- Quarterly Forecast

- June 30, 2024

- 7 min read

Q3 Forex Forecast: Dollar May Regain Strength Against FX Majors/Minors

With the recent wave of surprising economic developments, Quarter 3 of the Forex Markets is looking more interesting than ever.

The main question on everyone’s mind is: Where will the Dollar be? And will we be in for a risk-on or risk-off quarter right before the US Elections?

We’ll delve into these questions by taking a deeper look at technical charts of significant FX majors, and also at bank interest rates from key players in the Forex market.

Q3 Forecasts – What’s Included:

- DXY (Dollar Index)

- Euro

- Japanese Yen

- Swiss Franc

- British Pound

- Australian Dollar

U.S Rate Cut Expectations Lowered to Just One

On June 12th, Federal Reserve Chair Jerome Powell announced a shift in their rate cut projections, reducing the anticipated cuts to just one instance in 2024. This is somewhat of a setback to market expectations as the Federal Reserve has previously projected three rate cuts in 2024.

This announcement comes amidst mixed economic data: a lower-than-forecast Producer Price Index (PPI) month-over-month, coupled with higher-than-expected Flash Manufacturing and Flash Services PMI data.

Source: ForexFactory

A decreasing PPI typically signals a drop in inflation, potentially allowing the Federal Reserve to ease interest rates and implement a rate cut. However, the positive PMI data indicates that the U.S. economy is performing better than anticipated.

Source: ForexFactory

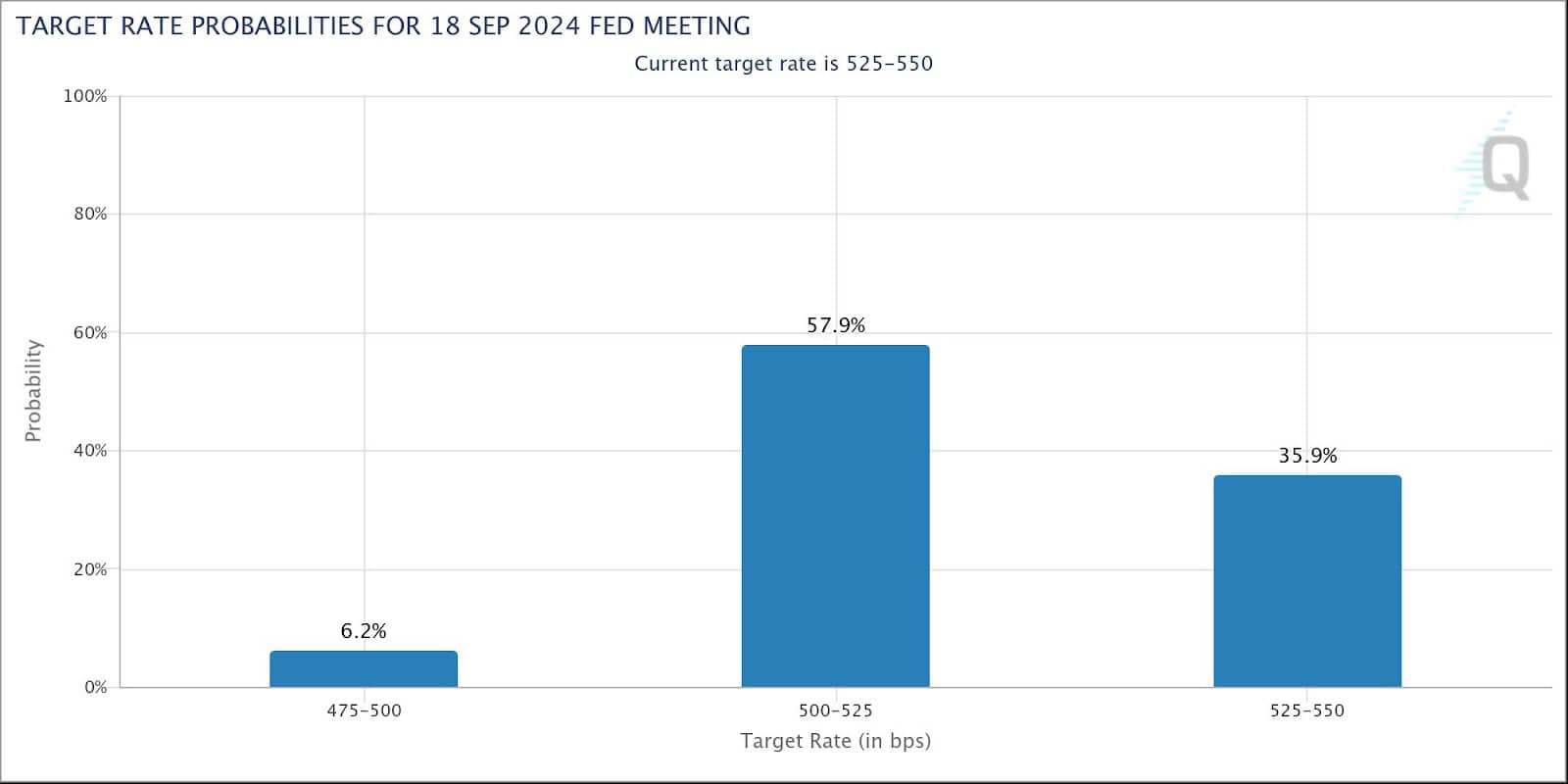

All these economic revelations point to the Federal Reserve delaying the rate cuts, with many market participants looking at September or November as the month for a rate cut to occur.

Fortunately, there has been no uptick in the market expectations for a rate hike in 2024. As of June, 57.9% of the market expects a rate cut on the September 18th Fed Meeting, as per the Fedwatch Tool’s Target Rate Probabilities.

Source: CME Group

Interest Rates Will Set The Tone in Q3

The interplay of interest rates between the various national banks of the world will determine the direction of FX Majors/Minors in Q3.

Currently, the Eurozone is not performing well economically, and the Swiss National Bank has raised their rates. Factors like these will drive the valuation of the USD higher.

Furthermore, upcoming economic announcements for the U.S. in Q3, such as PCE and Non-Farm Payrolls, will play a crucial role in shaping market expectations and the Federal Reserve’s future actions.

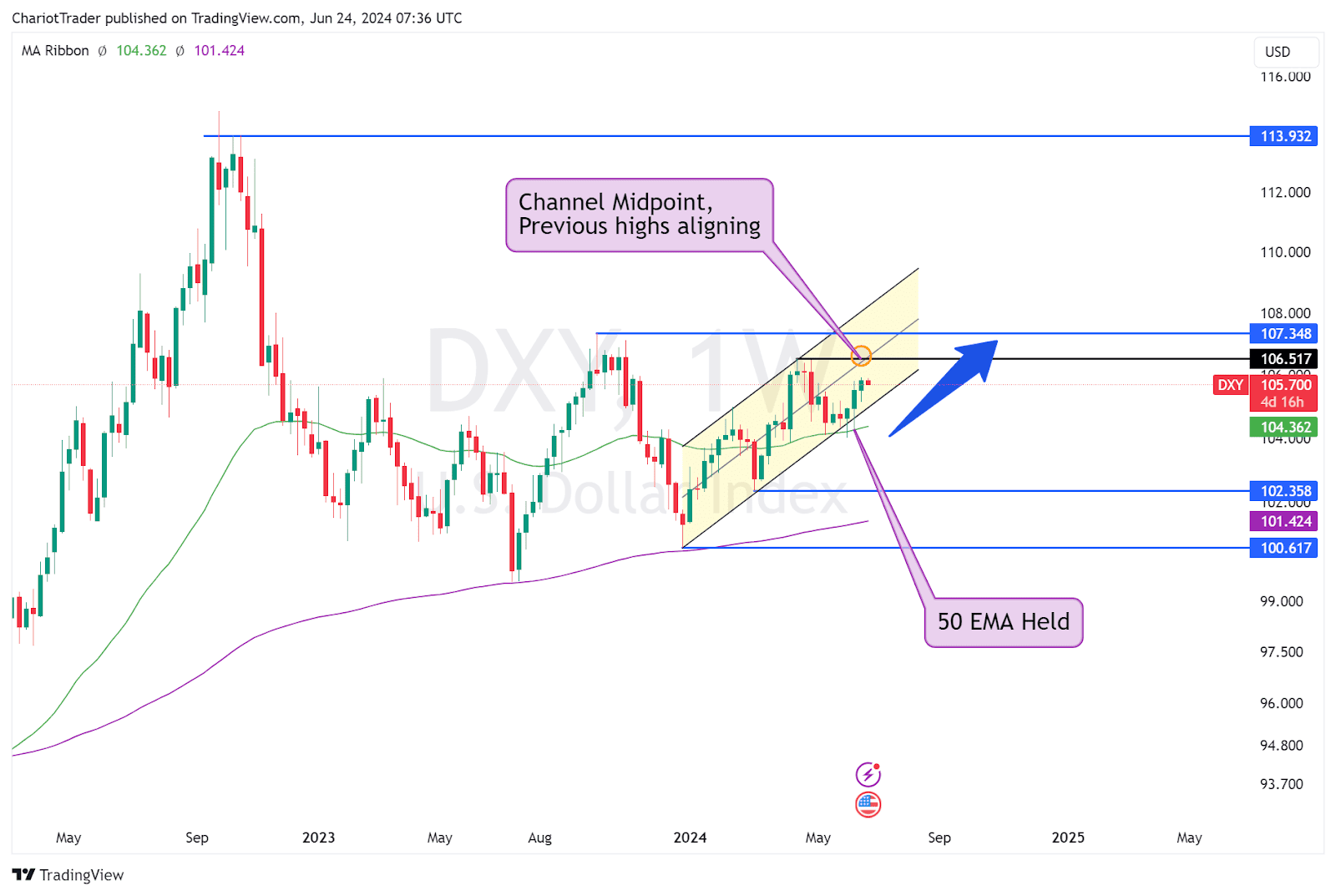

DXY (Dollar Index) Q3 Outlook

On the technical side of the DXY (Dollar Index), a potential ascending channel is forming on the weekly timeframe. After two consecutive weeks of failing to break down, the DXY has held both the weekly 50 Exponential Moving Average (EMA) and the channel’s lower trendline.

The DXY has the potential to climb to its previous high around 107.156 or reach the midline of the parallel channel, which could trigger a bearish rejection. If this occurs, the DXY might break the channel to the downside, targeting the March 2024 lows of 102.358 or even lower at 100.617.

EURUSD Q3 Outlook

As the far-right gains popularity in EU electoral votes, markets have reacted with uncertainty, causing the Euro to plummet against the Dollar. This, combined with poor economic performance in the Eurozone, injects further bearish sentiment into the market.

Traders should exercise caution with the European elections from June 30 to July 7, 2024, as this period could present significant volatility.

Technically, the EURUSD appears to be consolidating within a weekly symmetrical triangle, with the ADX trailing lower. Approaching the triangle’s apex, we can expect a breakout with the ADX moving higher. The price targets would be approximately $1.18 or $0.99.

Fundamentally, continued rate cuts for the Euro could pressure the EURUSD pair, strengthening the Dollar and potentially revisiting psychological levels at $1.00.

Weak Eurozone Economy News Suggests Rate Cuts Are Inbound

In a surprising turn of events, the Eurozone reported much lower manufacturing and services PMI data than forecasted, with some figures coming in 3 points below expectations. This is bearish for the EURUSD as it highlights the incentive for the European Central Bank to implement rate cuts to stimulate the European economy, thereby widening the divergence between Euro and US Dollar interest rates.

Source: ForexFactory

| ECB Current Rates: Deposit 3.75, Main Refinancing 4.25 |

| Forecast: Two deposit rate cuts in September and December, amounting to 75 BPs |

USDJPY Q3 Outlook

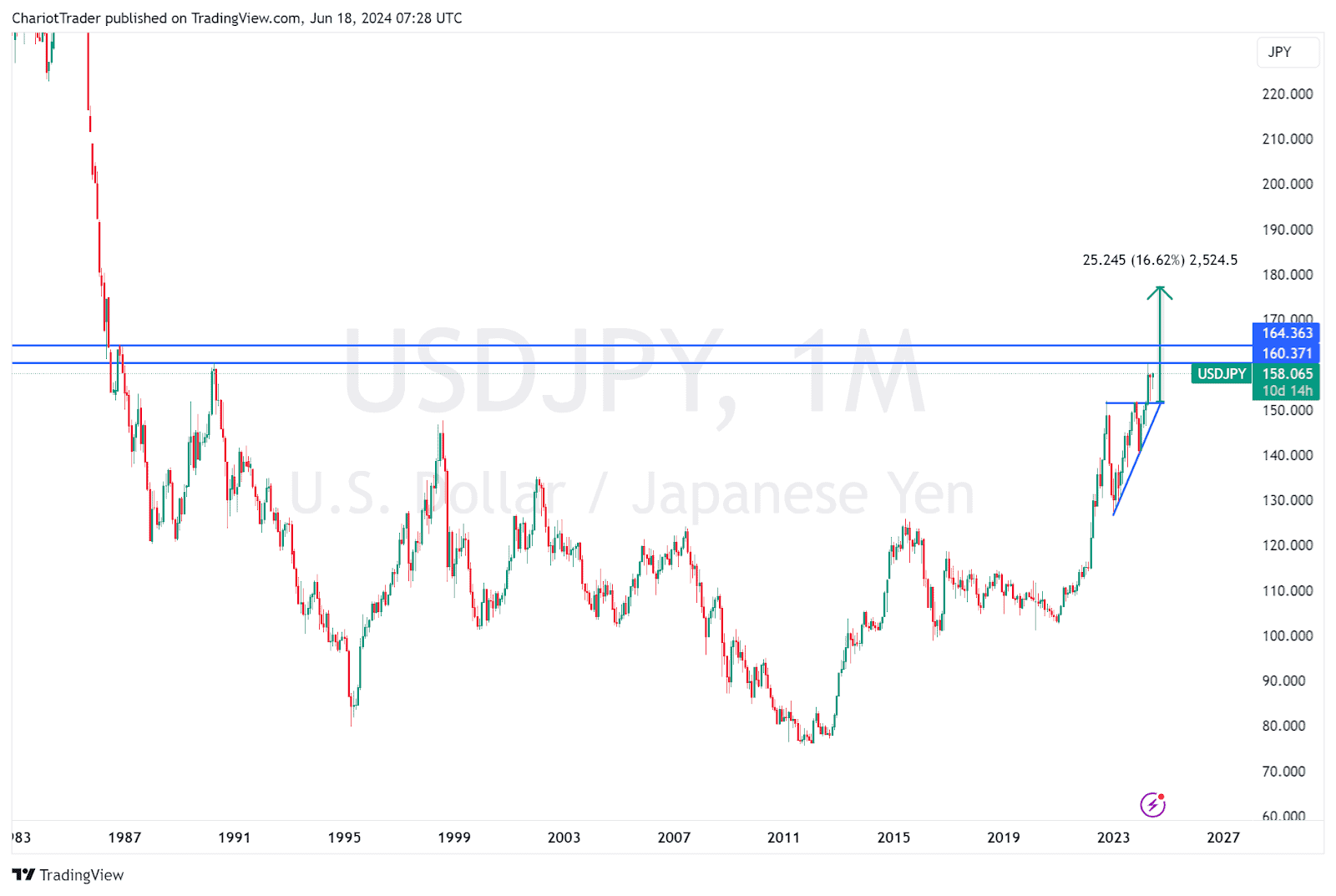

The Bank of Japan’s loose monetary policy is expected to be maintained throughout Q3 2024. This drives a significant difference between the US and Japan’s interest rates, sitting at 5.50% and <0.10% respectively. Investors may switch from Yen to USD in order to earn from the interest rates.

On the technical side, there is a possible ascending triangle that could propel USDJPY towards 176.00. However, traders should be cautious of the monthly resistance zone between 160 and 164 that lies ahead. If this scenario unfolds, we should see a strengthening Dollar (rising DXY) in Q3 of 2024.

The question on everybody’s mind now is: when will Japan be getting a rate hike? And if not, how much lower can JPY go – thus strengthening USD and other assets traded against the dollar.

Currently, there are two news to keep an eye on, regarding JPY pairs:

- Tankan Large Manufacturers Index – If the readings come in higher, JPY should move up.

- Consumer Confidence – If readings are higher than forecasted, JPY should climb.

| BOJ Current Rates: <0.10% |

| Forecast: Expected to maintain current rates |

USDCHF Q3 Outlook

USDCHF has remained largely range-bound, only dipping below its 2021 lows briefly in 2023 before reclaiming them in February 2024.

Surprisingly, the Swiss National Bank reduced its rates on June 21st, 2024, by 25 basis points, bringing them down to 1.25%. This dovish stance has the potential to strengthen the USD in the coming months.

Traders should monitor the range lows at 0.88 to 0.86 Francs as support levels, potentially pushing the pair back towards 0.92 Francs, which should serve as a minor resistance zone. If USDCHF can push higher from 0.92 Francs, it may rise to test the range highs at 1.019 Francs, which coincides with the monthly 200 EMA. This would be a bullish sign for the US Dollar’s valuation and exert bearish pressure on other FX Majors and Minors.

| SNB Current Rates: 1.25% |

| Forecast: Expected to maintain current rates |

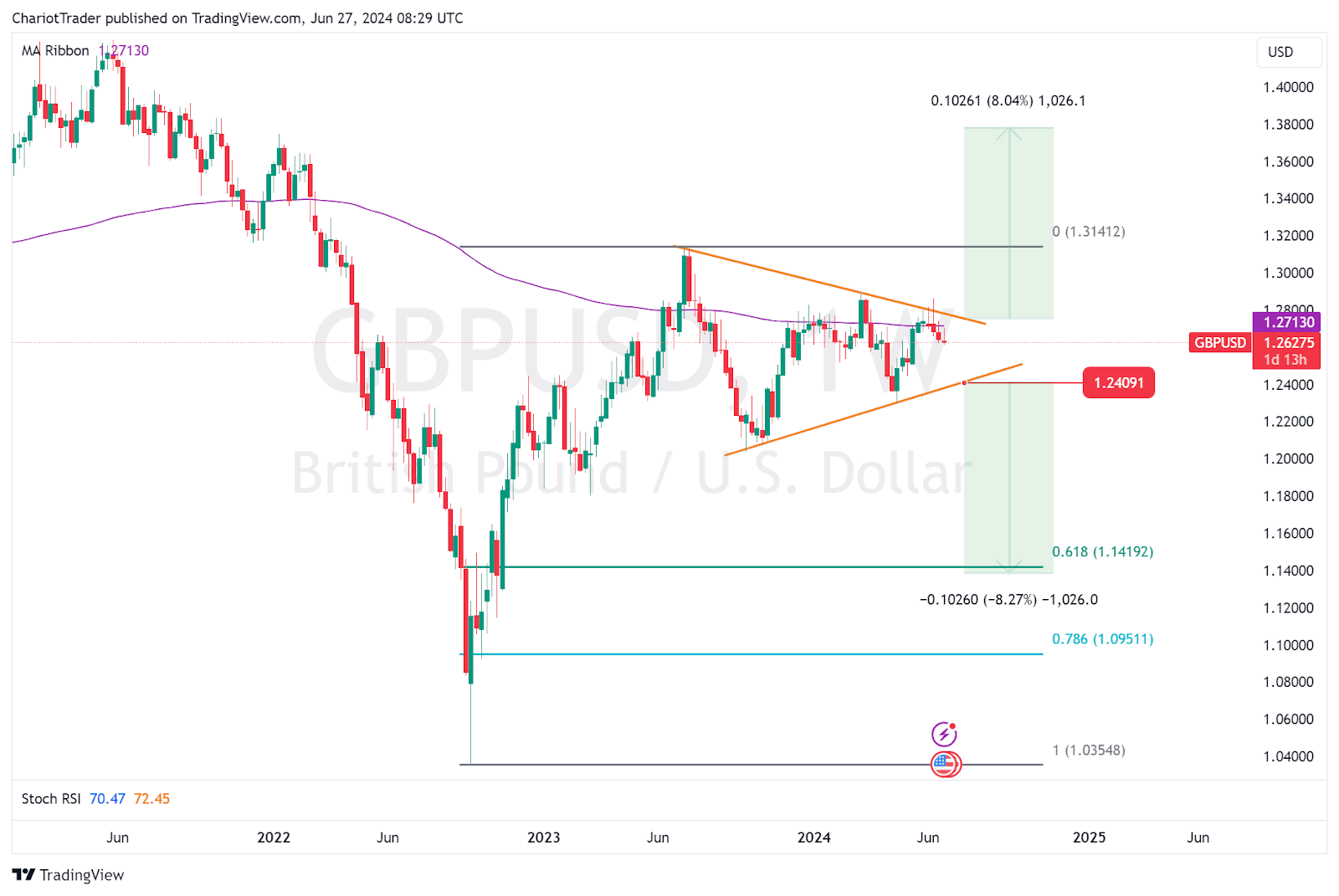

GBPUSD Q3 Outlook

The Bank of England has reached its 2% inflation target, ushering in a wave of relief for people living in the United Kingdom. This may signal some easing on the interest rates in the coming future. For now, the BoE is remaining cautious and holding the rates at 5.25%, but many experts expect a rate cut in August.

This narrative would align well with the technicals on GBPUSD, which is currently seeing a rejection from the 200 week EMA, and the top trendline of a symmetrical triangle.

If GBPUSD is going to decline further, it has the potential to revisit the lower trendline at approximately $1.2409, or even break down towards the 0.618 Fibonacci Retracement Level at $1.1419. This move would mark approximately 1,000 pips from the breakout point, which may happen in Q3.

| BoE Current Rates: 5.25% |

| Forecast: Expected to cut rates in August |

AUDUSD Q3 Outlook

The AUDUSD pair is looking great for a bullish breakout, especially with the recent Year-over-year CPI surge from 3.6% to 4%. This adds to the speculation of a rate hike coming before the end of 2024 for the Aussie dollar, which supports the idea of an upward move in AUDUSD.

Though an official rate hike has not yet been announced, we have to consider the markets may begin pricing in their expectations. Traders are advised to keep an eye on the next RBA meeting scheduled for August 5-6, and also on some technical factors laid out in the chart above.

Additionally, we may have a symmetrical triangle trade opportunity in front of us – created from the lows in November to the highs in December 2023. The measured move target should give us a move of 600 pips, bringing AUDUSD to $0.7285.

However, traders should still be aware of the descending trendline, and the high of the symmetrical triangle ($0.6871) acting as resistance zones.

Overall, the fundamentals and technicals of AUDUSD seem to support a bullish move.

| RBA Current Rates: 4.35% |

| Forecast: Expected to implement a rate hike in Q3 or Q4 |

You may also be interested in:

Q3 Energy/Metals Forecast

Q3 Indices Forecast