- Weekly Outlook

- October 10, 2025

- 4 min read

S&P 500 Drops Sharply as 100% China Tariff Shocks Markets – Weekly Outlook Ahead of CPI, NFP & Housing Data

Recap: Trade Tensions Trigger Market Selloff

Markets were blindsided late Friday after President Trump announced a 100% tariff on all Chinese imports starting November 1, marking a dramatic escalation in U.S.–China trade tensions.

According to Reuters and AP News, the move is a direct response to Beijing’s new export restrictions on rare earth materials — critical inputs for U.S. technology and defense sectors.

The announcement sent risk assets sharply lower:

- S&P 500 dropped over 2%, breaking its multi-month uptrend channel.

- Nasdaq plunged even further as tech stocks — heavily reliant on Chinese supply chains — took the biggest hit.

- Dow Jones fell nearly 900 points, erasing most of October’s gains.

Investors quickly rotated into safe havens, with Treasury yields dipping and the dollar firming slightly. The timing — just before a data-heavy week — amplified volatility and triggered broad risk aversion into the close.

The Week Ahead: Key Data to Watch

Next week’s economic calendar could either deepen the selloff or stabilize sentiment. Here’s what traders will be watching:

| Date | Event | Market Focus | Street Consensus / Expectations |

|---|---|---|---|

| Friday, Oct 17 | Non-Farm Payrolls (NFP) | Labor market strength, wage growth, and unemployment rate. | Consensus expects ~140K jobs added, down from 187K last month. Wage growth seen at 0.2% MoM. Weakness could stoke recession fears; strength could revive inflation anxiety. |

| Wednesday, Oct 15 | U.S. CPI (Consumer Price Index) | Inflation trajectory — key for Fed policy outlook. | Headline CPI expected to rise 0.3% MoM, core at 0.2% MoM. A hotter-than-expected reading could reignite rate-hike bets. |

| Thursday, Oct 16 | Building Permits & Housing Starts | Health of housing sector amid high mortgage rates. | Permits forecast to ease slightly to 1.42M (from 1.45M). Continued weakness would signal stress from tighter financial conditions. |

Economists at Bloomberg Economics note that this week’s inflation print “could set the tone for November’s Fed meeting,” while Reuters analysts highlight that “the NFP data will likely define whether the Fed leans dovish or keeps rates elevated through year-end.”

With tariffs now clouding the outlook, traders will be weighing whether economic resilience can offset policy-driven headwinds.

Market Technicals: S&P 500 Breaks Channel Support

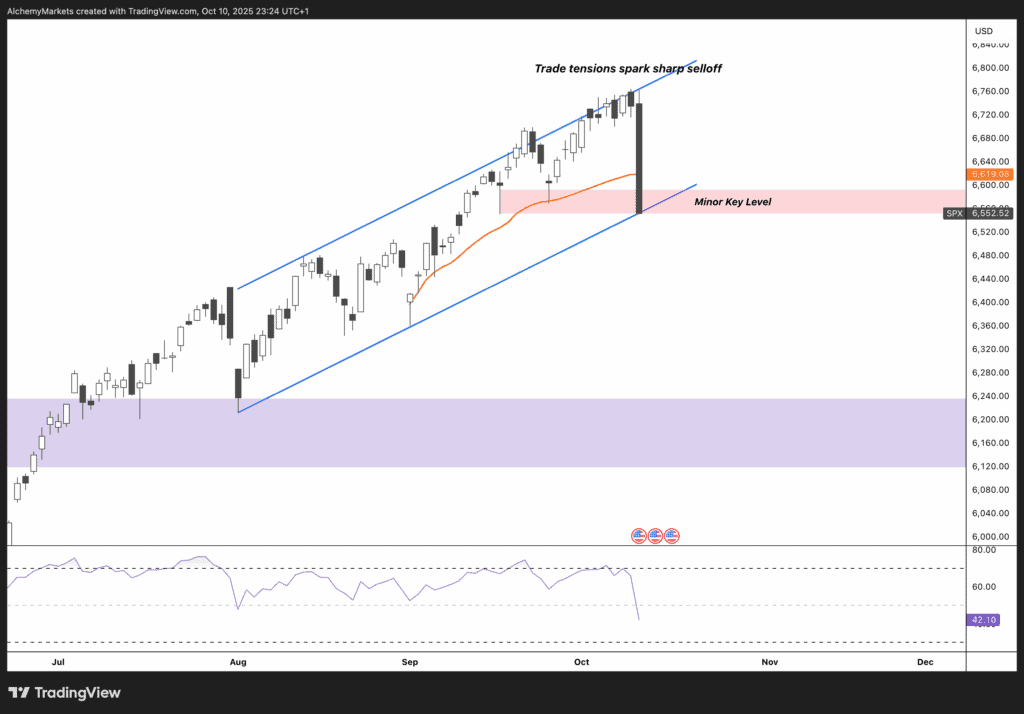

From a technical perspective, the S&P 500 (SPX) has finally cracked beneath the ascending channel that guided price action for the past four months.

- The sharp selloff on Friday produced a decisive breakout to the downside, confirming a potential trend reversal.

- The index sliced through both the channel support and the 50-day moving average (orange line) in a single session.

- The next Minor Key Level (around 6,600 – 6,620) is now the immediate support zone to watch.

- RSI momentum has dropped to the low-40s — not yet oversold, implying potential room for further weakness if fundamentals disappoint.

A sustained break below this minor support could open the door to a deeper retracement toward the 6,200-6,250 region — the previous consolidation zone from July. However, a rebound early next week (especially if CPI or NFP data comes in soft) could see SPX retest the underside of the broken channel, confirming a “retest-and-reject” structure.

Outlook Summary

- Macro Sentiment: Fragile. The tariff shock re-ignited geopolitical risk, pressuring equities while boosting demand for bonds and defensive assets.

- Economic Data: CPI and NFP will be pivotal — inflation and employment trends could either validate the selloff or trigger a relief rally.

- Technical View: The S&P 500’s break of the ascending channel shifts bias from buy-the-dip to sell-the-rally until proven otherwise.

Short-term traders should expect elevated volatility, especially around mid-week CPI data and Friday’s payrolls report. For longer-term investors, the next few sessions may clarify whether this is a healthy correction or the start of a deeper pullback driven by trade and macro uncertainty.