- Quarterly Forecast

- October 1, 2024

- 6 min read

Q4 2024 Equities Outlook: Navigating Volatility, Rate Cuts, and Global Growth Trends

Brief Breakdown of Q3 2024

• Market Volatility: Q3 saw increased volatility driven by concerns over a potential economic slowdown and the Federal Reserve’s monetary policies.

• Investor Sentiment: Fears arose around whether the Fed was adequately addressing inflation, which led to market corrections and investor uncertainty.

• Sector-Specific Recessions: The economy experienced rolling recessions in sectors like technology and housing, contributing to market instability.

• Stock Market Resilience: Despite short-term volatility, the fundamentals of the stock market remained strong, allowing equities to rebound.

• Profit Margins Normalising: Profit margins across various sectors showed signs of recovery, suggesting a return to more normal market conditions post-COVID.

• Opportunities for Investors: Market resets and corrections during Q3 presented opportunities for investors to acquire fundamentally strong stocks at attractive prices.

Fundamental Outlook for Q4 2024

1. Market Volatility and Opportunity

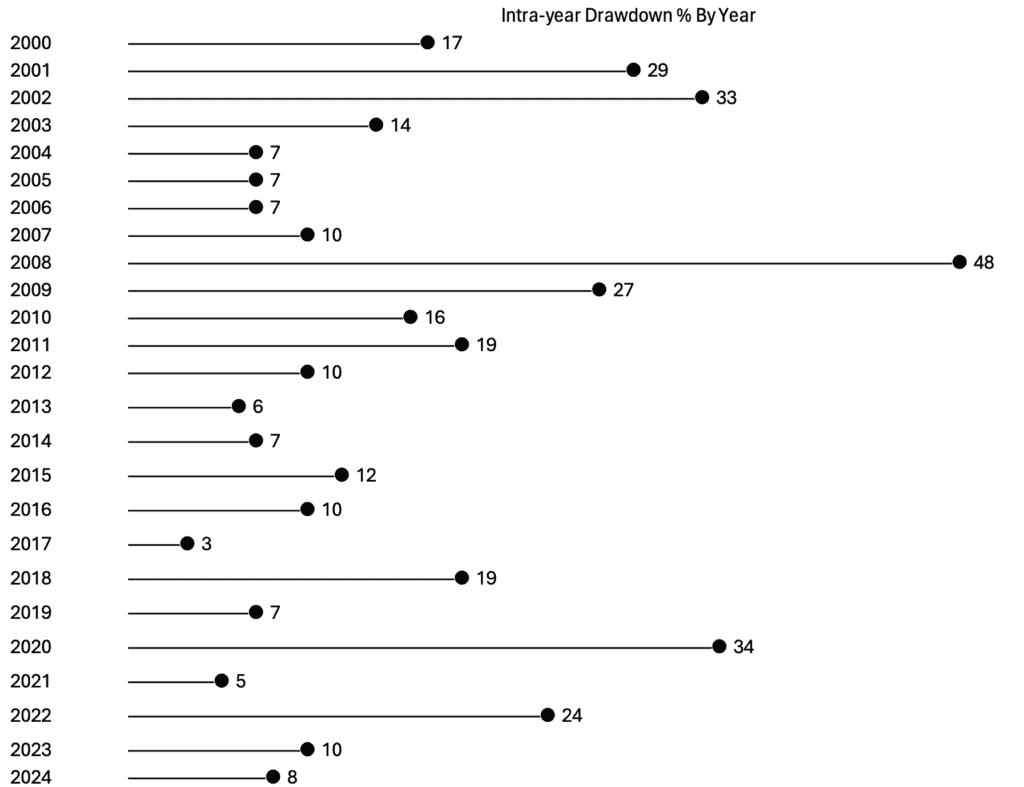

Source: Bloomberg

Volatility will continue to be a key theme as we move into Q4 2024. Historical data shows that market corrections of 10% or more occurred 12 times in the past 24 years, with intra-year drawdowns ranging from 3% to as high as 48%. Despite these frequent corrections, the S&P 500 has consistently delivered an average annual return of 11% over the same period. For investors with strong conviction and a long-term perspective, volatility presents opportunities to acquire high-quality stocks at discounted prices.

2. Federal Reserve Rate Cuts and Market Response

One of the most important factors in Q4 2024 will be the Federal Reserve’s rate cut strategy. Historically, equity markets respond favourably to rate cuts, particularly when such cuts are not accompanied by a recession. Large-cap stocks have typically outperformed small caps following rate cuts, offering an attractive opportunity for investors.

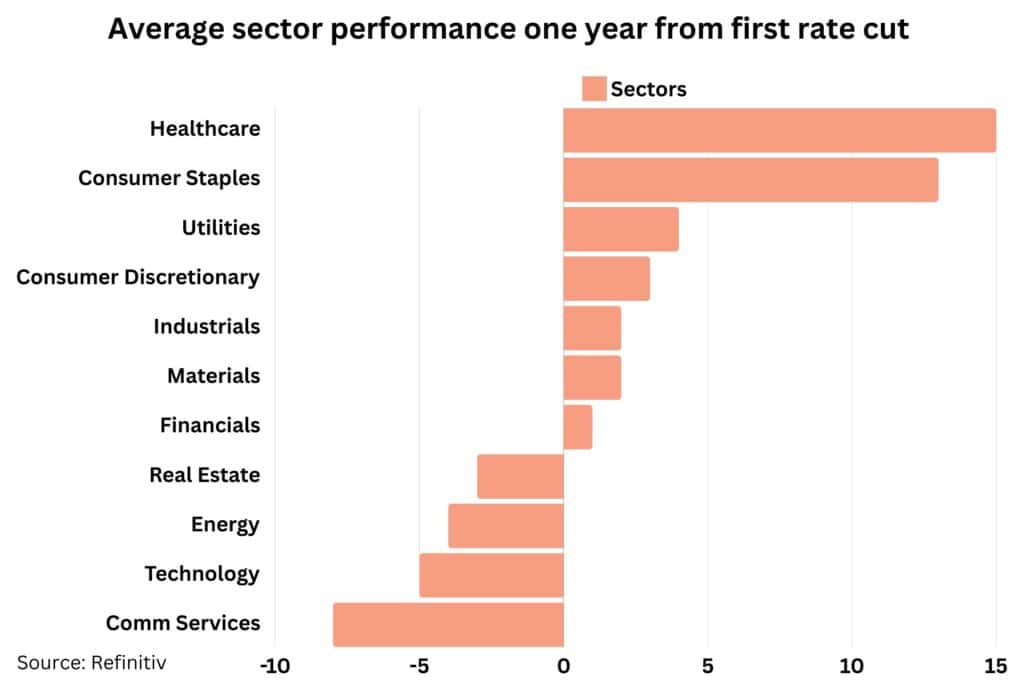

3. Sector Opportunities Post-Rate Cut

Certain sectors stand out as potential winners in the wake of rate cuts. Historically, healthcare and consumer staples have emerged as top performers in the year following the first rate cut of a cycle, both boasting a high “hit rate” of 83% and positive returns. Extending the outlook to two or three years post-cut shows a broader recovery, with cyclicals like financials also starting to gain traction.

4. Long-Term Equity Resilience

Over the long run, equities have proven remarkably resilient, even through periods of significant political, economic, and social upheaval. From presidential elections to major geopolitical events, the stock market has continuously adapted, rewarding investors who remain patient.

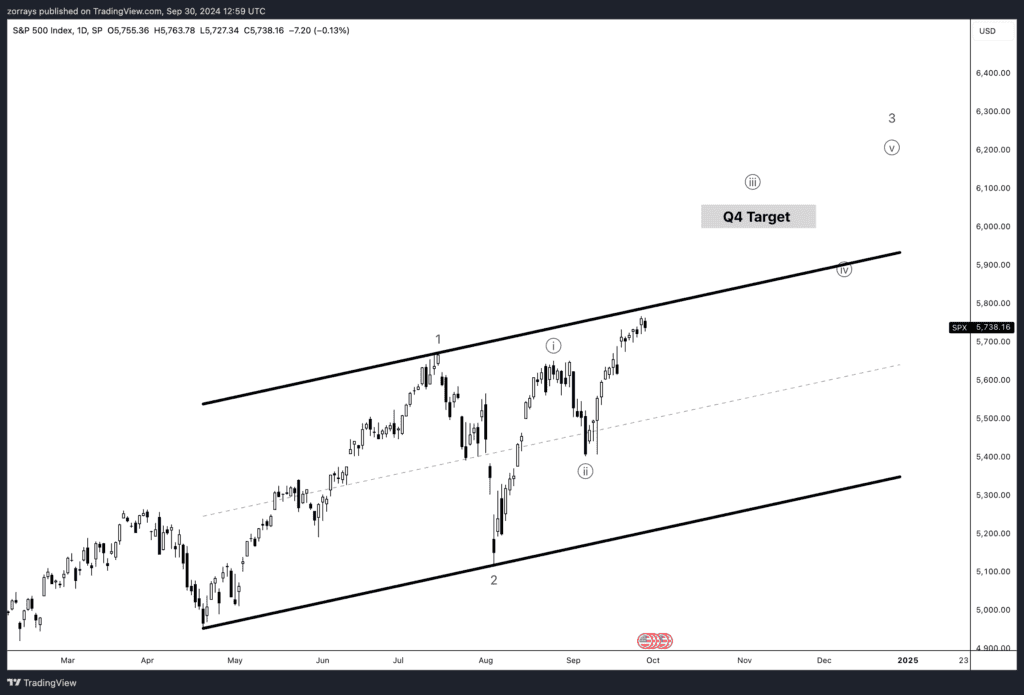

S&P 500

As we enter Q4, the market continues to align with our Q3 outlook, maintaining an upward trajectory. Our primary count suggests that the broader market is showing impulsive behaviour to the upside. This strength has been supported by the Fed’s recent rate cut, but attention has now shifted to the upcoming election and its potential market impact. There is still uncertainty surrounding whether the economy has experienced a soft or hard landing, with most signs pointing to a soft landing. However, speculation remains around the job market and its ongoing resilience.

Our initial target is set at 6,000. To confirm this move, the price needs to break above the upper bound of the current ascending channel, which would solidify the case for further upside and confirm that this is an impulsive move rather than corrective.

Alternatively, we could see the S&P 500 move sideways if upcoming economic data is weaker than expected, leading to renewed uncertainty in the market. In such a case, we may see a pause in the upward momentum as the market processes this data.

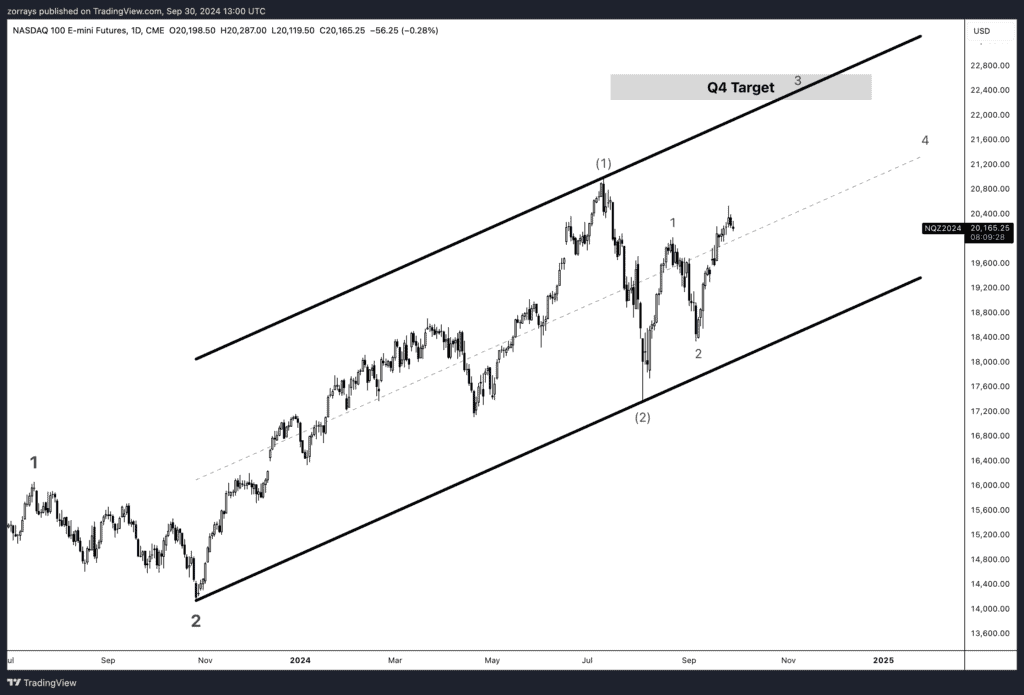

NASDAQ

The NASDAQ remains more sensitive to economic cycles compared to other indices, as it tends to grow significantly during expansion phases but is more vulnerable during recessions. As a result, we approach forward-looking projections with caution. Both the NASDAQ and S&P 500 are highly sensitive to interest rate movements, but the NASDAQ is more acutely impacted due to the nature of the companies it hosts. Technology and growth stocks derive much of their value from future earnings, which are discounted more heavily when interest rates rise, reducing their present value. In times of rising inflation and central bank action, this can lead to larger declines in NASDAQ valuations.

Currently, the NASDAQ is unfolding a series of 1-2, 1-2 in the world of Elliott Wave Theory, signalling potential upward momentum. However, we remain cautious given the possibility of a wave 4 correction as we approach the elections. Monitoring job and earnings data will be critical in determining whether this corrective phase materialises.

Our ideal scenario is seeing the price break the upper bound of the ascending channel, which would confirm we are in a wave 3 impulse, solidifying a more bullish outlook for the remainder of the year.

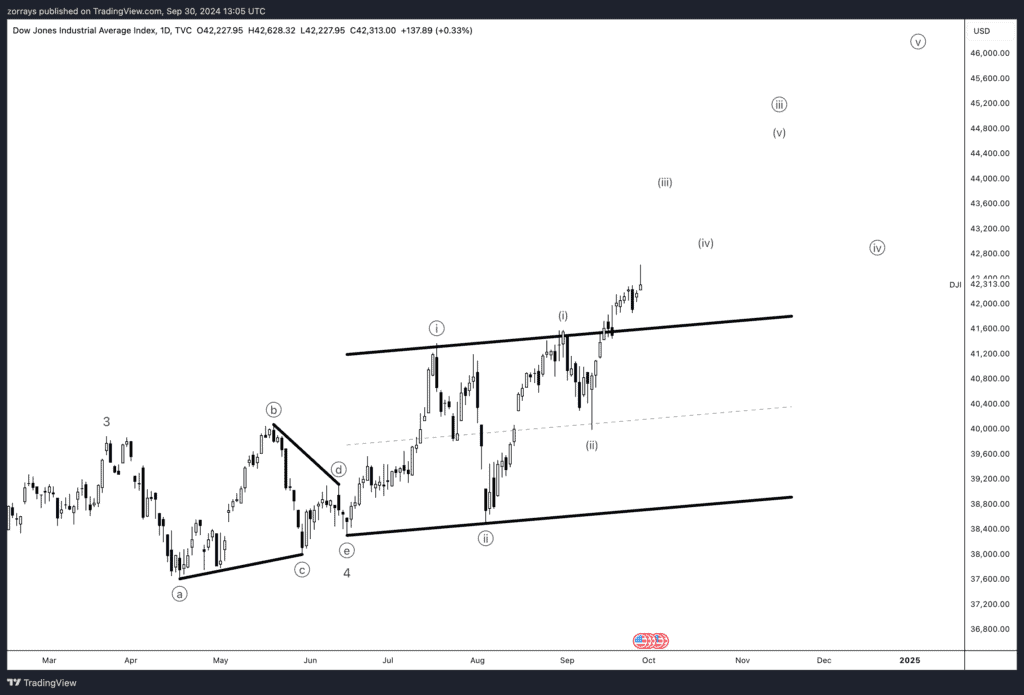

Dow Jones Industrial Average

The Dow Jones is traditionally seen as a safe-haven index during market downturns, largely because of its focus on stable, blue-chip companies that tend to be less volatile. While the NASDAQ and S&P 500 are more sensitive to economic cycles, the Dow tends to perform moderately during expansions and recessions. Its blend of cyclical industries and defensive sectors helps it grow steadily during expansions. On the downside, its industrial and financial sectors tend to underperform, but defensive sectors like healthcare and consumer staples provide a buffer.

Currently, the Dow has broken out of its ascending channel, indicating a more impulsive move compared to its counterparts. We may be in the midst of a wave 3 of 3, which suggests further upside through Q4 2024, with the potential for a strong continuation of the trend.

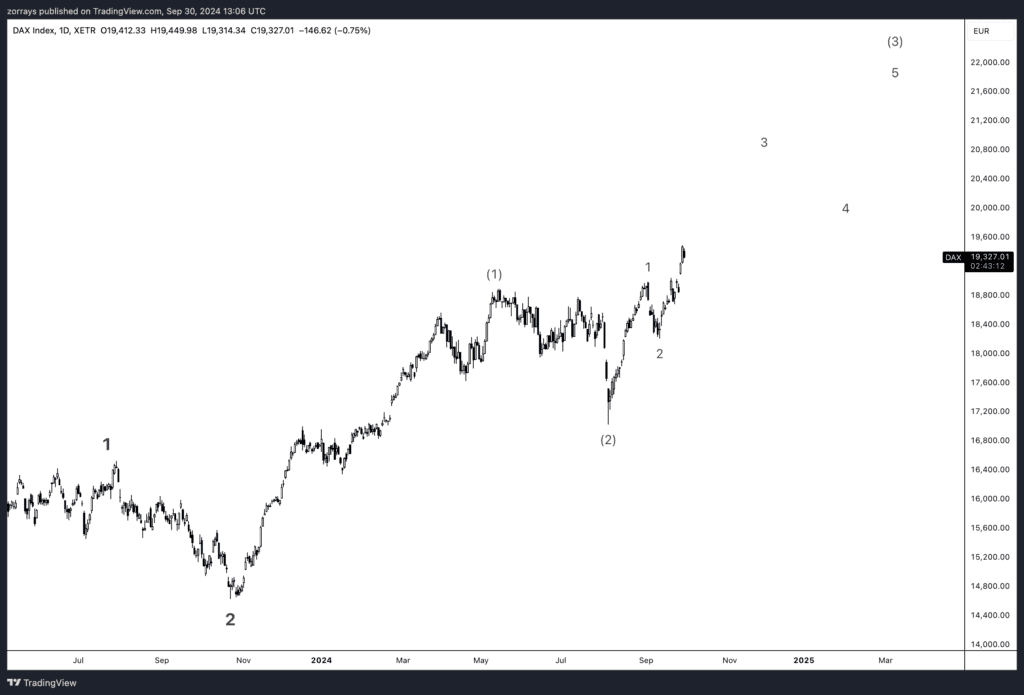

DAX

While the German economy remains sluggish, with GDP expected to contract by 0.1% in 2024, the DAX is telling a different story. Despite economic challenges, such as high energy costs and weak exports, the DAX is currently in an impulsive phase, moving into wave 3 of 3, suggesting that the market is pricing in a positive forward-looking economic outlook.

This optimism is likely driven by expectations of improving conditions in 2025, as Germany continues to cut interest rates. The German central bank has already lowered rates from 4.5% to 3.65% and is projected to cut them further to 2.65% by Q3 2025. While growth is slow, the DAX’s current upward momentum indicates that investors are anticipating a gradual recovery, supported by these rate cuts and a potential revival in domestic consumption and investment.

In terms of technicals, the DAX breaking into wave 3 of 3 signals a strong bullish trend, with the index pricing in future economic improvements despite current sluggishness.

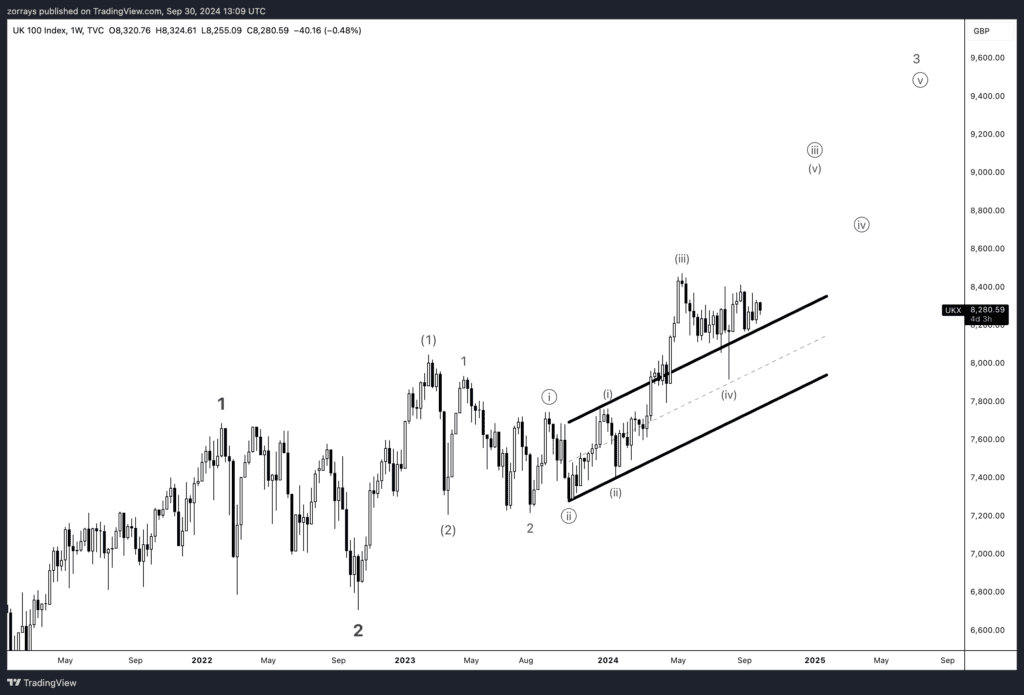

FTSE100

The FTSE 100 has continued to move sideways since our Q3 2024 projections, showing little significant price movement. Although the Bank of England (BoE) has reduced interest rates, and the UK has reached its inflation target, the economy remains sluggish. UK GDP grew by 0.6% in Q2 2024, indicating some recovery, but the pace is slow. The UK PMI also shows some moderation, with the composite PMI dropping to 52.9 in September from 53.8 the previous month, reflecting weaker momentum in private sector activity.

Given these mixed signals, the BoE may be inclined to cut base rates further in order to stimulate economic growth. As we approach the end of wave 4, we are carefully watching to see if Q4 2024 will mark the breakout from this consolidation phase. A breakout from wave 4 would indicate renewed momentum, but we remain cautious until we see clearer economic data and market movements.

You may also be interested in: