- Opening Bell

- Febbraio 9, 2026

- 3 min di lettura

Caution Today: Large Inside Selling Detected on Last Friday

This week is shaping up to be an important one for rotation trades, particularly as insider activity continues to lean heavily toward selling.

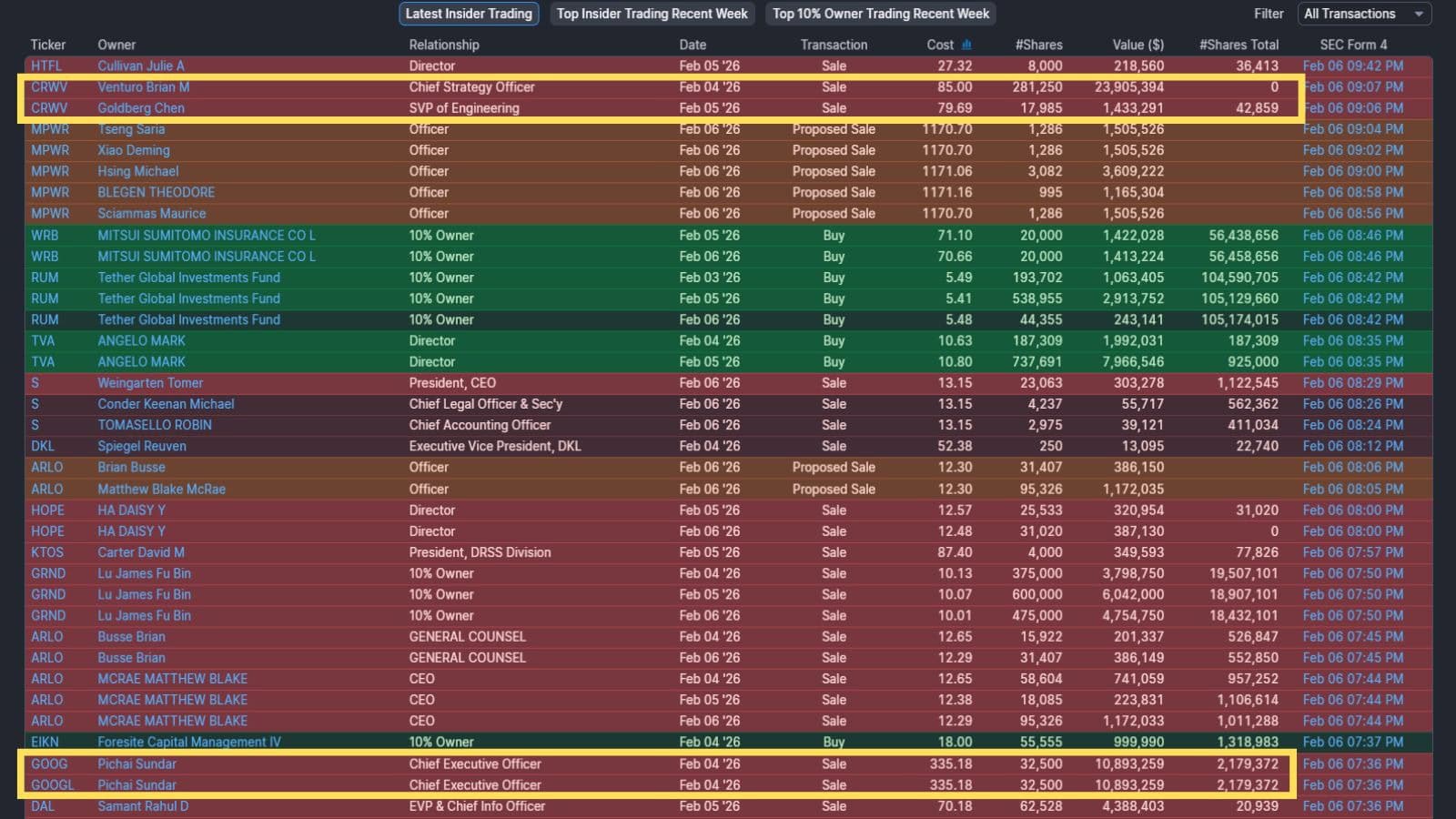

On Friday, February 6, we saw a notable wave of insider selling across multiple sectors.

Two transactions stood out. Alphabet CEO Sundar Pichai sold 32,500 shares each of GOOG and GOOGL, while CoreWeave’s Chief Strategy Officer sold over USD 23 million worth of shares, reducing his position to zero.

Source: https://finviz.com/insidertrading?tc=7

Looking across insider activity more broadly, most reported transactions last Friday were either outright sales or proposed sales. Meaningful buying was limited, with Eikon Therapeutics in biotechnology and Sonos in consumer electronics standing out as exceptions.

Our bias remains cautiously bearish for technology stocks over the next one to two sessions. The scale and concentration of insider selling is consistent with distribution behaviour, a sign that insiders are selectively protecting capital at current valuations.

| CoreWeave is a high-growth AI infrastructure company focused on cloud computing for machine learning workloads. GOOG and GOOGL represent Alphabet’s two share classes, both tied to Google’s core advertising, cloud, and AI businesses. |

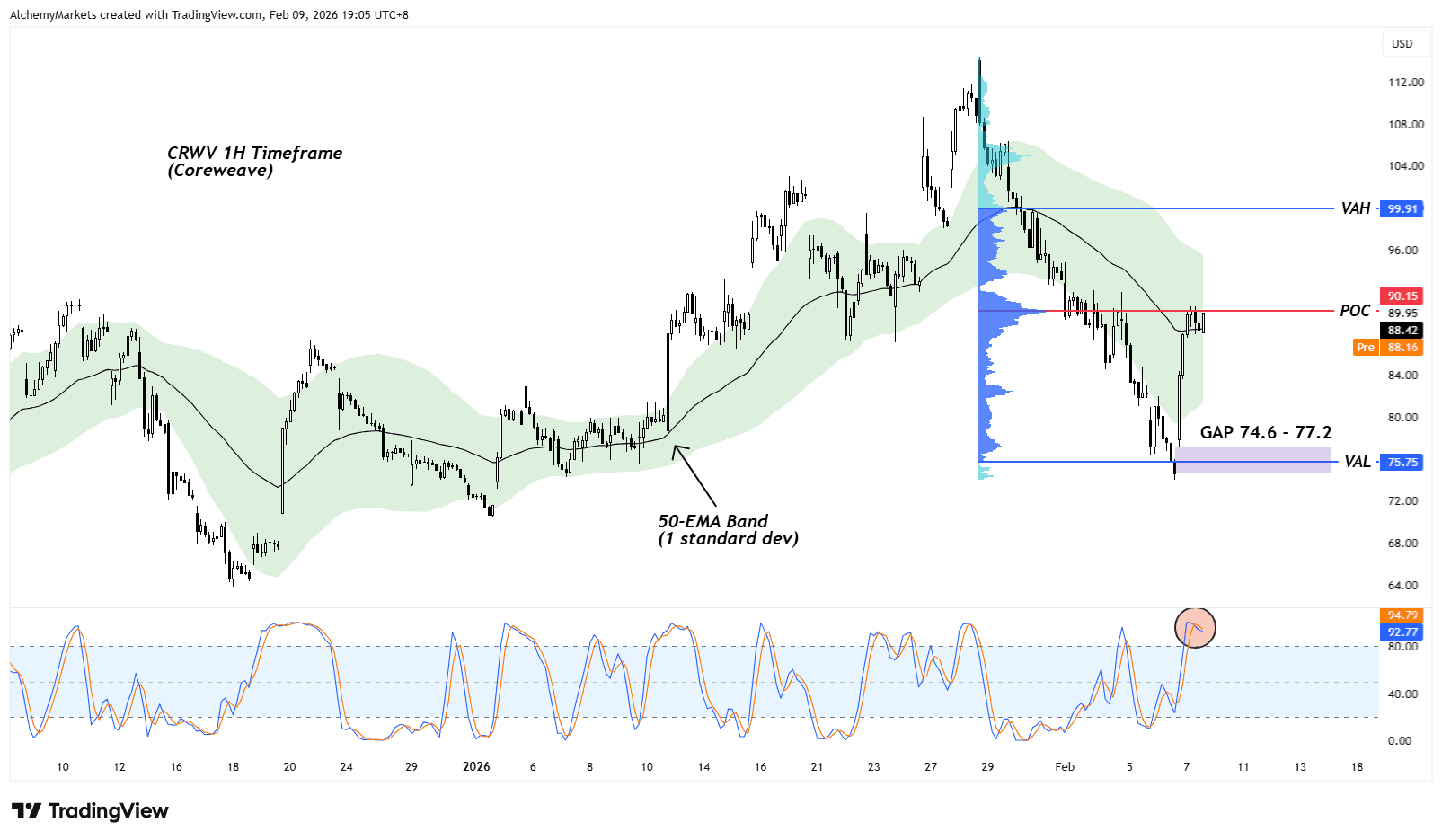

CoreWeave (CRWV)

CoreWeave is set to open lower, aligning with the heavy insider selling observed last week. Momentum indicators support this view, with a bearish Stochastic RSI cross already in place.

Using a fixed-range volume profile, we can see that price has recently tapped into a high-volume bearish zone from the prior sell-off. This suggests supply remains active at current levels.

The 50-EMA band on the 1-hour timeframe continues to act as a reliable trend guide. Historically, once CRWV breaks directionally, price tends to stay within the band until a genuine reversal occurs. At present, the dominant pressure remains bearish.

If price pushes lower, a test of the gap between 74.6 and 77.2 becomes likely. But, watch for a fakeout of another probe of the point of control. Should the POC be reclaimed, a move toward the upper Bollinger Band near 96 could be another inflection point.

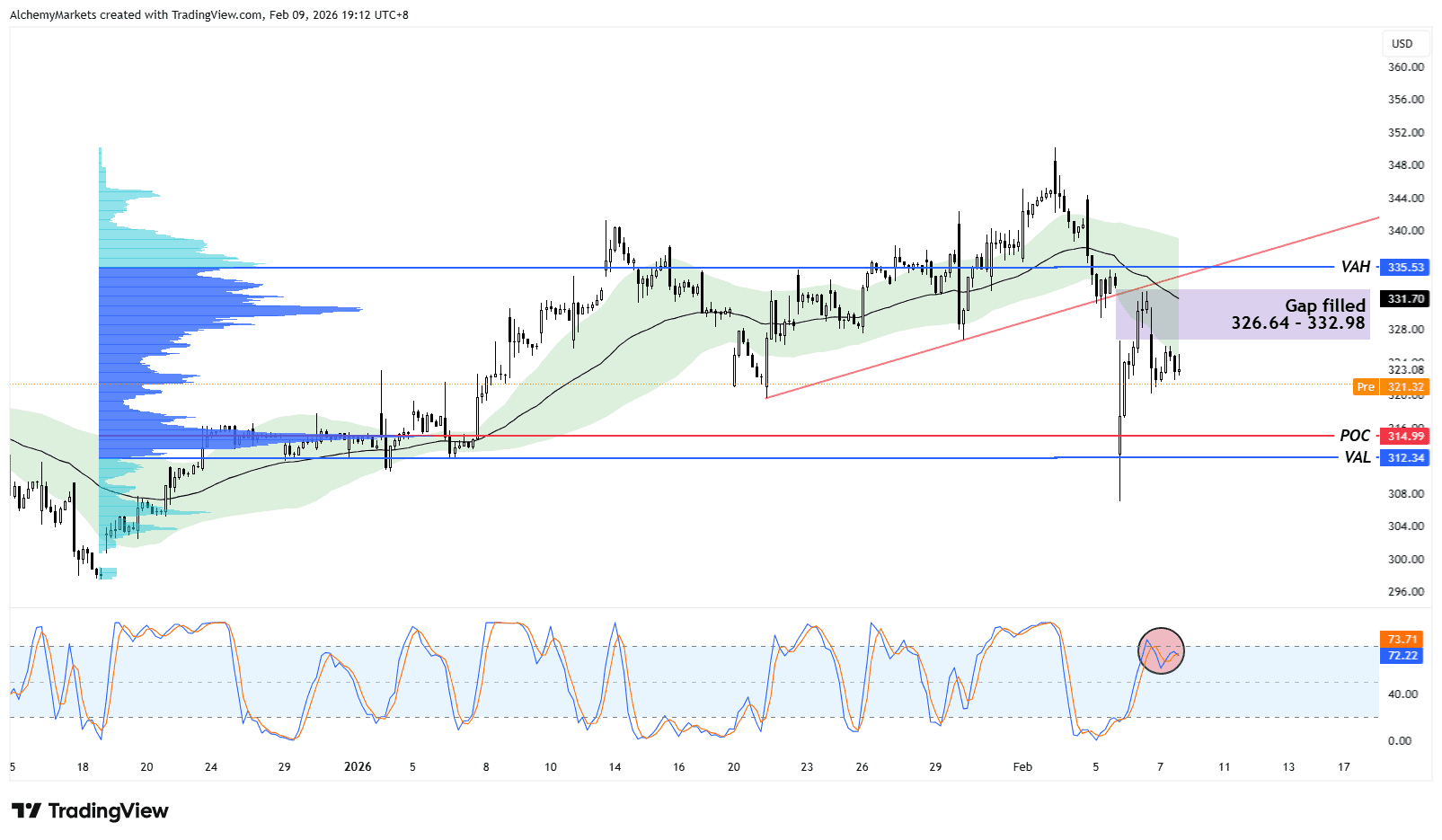

Alphabet (GOOG)

Alphabet is showing early signs of weakness following a rejection from the 1-hour 50-EMA Bollinger Band®. Price has accepted back into the rally’s fixed-range volume profile, signalling waning bullish momentum rather than a confirmed trend reversal.

The stock is also set to open lower, reinforcing the insider-selling narrative. Stochastic RSI remains overbought and has begun to roll over.

A continued pullback could see price revisit 314.99, the rally’s point of control, followed by 312.34 at the value area low, both of which previously attracted buyers. For now, the 50-EMA band should continue to act as a suppressive force on upside attempts.

XLK Technology Fund’s Bearish Alignment

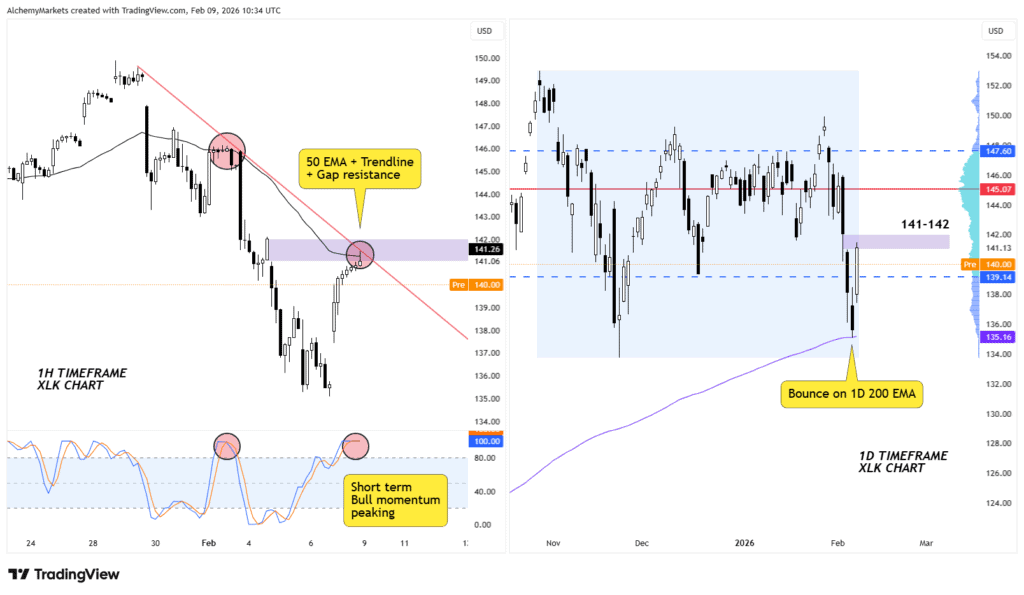

From a technical perspective, the Technology Select Sector SPDR Fund (XLK) is now testing short-term resistance.

Premarket action is leaning lower, with price capped by the 50-EMA on the 1-hour chart and a minor price gap between 141 and 142 acting as overhead pressure.

However, zooming out to the daily timeframe tells a more balanced story. XLK bounced cleanly off its daily 200-EMA last Thursday, suggesting longer-term buyers are still defending key levels.

For now, this sets up a tug-of-war between short-term distribution and higher-timeframe support, with the near-term bias favouring downside follow-through before any meaningful continuation higher.

Bottom Line

Insider activity continues to point toward late-cycle behaviour, reinforcing a rotation-driven market rather than a broad risk-off move. Technology remains vulnerable in the near term, while markets rotate to more defensive stocks and positions.