- Weekly Outlook

- March 21, 2025

- 3min read

Post-Fed Market Outlook: Consumer Trends, UK Policy, and SPX Technical Levels

United States: Consumers in the Spotlight Amid Growing Concerns

Consumer Sentiment – Tuesday, March 18

This week kicks off with a focus on U.S. consumer sentiment and spending data. Recently, households have grown increasingly cautious. Worries are rising over:

- Government spending cuts that could affect jobs and entitlements.

- Potential tariffs that may drive up prices and pinch household budgets.

- Falling equity markets, adding to the nervousness about economic stability.

This combination is making consumers more hesitant, fueling fears about the broader economic outlook.

Inflation & Personal Spending – Friday, March 22

Despite softer consumer sentiment, Fed Chair Jerome Powell remains calm. He emphasized that sentiment data has not been a reliable indicator of actual consumption lately, and there’s no rush to change monetary policy.

All eyes will be on February’s personal spending report. January saw a decline:

- –0.2% MoM in nominal terms.

- –0.5% MoM in volume terms.

However, the forecast for February looks more positive:

- +0.7% MoM (nominal).

- +0.4% MoM (volume).

Still, economists warn that consumer spending may soften in the months ahead. If it does, this could pave the way for a potential Fed rate cut in September.

United Kingdom: Inflation and Fiscal Policy in Focus

Inflation Update – Wednesday, March 20

The UK’s headline CPI (Consumer Price Index) is expected to dip slightly this week. But the broader trend for 2025 remains upward. Key drivers include:

- Energy prices are no longer pulling inflation down.

- CPI may peak close to 4% by the second half of the year.

- Services inflation is likely to show gradual improvement.

February’s data may show a modest decline, but spring could bring more noticeable progress.

Spring Budget Statement – Wednesday, March 20

Chancellor Jeremy Hunt is expected to deliver a cautious Spring Statement. With rising debt interest costs, the Treasury is under pressure to identify savings and stay within fiscal rules.

Key takeaways:

- The upcoming changes will likely have minimal short-term impact on the economy and the Bank of England.

- However, they do set the stage for tougher decisions in the Autumn, including potential tax increases later in the year.

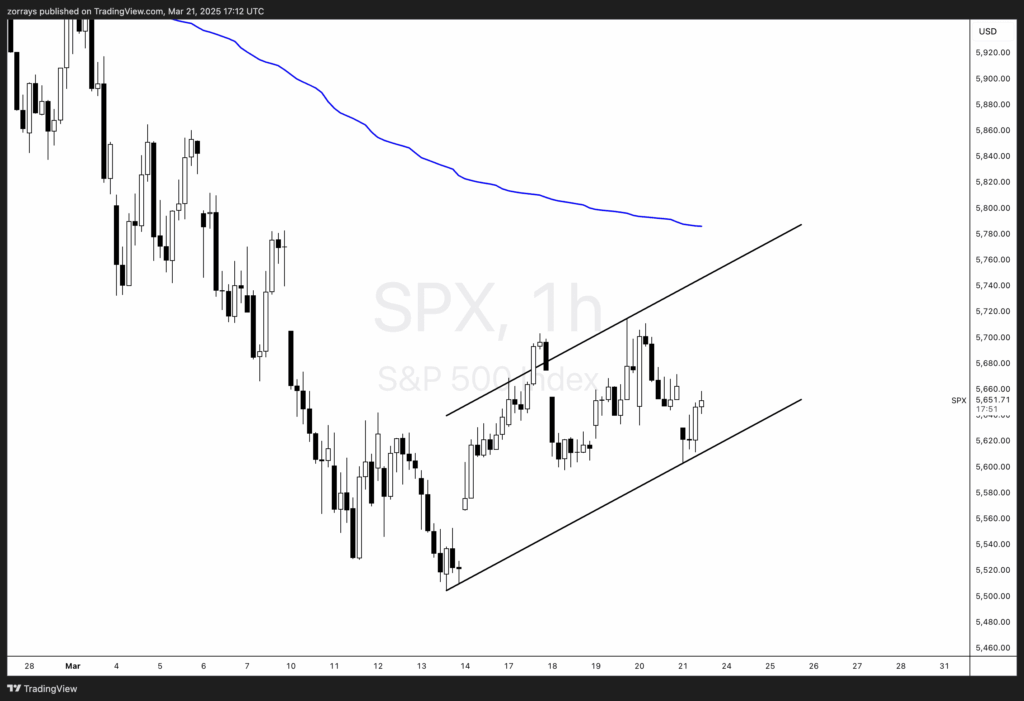

SPX 1H Chart Analysis – Post-Fed Price Action

As we move into the post-Fed trading environment, we can see that SPX is attempting to push towards the upper boundof the ascending channel. The market is showing signs of a potential continuation of this short-term uptrend, with buyers stepping in near the lower boundary of the channel.

A key level to watch is the VWAP line (blue), which is positioned above the current price. This could act as a magnet for price action, especially if momentum continues to build.

If SPX maintains strength and follows this trajectory, we could see further upside testing around 5,750–5,780. However, a rejection at the VWAP or upper channel resistance could bring another retest of lower support levels. Keep an eye on price reactions as we approach these key technical zones.