- Weekly Outlook

- September 5, 2025

- 3 min read

Weak Jobs Data Raises Pressure Ahead of Key Inflation Print – SPX Falling Wedge

Softer Non-Farm Payrolls Underscore Cooling Labour Market

The August US employment report came in weaker than expected. Non-farm payrolls rose by just 22,000, well short of the 75,000 consensus forecast. Even with upward revisions of 29,000 across the prior two months, the overall tone remains soft.

- Unemployment rate: rose to 4.3% (from 4.2%)

- Underemployment (U-6): climbed to 8.1% from 7.9%

- Average weekly hours: slipped to 34.2

- Wage growth: slowed to 3.7% YoY from 3.9%

This weakness was broad-based. Private education and health (+46k), leisure and hospitality (+28k), and retail (+11k) added jobs, but other sectors were flat or declining. Stripping out those three areas, payrolls have now fallen four consecutive months – a worrying sign for the broader economy.

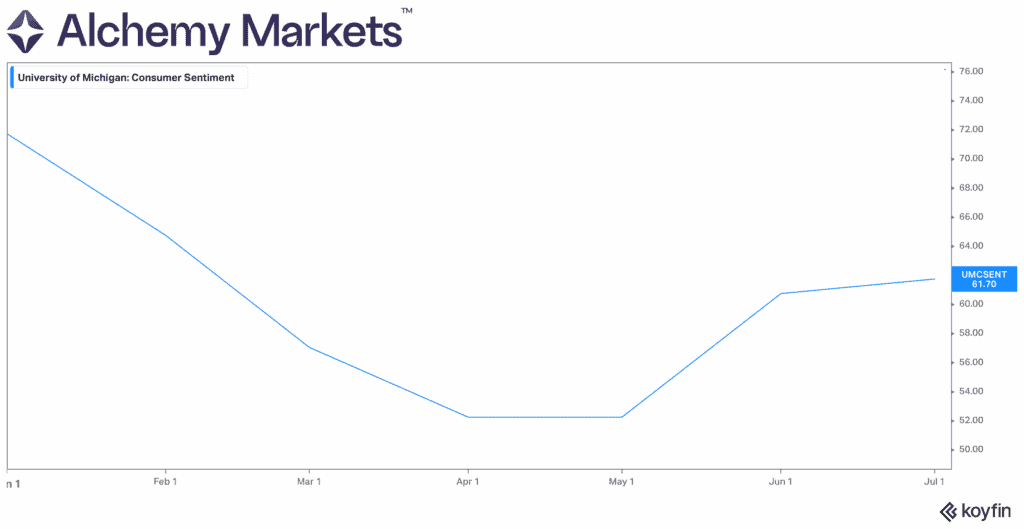

Households Brace for Job Losses

The University of Michigan consumer survey highlights how worried households have become. A net 49% of Americans expect unemployment to rise over the next 12 months – one of the most pessimistic readings in the past half-century.

Given that consumer spending drives 70% of US GDP, the combination of tariff-induced price pressures and growing job insecurity suggests downside risks for growth are mounting.

This backdrop strengthens the case for the Federal Reserve to act. Markets are pricing in 25bp cuts in September, October, and December, followed by more in early 2026. While a 50bp move in September is not our base case, the odds are no longer negligible, particularly if upcoming revisions to payrolls confirm weaker employment trends.

Next Week’s Key Data: Inflation & Consumer Confidence

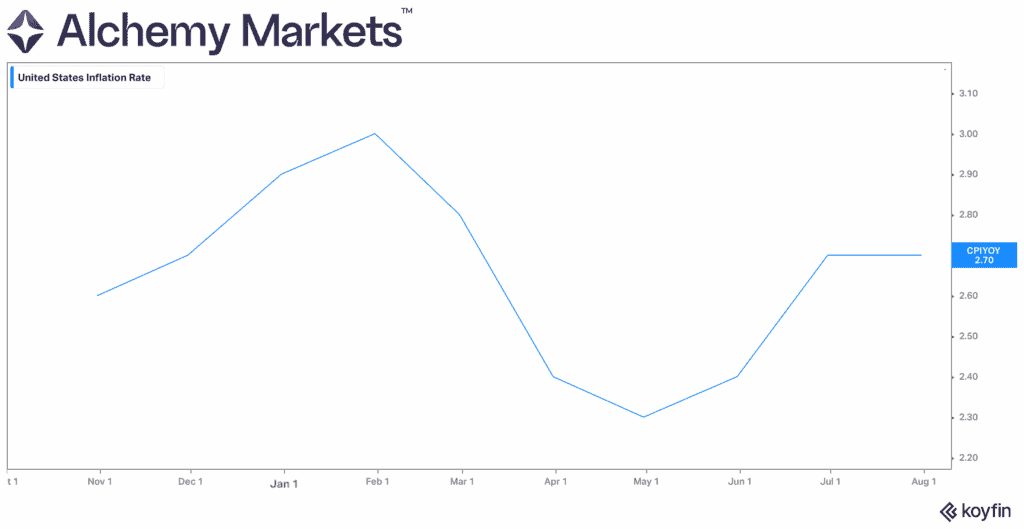

Inflation (Thursday):

This will be the final major release before the Fed’s 17 September FOMC decision. Expectations are for a 0.3% MoM increase in both headline and core CPI.

- Tariffs continue to push up goods prices, but goods only account for 19% of the CPI basket.

- Housing, which makes up 33%, is showing clear signs of softening. Zillow and Cleveland Fed data confirm rents are cooling.

- Energy prices are falling.

- Wage growth, once a key driver of inflation, is now easing.

Taken together, these factors mean the Fed can cut by 25bp without fear of reigniting inflation.

Consumer Confidence (Friday):

The University of Michigan index remains fragile, reflecting two themes:

- Tariff-induced price hikes are squeezing household budgets.

- Fear of joblessness is climbing.

This will be reinforced by another hefty monthly borrowing figure from Washington, as tariff revenues continue to underdeliver.

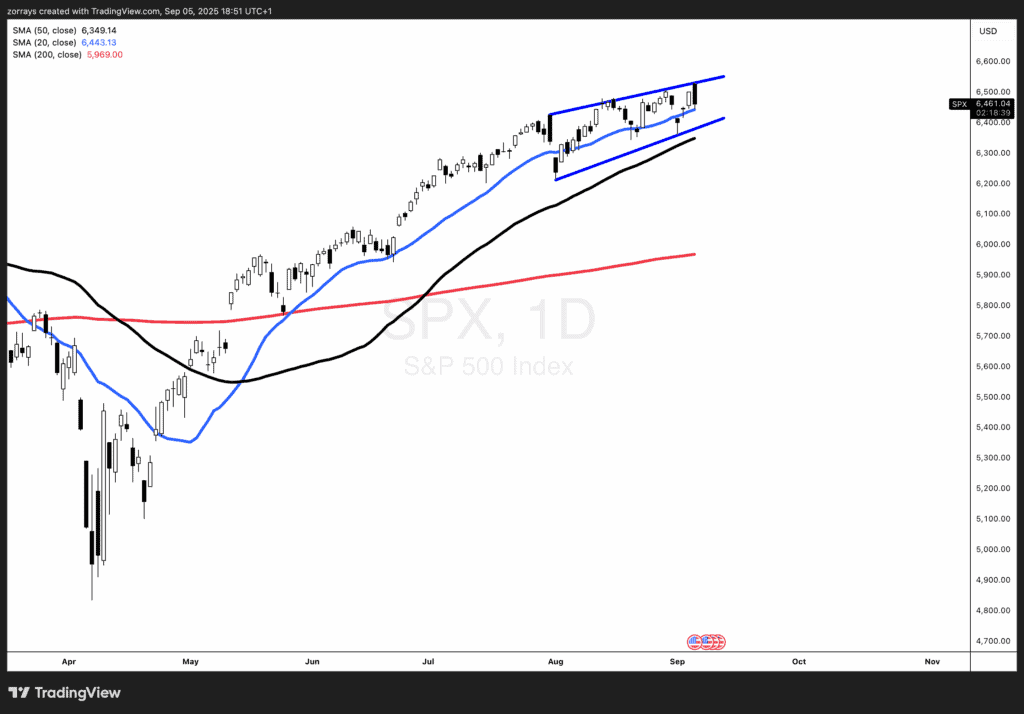

Technical Outlook: Rising Wedge Risks

The S&P 500 (SPX) daily chart shows price action constrained within a rising wedge pattern. The index is trading above its 20-day (blue) and 50-day (black) moving averages, with the 200-day (red) far below at 5,969.

- If the wedge holds, the market could attempt another push higher.

- A decisive break below both the 20-day and 50-day averages would open the door to a deeper retracement.

- The 200-day SMA remains the key downside magnet.

This wedge pattern aligns with the macro narrative: a slowing jobs market, softening demand, and uncertainty around Fed policy all increase the risk of a break lower.

Bottom Line

The weak August NFP report reinforces the idea that the US labour market is losing momentum. With inflation and consumer confidence due next week, markets will be watching closely for signs that justify a September cut. A 25bp move remains the base case, but the chances of a 50bp cut have edged higher. Technically, the S&P 500 is at a crossroads – a wedge breakdown would likely see investors test the 200-day moving average.