- Chart of the Day

- August 21, 2025

- 2 min read

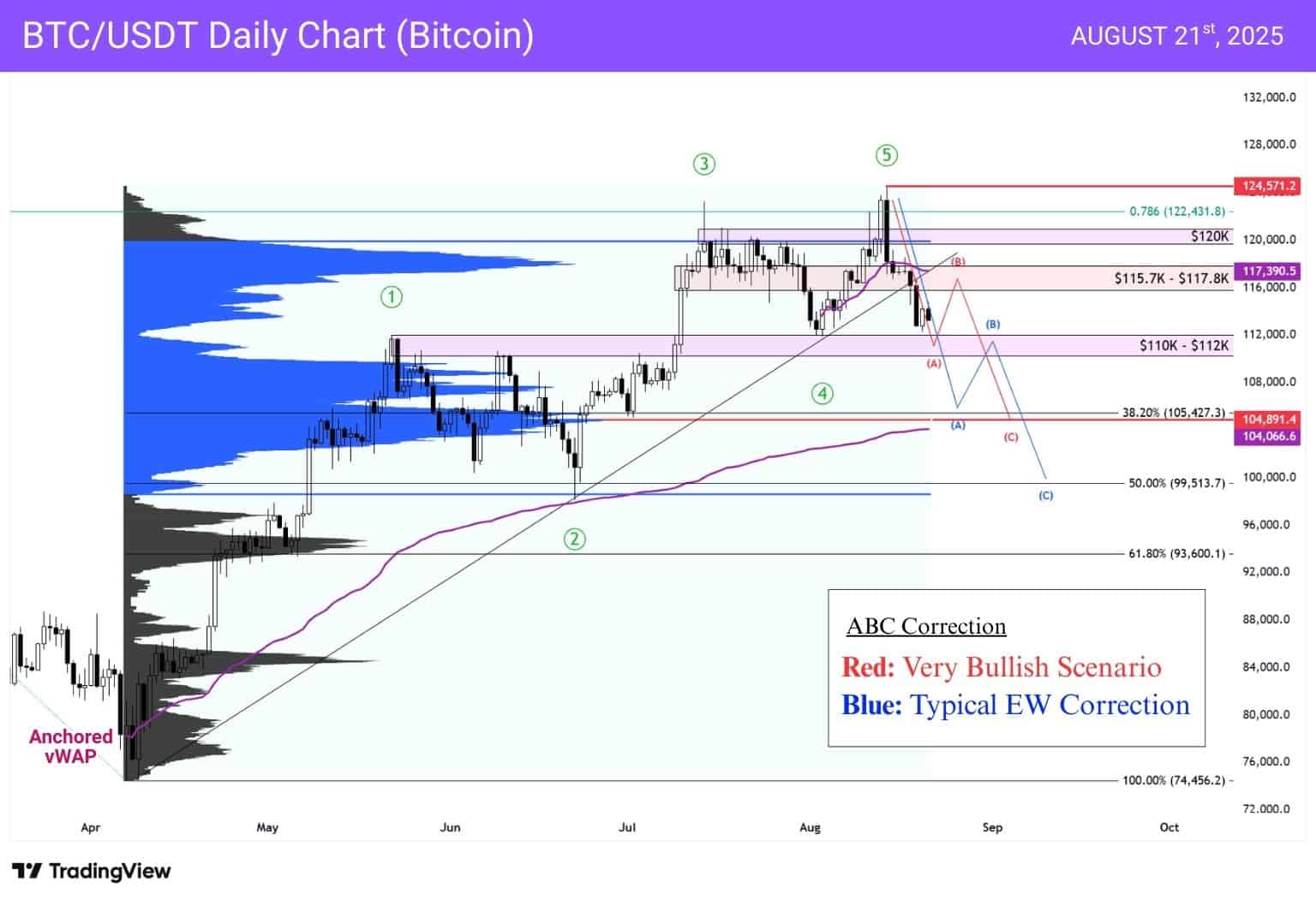

It’s Not Looking Good: Bitcoin Faces ABC Correction Scenario

Bitcoin has now corrected for six consecutive days, only pausing briefly on August 20 with a small bounce. After a clean 5-wave rally to new highs, the structure is increasingly pointing to an ABC correction: a typical Elliott Wave pattern that often follows impulsive moves.

Key Scenarios to Watch

In the chart above, you’ll see two key ABC correction scenarios to watch, one marked in red and one in blue. We’ll also one other possibility to keep in mind.

Shallow Zigzag (Bullish case – Red)

- Price holds $110k–$112k (prior highs + HVN cluster).

- Rebounds toward $115.7k–$117.8k, where the anchored VWAP and another HVN zone sit.

- Wave C then terminates near $105k (38.2% retracement + POC).

- This would fit a shallow zigzag, keeping the broader uptrend structurally intact.

Deeper Zigzag (Typical EW correction – Blue)

- Break below $112k confirms the smaller HVN cannot hold.

- Sellers push toward $105k (POC + 38.2% Fib), likely producing a reaction.

- A corrective B-wave bounce back to $110k–$112k could follow.

- Final C-leg extends into $99,513 (50% retracement) — the standard depth for post-5-wave corrections.

Extended Correction (Not considered until further signals)

- If $99,513 fails to hold, downside may stretch into $93,600 (61.8% Fib).

- This would imply an extended C-wave — still Elliott-valid, but usually driven by broader risk-off sentiment or liquidation cascades.

Additional Insights

Volume profile is decisive: $105k isn’t just a Fib level, it’s the highest-volume node since April. That means institutional activity is likely to defend or react heavily there.

Wave B behaviour will reveal the path:

- A sharp retrace (≥90% of A) opens the door for a Flat ABC — even a possible expanded flat where BTC fakes a new high above ~$124.6k before unwinding lower.

- Momentum divergence matters: If Bitcoin breaks $112k with accelerating sell pressure, the odds lean toward the deeper zigzag. But if $110k–$112k holds with slowing downside momentum, the shallow zigzag or even a running flat becomes more likely.

Bottom line: Bitcoin is in corrective mode — the only debate is depth. Hold $110k–$112k and bulls may limit losses to $105k. Lose it, and the door opens for a deeper test into $99k or even $93k.