- Opening Bell

- Febbraio 10, 2026

- 3 min di lettura

PY Steadies as Subdued JGBs Open the Door for Yen Recovery

Asian markets open with a constructive tone around Japan, following the LDP’s decisive election victory over the weekend. While political continuity is broadly supportive for risk assets, the yen reaction has been notably restrained, with Japanese Government Bonds (JGBs) emerging as the critical swing factor for FX markets.

Macro & Flow Dynamics: Why JGBs Matter

The key question for investors is whether the post-election backdrop ultimately proves yen-positive or yen-negative. So far, JGB yields remain well contained, easing concerns about aggressive fiscal expansion being funded through heavier bond issuance. This has helped stabilize the yen and discouraged fresh USD/JPY longs.

At the center of the debate is how the government plans to fund its proposed JPY5 trillion temporary consumption tax cut. One option being discussed is drawing on the Foreign Exchange Fund Special Account (FEFSA), which benefited from roughly JPY5 trillion in gains last fiscal year due to currency and capital appreciation on Japan’s large FX reserve holdings (predominantly US Treasuries).

While Japan has historical precedent for reallocating FX reserve gains to the general account, this remains a politically and institutionally sensitive issue. Markets appear reassured—for now—that this path would limit upward pressure on JGB yields. As long as yields stay anchored, investors are more inclined to take a glass-half-full view on the yen.

Another important pillar of support is capital inflows into Japanese equities. Some local brokers estimate as much as JPY10 trillion in foreign inflows over the next three months, a dynamic that would naturally raise hedging demand and reduce the appeal of extended USD/JPY long positioning.

FX Implications: Pressure Builds on USD/JPY

Against this backdrop, investors may increasingly question the sustainability of USD/JPY above recent highs. A combination of stable JGBs, equity inflows, and a softer dollar environment globally could act as a catalyst for USD/JPY to break below the 155 handle, aligning the yen more closely with recent strength seen in the euro and Swiss franc during periods of broad USD weakness.

Technical View: Bearish Bias Below the Channel

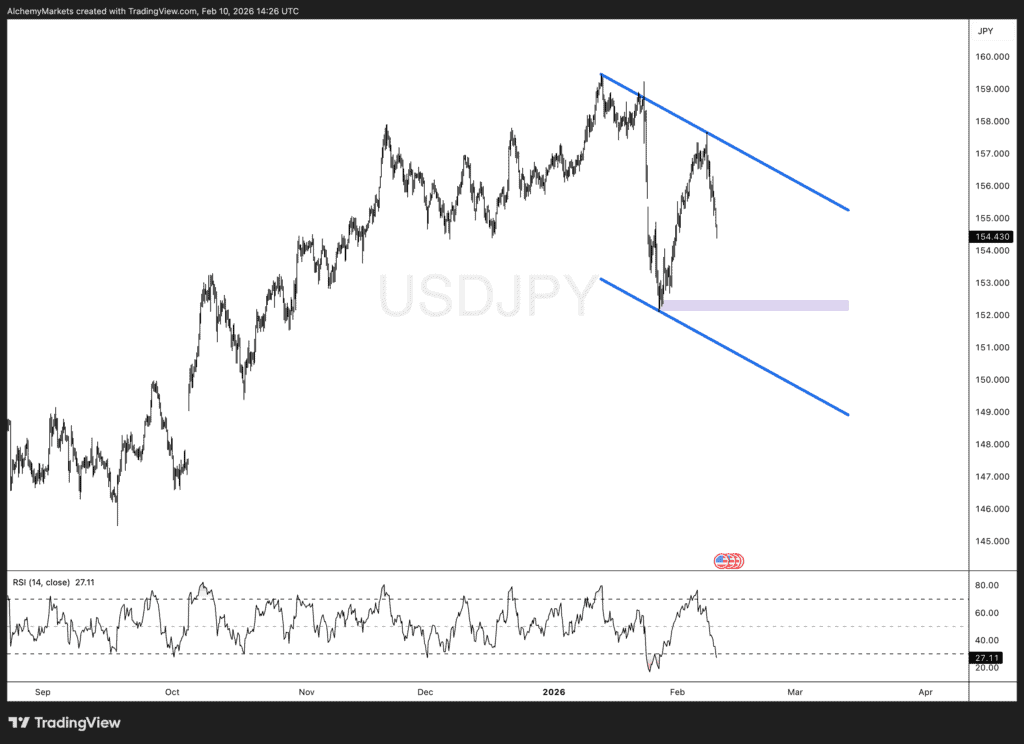

From a technical perspective, USD/JPY has rolled over into a downward-sloping channel, with momentum indicators reinforcing the near-term bearish tone.

- RSI is drifting toward oversold territory, suggesting downside momentum is still active rather than exhausted.

- 155.00 now acts as a key pivot; sustained trading below this level keeps pressure on rallies.

- 152.00 stands out as the first major horizontal support, marking a prior demand zone.

- If USD/JPY continues to weaken, the lower bound of the descending channel becomes the next downside target, reinforcing a broader corrective move rather than a shallow pullback.

Opening Bell Takeaway

As long as JGB yields remain subdued, the balance of risks tilts toward a gradual yen recovery. With equity inflows building and technicals softening, USD/JPY looks increasingly vulnerable to further downside, with 152.00 in focus initially and the channel floor acting as secondary support if dollar weakness accelerates.