- Weekly Outlook

- June 28, 2025

- 4 min read

U.S. Rate Cuts, Eurozone Inflation, and Crude Oil’s Quiet Comeback

Weekly Global Outlook: What to Watch This Week

As we head into a shortened trading week due to the U.S. Fourth of July holiday, markets are anything but quiet. Investors have their eyes on interest rate expectations, key employment data, eurozone inflation numbers—and oil, which may finally be waking up from a long nap.

Let’s break down what’s ahead by region and market:

United States: All Eyes on the Fed, Employment, and Inflation

Rate Expectations: A September Cut Looking More Likely

This week’s focus for the U.S. is crystal clear: rate cuts. As trade tensions continue to cool off, financial markets are starting to believe that the Federal Reserve might move quicker than expected. Earlier, the outlook was for just two 25bp cuts—one in September and another in December. Now, we’re inching closer to the possibility of a third 25bp cut by year-end.

Some Fed officials, like Kevin Warsh and Michelle Bowman, are even hinting at a potential cut as soon as July. But others are staying cautious. Their concern? The price hikes caused by tariffs might be short-term noise. They want to be sure inflation won’t stick around longer than it should before making any big moves.

Employment Data (Thursday): Holding Steady for Now, but Storm Clouds Ahead

The Fed doesn’t just look at inflation—it also keeps a close eye on jobs. That’s why this week’s employment numbers matter. Expectations are for a decent showing, with around 100,000 new jobs added. Sounds good on the surface, right?

But dig a little deeper, and cracks start to show. Job vacancy numbers are dipping. Business hiring surveys are slowing. Jobless claims are rising. If that trend continues into the summer months, we could be looking at softer data from July to September. And that might push the Fed to act sooner—cutting rates in September and possibly again in October and December.

Eurozone: Prices Rising, Jobs Resilient

Inflation Data (Tuesday): A Modest Uptick Expected

Inflation in the eurozone has been tame lately—too tame, in fact, which is why the European Central Bank already cut rates to 2%. This month, however, we might see a slight uptick. Why? Oil prices are creeping higher, and we’re starting to see that at the pump.

Services inflation in May was unusually soft, so June might bounce back a little. Still, with economic growth slowing, any price increases are expected to stay limited in the near term.

Unemployment (Wednesday): Southern Europe Leading the Charge

Unemployment across the eurozone remains low, especially in the south. Spain, Italy, Greece, and Portugal are seeing solid job growth, which is helping to offset weakness in northern economies like Germany and the Netherlands. As a result, the eurozone-wide unemployment rate is expected to stay in the low 6% range.

Chart of the Week: U.S. Oil (WTI)

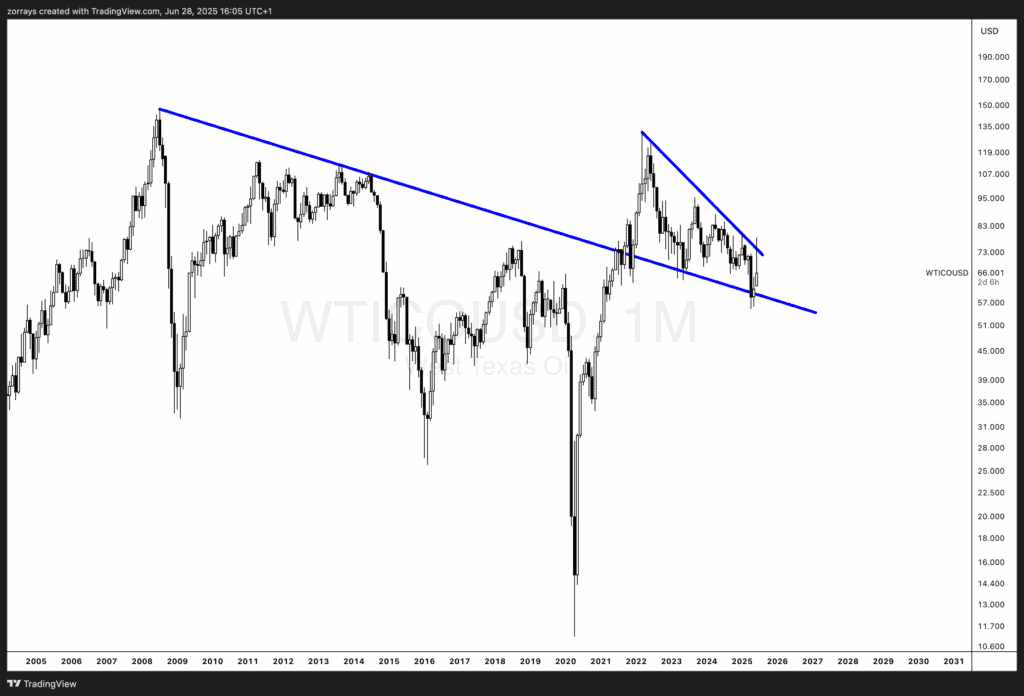

Looking at the monthly chart of WTI crude oil, we’re sitting at an interesting crossroads.

After breaking above a major long-term trendline that’s capped price since the 2008 peak, oil has since pulled back — and now, that same trendline is acting as key support. Technically, price is compressing into a wedge or triangle formation. The range is narrowing, the swings are getting smaller, and typically, this sort of tightening leads to expansion — a breakout.

But what gives this setup real weight is how the fundamentals are lining up beneath the surface.

- Supply side pressure is building. U.S. inventories are being drawn down week by week, and rig counts — a forward-looking supply gauge — are starting to trend lower.

- Geopolitical risks remain elevated, which historically supports oil prices when tensions rise.

- And interestingly, positioning data shows traders are still very underexposed to oil—suggesting that if price starts moving higher, there’s plenty of fuel for a strong move as money re-enters the space.

From a macro-technical lens, WTI is sitting just above the confluence of long-term trendline support and horizontal structure around the $65–$67 zone. This area may act as a springboard if bulls step in.

If the price breaks below the wedge, it could suggest deeper economic worries are gaining traction — like fading global demand or recessionary pressures. But if it holds and turns up from here, it may mark the start of a new uptrend, quietly supported by tightening supply and overly bearish sentiment.

Keep an eye on this chart — it could be telling us something about broader market sentiment and economic resilience long before the headlines do.