- Opening Bell

- September 15, 2025

- 3 min read

Markets Wait for Fed Meeting — The Final Waltz Before The Storm

Markets are on a pause this week until September 17th, where arguably, the most important economic announcement for the coming months will be announced.

Will the Federal Reserve cut rates and finally pivot? Or will they shock the world and hold rates?

With equities stretched at record levels and macro signals turning uneven, this week’s decision carries more weight than usual.

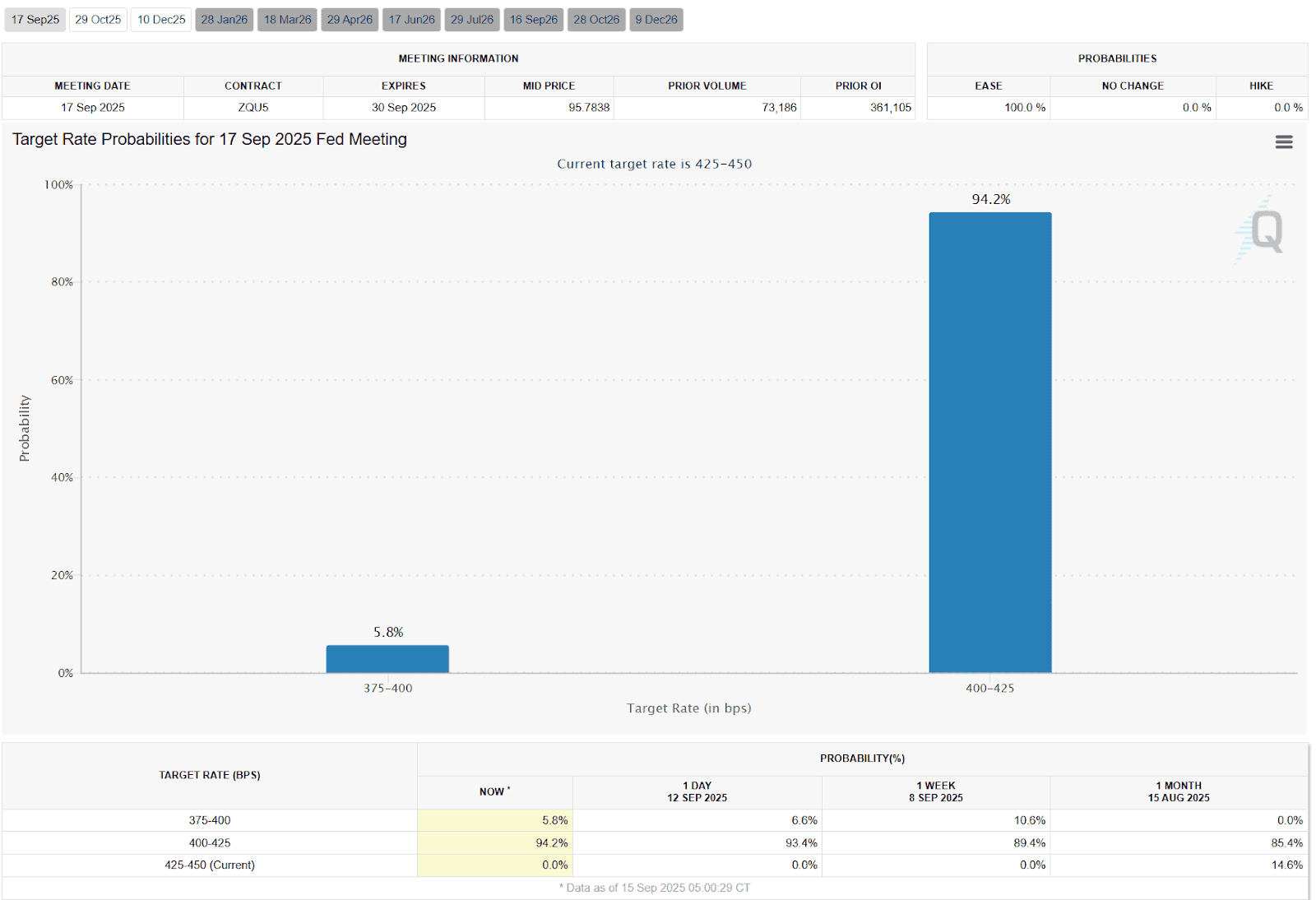

Odds Hint at a High Probability for a 25bps Rate Cut

The CME FedWatch tool puts a 94.2% probability on a 25 bps cut on the next FOMC and just 5.8% on a 50 bps move. A standard-sized cut is already baked in, meaning the bigger market driver will be the dot plot and Powell’s tone. A 50 bps move, while unlikely, would spark concern that the Fed sees deeper cracks in the economy. Conversely, a decision to hold would unwind much of the recent risk rally.

The backdrop is complicated: weaker jobs data has kept pressure on the Fed to ease, but inflation has ticked higher. That’s the uncomfortable recipe for stagflation — a scenario policymakers will want to avoid while still controlling the narrative.

Breadth and Divergence Tell a Different Story

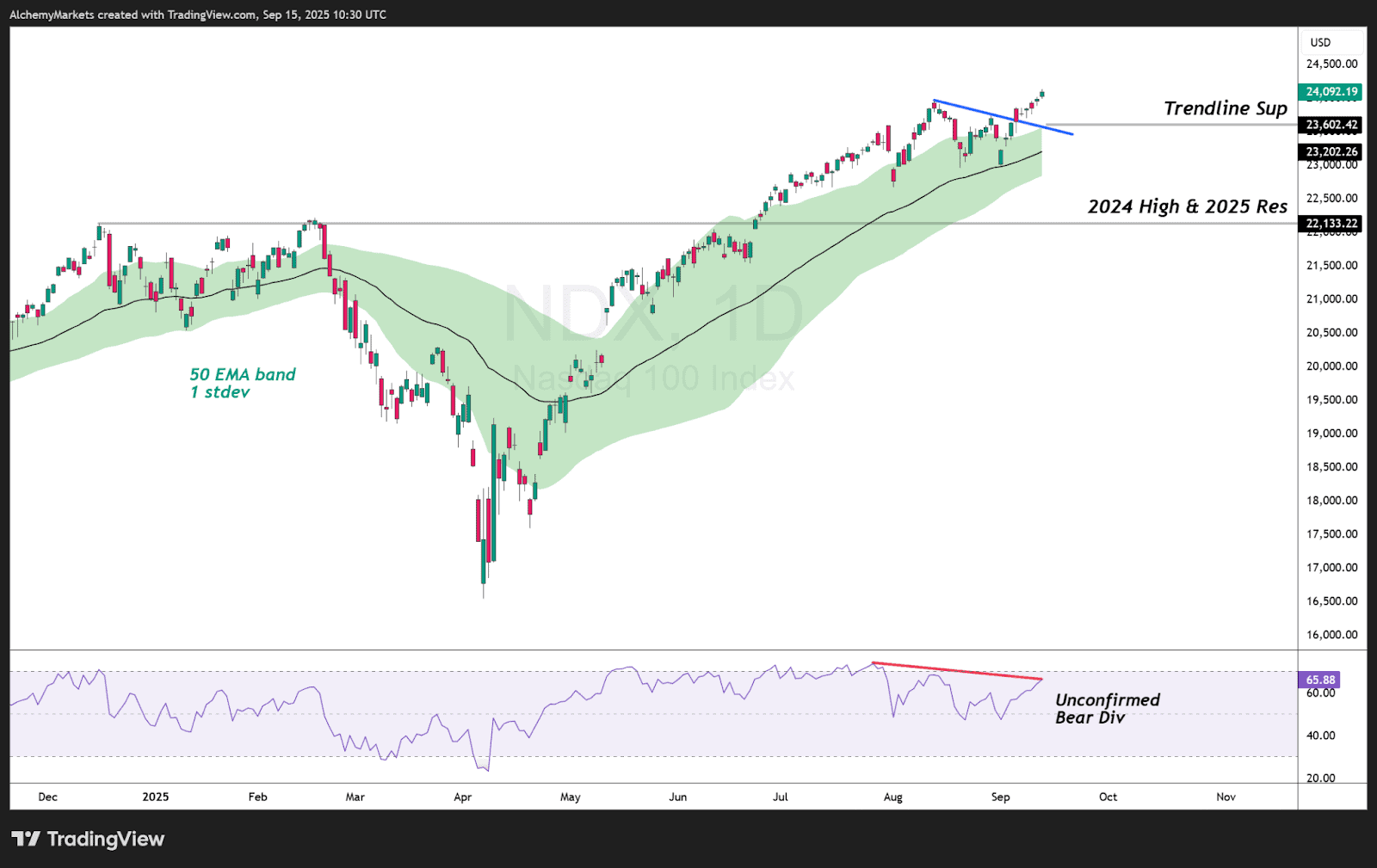

On the surface, equities remain buoyant. The Nasdaq 100 (NDX) trades well above its 50-day EMA band, grinding higher into record territory. Yet momentum is showing cracks: RSI is flashing an unconfirmed bearish divergence, where price makes new highs but strength does not.

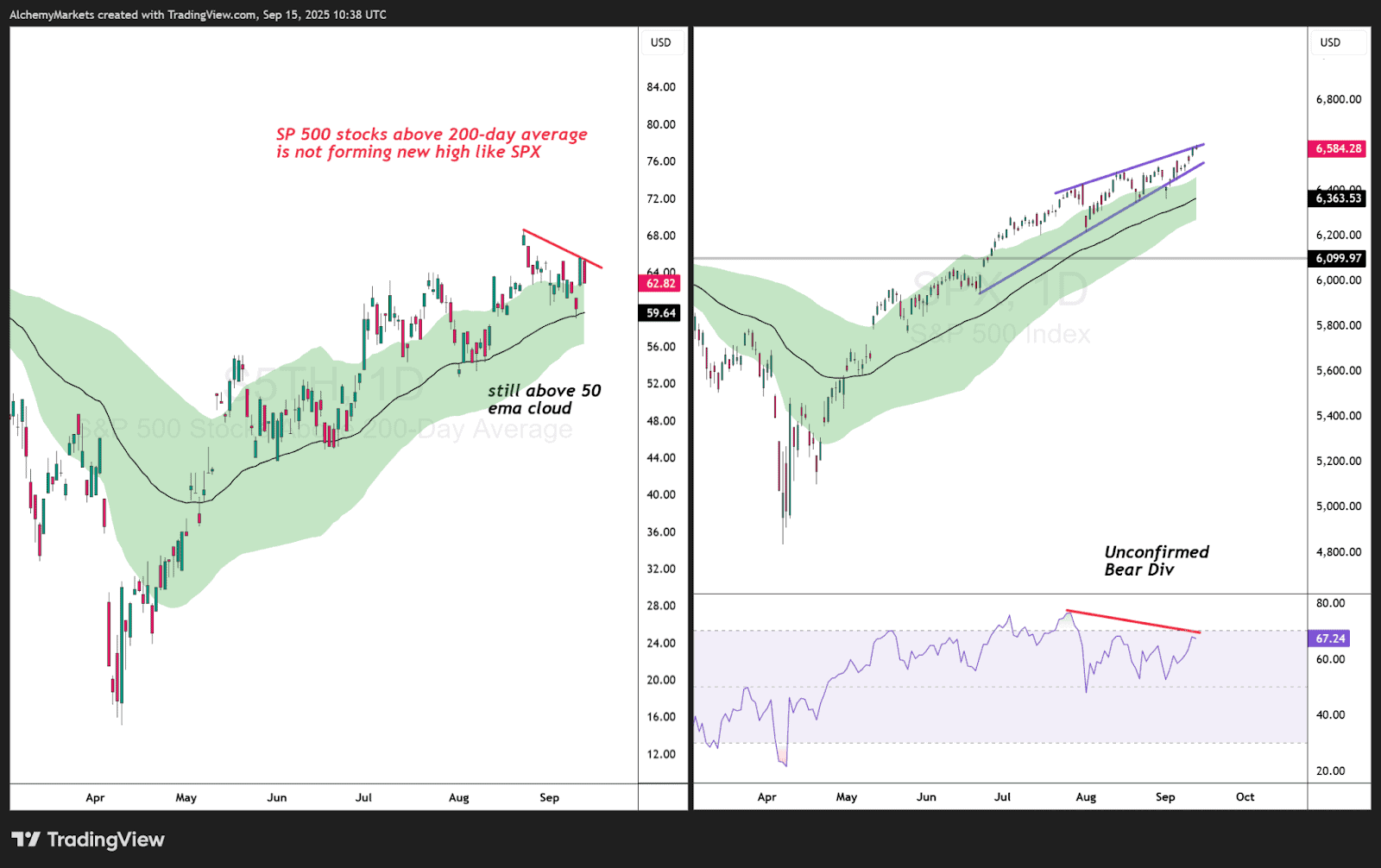

The S&P 500 is also in focus, but leadership is narrow. The percentage of S&P stocks above their 200-day average is failing to confirm new highs in the index, highlighting how a handful of tech giants are carrying the tape. Breadth risk is creeping in, and if those leaders like GOOG and NVDA falter, the downside could accelerate quickly.

The Narrative Traders Need to Watch

Right now, the rally is pinned by liquidity and positioning.

- If Powell leans dovish: expect tech momentum to extend, but divergences suggest fragility underneath.

- If Powell surprises hawkish: breadth risk means even a modest pullback could turn into something larger.

- If Powell cuts 50 bps: the Fed may be signalling panic, and markets will struggle to interpret it as good news.

Bottom Line

Markets are in a holding pattern until the Fed speaks. While the patterns are bearish (rising wedge), the rate announcement will play the bigger role here in shaking up the markets.

Positioning shows confidence, but divergences in breadth and momentum hint at fragility. The “final waltz before the storm” is less about direction and more about reaction — when the music stops, how markets move will depend entirely on Powell’s tone.