- Weekly Outlook

- May 31, 2025

- 3 min read

Key US & ECB Decisions, ISM Reports, and EUR/GBP Breakout Watch

U.S. Economic Landscape: Navigating a Soft Landing

The U.S. economy continues to exhibit signs of a soft landing, characterized by moderating inflation, a resilient labor market, and steady GDP growth. April’s inflation rate eased to 2.3%, the lowest since February 2021, aligning closely with the Federal Reserve’s 2% target. The unemployment rate remained steady at 4.2%, with the economy adding 177,000 jobs in April, surpassing expectations .

Consumer spending showed signs of deceleration, with retail sales growth slowing to 0.1% in April from 1.7% in March.Consumer confidence also declined, with only 15.7% of consumers expecting business conditions to improve, down from 17.8% in March . Manufacturing activity contracted, as indicated by the ISM Manufacturing PMI falling to 48.7 in April .

Despite these mixed signals, the Federal Reserve maintained the federal funds rate at 4.25%–4.50% in May, adopting a cautious approach amid economic uncertainties . The overall outlook suggests a gradual slowdown in growth without tipping into a recession.

Key Economic Events This Week

Monday, June 2 – ISM Manufacturing PMI (May)

The ISM Manufacturing PMI for May is scheduled for release, with expectations set at 48.7, indicating continued contraction in the manufacturing sector . This would mark the second consecutive month below the 50 threshold, signaling a slowdown in manufacturing activity.

Wednesday, June 4 – ISM Non-Manufacturing PMI (May)

The ISM Non-Manufacturing PMI, reflecting the services sector, is anticipated to show a reading of 52.0 for May, up from 51.6 in April . A reading above 50 indicates expansion, suggesting resilience in the services sector despite broader economic uncertainties.

Thursday, June 5 – ECB Interest Rate Decision

The European Central Bank (ECB) is widely expected to cut its key deposit rate by 25 basis points to 2.00% during its meeting on June 5 . This would mark the eighth consecutive rate cut, aimed at stimulating economic growth amid easing inflation and weak economic activity. However, internal divisions within the ECB suggest a cautious approach moving forward, with some policymakers advocating for a pause in rate cuts until at least September.

Friday, June 6 – U.S. Nonfarm Payrolls (May)

The U.S. Nonfarm Payrolls report for May is expected to show an increase of 130,000 jobs, down from the 177,000 added in April . The unemployment rate is projected to remain steady at 4.2%. This data will be closely watched for indications of labor market strength and potential implications for monetary policy.

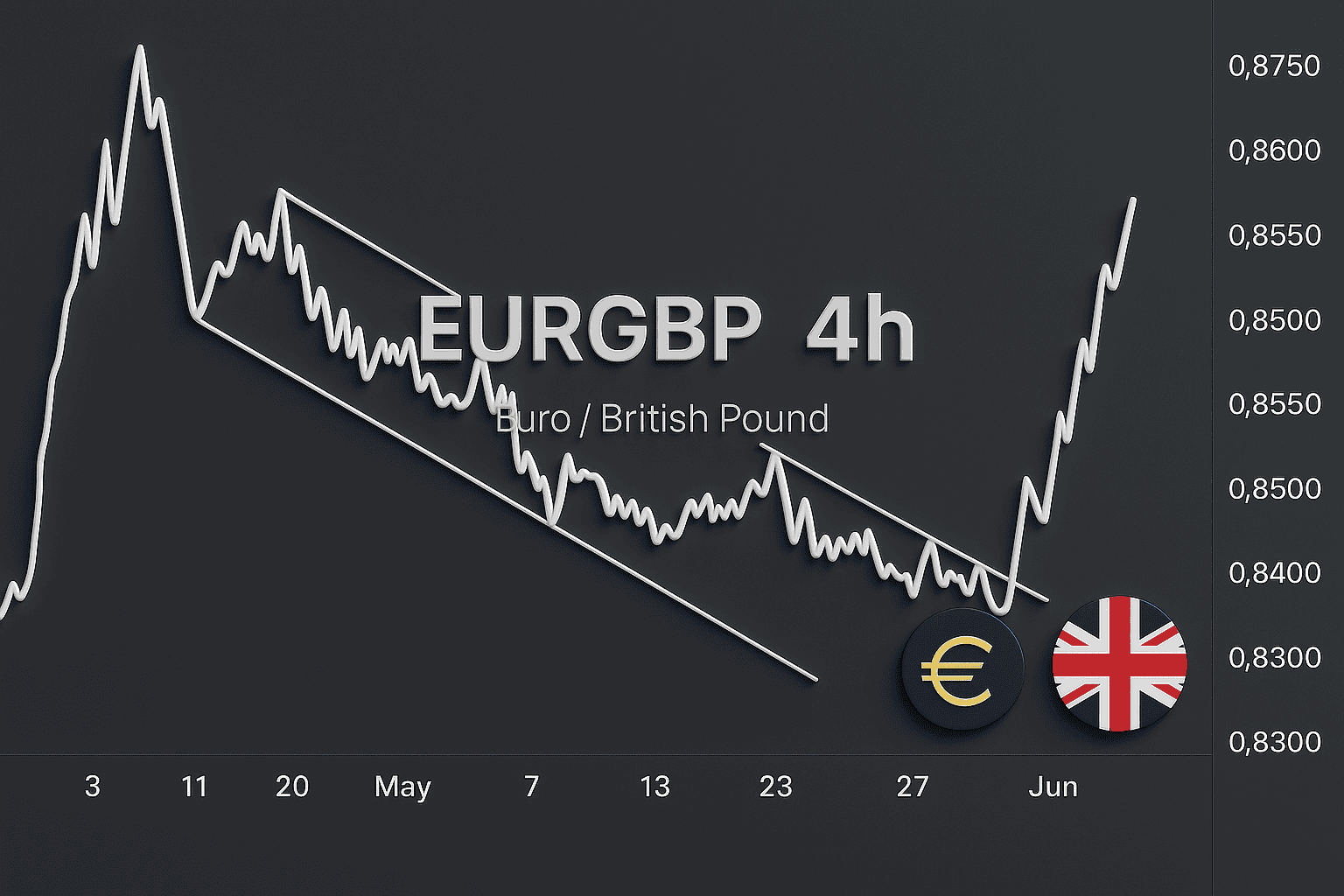

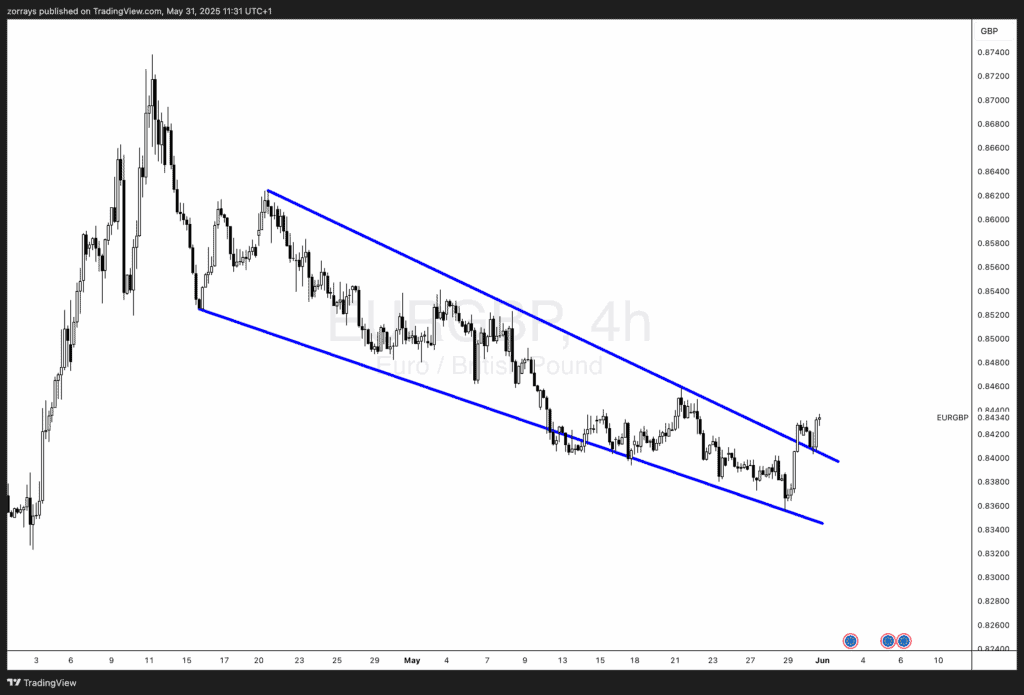

Chart of the Week: EUR/GBP Breaks Multi-Week Trendline

The EUR/GBP currency pair has recently broken out of a multi-week descending trendline and successfully retested it, signaling potential euro strength against the British pound. This technical breakout suggests a shift in market sentiment, possibly driven by differing monetary policy trajectories between the ECB and the Bank of England.

The ECB’s anticipated rate cut contrasts with the Bank of England’s recent decision to maintain its key interest rate at 4.25%, despite calls from some policymakers for a sharper cut amid economic uncertainty . This divergence in policy approaches may contribute to further euro appreciation against the pound in the near term.