- Weekly Outlook

- november 14, 2025

- 3 min läsning

SPX Faces a Critical Turning Point as Macro Data Reboots

Shutdown Aftermath Still Filtering Through

Although the government shutdown has ended, the effects will continue into next week. Federal workers are still waiting for back pay and benefits processing is running behind. These delays can temporarily soften household spending and create uneven short-term economic readings. The data release calendar has also been disrupted, and agencies need time to re-establish normal reporting cycles.

September Jobs Report Likely to Show Softness

Next week we stand a good chance of finally receiving the delayed September jobs report. Expectations lean towards a softer print, mainly because the ISM employment indicators and the ADP private payrolls series have already signalled a slowdown in hiring momentum. It’s not a collapse in labour demand, but the labour market is clearly losing some of its earlier strength.

Fed Minutes Set to Lean Hawkish

We’ll also get the Federal Reserve’s October FOMC minutes. These are likely to sound firm, given Chair Jerome Powell’s recent warning that a December rate cut should not be treated as a certainty. A hawkish tone would reinforce the message that policy will stay tight until inflation improves more convincingly, keeping pressure on risk assets as we move into next week.

Housing Data Remains Subdued

Existing home sales and the National Association of Homebuilders’ sentiment survey are due, and both are expected to remain soft. Affordability is heavily constrained, with high prices and elevated mortgage rates continuing to keep both buyers and sellers on the sidelines. Housing is unlikely to provide any positive surprise next week.

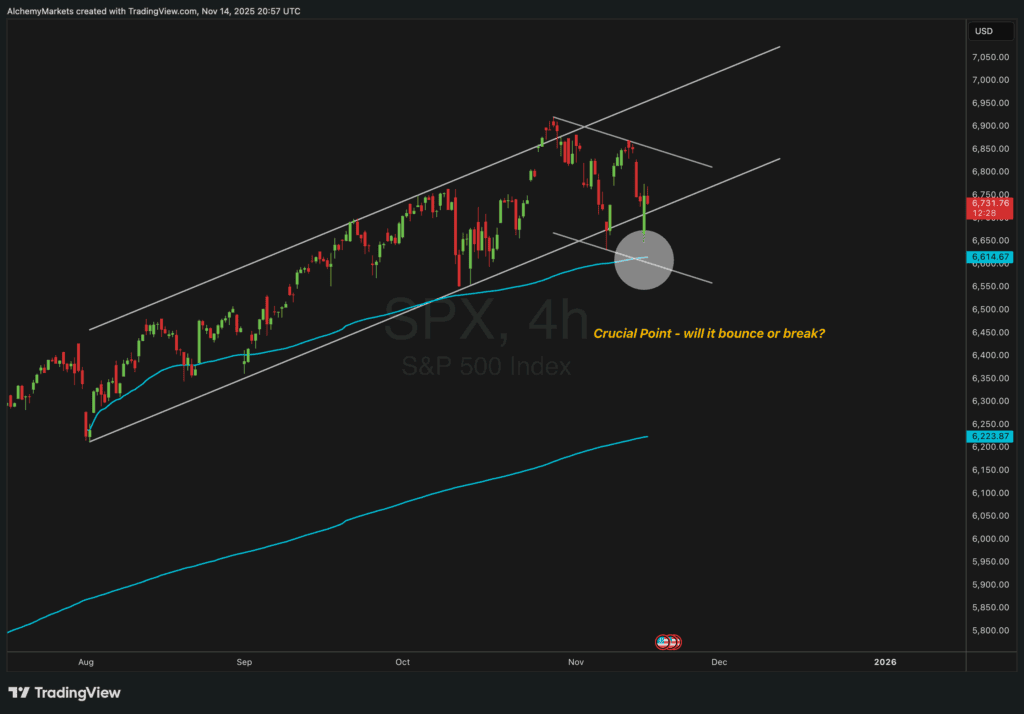

SPX Technicals: Sitting on a Critical Support Cluster

The SPX heads into next week at a major technical inflection point. The index has pulled back into the lower boundary of the rising channel that has guided price since late summer. At the same time, a short-term descending channel has formed, compressing price action and signalling fading momentum.

Price is also sitting directly on an anchored VWAP drawn from a key prior swing. This confluence creates a make-or-break zone.

If SPX bounces from this area and reclaims the upper line of the descending channel, the broader uptrend can resume.

If it breaks below both the channel support and the AVWAP next week, it would invalidate the structure and open the door to a deeper move lower.

What It All Means for Next Week

Markets head into next week facing a blend of delayed economic data, a firm central bank, and a technically vulnerable equity market. With liquidity thin and volatility pockets widening, reactions around these levels could move sharply. The SPX is effectively sitting at a crossroads, and next week’s macro releases may determine whether buyers can defend this crucial support zone or whether momentum carries the market lower.