- Quarterly Forecast

- June 29, 2024

- 7 min read

SPX, NQ, DJIA, DAX, FTSE 100: STRONG Q2, CAUTIOUS Q3 AHEAD

Q3 Forecasts – What’s Included:

- S&P 500

- NASDAQ

- Dow Jones Industrial Average

- DAX

- FTSE 100

Macro Summary

- Market Performance: The S&P 500 (SPX) saw modest gains in Q2 2024, primarily driven by the technology sector, despite initial market stagnation due to fading hopes for aggressive Federal Reserve rate cuts.

- Inflation Trends: Inflation decelerated in both the U.S. and Eurozone, providing a supportive backdrop for equity markets. U.S. inflation fell without significant economic damage, termed “immaculate disinflation”.

- Federal Reserve and ECB Policies: Early expectations for significant rate cuts diminished, tempering market enthusiasm. However, the ongoing decline in inflation rekindled hopes for at least one rate cut by year-end in both regions.

- Sector Performance: The technology sector continued to drive market performance, particularly in the S&P 500 and Nasdaq indices, with innovations in AI and strong earnings expectations shifting towards positive investor sentiment.

- Top and Lagging Indices: The Nasdaq (NQ) led with notable gains, while the S&P 500 posted modest returns. The DAX outperformed other European indices, whereas the Dow Jones (DJIA) lagged, reflecting broader market caution amid mixed economic signals.

S&P 500

Technical Analysis

The S&P 500 (SPX) is experiencing a strong upward surge, potentially heading into a significant Fibonacci based resistance between the 5661 – 5853 zone. According to Elliott Wave Theory, this upward movement represents the third wave in an impulsive cycle. Once this wave completes, a correction is expected, which would likely form the fourth wave. After the correction, the market could see another upward move into the fifth wave. However, predicting the exact height of this next wave is challenging due to market complexities and varying influences.

Factors Driving Price Up: The S&P 500’s recent rally has been supported by robust earnings growth, particularly in the technology sector. Companies like Nvidia, Amazon, and Meta have shown substantial gains, with Nvidia’s stock soaring due to high demand for AI chips.

Furthermore, economic data has been stronger than anticipated, with the U.S. economy growing at an annualised rate of 3.3% in the fourth quarter of 2023. This growth, combined with cooling inflation, has led to optimistic market expectations for continued economic strength and potential interest rate cuts by the Federal Reserve.

Potential Stalling Factors: Conversely, the market could face headwinds if inflation data fails to decline as expected. If the Federal Reserve perceives inflation as stubborn, it may delay rate cuts, which could dampen market enthusiasm.

Additionally, any unexpected economic slowdowns or negative earnings surprises from major companies could also stall the market’s upward momentum. A less confident Fed, concerned about persistent inflation, might refrain from reducing rates, which could lead to a market pullback.

NASDAQ

Technical Analysis

The Nasdaq (NQ) has been climbing within an ascending channel and has recently broken out, indicating a rapid surge in price, characteristic of the third wave in an Elliott Wave cycle. This breakout suggests the market is experiencing a strong bullish phase, often seen in wave 3 of (3). Looking ahead, the next quarter could see the completion of wave 3, followed by a potential correction into wave 4. However, predicting the exact peak of this movement is challenging as the price is in uncharted territory.

Factors Driving Price Up: The factors driving the NQ’s current upward momentum are similar to those influencing the S&P 500. The primary drivers include robust earnings growth in the technology sector, cooling inflation, and strong economic data. The expectation of potential Federal Reserve interest rate cuts, due to lower inflation rates, is bolstering investor confidence and driving the market higher.

Potential Stalling Factors: Conversely, if inflation data does not continue to decline as expected, the Federal Reserve may delay or reduce the extent of rate cuts, which could stall the NQ’s rise. Any signs of economic slowdown or negative earnings surprises from major tech companies could also hinder further gains.

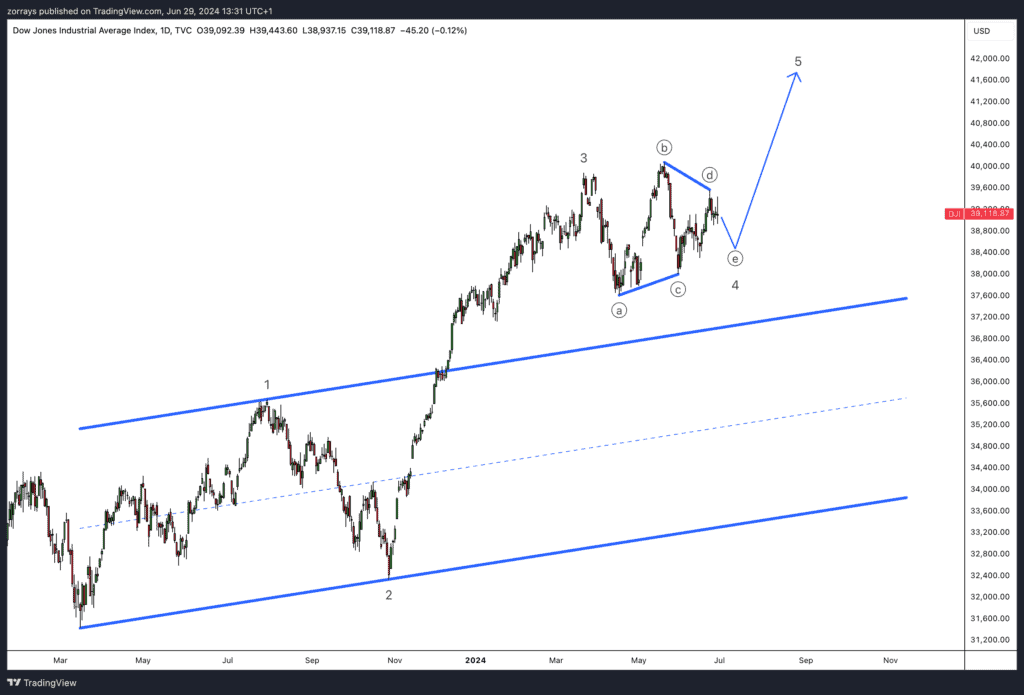

Dow Jones Industrial Average

Technical Analysis

The Dow Jones Industrial Average (DJIA) has entered a sideways consolidation phase, forming a wave 4 triangle pattern. This phase involves price action unfolding within the bounds of waves A through E. Currently, the DJIA is developing wave E, which needs to complete before a potential breakout to the upside. This breakout, marked by the completion of wave D, is expected to launch the DJIA into wave 5, targeting higher price levels.

Factors Driving Price Up: The macroeconomic factors influencing the DJIA are consistent with those impacting the S&P 500 and Nasdaq. Positive drivers include continued cooling of inflation, which could lead to anticipated Federal Reserve interest rate cuts, thus providing a favourable environment for equity markets. Strong corporate earnings, particularly in key sectors, and robust economic data are also supporting market sentiment.

Potential Stalling Factors: However, potential stalling factors include the possibility of inflation not declining as expected, which could cause the Fed to delay or minimise rate cuts. Additionally, any signs of economic slowdown or disappointing earnings reports from major companies could weigh on the index, leading to further consolidation or downward movement.

DAX

Technical Analysis

Since the start of Q2 2024, the DAX index has decreased by just under 2.5%. Despite this overall decline, the index managed to reach a new high, climbing over 7% before dropping by 5%. Currently, the DAX is in a corrective phase, and it is crucial for this correction to conclude above the 17,626 support area. Should the index fall below this level, the correction could deepen significantly. Post-correction, the expectation is for the DAX to form a new high as it moves into Q3 2024.

Factors Driving Price Up: The potential for the DAX to rise includes continued improvements in economic indicators such as GDP growth and industrial output in the Eurozone. Positive earnings reports from major German companies and easing inflation rates could also bolster investor confidence. Additionally, if the European Central Bank (ECB) signals potential rate cuts in response to cooling inflation, this could provide further upward momentum for the DAX.

Potential Stalling Factors: Conversely, the DAX may face downward pressure if inflation remains stubbornly high, causing the ECB to delay rate cuts. Economic slowdown or disappointing earnings results from key sectors like manufacturing and automotive could also contribute to further declines. Persistent geopolitical uncertainties or disruptions in supply chains could exacerbate market scepticism, leading to a deeper correction.

FTSE100

Technical Analysis

In Q2 2024, the FTSE 100 (UKX) experienced a significant surge, particularly notable until May. Since then, the index has entered a corrective phase, which is likely to develop into a sideways correction characteristic of a wave 4 pattern. This correction typically retraces around 38.2% of the preceding wave 3, aligning with the 8,065 level in this case. As long as the price remains above 7,762 invalidation level, the extreme of wave (i) in this impulsive cycle, we can expect a sideways movement throughout Q3 2024, followed by a potential surge to new highs.

Factors Driving Price Up: The FTSE 100 could see upward momentum driven by continued improvements in the UK economy, which has recently emerged from a recession. This economic recovery has allowed the Bank of England (BOE) to adopt a more relaxed stance regarding interest rate cuts. As the UK progresses towards its inflation target of 2%, investor confidence could increase, supporting further gains in the index. Positive corporate earnings and stable economic growth would also bolster the market.

Potential Stalling Factors: Conversely, the index could face challenges if inflation remains higher than expected, prompting the BOE to delay or reconsider rate cuts. Any signs of economic slowdown or disappointing corporate earnings could also hinder further gains. Additionally, persistent geopolitical uncertainties or adverse developments in global markets could exacerbate market volatility and lead to deeper corrections.

You might also be interested in: