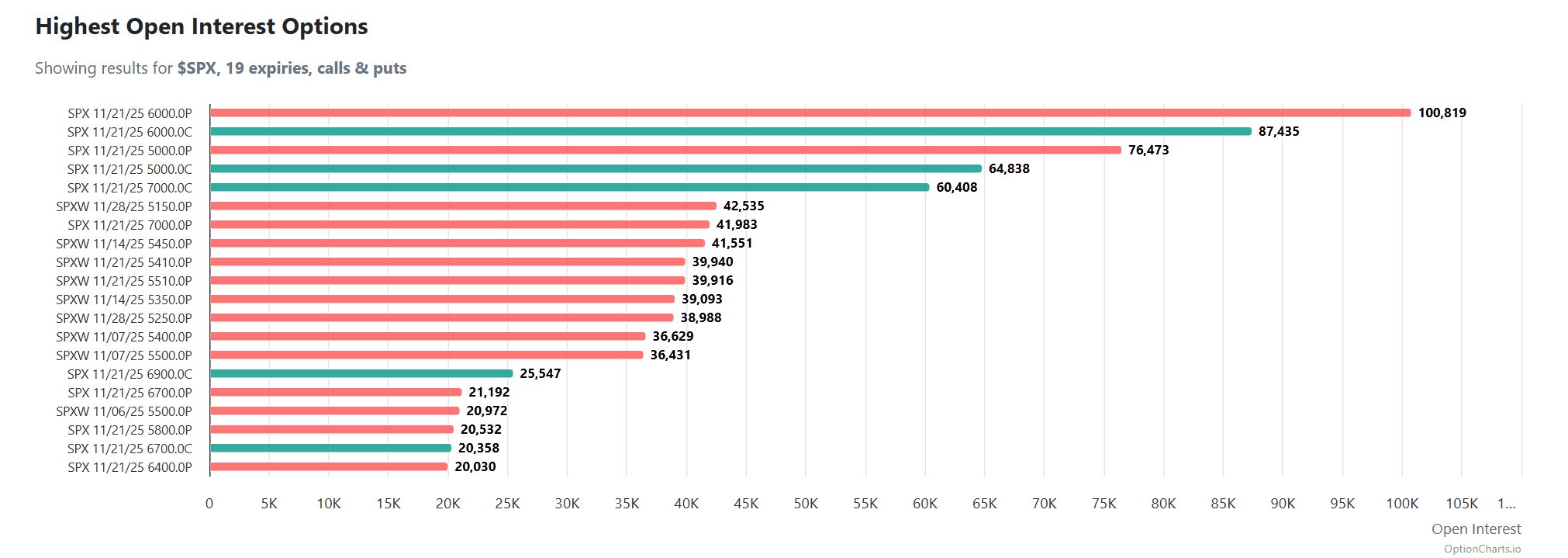

The Positioning Context: November 21 Matters

Under the surface, market participants are positioning heavily for the November 21, 2025 options expiration. That date holds:

- The highest open interest of any upcoming expiry

- A notable skew toward puts, particularly at the $6000, $5500, and $5000 strikes

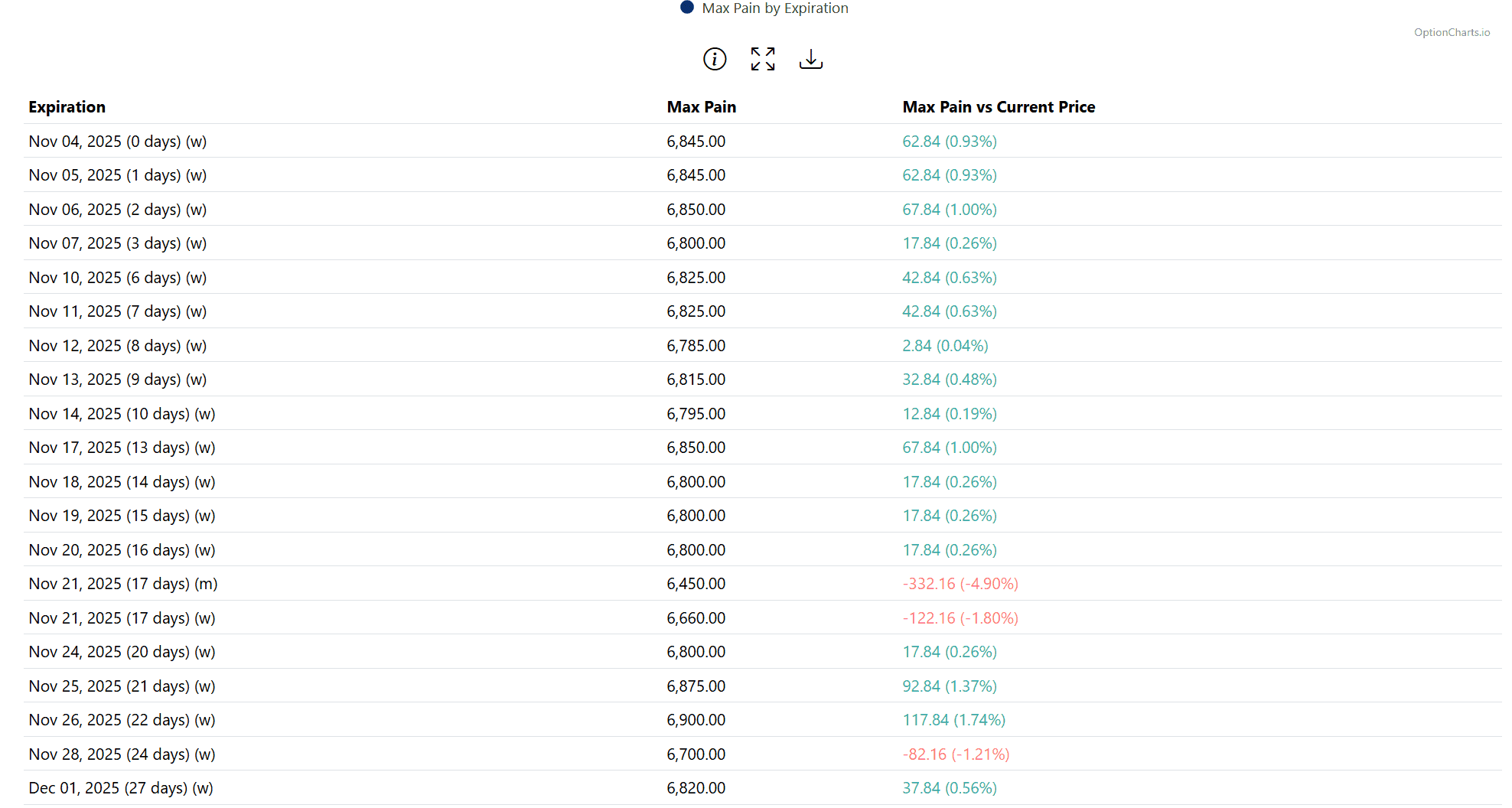

- A calculated Max Pain level of $6,450 — over 300 points below current price

“Max Pain” refers to the strike at which the most options expire worthless.

While not a forecast, it represents a price point where dealer hedging behavior and position unwinding may begin to influence the tape, especially if SPX loses its current footing.

Why This Matters

For clients tracking risk exposure or managing index-linked products, the intersection of:

- Fading momentum

- Key technical support under test

- Heavy downside options positioning into a major expiry comes together to create a scenario worth monitoring closely.

If SPX breaks below 6,735 in coming sessions — especially without a bounce from key macro inputs (e.g. CPI, Fed commentary, or a yield retrace) — dealer hedging flows may tilt from stabilising to amplifying selling pressure.

This could increase downside volatility and pull the index toward the 6,500–6,450 zone, where large open interest and Max Pain reside.