- Weekly Outlook

- August 16, 2025

- 6min read

Shocking Fed Shift? 5 Jackson Hole Questions That Could Move Markets – SPX Outlook Inside

Jackson Hole 2025: All Eyes on Powell

Each year, the world’s most powerful central bankers and economists gather in the remote peaks of Jackson Hole, Wyoming. But while the setting is serene, the implications are seismic.

This year’s symposium, titled “Labour Markets in Transition”, is poised to be a policy-defining moment for Fed Chair Jerome Powell—and for markets hungry for clarity on inflation, interest rates, and the future of monetary policy.

What Is the Market Expecting This Year?

With inflation cooling modestly and growth showing signs of fatigue, investors are betting on at least one rate cut by September. But the Fed’s language has stayed cautious. And with internal politics heating up—amid debates over independence, presidential influence, and even succession—the stakes for Powell’s Jackson Hole address couldn’t be higher.

5 Key Questions Facing Jerome Powell at Jackson Hole

1. Will Tariff-Driven Inflation Force Powell’s Hand?

Tariffs, particularly those targeting Chinese electric vehicles and semiconductors, are once again inflating input costs. July import prices rose 0.4%, the first solid jump in months. But who’s eating that cost?

Data suggests U.S. corporations are still absorbing the blow, lacking pricing power to pass it on. This deflationary absorption may buy Powell time. However, with retail inventories declining—especially in autos—companies may soon be forced to hike prices.

Powell will likely acknowledge that inflation risks remain skewed to the upside. But whether they’re persistent enough to delay a rate cut remains to be seen.

2. Is the Labour Market Really Resilient?

In July, Powell said the labour market wasn’t weakening. Two days later, a shock revision to payrolls painted a different picture. Job growth slowed, and confidence surveys like ISM and U. of Michigan echo labour weakness.

While Powell may downplay payroll revisions in favour of the unemployment rate (still below 4%), sluggish wage growth contradicts the idea of a tight labour supply.

With the symposium themed around labour, expect Powell to walk a fine line: acknowledging softness without triggering panic.

3. Will the Fed Push Back Against Rate Cut Expectations?

Markets are fully pricing in a September cut. But Powell might hesitate to pre-commit. Why? One more jobs and inflation print is due before the September meeting.

Expect Powell to re-emphasise data dependence, possibly tempering expectations. But he’s unlikely to strongly oppose a market already banking on easing—unless the next data sets surprise to the upside.

4. How Will Internal Politics Shape the Fed’s Next Move?

Treasury Secretary Scott Bessent has called for a 50bps cut. Meanwhile, Trump’s appointee Stephen Miran, still awaiting confirmation, could push for even more.

The drama raises questions: Will the Fed board fracture under political pressure? Will Powell assert independence, or will this be his final Jackson Hole?

5. Could Powell Signal a Longer Easing Cycle?

Beyond September, the path is murky. The market is split on whether we’ll see one, two, or even three more cuts in 2025. Powell might hint at gradual normalisation, especially if he sees inflation as manageable and labour cooling.

SPX Technical Analysis – Is a Bullish Breakout Building?

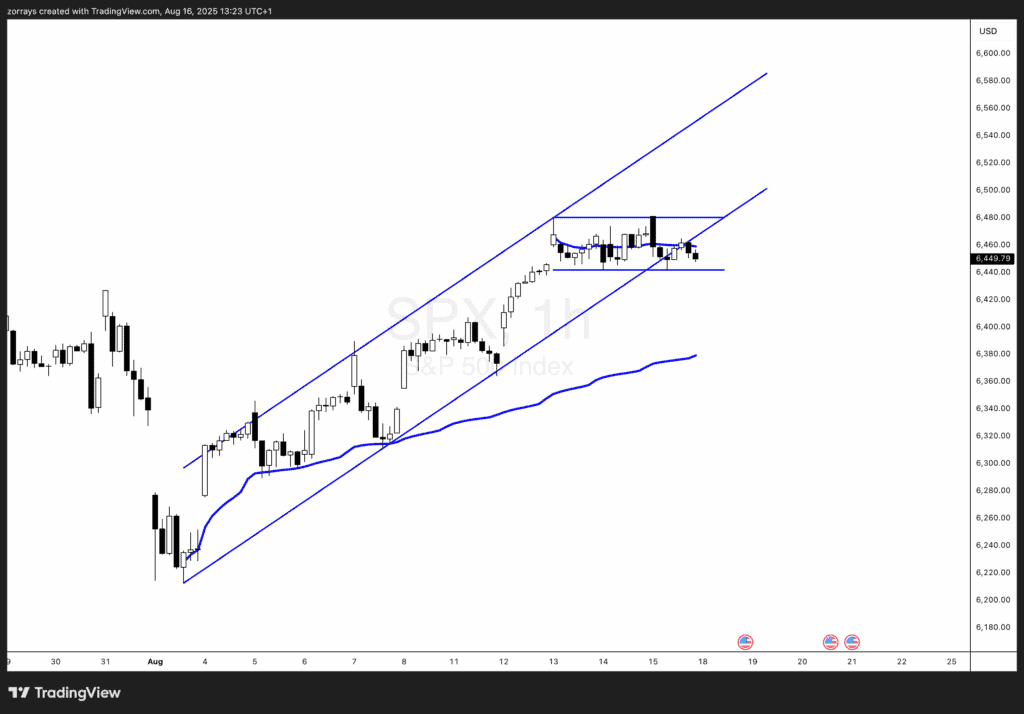

The SPX is currently trading within a well-defined ascending channel, respecting both upper and lower bounds since early August. Price recently consolidated into a parallel channel at the upper end—often a bullish flag continuation pattern.

As long as SPX remains inside this ascending channel, the outlook is mildly bullish. The pullback toward the lower parallel is viewed as healthy consolidation, not breakdown.

Momentum appears to be building for another push higher, especially if Powell delivers a market-friendly tone at Jackson Hole. However, a clean break below the lower blue horizontal support would invalidate this view and shift sentiment near-term.

What to Watch for in Powell’s Speech

- Use of the phrase “data dependent” or “gradual normalisation”

- Comments on labor market “slack” or “softness”

- Emphasis on “transitory” or “durable” inflation

- Tone around independence and market expectations

International Watch: How Will Global Central Banks Respond?

The ECB and BOE are also near inflection points. A dovish Powell may give them cover to pause. BOJ, meanwhile, remains firmly dovish, offering a contrast that could weaken the yen further.

Fed Credibility and Independence in Focus

Political heat, dovish market expectations, and rising internal voices are testing the Fed’s ability to appear neutral and data-driven. Powell’s speech must reassert credibility without spooking markets.

The Market’s Rate Path Assumptions – Accurate or Fantasy?

CME FedWatch shows 80% odds of a September cut. Yet real economic indicators suggest caution. Powell could take the opportunity to level-set expectations—especially if the Fed wants to avoid pre-committing.

Earnings, Growth, and Macro Signals Post-Symposium

Watch for:

- August CPI (due Sept 10)

- August payrolls (due Sept 6)

- ISM Manufacturing/Services

- Corporate guidance from retail/tech

Positioning Ahead of the Event

Institutions appear net long tech and cyclicals, suggesting optimism. But options flows show significant hedging. Expect volatility spikes around the speech window.

FAQs About Jackson Hole and the Fed’s Path Forward

1. What is the Jackson Hole symposium?

It’s an annual economic conference hosted by the Kansas City Fed, bringing together global central bankers, economists, and policymakers.

2. Why does Jerome Powell’s speech matter so much?

Markets closely watch Powell’s tone and forward guidance, which often sets the stage for near-term policy moves.

3. Is the Fed expected to cut rates in September 2025?

Yes, markets currently price in a high likelihood of a 25bps cut.

4. How do tariffs factor into Fed decisions?

Tariffs can raise prices, impacting inflation—a key input into Fed policy. But their long-term effect depends on corporate pricing power and supply chains.

5. What will happen to SPX if Powell is dovish?

SPX is likely to break higher, especially if it stays in the current ascending channel.

6. Could Powell’s speech shift global monetary policy?

Yes, especially for the ECB and BOE, which often move in sync with the Fed.

Conclusion: Why This Jackson Hole Could Reshape 2025 Policy

With markets pricing in cuts, inflation showing mixed signals, and labor markets wobbling, Jackson Hole 2025 may turn out to be a defining moment for U.S. monetary policy.

For now, the SPX remains in a bullish channel, suggesting optimism prevails—but all eyes are on Powell to either validate or reset expectations.