- Quarterly Forecast

- September 29, 2025

- 4 min read

Q4 2025 Market Outlook: S&P 500 Mildly Bullish, Nasdaq Driven by AI, Dow & FTSE Face Correction Risks

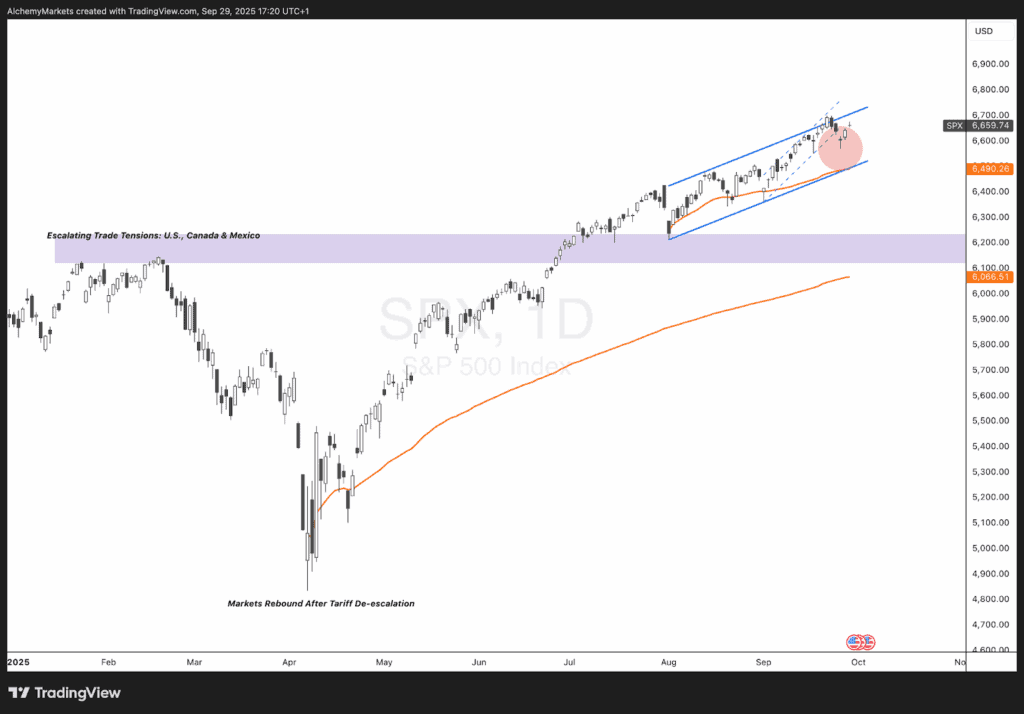

S&P 500 (SPX) – Mildly Bullish but Correction Risk is Rising

The S&P 500 pushed higher into late Q3 but was rejected at channel resistance. Short-term, the index is leaning corrective, though the anchored VWAP from summer lows is still acting as support.

Why we’re mildly bullish:

- U.S. growth has slowed, but AI investment and services demand are still carrying the economy.

- Fed easing is in motion, and markets now expect more cuts into 2026 — this supports valuations.

- Earnings have been modest but consistent, with breadth slightly improving beyond mega-caps.

What can flip this into a correction:

- Sticky services inflation that forces the Fed to stay cautious.

- Higher yields at the long end pressuring multiples.

- Margins squeezed by wages, tariffs, and energy.

Levels to watch:

- Support: 6,200 (anchored VWAP + 200-day). Break here = deeper correction.

- Resistance: A clean break back above 6,700 reopens upside momentum possibly up to 7,200..

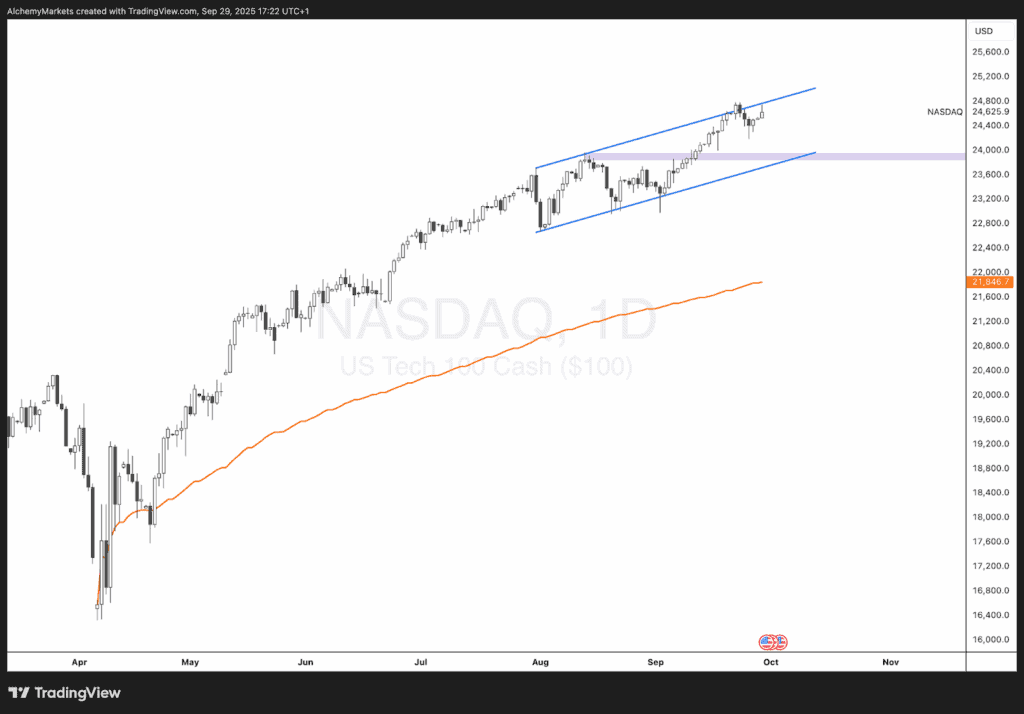

NASDAQ-100 (NDX) – AI Still Driving the Tape

The NASDAQ has been the clear leader in 2025. After a strong run, it’s now consolidating, pulling back toward 24,000 support, which aligns with the anchored VWAP.

Why we think it can bounce:

- AI spending is real — corporates continue to pour capital into AI infrastructure, directly supporting GDP and tech earnings.

- Unlike other indices, returns here are earnings-led, not just valuation-driven.

- The tech sector has shown resilience in every earnings season this year.

Risks to this view:

- If 22,800 breaks, downside opens to a deeper correction, possibly to anchored VWAP.

- Over-concentration in mega-cap tech means any earnings miss could weigh heavily.

Levels to watch:

- Support: 22,800 (anchored VWAP + shaded zone).

- Resistance: Breakout above 24,600 reopens a run into year-end highs.

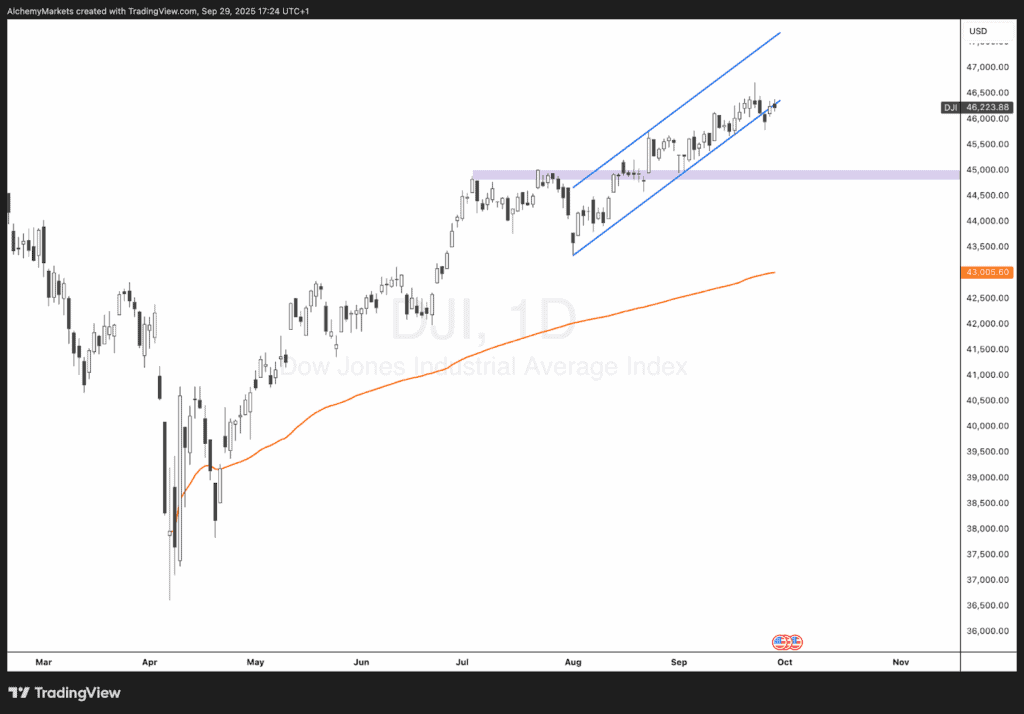

Dow Jones Industrial Average (DJI) – In Correction Mode

The Dow lagged Q3, reflecting its heavier weight in industrials, energy, and financials. It has now broken below its rising channel, pointing to a short-term correction.

Why we’re cautious here:

- The Dow is more cyclical and trade-sensitive. Tariffs, a strong USD, and slowing global demand are clear risks.

- Long-end yields weigh more on these sectors than on tech.

- Earnings growth is modest, with less AI uplift compared to SPX/NDX.

Levels to watch:

- Support: 45,000 (anchored VWAP + round number support). Below that, 43,000 anchored VWAP support is next.

- Resistance: Needs to reclaim 46,200 to stabilise the structure.

View: Short-term correction likely into 45,000, where buyers may step back in.

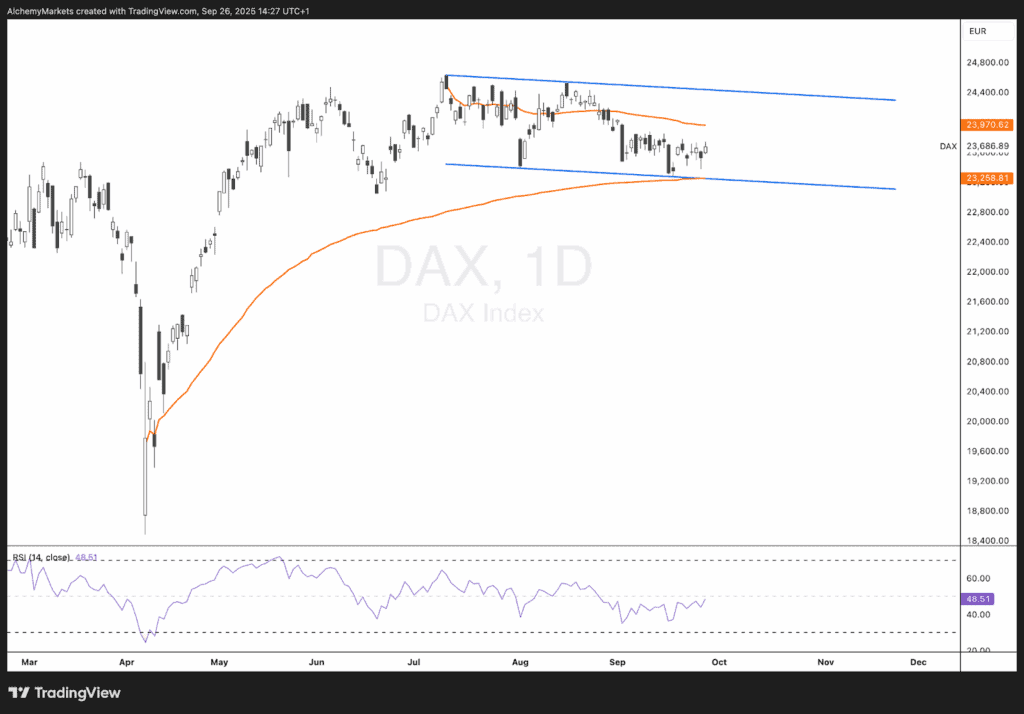

Germany: DAX – Flag Pattern Defines Q4

The DAX is coiling inside a flag pattern. For now, price is supported by the anchored VWAP from April lows (~23,250). A breakdown here could accelerate the correction.

Why we’re neutral for now:

- Growth in Europe is stabilising but fragile, with PMIs mixed.

- The ECB has shifted to an easing bias, but can’t move aggressively with inflation still above target.

- DAX earnings remain tied to autos, chemicals, and industrials, all sensitive to China demand and energy costs.

Risks:

- Energy shocks (gas or oil) into winter.

- Stronger EUR, hurting exporters.

- China demand rolling over.

Levels to watch:

- Support: 23,250 anchored VWAP — a break risks downside toward 20,800.

- Resistance: Breakout above 24,000–24,200 would confirm a bullish flag resolution into possibly 26,500..

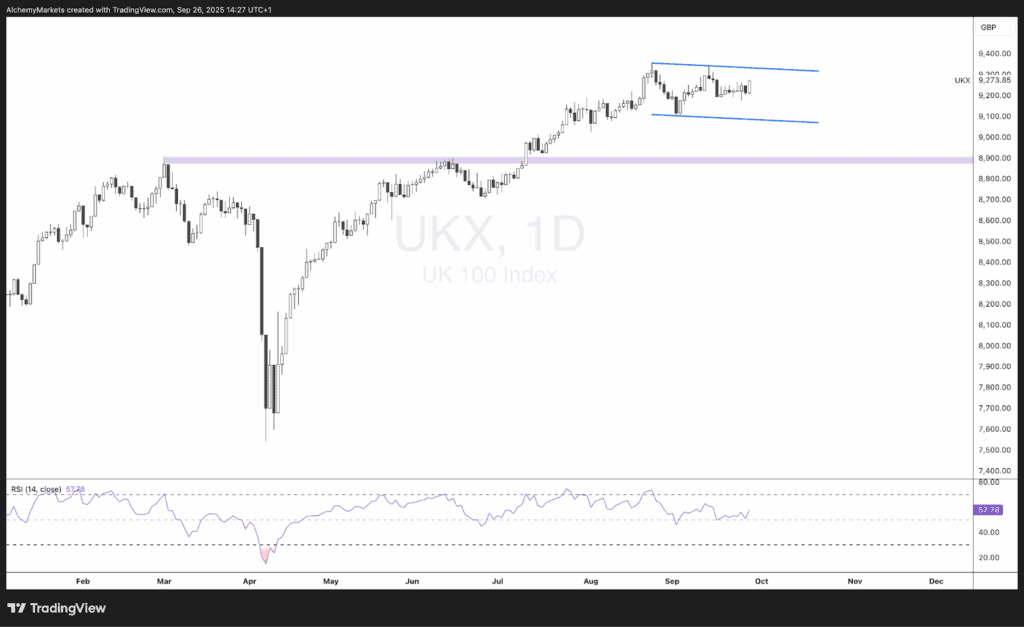

United Kingdom: FTSE 100 – Topping Risk is Building

The FTSE 100 is trading near 9,250, consolidating after a strong run from April lows. But the chart is showing signs of topping, and momentum is fading.

Why correction risk is rising:

- Inflation is stickier in the UK than elsewhere, forcing the BoE to stay cautious.

- UK households face real income pressure from mortgages and wages, which drags on consumption.

- Fiscal space is limited ahead of the Autumn Statement.

But here’s what could keep it supported:

- Energy & commodities: As long as oil and metals stay firm, miners and energy majors support earnings.

- Dividend yield: The FTSE’s yield premium over U.S./Europe keeps attracting flows.

- Defensives: Staples and healthcare cushion downside in risk-off phases.

Levels to watch:

- Resistance: 9,300–9,350 – if breaks we can see price travel to 10,000.

- Support: 8,900 (prior breakout zone) — if this breaks, a correction into 8,500 is likely.

Cross-Market Takeaways for Q4

- U.S. remains leader (NDX > SPX > Dow) thanks to AI and earnings strength.

- Europe is range-bound, with DAX at risk of breakdown if energy shocks hit.

- FTSE looks heavy — dividend yield and commodities help, but topping risk is clear.

- Rates and USD remain the big swing factors: higher yields or stronger dollar could weigh on all non-tech indices.