- Weekly Outlook

- October 17, 2025

- 3 min read

CPI, Fed Cuts & S&P 500 Technical Setup

All Eyes on Inflation and the Fed

This week’s focus in developed markets remains squarely on the United States, where macro uncertainty continues to dominate. With the government shutdown still ongoing, economic clarity is limited — key statistical agencies remain shuttered, delaying much of the usual economic data flow. Even once reopened, it may take several weeks before data collection and reporting normalise.

However, one critical data point will make it through: September’s Consumer Price Index (CPI). The Bureau of Labor Statistics has been given the green light to publish the report, primarily because it determines the Social Security Administration’s 2026 cost-of-living adjustment (COLA).

Consensus expectations are modest:

- Headline CPI: +0.4% MoM

- Core CPI: +0.3% MoM

While tariffs could start filtering through into prices, the Fed’s bigger concern right now isn’t inflation — it’s the weakening jobs market. With the Beige Book showing slowing activity and private sector job growth cooling, the stage appears set for a 25bps rate cut at the October 29th FOMC meeting.

In short: inflation may tick up slightly, but the Fed is more worried about economic softness than price pressures. Markets are already pricing in further easing through year-end.

Technical Outlook — S&P 500 (SPX) Setup

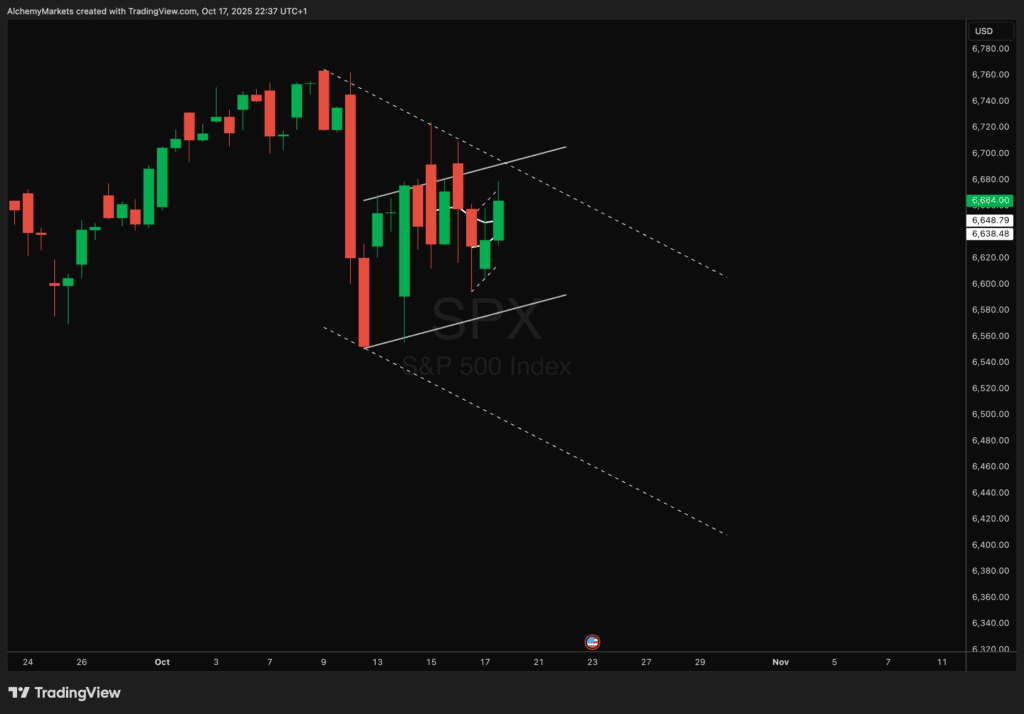

From a technical perspective, the S&P 500 Index (SPX) remains under pressure within a descending channel, as shown in the current chart setup.

- The recent bounce has been contained within a short-term bear flag, marked by parallel resistance and support lines.

- The anchored VWAP (Volume Weighted Average Price) — drawn from the recent swing high — continues to cap price rallies.

- Momentum has improved slightly, but not decisively; each attempt to push higher has met selling pressure near the upper channel trendline.

Unless the index can reclaim and hold above the anchored VWAP, the broader trend remains bearish. A breakdown below the short-term rising support line could open the door for another leg lower toward the 6,500–6,520 zone, aligning with the lower boundary of the descending channel.

Outlook Summary

| Theme | Direction | Key Level / Focus |

|---|---|---|

| US CPI (Sept) | Slightly higher | +0.4% MoM (headline), +0.3% (core) |

| Fed Policy | Dovish bias | 25bp cut likely Oct 29 |

| SPX Technical Trend | Bearish bias | Below anchored VWAP |

| SPX Support | 6,500 – 6,520 | Lower channel line |

| SPX Resistance | 6,670 – 6,700 | Anchored VWAP zone |

Bottom Line

With inflation data expected to show only modest price growth and labor data continuing to soften, the Fed remains on track for an easing cycle. However, equities may not cheer immediately — the S&P 500 looks technically vulnerable to another push lower as long as it remains below the anchored VWAP and trapped within its descending channel. A decisive break above that resistance would be needed to shift sentiment.